Smaller cryptocurrencies are becoming increasingly appealing to financial institutions, but the question is can they overthrow Bitcoin as the world’s largest digital currency?

We have recently written about the surge in price of Bitcoin. However, there are a big number of other digital currencies as well, trying to overthrow Bitcoin as the most-used and accepted currency of the internet, and the best candidates are Ethereum and Ripple.

The buzz has also shifted to blockchain. This is the underlying technology of cryptocurrencies. This technology is also already used for day-to-day operation by some banks.

The occupant of the third place, Bitcoin Cash is a Bitcoin derived from Segwit. Basically there is not much to say about Bitcoin Cash, so it will not be the subject of this article.

There are a lot of people on Crypto Market who don’t know anything about XRP, so an article of this type was absolutely necessary. A market study conducted in the United States showed that 67% of Americans didn’t hear about ETH, and probably if a study on the XRP currency is made, the percentage of those who have not heard about the currency would rise to 75-80%.

Let’s make a comparison between the three coins.

What you'll learn 👉

Ethereum

Ethereum is an open software platform that runs smart contracts. These are applications that run exactly as programmed without any possibility of downtime, fraud, censorship, or third party interference. In the Ethereum blockchain, instead of mining for Bitcoin, miners work to earn ether, a type of crypto token that is used to pay for computation time and for transaction fees.

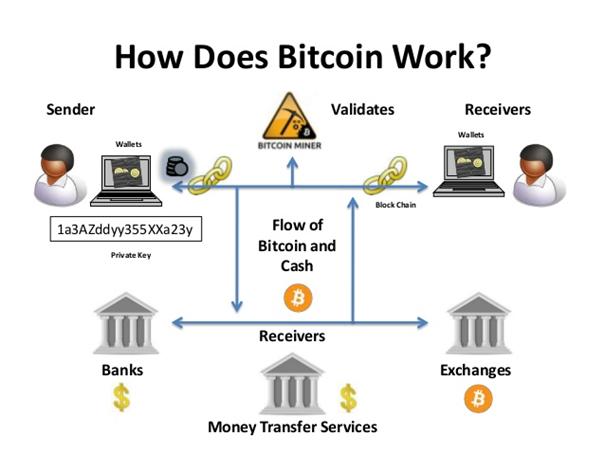

Is Ethereum like Bitcoin? Well, no. The two share the fact that they were built using public network technology – known as blockchain. This technology enables developers to build and deploy decentralized applications. But here is the similarity between Bitcoin and Ethereum. Bitcoin offers a single application, a P2P electronic currency exchange system that allows for online payments. In other words thus means a coin in its purest form. Bitcoin uses blockchain technology to identify Bitcoins. On the other hand, Ethereum uses a blockchain as a platform to run virtually any decentralized application.

The design and issuance of its own cryptocurrency is one of the most popular uses of the Ethereum platform. Many of the coins currently in existence on Crypto Market were created using the Ethereum blockchain platform, for example Ethereum had a hardfork upgrade this year, called Metropolis (Ethereum 3.0).

Ripple

Ripple is not an open, public blockchain. It is basically a “pseudo-cryptocurrency” – it was mined all at once by the parent company and they hold the majority of the cryptocurrency, around 60%.

Ripple is a payments network built on blockchain that has the advantage to be both a currency and a transport protocol, and has made significant progress in establishing strategic relations with financial institutions and banks. Just recently, Ripple made agreements with 10 new institutions, including eZforex.com, Star One Credit Union, Cambridge Global Payments, YES BANK, Axis Bank, Akbank, SEB, BBVA, MUFG, and SBI Remit.

Ripple provides one frictionless experience to send money globally. Ripple powers payments across networks with unmatched global reach for real-time payments at the lowest cost. XRP is the native asset of the Ripple ecosystem, and it can be used on the Ripple network to minimize settlement risk and delays, and also to lower liquidity costs.

Being built for commercial use, XRP is the fastest and most scalable digital asset that allows real-time global payments. It provides banks and payment providers with a first on-demand liquidity option for real-time transactions across national borders.

The problem with Ripple – it is not even a public blockchain based currency and only a small fraction of it is actually available on the market.

I would use Ripple as a hedge because the banks might make it go mainstream and it might increase in value, but I don’t really like it.

The problem with XRP is its huge supply. There are still lots and lots of XRPs being held by Ripple Labs, so they can dilute the market and lower the price whenever they want. And keeping XRP price low might be what they want – the lower the price, the less will banks have to pay for transactions.

Part of me still believes in Ripple mostly because of their team. But I’m not sure, that thing might never pop and it is designed to stay low in price.

The Ripple cross-border payment technology is currently used by over 100 institutions. Ripple created a suite of three tools in the summer of this year, which are specifically designed to be used for cross-border payments. One of them, XRapid is Ripple’s solution that uses XRP as a liquidity tool. The day before the Swell conference, Ripple announces that: “In a precedent-setting moment, Cuallix has become the world’s first institution to use xRapid to reduce the cost of sending cross-border payments from the US to Mexico“. The use of Ripple cross-border payment technology and currency XRP reduces money transfer costs by 60% compared to Swift class transfers, and also such transfer takes 4 seconds while the classic Swift transfer takes between 3 and 5 days. Ripple launched the RippleNet Accelerator Program (the value of this program is $300 million) in October 2017 in order to increase the XRP volume and utility.

Bitcoin

Bitcoin and was released as open-source software in 2009 and is the entry currency on the Crypto Market. Bitcoin has brand name recognition around the world, and it is “fashionable” to invest in Bitcoin.

Bitcoins were designed to be – and, in many ways, are – the perfect digital currency: they’re frictionless, anonymous, and cryptographically astonishingly secure. For anybody who’s ever suffered the incompetence of a bank, or bristled at the fees involved in just spending money, either domestically or abroad – that is to say, for all of us – the promise of bitcoin is the holy grail of payments. Especially since, to all intents and purposes, bitcoins are invisible to law enforcement and the taxman

Bitcoin is by far the largest of the three. It has a market cap of almost $300 billion dollars, and that’s as much as a big multinational corporation! The price is only going up in the last weeks, hitting almost $20000 recently, and the daily volume is already billions of dollars, with hundreds of thousands Bitcoins exchanging hands every day (around 250.000 daily in May to be precise).

At present, there are a lot of companies and sites in the world that accept Bitcoin as a payment method, including Overstock.com, Wikipedia, Gyft, Expedia.com, CheapAir.com, Namecheap, OkCupid, Virgin Galactic, Pirate Bay, Reddit, Microsoft, Subway, WordPress.com, Newegg.com and Steemit. One more thing worth noting is that most coins currently on Crypto Market can be purchased with Bitcoin.

And yet, Bitcoin is far from global adoption, because it has problems in terms of transfer costs, especially in low-value transfers. For example, if you want to transfer the 50$ Bitcoin, then the transfer fee is 5$. As a result of misunderstandings between the mining community and the developers, Bitcoin suffered two segwitts this year resulting in Bitcoin Gold and Bitcoin Cash. Also, Bitcoin had an upgrade this year, called Lightning.

Conclusion

| Currency | Price (USD) | Scalability

(transactions per second)

|

Transaction speed | Mainstream |

| Ethereum | 450 USD | 15 TPS | 2 minutes | Yes |

| Ripple | 0.25 USD | 1500 TPS | 4 seconds | No |

| Bitcoin | 16000 USD | 3-7 TPS | 40 minutes | Yes |

Of the nearly 1500 digital currencies that exist, Bitcoin and Ethereum are the ones most likely to survive, followed closely by Litecoin and Ripple. This is pretty much in line with the history of business, which shows us that industries find stability with three to four players.

As you can see, none of the three coins are direct competitors. Each of the three virtual currencies has a different field of activity, and the only thing they have in common is the blockchain technology. Let’s not forget that of the three virtual currencies, Ripple is the least known in mainstream. To get good returns (ROI) on Crypto Market, it is highly recommended to buy a coin when it has not entered the mainstream and when its price is underestimated. That’s the reason why I think it’s the best investment for holding for 3-5 years, and Ethereum is the best example. Those who purchased this currency two years ago, when its price was $0.5 USD and had patience, had the opportunity this year to sell it for $800, which is an incredible ROI (%) that cannot be earned on any capital market in the world. XRP may have a similar evolution in the coming years, when it enters the mainstream.

Crypto Market is a young and emerging market, so we hope all three currencies will develop positively in the years to come.

Crypto Market will attract more and more money from other capital markets, such as Forex and Stock Market. Why would the Crypto Market attract a Forex trader? Because on Forex, money is hard to win and easy to lose, and a Forex trader would find it easier to make money on the Crypto Market. Also, as we all know Forex is the most risky market. Why would the Crypto Market attract a Stock Market trader? Because the Stock Market currently has very low ROIs.