Cryptohopper Review: Automated Trading Platform With Advanced Strategies To Make Money

The quest for a reliable, efficient, and versatile trading bot often leads to a name that resonates with both novice and seasoned traders alike – CryptoHopper. This platform has carved a niche for itself by offering a comprehensive suite of features that cater to a wide array of trading needs.

CryptoHopper, a cloud-based trading bot, is designed to simplify the trading process, making it accessible to traders of all experience levels. It’s not just about automated trading; CryptoHopper goes a step further by offering mirror trading, where your bot can mimic the trades of expert traders. This review will delve into the core aspects of CryptoHopper, addressing key questions like “Is CryptoHopper legit?” and “Is it a scam or a reliable bot?”

With its advanced dashboard for semi-automatic trades, a friendly user interface, and a plethora of trading strategies, CryptoHopper has positioned itself as a go-to solution for automated crypto trading. Whether you’re curious about its performance, pricing, or customer support, this review aims to provide a comprehensive understanding of CryptoHopper and its offerings.

| 📚 Topic | 📝 Summary |

|---|---|

| 🤖 Cryptohopper Functionality | Cryptohopper is an automated crypto trading platform that simplifies the trading process. It provides assistance to traders of all experience levels, maximizing their trading opportunities and profits while reducing the chance of losses. It offers features such as automated trading, mirror trading, DCA bots, shorting, paper testing, arbitrage, and A.I. for backtesting. |

| 💰 Pricing and Packages | Cryptohopper operates on a subscription model with three pricing plans: Explorer, Adventure, and Hero. The platform provides a 7-day free trial for the Explorer package. The monthly cost for the Explorer package can range from $9.99 to $99.99. The platform also offers enterprise-grade custom-tailored packages for more serious clients. |

| 🔄 Trading Strategies | Cryptohopper allows users to set up their own trading strategies or rely on outside signals. It offers a variety of strategies including trailing stop-loss, trailing stop-buy, Dollar Cost Averaging, shorting, trailing stop-short, and more. Users can also subscribe to signals from experienced traders. |

| 🛠️ User Interface and Setup | Cryptohopper has a user-friendly interface and a simplified setup process. It offers a drop and drag designer for designing your automated bot. The platform also has an advanced dashboard for semi-automatic trades and a central hub for all your trading needs. |

| 📈 Performance and Profitability | Cryptohopper’s performance and profitability depend on market conditions and the user’s settings. Some users have reported gains of up to 70% in bullish markets. However, it’s important to trade with maximum security and not take unnecessary risks. |

| 🔒 Security | Cryptohopper collaborates closely with exchanges and authorities to ensure the security of user accounts. The platform also offers industry-leading security mechanisms to protect user data. |

| 📚 Learning Resources and Support | Cryptohopper provides a wealth of learning resources and support options. It has an active community on Discord, a helpful forum, and an interactive helpdesk. The platform also offers detailed tutorials and extensive documentation for users. |

A bot is essentially a piece of pre-programmed software; it requires a certain amount of human input to operate properly. Moreover, it offers exchange arbitrages. To explain it bluntly, a human programmer/trader sets up the software in a way he believes will result in profit, sets it loose onto the market, and hopefully starts earning money.

| Price | Free Trial / $19 / $49 / $99 Per Month |

| Payment Options | PayPal / Bank Transfer / Crypto |

| Exchange Support | OKEX / KuCoin / Bitvavo / Binance / Binance US / Coinbase Pro Bittrex / Poloniex / Kraken / Bitfinex / Huobi |

| Cloud Based | ✅ |

| Signals | Marketplace of Free & Paid Signals |

| Strategies | 30+ Indicators / 90+ Candle Patterns |

| Arbitrage Bot | ✅ |

| DCA | ✅ |

| Scalping | ✅ |

Crypto trading bots are capable of overcoming most limitations of the average trader: they can trade 24/7 without the need to rest or eat and without succumbing to human emotions. As such, they do have a certain appeal, especially to people who aren’t willing to spend their entire lives staring at charts and making trade orders.

That being said, we decided to take a look at one of the currently available market options called Cryptohopper.

What you'll learn 👉

About Cryptohopper

Cryptohopper bot is a rather young automated crypto trading platform, having its domain originally registered in July 2017.

Created by two brothers from the Netherlands, one a day trader, and the other a web developer, it can brag about having a perfect blend of experience and knowledge – both in the worlds of trading/technology – behind it from the start.

The two merged their ideas, skills, and experiences and created Cryptohopper.

Crypto Hopper Review: Supported Cryptocurrency Exchanges

The bot can connect to a wide variety of exchange Application Programming Interfaces (APIs) and trade a significant pool of coins automatically, 24/7. It currently offers integration with the following crypto exchanges:

- Huobi – premium Cryptohopper partner

- Poloniex

- Kraken

- Bittrex

- Binance

- Coinbase Pro

- KuCoin

- Cryptopia

- Bitfinex

Work is apparently being done to integrate the bot with HitBTC, Cobinhood, Cex.io, Bitstamp and bitFlyer APIs.

Cryptohopper is different than most of the cryptocurrency market competitors in the sense that it’s web-based; it’s stored on the company’s servers, operates on a cloud-like infrastructure and can be accessed through any web browser.

While the advantages of this include fast and simple access to the bot, without needing any additional hardware to set it up and keep it running, the downsides are that the bot can suffer slowdowns at times of high website traffic.

While the hopper itself is one of the best in terms of interface and capabilities, some users have found that it doesn’t perform well in bear markets and can result in more losses than positive trades.

✅ Many users recommend creating your own strategy using technical analysis indicators such as Bollinger Bands and MACD.

✅ In terms of daily profit, it really depends on the market and your hopper settings. Some users aim for at least 1% per day, while others aim for 3%. It’s important to have a good risk vs reward ratio strategy to ensure profitability.

✅ Some users have found success with using templates and signals, while others prefer to trade manually without them. It’s important to find what works best for you and your trading style.

✅ Stop losses are important to have in any strategy to minimize losses.

✅ In bullish markets, some users have reported gains of up to 70%. However, it’s important to trade with maximum security and not take unnecessary risks.

Features

Cryptohopper offers a wide array of features:

- Automatic trading: automated trading of your favorite coins. Set up your own trading strategy and let the bot trade for you.

- Mirror trading – Subscribe to an expert trader so that your bot can automatically trade on his trades. They provide a marketplace where you can quickly compare the performance of signalers and pick the best one for you. You don’t need to follow the sell signal they send, but you could also copy their trades semi-automatically. Use theStop-Loss function to protect against deep losses, while letting the Trailing Stop-Loss help you sell at the right time.

- DCA bots – Dollar cost averaging is a strategy that allows investors to invest a fixed amount of money each month. If the market goes up, you will end up making more money overall. If the market goes down, you will still make less money overall, but you will not lose any money.

- Shorting – One way to make up for a loss-making position is our Short and Trailing Stop-Short feature. It’s an exciting feature for traders that are looking for an alternative for their traditional stop-loss. When you expect a position to make a more significant loss, you initiate a Short, and your bot will sell the position. When you think the price has reached its bottom, you consolidate your short and directly buy back the position.

- Paper testing – Paper trading is an online service that allows you to trade using actual exchange data with simulated crypto assets. You can experience the platform without risking your own money.

- Arbitrage – Arbitrages are trades that exploit inefficiencies in the market. They are made possible because there are always opportunities to buy low and sell high. There are many ways to arbitrage, including using different exchanges, buying at a lower price and selling at a higher price, and even using different currencies.

- A.I. stands for Algorithmic Intelligence – it is essentially an automatic backtester that will try to find the best trading pair and strategy for you to use in a given market trend.

- Crypto signals: Alternatively, if you don’t want to/don’t know how to set up your own strategies, the bot allows you to automate your trading by copying trading signals sent to you by third-party technical analysts (signalers).

- Risk-minimizing features: constant automatic price trailing, trailing stop-shorts, trailing stop-buys, stop-losses and sell with profit options limit your chance of losing everything you have.

- Streategy Designer: save and load your own templates to quickly setup and change your crypto trading bots.

- Technical analysis: the bot offers dozens of volatility, trend and volume indicators as well as tools to perform technical analysis of the cryptocurrency market, all of which helps you determine the ultimate trading strategy.

- Backtesting: lets you analyze data from the past, which can help you fine tune your trading strategy for optimal profitability.

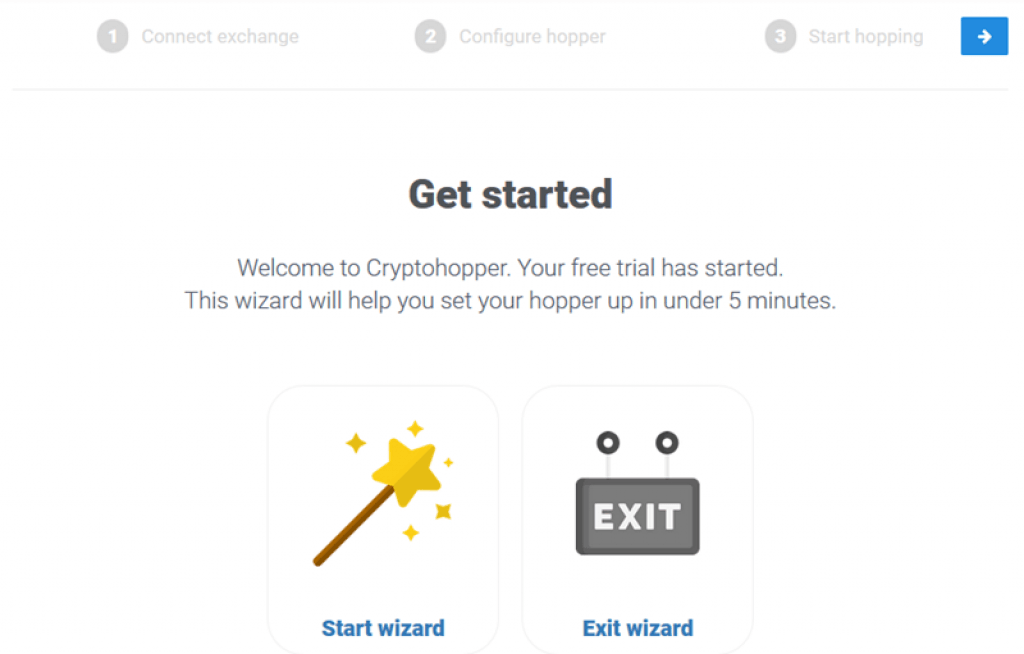

Cryptohopper is relatively easy to get into; you need to first create an account on the platform; Once the account is created, you’ll be given access to your hopper, aka the actual trading bot.

After doing that, you need to select your exchange and connect it to your hopper by entering the exchange wallet’s trade-only API keys. The entire process is made simpler thanks to a useful wizard which will lead you through every step of the way.

Friendly User Interface

When it comes to the end-to-end process of designing your automated bot, Cryptohopper has made the process super simple. In fact, they have created a simplified drop and drag designer that allows you to design your automated bot from the ground up.

All you need to do is click on the specific indicator that you want to implement, choose whether you want to buy or sell, configure a few fundamentals such as volumes – and you’re good to go.

While you are here, have a look at our Gunbot review. Also, 3Commas is widely considered as the top rival for Cryptohopper so you can check out our 3Commas vs Cryptohopper comparison or the complete review of 3Commas.

Advanced dashboard for semi-automatic trades

This is the latest Cryptohopper feature geared at crypto traders who prefer semi-automatic trading.

This new dashboard lets users use advanced order options such as stop-loss, take-profit, trailing stop loss, trailing stop-buy and place an order by selecting a place-in directly through the order book.

Additionally, completed buy orders directly show up in your positions so you can track profits. Advanced dashboard also features a Trading View widget which enables experienced traders to analyze the market, while visually seeing your orders in TradingView.

This is essentially a central hub for all your trading needs, similar to what Coinigy offers (but of course, Coinigy has no automatic trading abilities – read Coinigy review here to learn more about it).

Automated Bot Features

Some of the additional features of Cryptohopper are:

- Bull Market If your bot is operating in a potential bull market, you can utilize the useful trailing stop loss feature. This is how you can protect your trading gains with adjustable stop losses, subsequently allowing you to exit your positions when an eventual market correction does take place. The bot also allows you to search for potential pricing targets, and automatically place trading profits into a reserve fund.

- Bear Market If the markets have taken a downturn, then you can program your bot to be ready to exit a trade at the first sign of a downward trend.

- If you’re convinced that a particular crypto asset is only in bear crypto market temporarily, then you can get your automated bot to facilitate dollar cost averaging. This is where your bot purchases additional coins at pre-defined intervals (such as every 5% decline in price).

- Consolidation Periods Consolidation periods or sideways markets can be a nightmare to trade. However, they also present multiple opportunities to scrape micro profits within a specific range. For example, if Bitcoin was trading in the $9,600 – $10,600 range, you could instruct your bot to enter and exit short term trades when certain triggers have been met.

Trading Strategies – Best Cryptohopper Strategy

The bot will require a trading strategy to operate and trade for you. While other crypto trading bots come with pre-programmed strategies, Cryptohopper mostly requires you to create a custom strategy using its tools. A user gets to set up the bot parameters himself, but the process isn’t that complicated; you’ll be given a host of settings that you can tweak and adjust in a way which you believe will bring you the biggest profit. Some of the strategies you’ll find when trading with Cryptohopper include:

- Trailing stop-loss

- Trailing stop-buy

- Dollar Cost Averaging

- Shorting

- Trailing stop-short

- Config pools

- Triggers

- Backtesting

- Walletscrubber

- Auto synchronize

- Reserve funds

- Manual buy and sell

Ultimately, you’ll be able to either set up your own strategy or rely on outside signals.

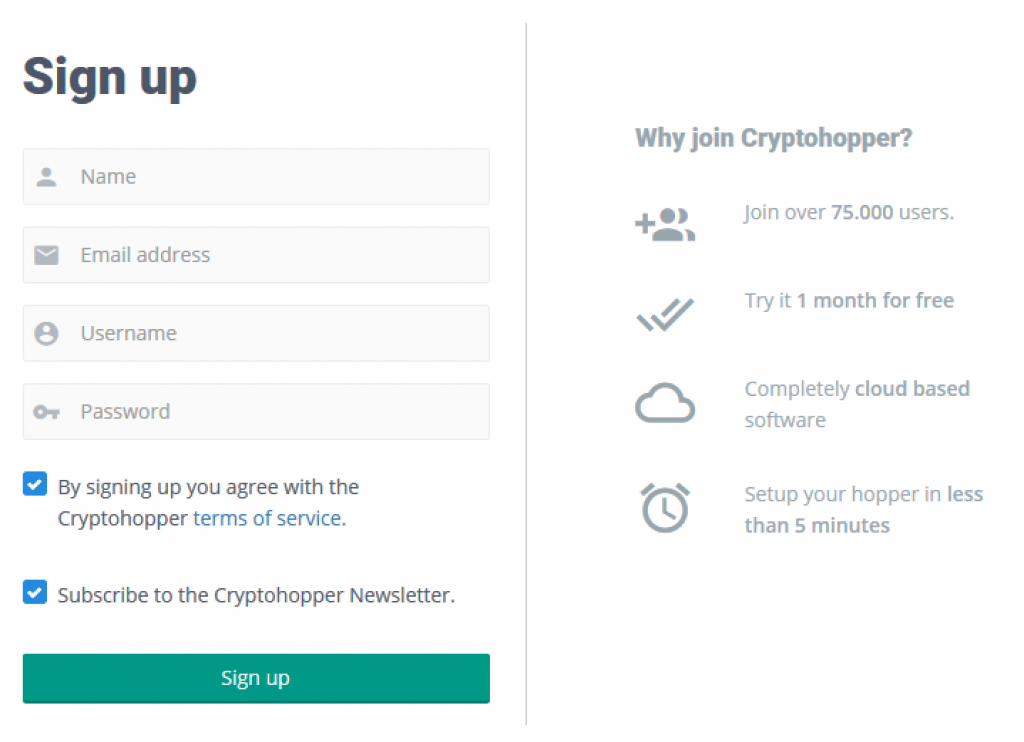

Cryptohopper Account Registration

Registering an account on Cryptohopper platform is a simple process as the main page has a prominent green “Signup” tab at the top of the page.

1) Create an Account

Open the Cryptohopper website and fill out the required information: name, email address, username, and password in order to sign up.

You then need to confirm your email account by clicking the activation link you will receive in your inbox, and gain access to the dashboard.

2) Setup your Account

After you are in, the platform has a convenient setup wizard that will lead you through the account configuration and do things like exchange API keys integration and other mandatory configurations.

After this, you are ready to use the bot. It is that simple.

You can subscribe to signals, configure templates, and begin backtesting the Hopper, as well as add more security by setting up the two factor authentication on your account.

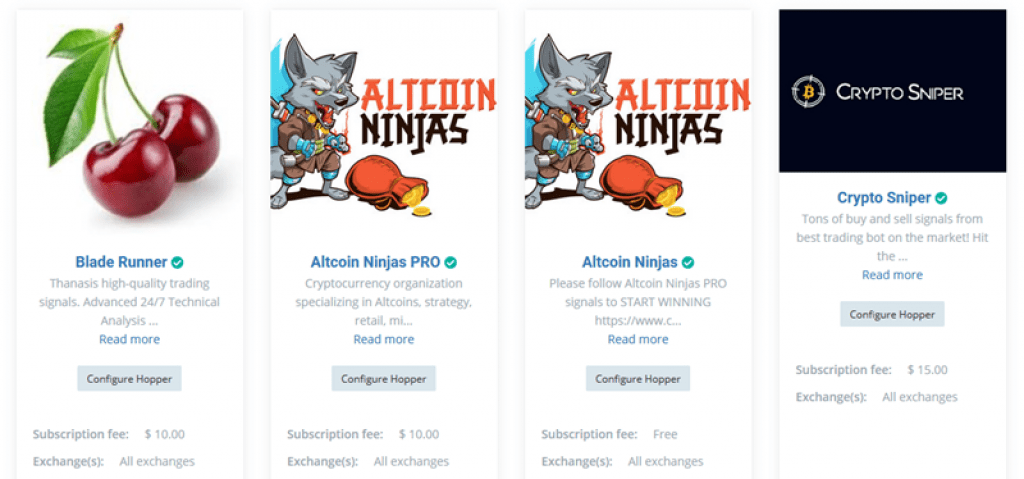

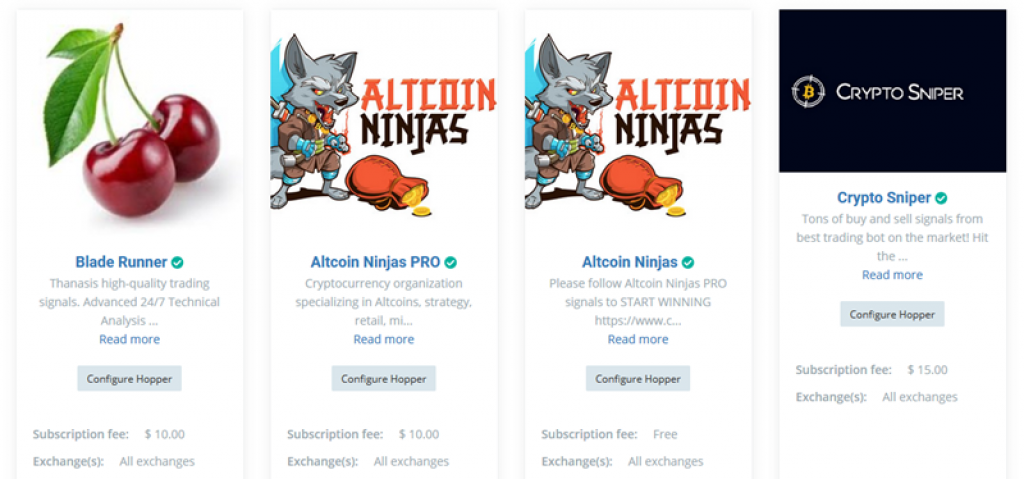

3) Cryptohopper Signals Review: How to Signup to Signallers

Cryptohopper enables users to sign up to integrated professional external signals, a service that is provided by experienced traders who look for positive signs of an upward move. There are two options: both free and paid subscriptions to signallers.

Signals/signalers are an interesting feature of Cryptohopper, reminding us of the social trading elements we saw with platforms like eToro or Genesis Vision.

Signals are inputs sent by trading groups called signalers; your crypto bot can use these signals to adjust its trading behavior. Cryptohopper has 20+ crypto signalers and all of them have their own signal track record visible to everyone. That way the person using the crypto bot can check out signalers’ past work and choose to follow his signals, if he/she feels that signaler was on point with his calls.

When a signaler sends out a trade signal, user’s crypto bot will pick up on it instantaneously and automatically and execute what the signal told him to. It’s also possible to follow multiple signalers at the same time. Some signalers are free, others require certain compensation for their signals. So far, Cryptohopper is the only automatic trading platform to embed signalers onto its platform.

Each user is given significant flexibility with his trading strategy. He can choose not to tweak the hopper (bot) much, leaving his trading fortunes to the default settings. He can also dig deep and either learn how to use Cryptohopper tools to analyze various technical indicators himself or sign up for automated signals with one of the third party signalers available on the platform.

You can create several strategies, either for different coins or for different (bear/sideways/bull) markets. Bots trading features can also be turned off at your volition. There is much more to say about the bot; all of it is explained in detail in Cryptohopper documentation which we’ll cover a bit later in the article.

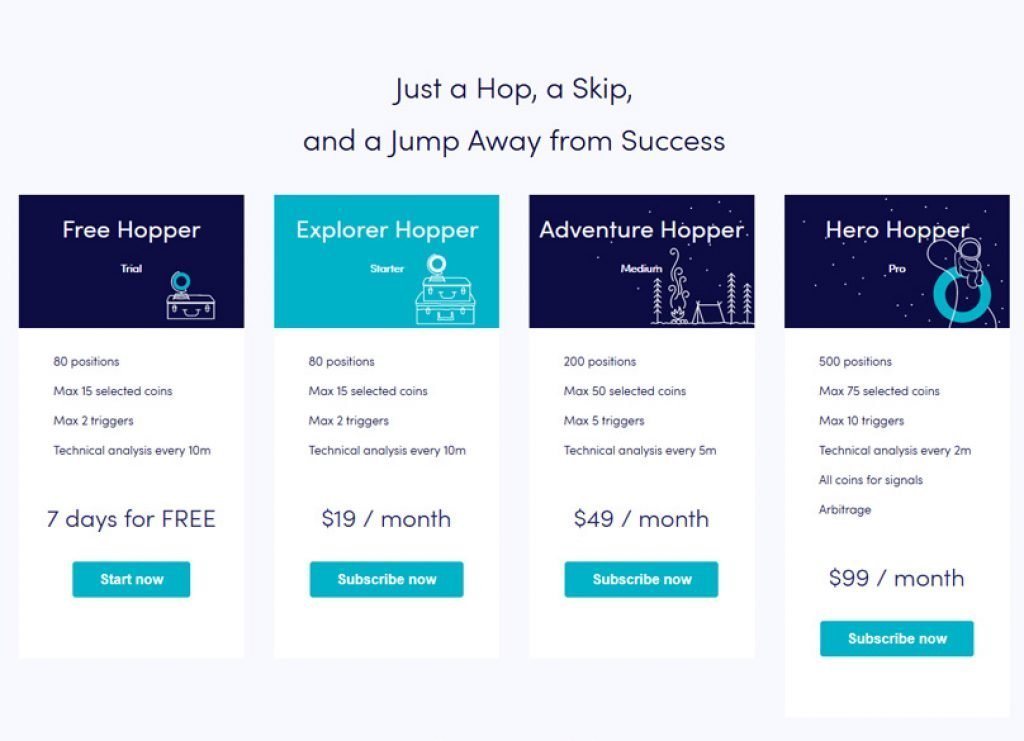

Cryptohopper Pricing

Cryptohopper service uses a subscription model with 3 pricing plans on offer:

You do not have to enter your credit card information before choosing which plan to use.

All accounts include 0 additional trading fees from Cryptohopper, buy settings lower bids, cooldown, trailing stop, settings like stop loss, TSL, auto close, and DCA, personal & global trading cryptocurrencies stats, 120+ indicators & candle patterns, syncing/tracking/selling manual buys, strategy backtesting with historical data, active community and staff support, and a reserve section to manage savings.

Once you access the Cryptohopper website you’ll be able to enter a 7-day trial of the Explorer Hopper.

Alternatively you can get a 30-day free trial period of the same plan if you sign up via a referral; either way you’ll get to know the software better and decide if you want to purchase one of the full packages listed above. Cryptohopper also offers enterprise-grade custom-tailored packages for more serious clients. The packages can be bought either on a monthly basis or full year in advance.

Read our full guide on bitcoin trading bots and see which are the best!

According to its promotional material, the bot is capable of giving you a steady stream of profits even if you have little to no knowledge about cryptocurrency trading.

The claim is head-scratching at best, as money-making schemes which brag about how “easy” and “simple” it is to achieve constant profits usually turn out to be complete scams. Still, we can give Cryptohopper the benefit of the doubt here, as their claims and marketing aren’t that outlandish and are in line with typical modern-day western advertising practices.

Paying with cryptocurrencies on Cryptohopper

In order to pay for your chosen monthly subscription, you can either do this via PayPal, or by depositing cryptocurrency. If choosing the latter, the platform supports the following coins.

- Bitcoin (BTC)

- Bitcoin Cash (BCH)

- Ripple (XRP)

- Zcash (ZEC)

- Monero (XMR)

- Litecoin (LTC)

- Dash (DASH)

Cryptohopper Customer Support

Cryptohopper has a rather active community behind it. While their Reddit page hasn’t seen much activity in a while, they have a very lively Discord where users can go and ask any sorts of questions about the bot. A good source of information/communication is the Cryptohopper forum, which you can access once you create an account on the bot’s website.

Cryptohopper website also has an interactive helpdesk which you can use to find a solution for your bot-related problems. From getting started with the bot, over configuration and general questions, to strategy designing and internal features of Cryptohopper, the knowledge base offered here is really good.

Knowledgebase and extensive QA

Besides those direct means of support, the project offers an extensive library of resources for getting started with/troubleshooting the bot. The resources section of their website contains detailed tutorials on how to set up Cryptohopper and its tools. These tutorials are laid out in a simple, step by step manner, making it very easy to digest and apply the instructions. Furthermore, you can use the extensive documentation section, this relatively regularly updated blog or this community-created review if you are interested in learning more about Cryptohopper, bots and trading in general.

Conclusion

Cryptohopper is a trading bot that offers some interesting features, including cloud trading, some social trading options and a large variety of coins/exchanges to trade on/with. Stop losses and trailing stops are especially welcome elements here, as they help you tremendously with risk management. As with any trading bot, you’ll find conflicting reports regarding its effectiveness, functionality and safety.

While Cryptohopper is in its essence an algorithmic trading platform, it is easy to setup and use and is a perfect fit for both newer traders as well as more experienced practitioners.

⚡️ The development of the Cryptohopper Academy video series and multi-lingual Hopper forum are enormously helpful for traders who are only just dipping their toes into the turbulent waters of crypto trading.

With its comprehensive list of features, general user-friendliness, and support for 75 different cryptocurrencies and nine leading exchanges, Cryptohopper has a lot going for it and does well to stand out it a market full of competing trading bots and cryptocurrency management platforms.

One important notice for all users of crypto bots or any crypto service – pay attention to best practices when it comes to your device security. Cryptocurrencies are a honeypot for all top-notch dark hackers and your money could be gone very fast if you are not cautious.

⚡️ As a result, it’s best to set up 2FA on your account, and to make full use of the free trial run, as well as make a modest financial commitment to start off. It may also be a good idea to connect the bot with a live account that contains a moderate amount of funds as there is less to risk if the bot underperforms or the signals do not generate the expected results.

It’s also important to note that while trading bots do not have withdrawal access, if they become compromised malicious actors can take advantage of a bot’s API access to buy extremely low value coins that are then “pumped and dumped” on other exchanges.

Furthermore, users have reported that the free third party signals are of a low quality, especially in sideways or bearish markets as the notifications arrive too late, and expose the trading bot to sudden downturns.

⚡️ Still, a couple of negative reviews here and there can be brushed aside; not everyone will be able to grasp the concepts related to Cryptohopper (no matter its relative ease of use) and sometimes people’s experience will suffer due to their own hardware/internet. That shouldn’t scare you away, as this bot is one of the more user-friendly ones on the market. Ultimately, Cryptohopper is a fully functional, legitimate tool which can, with some hard work and a bit of luck, potentially help anyone turn a profit by trading crypto.