CoinFlex Review – Fees, Supported Coins & Countries, Deposits & Withdrawals

Today, we will talk about Coinflex, an exchange with a few peculiarities. It has its good and bad sides, and they will be adequately covered in this CoinFlex review. After this discussion, you can decide if this is an exchange you can be comfortable using or not. Let us start!

What you'll learn 👉

WHAT IS COINFLEX?

Coinflex (short for Coin Futures and Lending Exchange) was established in 2019 as a spin-off of Coinfloor, a UK exchange that made history as the first publicly auditable crypto exchange and one of the leading crypto trading platforms globally. It was co-founded by Mark Lamb and Sudhu Arumugam, prominent crypto personalities in the UK. The following facts stand out about the Coinflex exchange.

- It is duly registered in Seychelles

- It offers referral bonuses and affiliate commissions for its users.

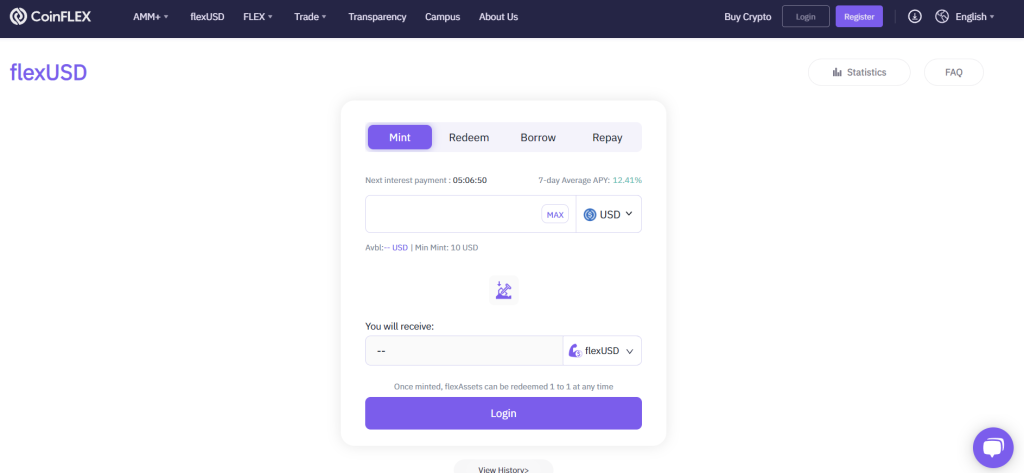

- It recently launched flexUSD, a stablecoin that yields interest every eight hours

- Apart from flexUSD, it also offers Promissory Note Tokens (PNTs), which are basically loans borrowed from liquidity providers on the platform.

- It is backed by corporate giants who act as both investors and liquidity providers. Some of them are Polychain Capital, Nascent Ventures, Grapefruit Trading, etc.

- It offers both DeFi and CeFi products.

- It occupies a unique position as the first physically settled futures exchange.

SERVICES AND FEATURES

Spot Exchange

This is where the supported coins are traded against USD. When this article was written, there were 41 different markets traded on the Coinflex spot exchange. The pairs range from common ones like BTC/USD, ETH/USD, BCH/USD, etc., to more unique ones like flexUSD/USD, GrapefruitUSD/USD, etc.

The spot exchange feature of Coinflex offers detailed charts which show both candlesticks and trading depth. There are six different order types on Coinflex’s spot exchange, namely:

👉 LIMIT ORDER: Orders that rest on the order book and are not immediately executed

👉 MARKET ORDER: Orders that are executed immediately without resting on the order book

👉 STOP-LIMIT ORDER: Orders that mitigate against further losses by selling off the tokens when the price has depreciated to a certain level.

👉 MAKER-ONLY ORDER: This ensures that the trader remains a market maker by ensuring that orders always rest on the order book.

👉 IOC (IMMEDIATELY OR CANCEL): This ensures that the trader remains a market taker regardless of the price conditions

👉 FOK (FILL OR KILL): Orders are completely executed or not executed at all.

PERPETUALS

This feature consists of 29 swap pairs with a maximum leverage of 100x. Like futures, perpetuals allow traders to speculate on the future price of an asset. The only difference is that perpetuals do not expire.

Perpetual contracts on Coinflex differ from those of other exchanges in that it is possible to deliver a perpetual position to the spot market. This is a highly risky option as you stand the chance of losing all or part of your assets if the crypto market suddenly moves against you.

FUTURES

As mentioned earlier, the difference between futures and perpetuals is that futures expire while perpetuals do not. Some futures contracts on Coinflex expire on the last Friday of the quarter, generally by 12 Noon UTC. Other futures contracts expire twice a year, also on the last Friday of the six-month period.

There are five futures contracts in total for Coinflex. Two are for BTC/USD (one quarterly, the other semi-annually), two are for ETH/USD (one quarterly, the other semi-annually), and the last one is a quarterly futures contract for BCH/USD.

SPREAD

This trading mechanism trades the difference between the perpetual and futures contract of a pair of assets. It has two legs, one for the perpetual contract and the other for the futures contract. It is a more volatile trading type but offers quicker gains, especially as Coinflex allows traders to trade up to 250x leverage (125x on each leg).

Closing the ticket directly is not encouraged as you can only close one leg at a time, and this may leave the other leg open to liquidation. The safest way to close the position is to apply another trade in the reverse direction.

REPO

It means Repurchase Agreement and is simply a borrowing and lending service traded as an exchange product on Coinflex. It is a peculiar type of trade where interest rates are displayed instead of prices. Also, bidding in a REPO market means that you have USD to put down as a loan in exchange for other coins as collateral, while the reverse is the case if you make an offer in a REPO market. There are currently 29 different REPO pairs traded on Coinflex.

INDEX

This trading tool tracks the performance of a group of assets.

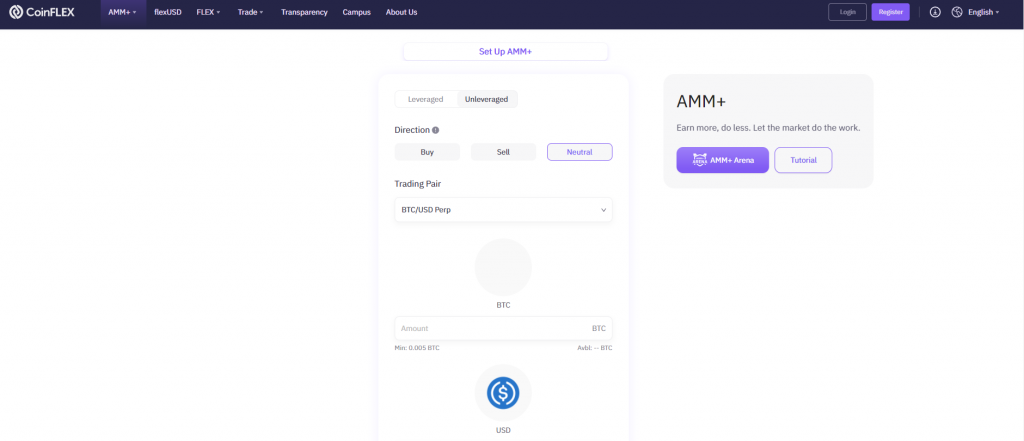

AMM+

AMM means Automated Market Maker. It is the main engine that powers most of the DeFi world, in which anyone can create a liquidity pool and become a liquidity provider. Liquidity providers, LPs for short, get rewarded with a percentage of the AMM fees proportional to their stake in the liquidity pool. The concept was popularised by Uniswap, which is still the largest decentralized exchange by trade volume.

AMM+ by Coinflex goes a step further. It combines the AMM concept with leveraged trading to enable traders to engage in liquidity, providing access to up to 10x leverage. In addition, users can use other assets as collateral to provide liquidity to a pool. For example, users can add BCH or LINK as collateral for the ETH/USD liquidity pool. This concept is groundbreaking in the crypto world and adds to Coinflex’s uniqueness.

PROS AND CONS OF AMM+

- PROS:

- It offers lower fees than many other decentralised exchanges.

- The option of leverage gives it deeper liquidity, which in turn reduces price slippage.

- It requires little capital to be a liquidity provider (as little as $200).

- It is a way of earning passive income for as long as you want.

- CONS:

- In addition to the risk of impermanent loss, AMM+ comes with liquidation risk, too, since leveraged trading is involved.

- The concept can be complex for those not very familiar with the DeFi world.

COINFLEX SUPPORTED COINS

There are 39 coins currently listed on Coinflex. They are BTC, ETH, BCH, FLEX, XRP, CELR, AAVE, SHIB, USDT, LINK, BNB, DASH, SUSHI, COMP, DOT, UNI, MKR, REVV, CRV, YFI, SNX, DOGE, BAL, OMG, BAND, LTC, flexUSD, LDO, GOC, GrapefruitUSD, MountainVUSD, RSR, AXS, EfrontierUSD, LEASH, FolkvangUSD, BONE, and NibbioUSD. The coins are traded in 41 markets on the exchange.

COINFLEX DEPOSITS AND WITHDRAWALS

Coinflex does not support fiat deposits and withdrawals at this time. The only way of adding funds to the exchange is by depositing cryptocurrencies. However, the exchange allows you to buy crypto with credit cards.

The payment is processed by MoonPay, a third-party payment service provider. With this feature, you can purchase AAVE, AXS, BCH, BTC, COMP, DASH, USDT, USDC, DOGE, ETH, LINK, LTC, MKR, OMG, SNX, SHIB, and UNI with about 42 fiat currencies.

Deposits of cryptocurrencies are free on the platform, while withdrawal fees are subject to the network fees of the particular coin. Interestingly, though, Coinflex offers fee-free withdrawals for BCH, FLEX, flexUSD, and DOT.

COINFLEX TRADING FEES

The trading fees for both spot and derivatives trading are tiered according to several factors. To make it easier to grasp the concept, I will outline the various fee structures for each feature of the exchange in a table. However, let me first explain what the different VIP levels (or tiers) mean.

- VIP 0 – Zero 30-day trading volume or flex balance

- VIP1 – $2,000,000 30-day volume or $1,000 worth of Flex

- VIP 2 – $20,000,000 30-day volume or $10,000 worth of Flex

- VIP 3 – $100,000,000 30-day volume or $50,000 worth of Flex.

- VIP 4 – $200,000,000 30-day volume or $100,000 worth of Flex

- VIP 5 – $1,000,000,000 30-day volume or $500,000 worth of Flex or 2.5% of total maker volume

- VIP 6 – $2,000,000,000 30-day volume or $1,000,000 worth of Flex or 5% of total maker volume.

| VIP LEVEL | SPOT MAKER FEE | SPOT TAKER FEE | FUTURES MAKER FEE | FUTURES TAKER FEE |

| 0 | 0% | 0.08% | 0% | 0.08% |

| 1 | 0% | 0.074% | -0.004% | 0.074% |

| 2 | 0% | 0.069% | -0.009% | 0.069% |

| 3 | 0% | 0.063% | -0.013% | 0.063% |

| 4 | 0% | 0.057% | -0.017% | 0.057% |

| 5 | 0% | 0.051% | -0.021% | 0.051% |

| 6 | 0% | 0.04% | -0.03% | 0.04% |

The negative maker fee for futures trades means rebates instead of fees. The rebates are paid in FLEX tokens.

DOES COINFLEX HAVE MANDATORY KYC?

CoinFlex does not mandate KYC verification unless you want to withdraw more than $10,000 worth of crypto from your account. There are three levels of KYC, each with additional requirements and limits.

KYC1 is the default verification level when you first sign up on the exchange. It offers you access to a lifetime transaction of $10,000 or lower. You do not need to provide much info here apart from your email and password.

KYC2 is the next level that opens up access to a daily transaction limit of $10,000 worth of crypto. You’ll need to provide personal information about yourself. Information like your name, date of birth, country of residence, Identification document type and expiry date, etc.

KYC3 is the last verification level. Those who have completed this level have no withdrawal limits as far as the exchange is concerned. The documents required for this level are the identification documents and the proof of address documents for individuals. Corporate institutions are required to submit certificates of incorporation, staff registry, and other corporate documents.

SUPPORTED COUNTRIES ON COINFLEX

CoinFlex allows residents from about two hundred countries to access its services without any restrictions. However, its services are prohibited from residents of Afghanistan, North Korea, Belarus, Somalia, Central African Republic, Libya DR Congo, Myanmar, Ivory Coast, Liberia, Crimea, Syria, Cuba, Zimbabwe, Yemen, Quebec, the United States of America, South Sudan, Syria, and Venezuela. This may change in the future, but there is no indication of that now.

DOES COINFLEX HAVE FIAT DEPOSIT?

CoinFlex does not allow users to deposit fiat directly on the platform. It only offers them the ability to buy Crypto directly on the platform with Credit cards. To do this, it employs the services of a third-party payment provider, MoonPay. This platform allows users to purchase 17 coins with 42 fiat currencies.

When you deposit USDC on the platform, they are treated as USD deposits pegged to a 1:1 ratio. USDC deposits are free on the CoinFlex platform. You may only have to pay network fees on the platform you’re sending from.

DOES COINFLEX HAVE A NATIVE TOKEN?

Yes, it does. We will now talk about two of those tokens that are native to the platform.

FLEX COIN

This is the main coin of the CoinFlex ecosystem. It was launched on July 4, 2019, with a maximum supply of 100,000,000 coins. It is burned daily and currently has a circulating supply of about 78 million tokens. It has the following uses:

- Holding at least $1000 worth of FLEX coins allows you to enjoy discounts on trading fees.

- It is used as collateral for partaking in various aspects of futures trades.

- It allows users to enjoy up to a 20% referral bonus for life

- You can also stake it to earn rewards in FLEXDAO.

flexUSD

This is a stablecoin like no other that generates interest every eight hours. The interest it yields is gotten from the funding rates of perpetual contracts on the platform. Thus, there would always be interest as long as there are perpetual contracts.

You don’t even have to do much to gain interest except hold it. It doesn’t even matter where you hold it; you will still get your rewards which are usually about 10-20% APR.

It is an Erc-20 token but also runs on the BCH smart contract system. Plans are also on the ground to add it to the Trc-20, EOS, and DOT smart contracts in the future.

IS COINFLEX LEGIT AND SAFE?

CoinFlex has an insurance fund that exceeds $1,000,000. This fund is in place to protect customers against losses resulting from thefts and hacks. They also store their funds with FireBlocks, a storage platform with over $30,000,000 worth of insurance against unexpected losses. Thus, users of the platform can be assured that even unexpected events do not translate to the loss of their funds.

CoinFlex keeps nearly 99% of the cryptocurrencies received in cold storage.

In addition to this, the exchange’s services are protected by state-of-the-art encryption, ensuring that hackers find it very difficult to penetrate. They also encourage user accountability by enforcing two-factor authentication before sensitive activities like fund withdrawals are processed.

CONCLUSION

CoinFlex is a unique website. It offers some features that are difficult to come by elsewhere. Even if you don’t want to trade, it still offers you the opportunity to earn passive income by simply holding flexUSD. I hope this article has helped you determine if this exchange is for you or not. Always remember that crypto trading is a risky venture, so make your research well before plunging into any aspect of it.

FREQUENTLY ASKED QUESTIONS

Read also: