FTX Leveraged Tokens are the extreme sports of crypto-trading. Even in a super-volatile cryptocurrency market, some people still crave more risk. I guess it’s for the same reason they jump off mountains with wingsuits or hurl themselves from airplanes. Why? Because assuming you don’t get REKD, the rush is amazing.

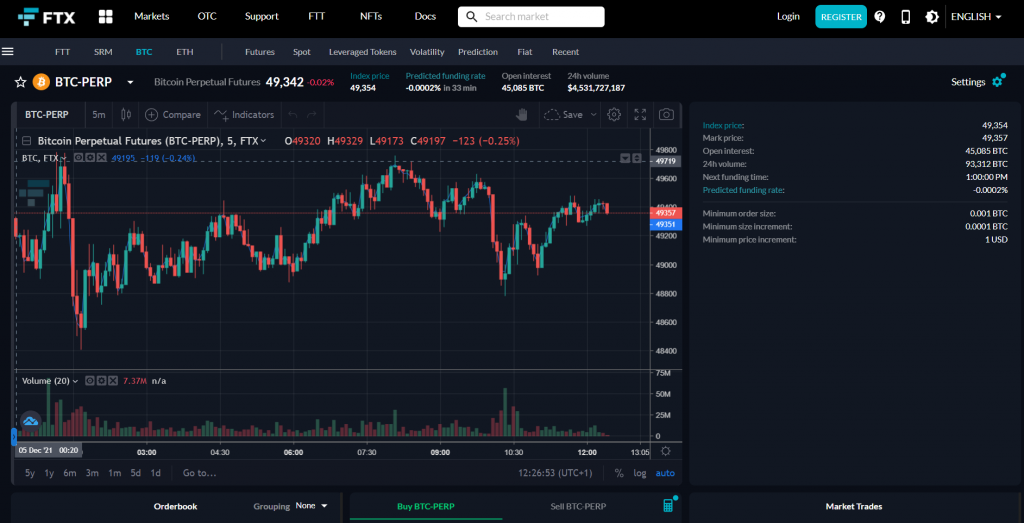

FTX exchange is smashing it at the moment with huge sponsorship deals and massive trade volumes. As I write, BTC and ETH are hitting all-time highs with politicians and sports professionals electing to be paid in crypto. Legislation is fumbling its way through Congress as financial institutions are scrambling to buy BTC. It’s all happening right now, and FTX is riding the crest of the wave.

With unprecedented recent gains in their wallets, some cryptophiles are keen to take a shot at more complex trading types. Let’s take a look at what FTX Leveraged Tokens are all about by answering the most common questions.

What you'll learn 👉

What are leveraged tokens?

Leveraged Tokens multiply your exposure to a given cryptocurrency. For example, a price increase of 5% on a regular trade would be worth 15% when you’re leveraged at 3x. It works the other way round, too. If the underlying crypto falls by 5%, your loss will be 3x = 15%. Ouch! FTX Leveraged tokens offer a little more than this, however.

There are 4 main token types – A Hedge Token at -1x token, a -3x token to short an asset, a 0.5x (HALF) token for the volatility-shy, and a 3x token for leveraging your longs. There’s also a volatility token – take a look at the options here and select “Leveraged Tokens” from the “Markets.”

How do FTX leveraged tokens work?

There’s more to FTX Leveraged Tokens than just a supercharging multiplier. The technicalities around “rebalancing” and “synthetic/wrapped tokens” ensure the whole thing works seamlessly. You can buy and sell them just like regular tokens on the spot market, but there’s some interesting stuff going on underneath the hood. Let’s break it down into the whys and hows.

Why use FTX leveraged tokens?

We get “more bang for our buck” by investing less to make more – or that’s the idea. Many margin-trading facilities will ruthlessly liquidate your position if you trip over the margin-call threshold. Things are less severe with FTX Leveraged Tokens thanks to “Rebalancing,” so there’s a little less risk of disaster.

Also, FTX continues to become a major player earning itself a reputation for trustworthiness. They’re not interested in ripping off suckers with a CFD (Contract for DIfference) offshore crypto exchange/gambling site. For the budding hobbyist who has caught the trading bug recently, it’s a great way of trying out ‘grown-up’ trading in a safer environment.

What are the main risks of using leveraged tokens?

The main risk is losing all your money, but this can be mitigated in the short term by good bankroll management. For example, set a rule that each trade should be no more than 5% of your trading account. This way, you’re extremely unlikely to be wiped out unless there’s another flaw in your strategy.

Leveraged positions are more vulnerable to flash-crashes and pump-and-dumps. Even on the big crypto exchanges with deep liquidity and tight spreads, we see curious temporary spikes on the charts, both up and down. Imagine holding a 10x leveraged position when an inexplicable 11% drop in the market, lasting seconds, wipes your entire position out.

Of course, you would have a stop loss so you might not lose everything, but there’s no guarantee. The price can jump from above your stop-loss to far below in one “tick.” Often, there’s no time to execute your stop loss. Of course, everyone else is now doing exactly the same, so even the deepest liquidity can’t save them. Poof! Everything’s gone in a cloud of digital smoke before the price returns to normal as though nothing had happened.

How do I buy and sell FTX leveraged tokens?

Open an account on FTX then make your way to the Leveraged Tokens list. The pairs are listed by their ticker symbols, with the token name in the next column. For example, the ticker symbol BULL/USD refers to a 3x Long Bitcoin Token. 3x is the leverage, Long is the direction of your trade, and Bitcoin is the asset to which you’re exposed.

At the bottom of the page you see a standard spot trading window where you choose Buy or Sell, the amount of the asset, and the order type. FTX has a cool selection of order types including trailing stops and stops market/limit etc. You can select POST and IOC to determine whether you will be a maker or a taker and whether your bids and offers will be automatically canceled. Hover over these options to read the explanation.

You can also swap FTX Leveraged tokens from your FTX wallet page using the “Convert” option. If you’re not too concerned about timing and entry, this is just as simple.

Creation/redemption

Most tokens are bought from the spot market or swapped, but you can also Create and Redeem FTX leverage tokens. There are plenty of fees if you do this so be warned. There’s also a warning from FTX that you should study the literature before starting down the creation/redemption path. Very wise. I’d stick to comparing the spot price with the swap price, considering the fees, and acquiring tokens that way.

How do leveraged tokens rebalance?

Think of each day in an FTX leveraged token’s life as a separate event, with an adjustment, depending on the previous day’s price action. The pair contained within the token is rebalanced to reflect the new market spot price of the real-world pair. Your initial trade price is always based on the updated values so in a bull market, this will compound your daily rewards.

Borrowing FTX’s example, two consecutive 15% daily jumps would be worth more than a regular 30%, 2-day increase. Day 2 starts higher, so the overall gain would be 31.4%, an almost 5% increase in return. Nice!

Rebalance Times

The standard rebalancing time or 3x tokens is 00:02:00 UTC, however, an adjustment can happen at any time if market conditions become too volatile. An 11.15% shift for the BULL tokens or 6.7% for BEAR tokens, will trigger a rebalancing. This is great for compounding your gains, but also compounding your losses.

When do leveraged tokens work best?

FTX BULL Tokens occasionally have an edge over a straight 3x leveraged position. Think of it as compound interest, which Einstein described as “The 8th Wonder of the World.” The BULL tokens reinvest their profits, increasing your exposure to the asset so you make more money.

This of course is great when the token is going up, but if the price later retraces, you will lose extra as you’re now more exposed. Compounding and Rebalancing are important and you can read about them here.

Read also:

- FTX NFT Marketplace Review [2022] – How To Use It (Fees, Wallet)

- FTX vs FTX.US [2022] – Fees, Supported Coins, Deposits & Withdrawals

- Binance vs FTX: Fees, Features, Limits, Payment Methods

- FTX vs BitMEX: Fees, Limits, Supported Coins, Deposit & Withdrawals

- Binance vs FTX: Fees, Features, Limits, Payment Methods

- FTX vs Coinbase: Fees, Features & Security Compared

- FTX Staking Review – Supported Coins, APY, Fees Explained

- FTX.US Review – Fees, Supported Coins, Payment Methods

- Bybit vs FTX: Fees, Leverage, Security & Features Compared

- FTX vs BitMEX: Fees, Limits, Supported Coins, Deposit & Withdrawals

Pros & cons

On the upside

All the basics are right – FTX is on the way up, they’re dynamic, and they’re not trying to fleece innocents of their crypto.

Leveraged tokens rebalance, so you have a gentler curve to slide down when things go wrong.

There’s a whole world of Perpetual Swaps and the underlying derivatives on which FTX Leveraged Tokens Work. It’s fascinating to learn about and it makes you smarter!

On the downside

These are leveraged tokens and the market is super-volatile. What’s the worst that could possibly happen?

Summary

FTX is as good a place as any to get started down the path of derivatives. You can find all sorts of futures base derivatives. Innovative market types are added regularly – it’s all great. But there’s the 300-pound gorilla in the room that we need to acknowledge. You can be wiped out – REKT.

Pay heed to the tale of the tortoise and the hare! Fools rush in where angels fear to tread. A bird in the hand is worth 2 leveraged birds in the perpetual swap bush… OK, that last one was mine. I think it might need work.

We apes/ primates crave the risk-taking that has been civilized and legislated out of our everyday lives. Today’s more sanitized version tries to polarize our outcomes for great success versus painful loss.

But trading shouldn’t be about emotions and instincts. The mental aspect of chasing losses often blinds a trader to the reasons they are losing in the first place. If you find yourself seeking out more extreme margin trading, turn the computer off and seek help.