As Ethereum enters 2025, staking has become a core part of the network’s economy. With withdrawals now available, more platforms and pools are competing to offer the best returns, liquidity options, and DeFi integrations. Whether you’re looking for a simple custodial staking solution or want to explore advanced restaking strategies, this guide compares the top Ethereum staking options available today.

In this detailed exploration, we not only list the best Ethereum staking platforms but also provide insights into what makes each platform stand out. For those wondering about the best Ethereum staking options, we’ve got you covered with in-depth analyses and comparisons. Join us as we navigate the rewarding yet complex world of Ethereum staking, helping you make informed decisions in your crypto investment journey.

| 🌐 Staking Platform | Description |

|---|---|

| 🔗 Lido | Lido is a decentralized staking solution that allows users to stake their Ethereum (ETH) and receive stETH tokens in return. It offers a user-friendly interface and provides an opportunity to participate in post-Merge Ethereum staking without the need to manage nodes or meet the 32 ETH requirement. |

| 🚀 RocketPool | RocketPool is a decentralized staking platform that enables users to stake 8, 16, or 32 ETH and receive rETH tokens in return. It leverages a network of node operators to ensure security, decentralization, and trustlessness, making it a popular choice for those seeking a decentralized staking solution. |

| 💰 Stakewise | Stakewise is a platform that provides liquid staking paired with lending or liquidity mining, allowing stakers to achieve APY rewards upwards of 10%. It offers sETH2 tokens and is known for its competitive APY rewards. |

| 🐟 Stakefish | Stakefish is a staking platform that allows users to participate in the validating process of Ethereum and earn rewards without dealing with the technical complexity of running nodes. It offers a straightforward interface and charges a fee of 0.1 ETH. |

| 🏦 Binance | Binance is one of the world’s largest cryptocurrency exchanges that allows Ethereum staking. It enables staking in a pool with as little as 0.1 ETH and offers a “Flexible Lock” option for redeeming assets at any time. Binance mandates the 32 ETH requirement for independent validators but tokenizes BETH as the sole proof of staked Ethereum in a 1:1 ratio. There are no staking fees charged by Binance. |

Staking on the Ethereum network is a new advantage that comes with its transition from proof-of-work to proof-of-stake consensus.

Ethereum staking involves one locking away their ETH tokens for a set amount of time or indefinitely. In return for locking away their coins, these holders are given more Ethereum for their trouble, making it A profitable move for the holders. This is similar to leaving your money in a bank account and letting it accrue interest. The difference here is that the staking rewards come at a much faster rate than interest in a bank account, and then rather than earning interest on a fiat currency, such as the US Dollar, you are earning it on Ethereum.

What you'll learn 👉

Ethereum Staking in 2025: Post-Merge and Post-Shapella

Ethereum made the transition to Proof-of-Stake in September 2022, replacing energy-greedy mining with validator nodes. Withdrawals were first made possible via the Shapella upgrade in April 2023, which increased stakers’ flexibility and liquidity.

Staking participation has increased significantly since withdrawals were enabled, APYs have been consistently 3-4% across the majority of providers, and unbonding times are shorter than ever. In 2024, the Dencun upgrade introduced proto-danksharding, lowering gas fees and improving the network’s scalability, changes that further boosted staking adoption.

Rocket pool

Rocket Pool is a decentralized staking network for Ethereum that helps people to stake their Ethereum without needing the standard deposit of 32 Ethereum, and the required Ethereum is just 0.01 to deposit with the pool and start earning your ETH. Rocket pool allows you to withdraw your tokens early for a 5% fee. Rocket Pool lets you withdraw your tokens at any time in exchange for their native rETH tokens.

Rocket pool protocol

Rocket pool is “the base layer protocol for post-Merge Ethereum, in a decentralized and trustless manner. The protocol is usable by stakers of all shapes and sizes, allowing anyone to stake ETH on the decentralized network with full autonomy. RocketPool’s mission is to create a solution that adheres to the rise of decentralized finance, keeping the platform away from centralization and working for a better future for the financial system. This combats the current centralization issues on the network as some staking options take up a large amount of the network.

Staked

Staked is a platform that provides staking services for post-Merge Ethereum. Staking on the post-Merge Ethereum network is much more complicated and convoluted, which is where Staked steps in. They are a platform specialized in helping the bigger players stake, such as exchanges, whales, and institutional investors.

They provide an easy-to-understand UI for stakers, who can then easily manage their funds. In order to start working with Staked, you need to contact them through a form available on their website. Once again, showing that they are aimed toward larger clients rather than the average cryptocurrency investor.

Ankr

Ankr is another staking solution for investors. They claim to have the “best user experience and the highest level of safety”. They also claim to provide some of the more lucrative reward schemes. They take care of all the distribution, all you have to do is send your funds, secondly, they can be moved around without having to wait till transactions are enabled on post-Merge Ethereum.

Ankr offers their users just over 2.3% yearly return on their ETH, this isn’t as big as some other pools, though combined with the price rise of ETH, it can mean a great return on your investment.

Ankr’s staking token aETHc is supported by a plethora of popular cryptocurrency platforms, such as UniSwap, SushiSwap, MetaMask, OnX, TrustWallet, and more!

Allnodes

Allnodes is another staking service that requires a minimum deposit of 32 Ethereum. They also offer to stake in a range of other popular cryptocurrencies, including Cardano, Polkadot, Solana, Polygon (Matic), Avalanche, and more. The current ROI offered through their platform is 4%, they offer a non-custodial platform, allowing you to keep your keys and, therefore, your crypto completely safe. They also offer multiple levels of sophisticated protection. They have hosted over 18000 nodes through their service, and this helps to show their high levels of trust and experience in the industry.

They offer their services to you for a minimum of only 5$ a month! A small price to pay for what could possibly be a great investment.

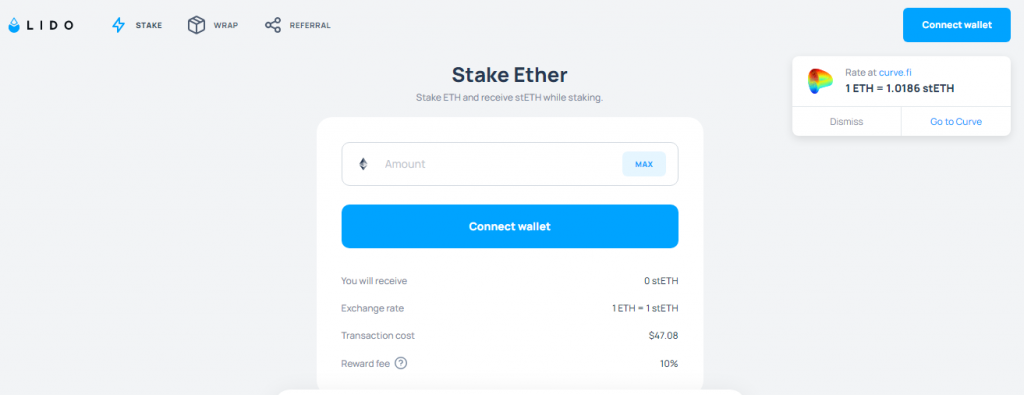

Lido

Lido is a popular staking service that was founded in April of 2019. Lido users will receive the “stETH” token, which is pegged to their ETH and can be used like ETH to earn yields and lending rewards. The current Lido staking reward is 3.1% per year. This is quite competitive, beating Coinbase and other services out there. Of course, as more people stake inpost-Merge Ethereum.

Staking ETH on exchanges

In addition to the staking services, we have previously discussed. A number of different exchanges have also started providing their own staking services. This makes it a lot easier for those newer to crypto, as they can stick with platforms that they are familiar with and don’t have to venture out and risk being scammed or misled by other parties.

Coinbase

Coinbase is one of these exchanges to start offering staking products to their customers, with their maximum APR available on ETH being 1.98% as of Feb 2025, generally on the lower side, though this is unsurprising considering their history with high transaction fees. One big bonus with Coinbase, which encourages its accessibility, is that you can start with as little as $1, as most platforms require a lot more to start staking. Withdrawals available, typically 24–72 hours processing.

Coinbase also offers to stake on a few other coins, including Algorand, Cosmos, Tezos, and more.

Kraken

Kraken exchange also offers Ethereum staking to their clients, and they expect to offer their customers an APY of 2-6% per year. Considering this, Kraken does allow you to trade your staked ETH for unstaked ETH, effectively allowing you to do so.

Binance

Binance is the third exchange-based Ethereum staking platform on this list. They offer their stakers just over 2.7%. Like Kraken and Coinbase, Flexible BETH-to-ETH redemption with variable wait times. Some have speculated that a good way to get into Ethereum staking on Binance is simply by purchasing their staking token BETH, as it is slightly cheaper than the cost of normal Ethereum, this can also be done in other places, such as Kraken.

Staking ETH in hardware wallets

CoolWallet Pro

CoolWallet Pro is a hardware wallet that blends the security of offline storage with the convenience of mobile access, a great fit for Ethereum stakers who want both safety and flexibility.

It’s about the size of a credit card and connects to your phone via encrypted Bluetooth, so you can stake ETH and manage DeFi activities straight from the CoolWallet app.

Unlike browser wallets, your private keys stay locked away inside a secure element chip, completely isolated from the internet. You can stake ETH through built-in DeFi partners, or link up with platforms like Lido and Rocket Pool using WalletConnect.

It also supports multiple blockchains, lets you stake other assets like Polkadot and Cosmos, and comes with extras like biometric login and military-grade encryption.

If you’re looking for a way to keep your ETH safe while still having the freedom to interact with Dapps on the go, CoolWallet Pro strikes a great balance between security and convenience.

What is Ethereum Staking

Ethereum staking is the practice of depositing 32 ETH to activate validator software. Through doing this you are responsible for storing data, transaction processing and the production of new blocks for the blockchain. These validators are needed to keep the network safe for everyone involved and in return, net you Ethererum for depositing your funds and helping to improve the Ethereum network. These returns are fully reliant on you fulfilling your duties as a validator node. If you act maliciously, fail to validate or go offline, you can lose your validator benefits.

👉 If you have less than 32 ETH to stake, this is where Staking-As-A-Service platforms come in. Like some of those we mentioned above, they pool together the funds of many smaller stakers and lock those funds away, allowing smaller stakers to gain the benefits on their behalf, for a small fee of course. The advancement of these Staking-As-A-Service platforms has led to offerings of withdrawals through the platform, and this lets users withdraw their funds early for a fee, making it even easier for users to get involved in staking their Ethereum.

By staking your Ethereum, you process transactions and run the network, this is why those using the network pay fees, as the fees are then used to pay the stakers.

This Proof-Of-Stake system is much more energy efficient than Bitcoin’s Proof-Of-Work system, which relies on intense, high-powered mining rigs sucking up huge amounts of electricity in order to function.

Ethereum Staking Platform Comparison (2025)

| Platform | APY | Min Deposit | Custodial | Withdrawal Time | Liquid Token |

| Lido | 3.6% | None | No | Instant (swap) | stETH |

| Rocket Pool | 3.5% | 0.01 ETH | No | Instant Days | rETH |

| Coinbase | 3.2% | $1 | Yes | 1-3 days | cbETH |

| Kraken | 3.4% | 0.01 ETH | Yes | 1-5 | ETH2 |

| Binance | 3.3% | 0.1 ETH | Yes | Flexible | BETH |

| EtherFi | 3.5% + bonuses | None | No | Flexible | eETH |

Advanced Staking in 2025: Restaking and LSTfi

One of the biggest shifts in Ethereum staking is the rise of ‘restaking’ via EigenLayer. This allows you to stake your ETH or liquid staking tokens (like stETH, rETH, cbETH) on EigenLayer to secure additional protocols, earning extra rewards on top of base staking yields.

This “restaking economy” has given birth to LSTfi (Liquid Staking Token DeFi), where staked assets are used in lending, yield farming, and liquidity pools. Platforms like Swell, EtherFi, and Puffer Finance have joined the market, offering new ways to maximize ETH yield without giving up liquidity.

How to choose the right Ethereum Staking Platform

Choosing an Ethereum staking platform depends heavily on the motivations behind staking your Ethereum. If you are in crypto mainly for the knowledge, technology, and pushing decentralized technology, it will make the most sense to choose RocketPool as that’s what they believe in, and their practices reflect that. If you are a newer cryptocurrency trader (token holder), you may be more comfortable with Coinbase or another crypto exchange staking system that removes all the hustle.

Centralization Risks

With the growth of liquid staking, centralization is an actual issue. Lido currently controls over 30% of staked ETH, which has sparked controversy around network security and danger to governance. Consequently, the majority in the Ethereum ecosystem now call for diversification among smaller providers like Rocket Pool, Stakewise, and EtherFi to keep staking decentralized.

Regulations in 2025

Staking regulations differ greatly by jurisdiction. In the United States, active SEC cases have prompted some exchanges to restrict or modify staking offerings to United States users. In the European Union and United Kingdom, staking is permissible but is subject to income taxation on rewards. Always verify your local laws prior to staking, particularly if using centralized exchanges.

ETH Staking Pools

If you want to stake on Ethereum but don’t meet the required 32 Ethereum to stake, you can stake your ETH in what is known as a “pool”. This is where Staking-as-a-Service comes in, as they handle everything for you and stake your coins on their behalf in crypto exchange for either an ETH or USD fee. There are many different pools out there, giving you a large amount of choice when deciding who to stake with. These pools compete by offering different pricing rates and ROI on their user’s staked funds.

Ethereum Solo Staking Platforms

Ethereum Solo staking platforms set up and manage all the technicals of staking for you just like any other staking platform for you, though the benefit of solo staking platforms is that you get to keep your private keys and, therefore, full control over your staked coins. This is referred to as a “non-custodial staking platform”. Most of these platforms take costs in the form of a monthly fee.

FAQ

Read also:

- How and Where to Stake Solana (Full Guide)

- Best Yield Aggregators on Ethereum Blockchain

- How Long Does it Take to Send Ethereum?

- How to Earn Passive Income with ETH

- How to short Ethereum? Short ETH on Binance & Co.

- Where To Spend Ethereum – Places That Accept ETH

- How To Send Ethereum From A Ledger Nano S

- Buy ETH With Credit Card, Cash or Wire

- Best 11 Ethereum Wallets [iOS, Android, Desktop, Hardware]