XT.com Review – Fees, Supported Coins & Countries, Payment Methods, Leverage

In the bustling landscape of cryptocurrency exchanges, XT.com has emerged as a noteworthy exchange that many traders are keen to explore. But what truly sets XT.com apart? Our comprehensive XT.com review delves deep into its features, security measures, and overall user experience.

Are you asking is XT.com legit? Or did you wonder about their KYC requirements? We’ve got you covered. From its inception in Singapore to its expansive offerings, this XT exchange review aims to provide clarity and insights for both novice and seasoned traders alike. Dive in to discover if XT.com aligns with your trading aspirations.

From security measures to deposit and withdrawal processes, we’ll cover all the essential features of Xt.com. So, grab a cup of coffee and join us on this journey of exploration and discovery!

| 📌 Topic | Description |

|---|---|

| 🌐 Web Address | www.xt.com |

| 📍 Main location | Singapore |

| 💱 Cryptocurrencies | BTC, ETH, ADA, USDT, DOT, XRP, UNI, LINK, and 100+ more |

| 💵 Fiat Currencies | USD, AUD, BRL, CAD, CHF, INR, and more |

| 💳 Deposit Methods | Visa Card, Mastercard, Apple Pay, Google Pay, Advcash, Simplex, Bank Transfers, Cryptocurrency |

| 💰 Deposit Fees | Varies |

| 📊 Trading Fees | Makers: 0.05%, Takers: 0.2% |

| 📱 Mobile app | Yes |

| 🛍️ Instant buying and selling | With fiat currency |

| 🪙 100+ crypto assets | Available to trade and buy |

| 🤝 P2P market | Competitive purchasing |

| 🔄 Diverse trading options | Professional and standard |

| 🖥️ Easy-to-understand interface? | Yes |

| 💸 Extra earnings | through saving and staking options |

| ⛏️ Cloud mining | available |

| 💬 Live Chat option | for quick customer support |

| 💰 Deposit Fees Note | The deposit fees on XT.com vary depending on the chosen deposit method. It is recommended to check the platform’s deposit page for the most up-to-date information[^0^]. |

| 📊 Trading Fees Note | The trading fees on XT.com are set at 0.05% for makers and 0.2% for takers |

What you'll learn 👉

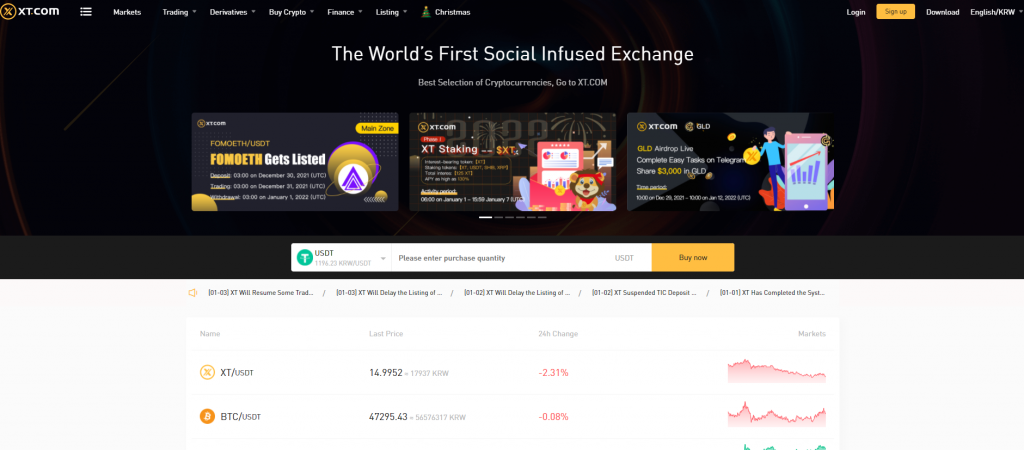

XT.COM OVERVIEW

The XT exchange was created in 2018 by Weber WOO in Singapore. It is one of the many arms of the XT group, a conglomerate that has grown to include the XT exchange, Capital, Labs, Academy, and Pool. It is registered in Seychelles but extends its services to other countries like Korea, Japan, etc.

Here are some of its features in summary:

- It has robust security features, from its storage options to its general functions.

- It provides OTC (Over the counter) trading through which large amounts of cryptocurrencies can be traded without slippage.

- It has a high-performance matching engine through which orders are executed with no delay.

- It has a customized trading view interface.

- It provides spot, margin, and derivatives trading options.

- It provides mining services

- Assets are stored in cold wallets to make them more secure.

- It has a native token, XT

- It supports wire transfers and bank cards for deposit and withdrawal of fiat currencies.

SERVICES AND FEATURES

BUY AND SELL CRYPTO

The Xt.com exchange offers users the opportunity to buy and sell crypto BTC, ETH, USDT, LINK, BNB, XRP, MATIC, AAVE, and about 30 other coins directly using various payment methods. Active users can use third-party payment channels or P2P to buy and sell those coins.

- Third-party payment channels: The channels used on the platform are Banxa, MercuryO, and AdvCash. These payment channels accept Visa cards, MasterCard, Apple Pay, and Google Pay to buy cryptocurrencies. If you want to sell crypto directly into fiat, you can only use the bank transfer option through Banxa.

- P2P: Short for peer-to-peer transactions, this payment method involves direct transactions between merchants and buyers to purchase USDT, ETH, and BTC.

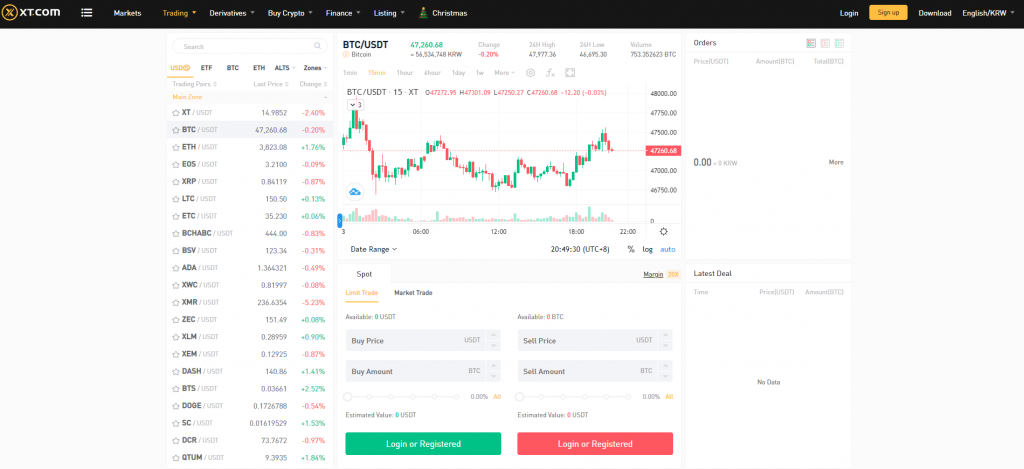

SPOT EXCHANGE

This feature allows users to trade cryptocurrencies against one another. To make navigation easier, the spot trading pairs are divided into sections, namely USD pairs, BTC pairs, ETH pairs, Alts, Metaverse, Web3.0, Layer 2, DeFi, etc.

There are two types of spot trading on Xt.com. The standard spot trading presents users with basic charts and trade functions and is meant for traders who are not so experts. On the other hand, there is Pro spot trading which presents users with more complex features like a more detailed graph function and deeper order books.

FUTURES TRADING

There are three types of futures trading on Xt.com. They are:

- USD-M Futures contracts: The contracts are denominated in USD as the base currency. Thus, profit and loss are denoted in dollars. This option is the futures contract with the most amount of coins.

- COIN-M Futures contracts: These are contracts denoted in the cryptocurrency as the base currency. Thus profits and losses are calculated in that particular coin, not in dollars.

- Quanto contracts: Also known as Quantity-adjusting option, this contract option takes it a step further than the first two. Thus, it is a combination of three currencies where two currencies are traded against each other, but profit and loss, as well as margins, are settled in a third currency.

Let me illustrate. An ETH/USD Quanto contract in BTC means ETH is traded against USD in standard futures but settles in BTC. Therefore, when it’s time to take profit, USD values are converted to BTC using a fixed exchange rate.

On Xt.com, there are currently three Quanto options open. They are BTCXWC, BTCTP, and ETHXT.

MARGIN TRADING

There are 39 coins currently traded on the margin on the exchange. These coins include XT, BTC, ETH, EOS, XRP, etc. The leverage options range from 3x to 20x. As is customary in crypto exchanges supporting this feature, Xt.com includes a warning for prospective margin traders of the need to consider the risks together with the rewards.

Just as in spot trading, there are two types of margin trading on the exchange. They are the standard and pro trading options. The differences between the two are the same, as explained earlier under spot exchange features.

ETFS

Exchange-traded funds are crypto equivalents of mutual funds that closely track the price of an asset and allow traders to trade that asset without having to own it. On Xt.com, the ETF page opens one to 121 leveraged tokens instead. Leveraged tokens are simply spot-traded tokens that are multiplied in value. Examples are BTC3L(BTC 3x Long), BTC3S, etc.

SAVINGS

XT offers some sales events from time to time where users are rewarded for saving some tokens like Sol, XT, etc., on the platform. The savings are divided into fixed and flexible savings with juicy rewards on both.

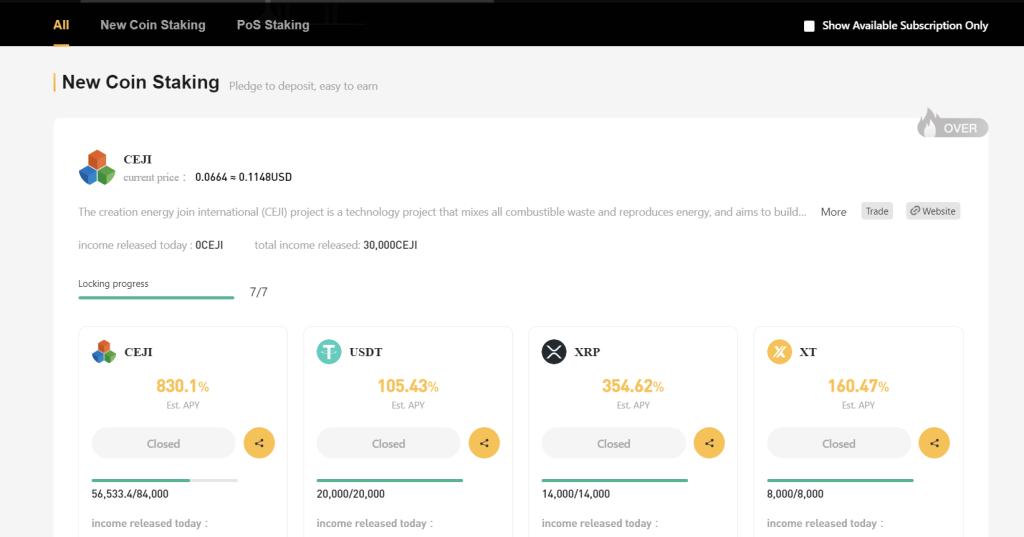

STAKING

This is similar to the savings feature but differs in that the coins are not saved with the exchange but are saved with the cryptocurrency protocol behind the coin itself. Thus, this service is available for coins like XTZ, ETH, TRX, KAVA, XWC, XRP, USDT, XT, and SHIB. The staking period is from 30-90 days, and rewards are distributed regularly.

POOL

The pool feature opens up traders to the possibility of mining DeFi coins under the oversight of the XT exchange.

ETH 2.0 STAKING

The Ethereum network is migrating to a more advanced version of its initial setup. This migration already started and should be completed by the end of 2022. After this migration is done, the network will become more scalable, sustainable, and secure as it works on a Proof-of-stake system.

Users can stake their Ethereum tokens on the ETH 2.0 launchpad to support its launch. Staked ETH will not be retrievable until ETH 2.0 has been fully launched. However, even now, stakes are rewarded with benefits as they await the launch of the proposed upgrade. This function is also available on the XT exchange.

XT.COM SUPPORTED COINS

When this article was written, there were 398 coins currently traded in 460 markets on the Xt.com exchange. Those figures are impressive and keep racking up as more coins get added regularly. Some of the coins are BTC, ETH, DOGE, SHIB, DOT, SOL, AAVE, QTUM, LINK, LTC, BCH, etc.

Also, 29 fiat currencies are currently supported on the platform. They include United States Dollars(USD), Euros(EUR), Pound Sterling(GBP), Australian Dollar(AUD), Nigerian Naira(NGN), Canadian Dollar(CAD), Singaporean Dollar(SGD), Japanese Yen(JPY), New Zealand Dollar(NZD), among others.

DEPOSITS AND WITHDRAWALS

The various fiat currencies can be deposited and withdrawn using third-party payment channels integrated with xt.com. The channels are Banxa, MercuryO, and Ad Cash. The deposit methods are bank transfer(only Banxa supports this mode), bank cards, Google Pay, and Apple Pay. The processing fee that would be paid for deposits and withdrawals varies depending on the payment channel chosen and the mode of payment.

Cryptocurrencies can be deposited and withdrawn using the standard industry method, where you copy and paste the receiving address accordingly. Each coin has its own withdrawal fee, while deposits are free for cryptocurrencies.

TRADING FEES

There is a standard maker (0.05%) and taker (0.2%) fee for spot orders. However, discounts are given based on how much BTC you hold and how many people you’ve referred to the platform. The table below explains further:

| LEVEL | 30-DAY BTC VOLUME OR NUMBER OF VALID REFERRALS | MAKER FEE | TAKER FEE |

| P0 | ≥0 BTC or 0 people | 0.05% | 0.2% |

| P1 | ≥0.1 BTC or 1 person | 0.04% | 0.16% |

| P2 | ≥0.5 BTC or 11 people | 0.035% | 0.14% |

| P3 | ≥1 BTC or 31 people. | 0.03% | 0.12% |

| P4 | ≥3 BTC or 51 people | 0.025% | 0.1% |

| P5 | ≥5 BTC or 81 people | 0.01% | 0.04% |

| P6 | ≥8 BTC or 101 people | 0.005% | 0.02% |

The above features are for spot trades alone. The exchange has said nothing on the trading fees for futures and margin

DOES XT.COM REQUIRE KYC?

Yes, the exchange mandates users to complete KYC verification before fully using their services. More on this will come later.

XT.COM SUPPORTED COUNTRIES

Even though the exchange is headquartered in Hong Kong, it has service centers in other countries like Japan, Singapore, South Korea, Spain, etc. There has been no statement from the exchange on whether US investors are currently allowed on the platform. Therefore, US traders are encouraged to make findings on that, perhaps from customer support, before opening an account with them.

DOES XT.COM HAVE A NATIVE TOKEN?

Yes, the native token of the exchange is simply known as XT. It is an Erc-20 token with a max supply of 100,000,000 coins that is claimed to have community rights. It is currently trading at double figures(in Dollars) in the live market

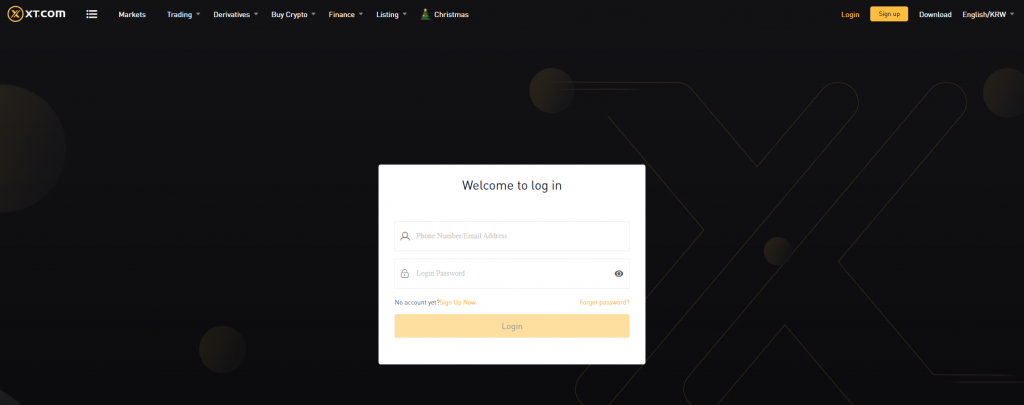

HOW TO START WITH XT.COM

Starting an account with Xt.com is not complicated. There is a signup button on the website’s homepage, which creates the whole process for new users. You can use either your phone number or email address to register an account with the exchange. After putting down your phone number or email for registration, an OTP will be sent to it, which you have to enter to complete the registration process.

When registration is done, the next step is KYC verification. This involves submitting your identification documents as well as a video selfie of you holding the document with your face clearly visible. Successful completion of KYC verification opens up more withdrawal and trade limits for the user.

IS XT.COM LEGIT AND SAFE?

Even though one can’t be 100% certain of the security of exchange in the crypto world(because anything can happen, right?), Xt.com gives certain reasons for confidence. Consider why:

- It stores its assets in cold storage wallets which are the best kind of wallets in the crypto world because they are shielded from online interference.

- There is a mandated KYC program that vets everyone who transacts on the platform to screen out possible fraudsters

- It has an impressive social media presence.

Even so, investors are urged to do their research well before depositing funds on the exchange.

IS XT.COM REGULATED?

Yes, the exchange is registered and licensed in Seychelles, East Africa. Thus, it can be held accountable for its actions

CONCLUSION

Have you decided whether or not the xt.com exchange is for you? In terms of security, user experience, coin availability, regions supported, etc.? I hope this article has been useful in helping you reach a well-informed decision.

Keep in mind, though, that cryptocurrency trading is a risky endeavor, and you should only invest money you can afford to lose. That being said, if you decide that this exchange is not for you, check out the reviews on this website about various crypto exchanges. I’m sure you’ll find your pick among them.

Read also:

- Is Probit legit?

- BingX (ex Bingbon) Review

- CoinDCX Review

- AAX Exchange Review

- 9 Binance Alternatives & Competitors

- BitWell Review

- Is Jubi legit?

- CoinSmart Review

- ZT Exchange Review

- Is VCC safe?

- Is HotBit safe to use?

- Is Uphold safe to use?

- Is WooTrade safe to use?

- Is CoinSwitch Kuber genuine?

a none compliant company, avoid them at all costs