BitWell Review – Fees, Supported Coins & Countries, Payment Methods, KYC Process

What you'll learn 👉

BitWell Overview

Bitwell launched back in 2020, fairly a new exchange compared to most competition. They have worked to make their website quite niche in order to fill a certain part of the market. This way they have managed to do less marketing since they do not need to cater to every part of the market. They work specifically on the derivatives market and create a good product and provide a great service for people who would like to wager on the future price of Bitcoin.

A derivative market means that there are two sides, but instead of buying or selling at that moment, you come to an agreement about the price on a certain date. One side says it will be X amount by Y time and the other says it won’t be. Whoever is right, gets the profit and that’s how you trade in a derivative market. This is what Bitwell is providing to people as a market however they are also providing regular leveraged trading as well these days which you could do as high as x100 on their platform.

Services & Features

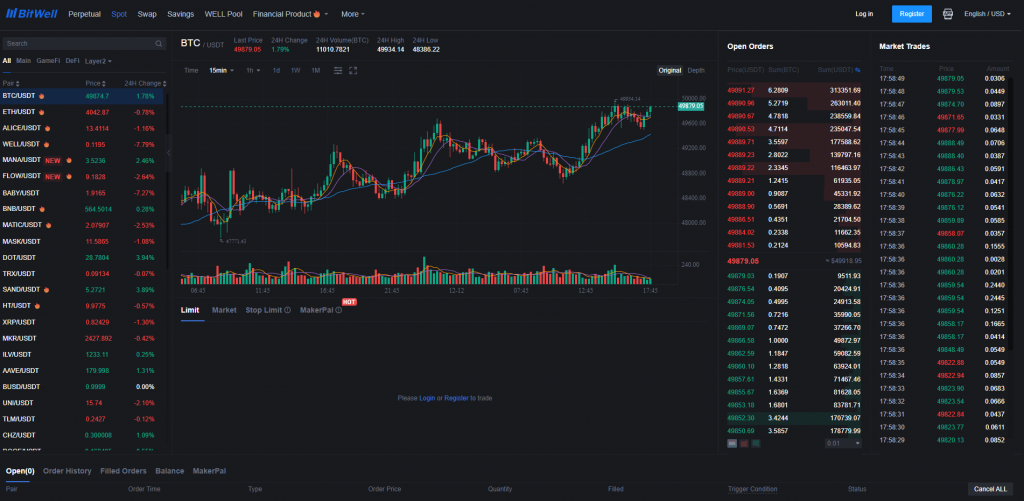

Spot Exchange

Even though Spot exchange is not what Bitwell is known for, they still have a decent size volume in the spot as well. Mainly people who are keeping their cash in the spot and trade meanwhile waiting until a derivative is open, or simply they just prefer to do their spot trades where they do their derivatives. There are some that use it for the only spot as well but the numbers are not so high.

With only 41 markets available and only 6 of them being over 10 million dollars in volume, it is clear that spot exchange is lacking the volume that it needs in order to be taken seriously. They are close to being in the top 50, but in order to be even better, they need to spread some of that top volume traded into other pairs as well. Usually, exchanges deal with crypto trading competitions on lower volume pairs to switch some of the top volumes into lower levels, which could be a good and quick solution for them.

Perpetual Trading

This is where BitWell really shines. They have a great selection for perpetual trading and they have over half a million dollars in perpetual trading every single day. This is not to say it’s like their leveraged futures trading but it is certainly a great reason to use BitWell for sure. With 300 million dollars alone in BTC/USDT perpetual trading volume, they have provided the world a good place to start trading.

Once again they could do marketing a lot better to focus on this side of their exchange if they wanted to, but so far it looks to be doing fine and not bothering anyone. When you are trading in an exchange and that exchange offers you all the ways you could trade without needing to check another website for it, that is usually the main bread and butter of that exchange. They get you with derivatives but they keep you with spot and perpetual together.

Options Trading

This is it for Bitwell, this is the real king of BitWell because that is what they are very famous for. They are 15th in derivatives ranking at Coinmarketcap and they have a huge volume on it as well. Considering options are important and doable as long as you find another person to take the opposite bet as you do, it means volume and liquidity is the key factor here.

Providing that to the customers (or attracting enough customers to provide to each other) is the thing that makes options exchange so valuable. With one of the highest crypto derivative volumes out there in the world, they have managed to provide as much as they should to the people. If you are looking for options trading, BitWell will be one of the exchanges you will hear about everywhere.

BitWell supported coins

Bitwell is not supporting an awful lot of coins. They have 41 coins listed and that is one of the fewest ones we have reviewed so far. However what they are aiming at is not to have many coins to trade, but to have a few that traded a lot. This is a different technique to many other newer exchanges. Normally new exchanges list as many coins and tokens as possible in order to attract traders and the community of those projects.

This usually leads to a decent size volume that is spread out into many different pairs but the newly listed ones usually end up getting traded very quickly and then calm down. Instead of doing this, BitWell focused on the top coins and offered high volume with multiple methods of trading with them, which seems to be working well for them.

BitWell Deposits & Withdrawals

Fees

Deposits don’t have any extra cost as per usual. However, withdrawal is one of the most unprofessional parts of this website ever. You can’t find any information anywhere regarding the fee unless you register and check it one by one. If you are already a customer here and have seen what the withdrawal fee looks like then you could feel fine.

However, someone who never registered here and wants to check the fee rates would not be able to do so unless they register. Not really a good look on their behalf. We have checked for you so that you do not need to register in order to both help our readers and also involuntarily help bitwell at the same time.

BTC withdrawal fee is 0.005 BTC

ETH withdrawal fee is 0.017 ETH

USDT depends on the network, its 35$ for ERC20 while 1$ for TRC20

XRP withdrawal fee is 2 XRP

And the cheapest one is TRX with just 1 TRX fee

These are the most used and traded ones so we have listed these for you. However, if you would like to check for more, unfortunately, you will have to register to their website in order to check. With a limit like 5 bitcoins per day, or nearly 300k dollars in USDT, they do not seem to cater for too big of a whale customer, but not really a big problem for the majority of the crypto world either.

BitWell Trading Fees

Spot trading is a flat %0.1 maker and taker fee for both of them. From what it seems there doesn’t seem to be a discount for the spot trading version with more volume, however, you could do it with affiliated links which means the person who invites others could share their fee payment. Options trading has a %0.015 maker and %0.04 taker fee, with a maximum of %10 max on premiums. And lastly, we have Perpetual which starts from %0.03 maker and %0.07 taker fee and goes as low as zero depending on how much volume a trader has.

Does BitWell require KYC?

There is no mandatory KYC which is interesting because in the exchange world KYC is usually mandatory since regulations of nearly every nation require it. With headquarters in Singapore that asks for KYC, it is definitely puzzling to see them not require KYC.

However they do “increase the limit” system of KYC, which means you are not forced to do it, but if you do share your KYC information with them, then you are going to have higher limits. This is another method that some other places use. However not many places use it at this high level, having a 5 BTC, and 300k USDT withdrawal limit without any information is usually not possible in most exchanges.

BitWell supported countries

Bitwell supports every single country in the world based on acceptance. There is no nation that was left alone regarding where you can reach the website. However, they do not take any responsibility if your government doesn’t allow you to trade at BitWell and you still do. Which means they let the customers decide on what their consequences will be.

This is both a liberal approach to exchange management and still liked by many people who couldn’t find exchanges anywhere else. When you are registering at BitWell you are taking your own responsibility and you state you are willing to face the consequences if you are hit with a legal repercussion.

Are US investors allowed on BitWell?

With the same mindset, USA citizens are “not” allowed to trade here based on what SEC has stated regarding exchanges without US license, and BitWell doesn’t have a US license which means you should not trade here if you do not want to go against the law.

However BitWell will not be the one who will stop you, they allow any US citizen to register, and there are zero rules regarding not being able to register from the USA. This means you are allowed to do something that SEC doesn’t allow you to do, it is in your hands to decide what you will do but we highly recommend not signing up if you are from the USA in order to stay on the legal side.

How to start with BitWell?

Registration is a very simple three-stage process. You enter your email, they will send you a code to that email to verify, then you write that code, you write your password, and confirm your registration. After that, you could also do verification to increase your limit if you want to, but the initial registration is only those three steps. You also need to put a funds password for being able to withdraw as well. It takes 24 hours to start, so you can’t withdraw on your first day, or after 24 hours any time, you change your funds’ password.

Does BitWell have a Native Token?

BitWell has a native token called “WELL”, which is ranked within the top 1000 in rankings. While not being anything special and not having too much of a volume, it is still promoted by BitWell. The fact that high discount offers don’t come with Well is the main cause of their low market price, normally most exchanges have very high discounts on trading fees with their native token, unfortunately, BitWell doesn’t offer something like that.

What is WELL token?

You could use it for paying a financial transaction if you would like to. It could be paid as the margin on your contracts and certain products could only be reached with WELL payments as well. Certainly, just an “alternative” and not good enough reasons to use it so far. However, they do have more works coming up soon that may give it some more utility. Obviously a low ranked token, WELL has not been a successful one so far and needs to increase its value tenfold before competing against other exchange native tokens.

BitWell Visa card

You could issue either a virtual or a physical visa card from Bitwell. It allows you to spend it online in many places if you would like to while allowing you to use your crypto as well. They instantly swap your crypto to fiat and pay the vendor, that way you never have to carry fiat ever again and keep all of your money in crypto. Unfortunately, as with everything else in BitWell, there doesn’t seem to be any further information regarding this product.

You could check the visa card page they have; Here and you will have every single piece of information anyone would have. One of the biggest problems they have is a lack of information regarding their products. There doesn’t seem to be even an indication that it has already started to roll out. So far what we know is they are collecting information from people who are filling out the required form just to get a feeling of how many people will apply.

Based on the number of people who filled the form, eventually, they will start actually accepting people as applying and will start sending them out. This is why they do not have any information regarding what the fees will be like, which coins will be accepted and which nations will be accepting them as well. It is a future product that is marketed like today’s service.

Is BitWell legit and safe?

Are they legit? They seem to be doing an alright job with the amount of volume they have and there haven’t been any known complaints about them scamming customers. This means that at least for now they are doing something correctly and gathering trust from the community. This doesn’t mean that they will stay like this, we have seen many good-looking websites “getting hacked” before, so there are no guarantees regarding their future.

However, if we are going to talk about their safety? Not being registered anywhere or sharing any information regarding their license, not asking KYC, not following any laws, allowing people to register wherever they are from, and not sharing any information with people regarding their website.. the list goes on. They certainly do not look safe to use, the only upside that they have right now for safety is the fact that they have not been hacked so far in the past 1+ year they have been in existence. As a top 20 derivatives exchange, that is a good achievement.

BitWell is founded by senior practitioners from top Internet companies like Amazon, Tencent and Baidu, as well as institutions such as Morgan Stanley, IBM and PayPal.

Is BitWell Regulated?

Unfortunately, this is another piece of information that BitWell doesn’t share with the public. When asked they have forwarded this problem to the PR department in order to put it on the website, but so far as we know, there is no information given regarding their regulations. If it is regulated properly by anyone, it is not publicly known and not shared anywhere.

Which could equal not being regulated at all for customers since any regulated exchange is unregulated as long as we do not share the results. Even though BitWell does the finance side of things incredibly well, they are not very professional when it comes to documentation for the public.

Conclusion

The end game comes down to one question; Are you looking to trade options? If you are then you should at least check out BitWell and see what they are offering and how much volume is in that trade. However, if you are not looking for a place to trade derivatives, then there is no reason for you to use BitWell at all.

With lower volume on spots, and not offering anything top exchanges can’t offer, they are certainly not in contention to be an all-around exchange at all. The only reason to even consider registering would be options trading.

If you are not fond of BitWell exchange, Make sure to check out our guides on other cryptocurrency exchanges:

- BitMart Review

- Coinbene Review

- Kraken Review

- Bitpanda Review

- Kucoin Review

- LBank Review

- Hotcoin Global

- Azbit Review

- Bit2Me Review

- CoinCheck Review

- AAX Exchange Review