Plus500 Review – Pros & Cons, Fees, Features, Security

Welcome to our in-depth Plus500 review, the ultimate guide for traders seeking a platform that combines a wide array of trading options with robust charting tools. If you’ve ever wondered, “Is Plus500 safe?” you’re in the right place. We’ll explore the platform’s regulatory credentials, customer service, and fee structure to give you a well-rounded view of its safety and reliability.

From commodities like gold and oil to a plethora of CFD options, Plus500 offers something for every trader. Read on to uncover the features that make Plus500 a standout choice in the trading world.

| Feature | Summary |

|---|---|

| 📈 Markets and Products | Plus500 offers a range of trading options including CFDs on stocks, stock indices, options, and thematic indexes. It also supports trading in commodities like gold, oil, and natural gas. |

| 📊 Charting Tools | The platform provides robust charting tools with 119 technical indicators. Users can also use multiple charts simultaneously. |

| 🛡️ Regulation | Plus500 is regulated by the FSCA in South Africa and holds licenses in major financial hubs like the UK, Australia, New Zealand, Israel, and Singapore. |

| 💳 Minimum Deposit | The minimum deposit varies by payment method: $100 for credit cards and eWallets, and $500 for wire transfers. |

| 💰 Deposit Fees | Plus500 is a zero-fee CFD provider for deposits. However, fees may be incurred for transferring money to and from the account. |

| 🛑 Inactivity Fees | A $10 monthly fee is charged after three months of inactivity. The account may be closed if there are insufficient funds. |

| 🌍 Supported Countries and Languages | Available in over 50 countries and supports over 31 languages, including English, Spanish, Chinese, Arabic, and Russian. |

| 📞 Customer Service | Comprehensive customer service is available through dedicated web pages, a communication system, and live support services. They also offer a detailed FAQ section and support via email and live chat. |

Plus500 is an international financial brokerage firm which provides online trading services in contracts for difference (CFDs) across more than 2,000 securities and multiple asset classes including commodities, options, ETFs, forex, shares, and cryptocurrency.

And ever since Plus500 listed cryptocurrency CFDs that can be traded on a margin, it awakened an interest of crypto enthusiasts and comparisons between Plus500 and other cryptocurrency margin trading platforms. For this reason, we will do a thorough Plus500 review – so keep on reading.

What you'll learn 👉

Plus500 at a glance

| Feature | Plus500 |

|---|---|

| Forex: Spot Trading | Yes |

| Currency Pairs (Total Forex pairs) | 50 |

| CFDs – Total Offered | 2033 |

| Social Trading / Copy-Trading | No |

| Cryptocurrency traded as actual | No |

| Cryptocurrency traded as CFD | Yes |

| Broker | Plus500 |

| Regulation | FCA (UK), CySec (Cyprus), ASIC (Australia), MAS (Singapore), FMA (New Zealand) |

| Minium Initial Deposit | €100 |

| Demo Account | Yes |

| Asset Coverage | Crypto, Indices, Forex, Commodities, Shares, Options, ETFs |

| Leverage | 30:1 Retail Accounts & 300:1 Professional Accounts |

| Trading Platforms | Proprietary, Web, Mobile, Windows Desktop, |

| Deposit Methods: | VISA, MasterCard, Local Bank Transfers, PayPal, Skrill |

| Withdrawal Methods: | VISA, MasterCard, Local Bank Transfers, PayPal, Skrill |

Where is Plus500 located and how well is it regulated?

The trading platform is owned by Plus500UK Ltd and has made sure to acquire all the licensing required for their activities. Original Plus500 Group was founded in 2008 in Israel with 400 thousand dollars of starting capital. The company went public in 2013 as Plus500 Ltd on the London Stock Exchange and raised $75 million through its IPO.

Plus500 currently remains a multi-asset trading platform that provides coverage to UK, US, European and Asian markets. It has received awards and recognition from industry watchers for its excellent service. Plus500 also has one of the highest rated CFD apps on the App Store and Google Play.

Plus500UK Ltd itself is a subsidiary of Plus500 Ltd and currently has its offices in London at 78 Cornhill in EC3V 3QQ. The entity is listed on the Main Market for Listed Companies of the London Stock Exchange.

The Financial Conduct Authority (FCA) authorizes and regulates Plus500UK Ltd to offer CFDs with FRN 509909. Plus500UK Limited is registered in Wales and England (with the company number 07024970). Outside of UK, Plus500 is regulated by the Cyprus Securities and Exchange Commission, Australian Securities and Investments Commission, Monetary Authority of Singapore and other similar agencies.

Plus500 is fully licensed to operate and trade in Israel and has its headquarters located in Haifa. Plus500 is available in 50+ countries and in more than 30 languages.

| Regulator | Countries Covered | Protection Offered |

| Financial Conduct Authority (FCA) | UK | All client funds are held in a segregated client bank account; Financial Services Compensation Scheme (FSCS) may cover up to £85,000 (for UK) if Plus500 fails. |

| Cyprus Securities Exchange (CySEC) | EEA countries (EU, Switzerland & Norway) | All client funds are held in a segregated client bank account Protection amount for EU, CH i Norway is €20,000. |

| Australian Securities & Investments Commission (ASIC) | Australia, New Zealand and South Africa | All client funds are held in a segregated client bank account. No Protection |

List of regulators covering Plus500, jurisdictions they cover, and protections they provide

History and reputation of Plus500

Launched in 2008, Plus500 started its business endeavors as a PC-based trading platform. From here onwards, every year brought an important development which boosted the company’s public profile and valuation.

A web-based version of the platform was created in 2010, opening CFD trading abilities to a wider audience of Linux, Mac, and smartphone-using individuals (introducing ETF around that same time). A year later the platform came to Apple’s App Store, a move which helped it grow above the number of 2 million transactions per month; releasing the Android version of the application helped here as well.

After covering all the internet-viable platforms, Plus500 went public on the London Stock Exchange’s AIM section in 2014; this was also the year during which the company introduced the world’s first Bitcoin CFD. 2015 saw the project go more mainstream and become a sponsor of the popular Spanish football club Atletico Madrid. Later on, 2016 was marked by the company adding CFDs for options and introducing their Web Trader.

Important developments transpired for the project a year later, when Plus500 made a sponsorship deal with the 2017 Super Rugby Australian Conference Champions, the “Plus500 Brumbies.” 2018 was the year during which the company saw its ordinary shares listed for trading on the Main Market for Listed Companies of the London Stock Exchange; final noteworthy achievement came some time later when Plus500 joined the UK FTSE 250 index of leading mid-cap listed companies.

Company’s focus is providing access to quality trade tools and assets to customers all over the world, with Western Europe seemingly being their main point of interest. They also claim to have three main principles on their mind when running their business:

- “Transparency – we make it clear to our clients exactly what they get and what they pay for. We pay no commission to our providers therefore our clients don’t pay any commissions. It’s what we expect from our providers, it’s what our clients get from us.

- Professionalism – our product is designed with enhanced security ensuring safe and seamless trading. It’s what we expect from our providers, it’s what our clients get from us.

- The Human Side – With over a million signups, Plus500 is operated by a dynamic group of programmers. We have our ups and downs and successes and failures, just like you. Keep faith in yourself, don’t change your behavior and continue going forward. It’s what we expect from our providers, it’s what our clients get from us.”

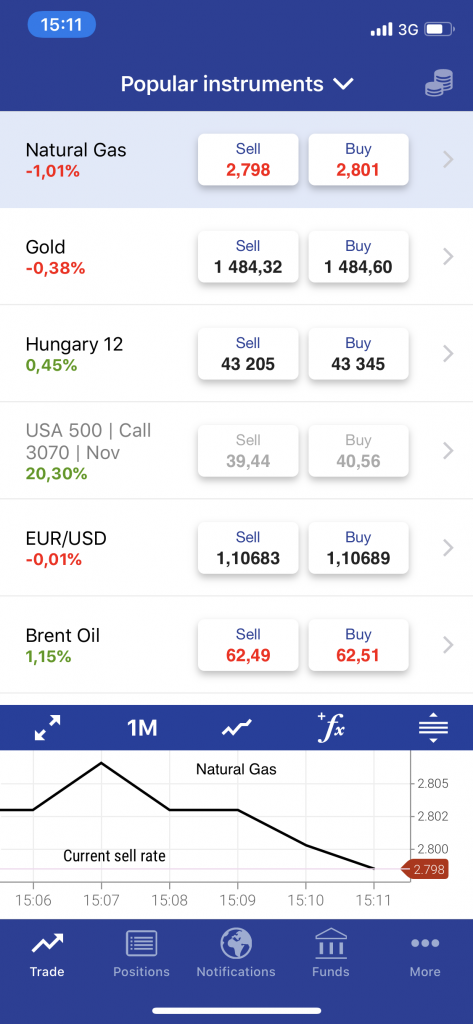

What can be traded on Plus500?

As noted in the intro, Plus500 offers trading for several kinds of trading instruments:

- Indices – The platform lets you trade indices like USA 500, NASDAQ 100 and France 40, all with leverage.

- Commodities – Commodities like oil, gold, natural gas, silver, cocoa, coffee, and sugar are also available for trade.

- Forex – Plus500 covers all the major fiat-to-fiat currency pairs like EUR/USD, GBP/USD and EUR/GBP.

- Shares – You’ll find CFD’s of popular shares from companies in USA, UK, Europe and other regions of the world.

- Options – Trade options contracts on stocks and indices like Germany 30, France 40, USA 500, UK 100, Italy 40, Hong Kong 50, Europe 50, Alphabet, Facebook, Apple, Deutsche Bank etc.

- ETFs – Plus500 provides a long list of ETF contracts with more than 50 available for trade. SPY, FAZ, QQQ, ERX, XME, IYR, SPXU, VNQ, XLP, EXW1.DE, SFY.CHA, GDX are just some of ETFs you’ll find here.

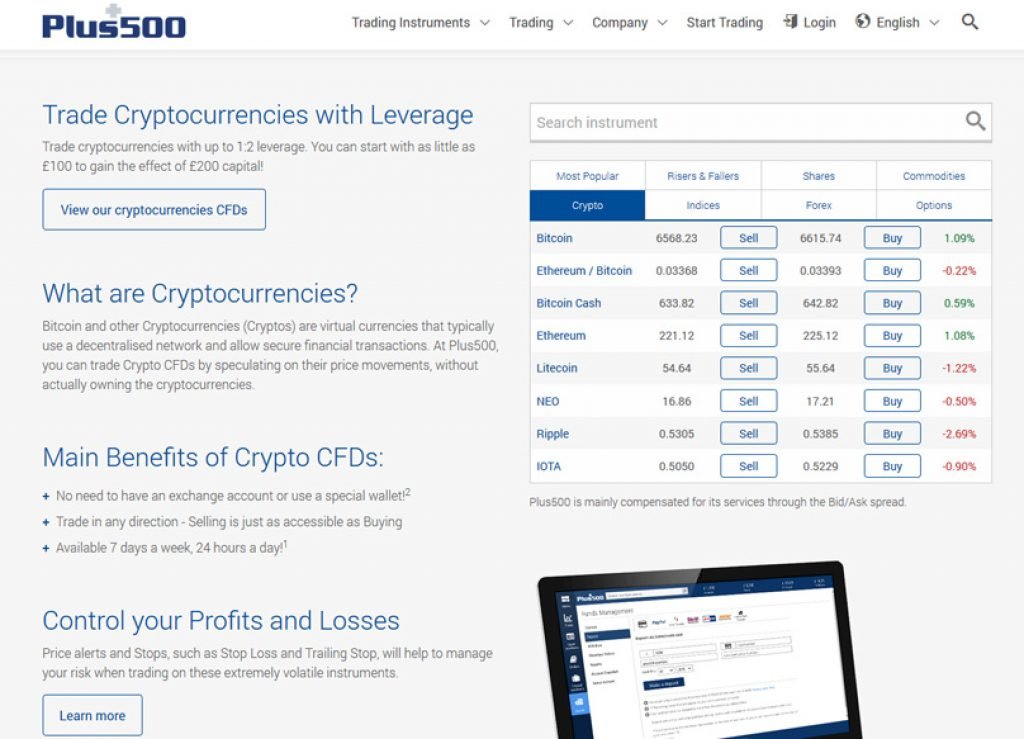

Trading cryptocurrencies on Plus500

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

74% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

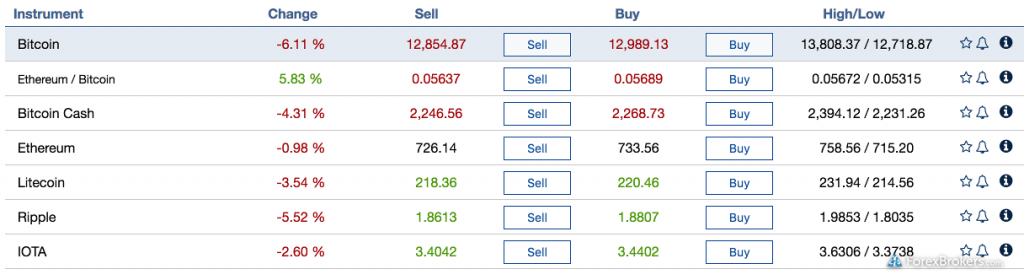

Plus500 recently introduced quite a few cryptocurrencies into its trading portfolio. Bitcoin, Bitcoin Cash, Ethereum, NEO, Monero, Ripple, Litecoin, and IOTA are currently listed on the platform.

Trading on this platform doesn’t give you any ownership (or any other) rights over the underlying asset.

Plus500 – leverages

The platform offers leveraged trading of its assets with the following leverage structure:

- Crypto – 1:2

- Indices – 1:300

- Forex – 1:300

- Commodities – 1:150

- Shares – 1:20

- Options – 1:5

- ETFs – 1:100

Plus500 tools and features

The platform also offers a wide array of trade risk management tools like close at profit (limit) and close at loss (stop loss) price levels, guaranteed stops, margin calls and trailing stops. Limits/stop losses let you set a rate at which point you will close your position automatically, protecting your profit or minimizing your loss.

Guaranteed stops are similar but place an absolute limit on the potential loss, limiting slippage that can occur with standard limit/stop loss orders; the downside is that guaranteed stop trades cannot be edited and come with additional spread charge. Margin calls are for the most part a standard element of any margin trading practice, as they allow your order to be liquidated before you lose more money than you have on your account/tied into your order.

Trailing Stops make it possible to place Close at Loss orders that automatically update as long as the market moves in your favor. The Close at Loss order gets activated when the market moves in an unfavorable direction.

Users are provided more protection by the platform banning certain trading methods like hedging, automated data entries, insider trading, or any other forms of market abuse.

Additionally, Plus500 has a built-in economic calendar which lists out important dates, events and predictions that can potentially affect the price of an asset tradable on the platform. This data is provided by Dow Jones and is split into a calendar with events that have their expected impact listed out and corporate events which encompass dividend and earnings releases. You can view events from yesterday, today, tomorrow, this week, or any other specific date range you set up.

You can also set up a wide range of alerts that will notify you when certain market conditions are achieved. Price alerts, change percent alerts and traders’ sentiments alerts (triggers when the percentage of sellers or buyers hits a certain threshold) are currently available. Your alerts can be sent via push notifications, email, or SMS messages.

You can create alerts by clicking the alert icon in the main trading screen, and you can view, edit and remove alerts by clicking the “Alerts” tab located in the application menu.

Plus500 scalping rules

Scalping is especially frowned upon on the platform; defined as “A trading strategy where a significant portion of the customer’s positions are opened and closed by him/her within 2 minutes,” you can expect to have your account suspended if you fall under this type of daytrading activity.

Plus500 Demo account

Another welcome feature is the Demo account which lets you trade in a demo mode with fake money; users who are looking to practice their trading skills will enjoy this feature the most.

How to signup on Plus500

To trade on Plus500, you’ll have to either create a full “Real Money” account or use the demo account provided on the platform. Both accounts allow you to trade in real market conditions, with the difference being the fact you don’t spend any real money with demo trading. You can choose your preferred account mode from the login screen or switch between the two accounts by clicking on “Switch to Demo Mode” or “Switch to Real Money” in the main platform screen or from the Plus500 app’s menu.

Types of accounts on Plus500

The platform recommends its users to have only one real money trading account. Plus500 doesn’t offer corporate/company accounts. There is an option to upgrade your account to a “Professional Account”, and the following criteria needs to be met for this to become eligible:

- Sufficient trading activity in last 12 months

You have performed an average of at least 10 transactions per quarter, of significant size, over the previous four quarters on the relevant market1 (with Plus500 and/or other providers).

- Financial instrument portfolio of over €500,000 (including cash savings and financial instruments)

You will not be required to deposit this amount.

The size of your financial instrument portfolio2 exceeds

€500,000.

- Relevant experience in the financial services sector

You work/have worked in the financial sector, for at least one year in a professional position which requires knowledge of the related transactions or services.

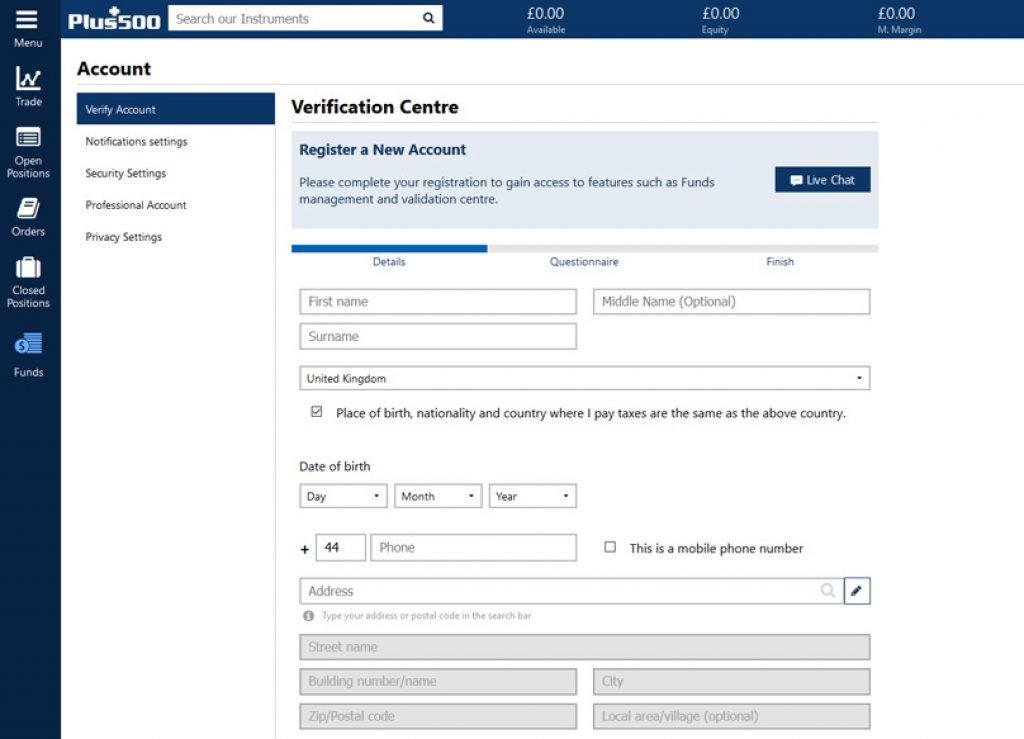

Account Verification on Plus500

Your individual account will need to go through certain verifications for you to be able to use the platform to its full capabilities. The verification of your name, date of birth, residential address, phone number, email address and payment method, and more will be required from Plus500 users. The platform points out that its legal/regulatory obligations and coverage require it to have its traders verified as real individuals.

You will also need to verify the source of your funds, either by providing your debit/credit card picture or a credit/bank statement which confirms you own the account you wish to fund your Plus500 wallet with.

Deposit methods on Plus500

Deposits can be made through bank wire transfers, Visa/Master Card cards, PayPal, or Skrill. Minimum deposits you can make on the platform are 100 Euros for debit/credit card deposits and 500 Euros for bank transfers.

All fund deposits must be made from a bank account tied to the Plus500 user; additional documents may need to be provided to prove you are in fact the person who owns the bank account. There are some situational deposit limits that can be imposed on your account, mostly related to the payment method you use and your credit situation.

Please note that eToro beats Plus500 in the majority of relevant metrics like social & copy trading, real stock and ETF trading, real crypto purchasing, adjustable leverage, allowed scalping and much more. Read more about eToro here or sign up for a free demo account by clicking here.

74% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

Withdrawals on Plus500

There are no deposit fees and you are given 5 free withdrawals per month which is a very commendable feature. Beyond that, the fee is $10 for one withdrawal. Accounts can be opened and tied to various base fiat currencies; this can help you avoid conversion fees when depositing money onto the platform.

There are minimum withdrawal limits for different types of withdrawal; for example the limit is $50 for Paypal and $100 for bank transfer and credit/debit cards. The time frame for processing a withdrawal request is normally 1-3 business days, in order to allow Plus500 to complete various security checks before releasing the funds from your account. All withdrawal methods have minimum amount thresholds which can be found on the withdrawal screen on the trading platform.

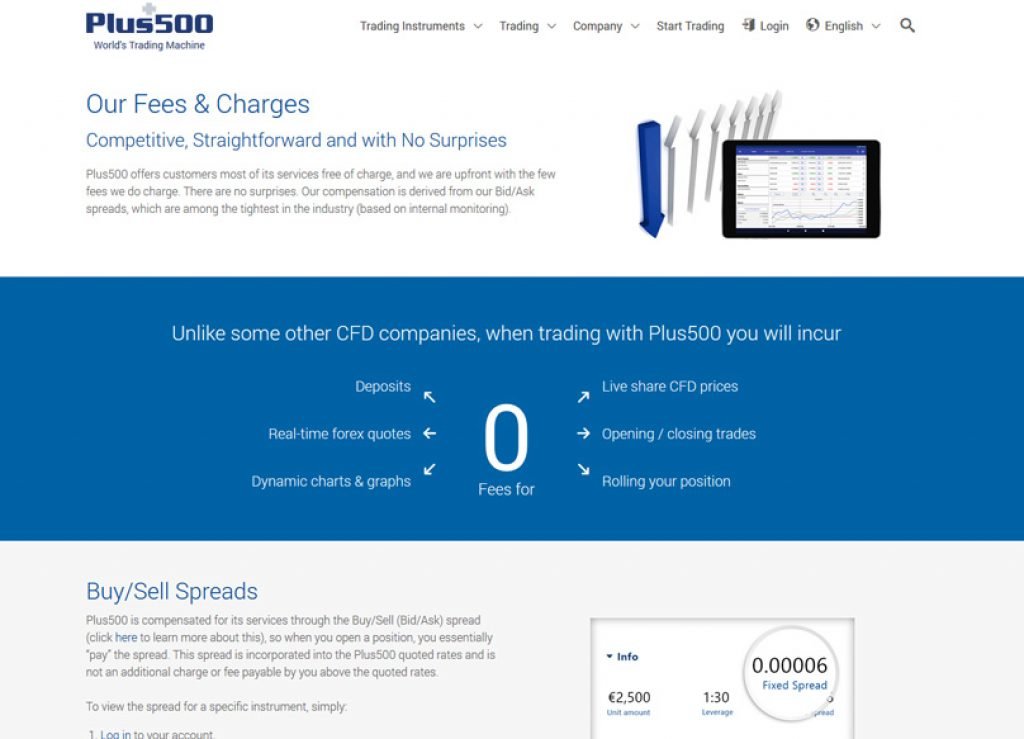

Plus500 Fees

The fee structure of Plus500 can be competitive at times, as some services are even offered free of charge. Deposits, live share CFD prices, real-time forex quotes, opening / closing trades, dynamic charts & graphs, rolling your position all incur 0 fees on the platform.

Plus500 is compensated for its services through the Buy/Sell (Bid/Ask) spread so when you open a position, you essentially “pay” the spread. Each instrument has a specific spread. Additionally the platform will at times calculate overnight funding fees (an overnight funding amount is either added to or subtracted from your account when holding a position after a certain time), guaranteed stop order fees (used to help you manage risks by guaranteeing the stop loss level), and inactivity fees (A charge of up to $10 will be levied, should you not log in to your trading platform for a period of three months).

Is Plus500 beginner friendly?

The platform interface breathes simplicity and ease of use, perhaps even a bit too much of it. Both the Web and mobile trading interfaces are clean, well designed, multilingual and overall suitable for both the beginner and the seasoned veteran of trading.

The platform seems particularly well-suited to traders who want to navigate quickly between many different trading instruments. Assets are listed under the seven categories available on the platform and can alternatively be found through the search bar that’s built into the Plus500 interface. Deposits and withdrawals are easy to make both from the web and mobile.

The interface lets you create watchlists, analyze charts, place and monitor trades. Technical analysis charts can be expanded to full screen and offer more than 100 technical indicators that you can apply to many different timeframes, from tick charts to weekly charts.

The interface does suffer in terms of advanced user compatibility, as it offers limited customization and a lack of advanced tools like MetaTrader4 (MT4). No outside tools can be used to pair Plus500’s web trading interface to enable added functionality either. Lack of a market news section or one dedicated to daily technical analysis can be a problem for some as well.

Is Plus500 safe to use?

Is Plus500 legit and reliable? There’s plenty of reasons to believe that Plus500 is a legitimate, secure platform to trade on. All subsidiaries of the company are regulated by jurisdiction-related laws and are compliant with KYC/AML requirements. Your deposits will be classified as “client money”, and afforded maximum protection in accordance with regulatory requirements. Client money is held in segregated trust accounts, and administered in accordance with regulatory requirements.

This segregation is expected to prevent your funds being compromised in case of company’s liquidation. Plus500 does not use client money for hedging, or any other investment or business purpose. The platform itself is protected by the SSL sensitive information transferring layer and 2FA authentication can be enabled.

Customer Support

Plus500 provides 24/7 email and live chat support in 15 languages. What users need to do is fill in the form available at the “Contact Us” section of their website and submit their “Request Form”. Following the submission of the Request Form, Plus500’s response will be sent by email directly to the email address the customer specified in the Request Form.

There is also chat support in English 24/7 in most jurisdictions it operates in. Multi-lingual nature of the platform doesn’t end here as traders can view the Plus500 website and mobile apps in 30 different languages.

There’s also an “Investor Relations” section on the platform through which Plus500 provides market information, results, financial statements, reports, latest news and other announcements that may be of use to platform users. On the minus side, the company does not offer customer support by phone which can be a problem to people who don’t have internet access. Additionally, the help/FAQ section of their website is somewhat lacking; this could be a good sign, implying that there weren’t many investor questions/problems to begin with.

Still, other brokers provide courses, videos, e-books, quizzes and more to help clients learn about the markets in which they are investing and about the platform they are investing on. Plus500 provides only one legally required “Key Information Document” (KID) that outlines the basics of what each available instrument is and the risks associated with trading it. The KID offers summary information on commodities, cryptocurrencies, ETFs, forex, indexes, options, and equities.

Please note that eToro beats Plus500 in the majority of relevant metrics like social & copy trading, real stock and ETF trading, real crypto purchasing, adjustable leverage, allowed scalping and much more. Read more about eToro here or sign up for a free demo account by clicking here.

74% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

Team

- Asaf Elimelech, CEO – Elimelech graduated in Accounting and Economics from Haifa University and possesses an accounting certificate in Israel. Mr. He has served as the Chief Executive Officer of Plus500 Ltd. since May 8, 2016 and its Executive Director of Plus500 Ltd. since February 28, 2016. Prior to joining Plus500, Mr. Elimelech was a supervisor at PwC Israel from 2008 to 2012, specializing in biotech and commercial audit, as well as providing tax services to clients.

- Gal Haber, Managing Director – Mr. Haber holds a B.Sc. in Computer Science from the Technion, Israel. Before co-founding Plus500, Mr. Haber served as chief operating officer of InterLogic Ltd, a ‘skilled games’ programme provider for the internet, and mobile devices, which he co-founded in 2004. At his current job, Haber has contributed significantly to the development of Plus500’s trading platform, making it user friendly and all-round more competitive.

- Elad Even-Chen, Chief Financial Officer – Mr. Even-Chen holds a B.A. in Accounting and Economics from Tel-Aviv University, an LL.B Degree from the College of Management and an MBA (specializing in Financial Management) from Tel-Aviv University. He worked as a finance director and vice president of business development at Plus500 before replacing Inbal Marom at the position of the project’s Chief Financial Officer.

- Penelope Judd, Chairman – A seasoned veteran of the accounting space with 30 years of experience in Compliance, Regulation, Corporate Finance and Auditing. She succeeded the company’s previous chairman Alastair Gordon who served as the chairman since Plus500’s 2013 IPO. Judd received a 99.61% of votes in her favor during 2018 shareholders voting on expanding the mandate of the company’s boardroom.

Partnerships

Plus500 has an interesting lineup of partnerships, having onboarded companies such as ADVFN, finanzen.net, FX Empire, and sports clubs like Atletico Madrid and Brumbies Rugby. Plus500 built a strong network of banks and financial institutions which ensure highest level of quality and performance for any client.

We recommend eToro

This is a high-risk investment and you should not expect to be protected

if something goes wrong.

Take 2 mins to learn more

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.

Should You Use Plus500?

While not fully crypto-oriented, Plus500 caught our eye due to the fact that they do offer some crypto-related trading. Daytraders and those who are quick on the trade trigger won’t find much luck here, as aggressive strategies will be frowned upon by the broker.

Otherwise, more long-term investors will discover that Plus500’s regulated platform offers security, reliability, friendly interface, and competitive fees that will serve as excellent grounds to build their CFD trading experience on. Is Plus500 a scam? Be aware: more than 80% of CFD traders end up losing their money. Make sure you do your due diligence and end up in the other 20%.

Please Note: 80.6% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

In case you are not swayed into registering on Plus500, you might be interesting in learning more about its direct competitors like eToro, AvaTrade, IQ Options or City Index.

You should put in your review that you get paid on a referral basis. Plus500 operate with a conflict of interest , they control platform and price. They profit when consumers lose. No amount of skill will make a difference these fraudsters control everything. People stay away from this scammers .