Liquid Exchange Review – Fees, Supported Countries & Coins, Deposits & Withdrawals

What you'll learn 👉

OVERVIEW

The Liquid exchange started in 2014 as two companies, Quoinex and Qryptos, before being mergexed and renamed Liquid Global exchange in 2018. It is based in both Singapore and Japan with full operating licenses under Japan’s Financial Services Agency. It also has offices in Vietnam and the United States of America.

Ranked 19th by exchange score, this exchange is a choice destination for many as it currently supports 113 cryptocurrencies and six fiat currencies in 201 markets. In October 2017, it became the first-ever licensed crypto exchange in Japan to launch an ICO(Initial Coin Offering). This article will take you on a journey at the end of which you would have enough information to decide if this is one exchange you can try or trust.

SERVICES AND FEATURES

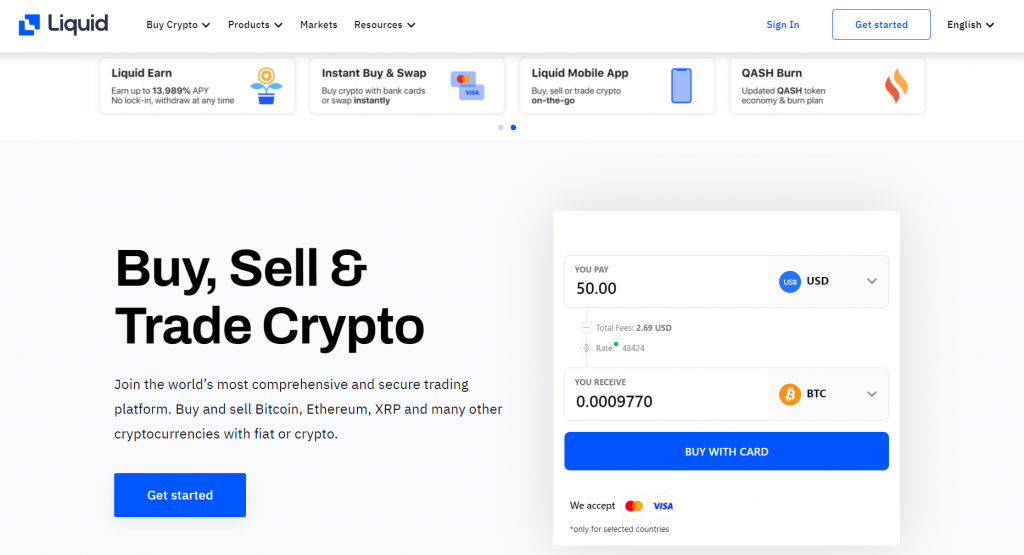

BUY CRYPTO FOR FIAT

The majority of markets on the exchange are for exchanging fiat with crypto. It currently features six fiat pairs, namely United States Dollar(USD), Euros(EUR), Australian Dollar(AUD), Singaporean Dollar(SGD), Japanese Yen(JPY), and Hong Kong Dollar(HKD).

There are also crypto to crypto trading pairs on the exchange, which is the only form of trading users from the US can partake in as they are not allowed by law to trade fiat for crypto on the exchange.

SPOT TRADING

Spot trading is supported on Liquid exchange. It is a trading method in which your buy and sell orders are immediately executed when pre-set conditions are met, a trading method devoid of margin or leveraged strategies.

There are four order types supported in the Liquid exchange:

- The limit order is where you set an order to buy or sell an asset when it gets to a particular price. Thus, your order rests on the order book. This is also known as a market-making order.

- The market order is where you buy or sell an asset at the prevailing market price. Here, your order doesn’t rest on the order book; it is immediately executed. This kind of order is known as a market-taking order.

- Stop-loss order where you set an order to sell your crypto asset if the market dips below a particular level. It is an important mechanism that helps to limit losses in cases of extreme market movements

- A trailing stop order is an advanced stop-loss order where your stop-loss order is adjusted by a specific percentage if the market moves in your favor. As such, it trails your profit line and may even help you gain more than you expect to gain.

MARGIN TRADING

The Liquid exchange allows margin trading up to 25x leverage. It is only available for trading between crypto and fiat. There are two types of margin trading on the Liquid exchange:

- Isolated margin where the leveraged position is isolated from the rest of your balances

- Cross margin where the trade position uses your entire asset balance as leverage

LIQUID INFINITY

It is a Liquid exchange feature that enables trading with up to 100x leverage using CFD(contract for difference) crypto trading platform. A CFD trading is an agreement between a buyer and seller that allows traders to trade on borrowed funds with higher leverages to rack in greater profits(or losses)

Currently, BTC/USD and BTC/JPY are the only supported pairs in Liquid Infinity, with others to come. It is traded 24/7 and can be funded with other cryptocurrencies different from the base pairs.

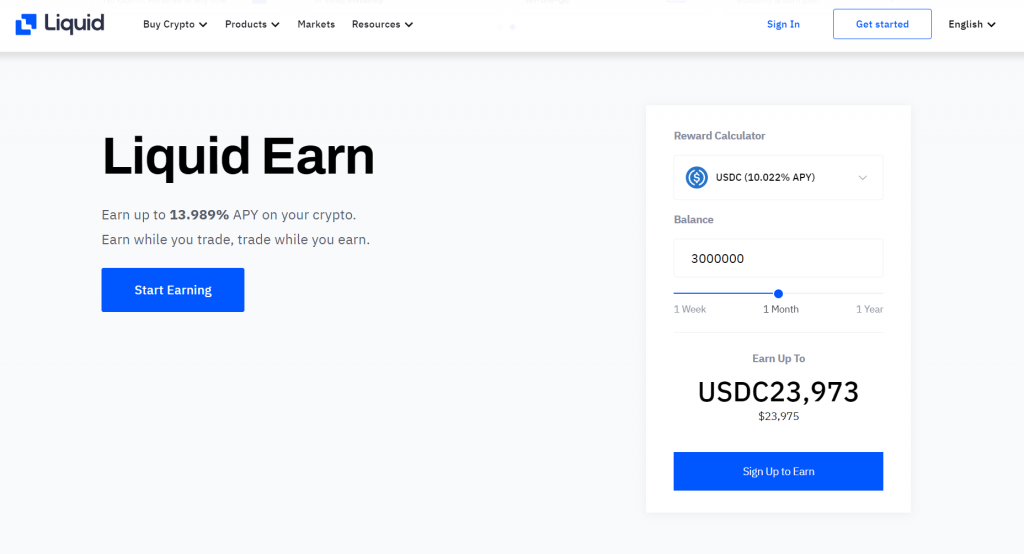

LIQUID EARN

The Liquid Earn program is a way of earning rewards by staking supported cryptocurrencies. There Is a rewards calculator where you can calculate how much you can earn when you deposit a specific coin. On the Liquid Earn feature, the APY differs from coin to coin, with a maximum of 13.989% possible on the platform.

Rewards are paid out weekly and can be withdrawn anytime. The wide range supported coins on the liquid earn program are BTC, ETH, XRP, LTC, BCH, LINK, SNX, XLM, UNI, DASH, USDT, USDC, and CEL.

LIQUID SUPPORTED COINS

Liquid exchange currently supports one hundred and thirteen(113) cryptocurrencies. The list includes, but is not limited to, Bitcoin, Ethereum, Cosmos, Compound, Aave, The Celsius Network, Dash, Tether, Bitcoin Cash, Litecoin, Chainlink, Monero, Ripple, Uniswap, etc.

The 113 coins supported are traded against one another and six fiat currencies in two hundred and one(201) markets.

LIQUID DEPOSITS AND WITHDRAWALS

DEPOSITS

- FEES: There are no fees for deposits of either cryptocurrencies or fiat currencies on the Liquid exchange. However, for fiat deposits, the payment platform might charge a fee for processing the payment.

- METHODS:Crypto deposits are straightforward. You copy your wallet address and paste it into the sender’s wallet column. For fiat deposits, though, there are different methods, which are:

- FOR USD DEPOSITS: Silvergate Exchange Network and SWIFT Network

- FOR EUR DEPOSITS: BLINC network, SEPA deposits, and SWIFT transfers (which are made via the InCore Bank AG).

- FOR SGD, AUD, HKD, and JPY deposits: SWIFT network via Far Eastern International Bank.

- JPY deposits also support BLINC networks

WITHDRAWALS

- FEES: Crypto withdrawal fees differ from coin to coin according to the network fees and the traffic density at the point of withdrawal. For fiat withdrawals, there is a 0.1% fee for up to 13 Dollars or equivalent

- METHODS: The method of withdrawing crypto is also straightforward. Paste the receiving address in the address column, and you’re good to go!

For fiat withdrawals, it is the same method for deposits that also works for withdrawals. However, USD SWIFT withdrawals carry a fee of 50 dollars, while EUR non-SEPA withdrawals carry a fee of 50 Euros.

- LIMITS: For individual accounts, there is a limit of 20,000 dollars for daily withdrawals while it is a 300,000 dollars limit for monthly withdrawals.

For Corporate accounts, the daily limit is 150,000 dollars while it is 1,000,000 dollars for the monthly limits.

LIQUID TRADING FEES

Like every other exchange, Liquid exchange charges fees to improve security protocols to keep users’ digital assets safe and improve the platform’s overall performance. These trade fees are calculated per trade and at order execution. The trading fees on the exchange can be divided into two categories:

SPOT/MARGIN/INFINITY TRADING FEES

| LEVEL | 30-DAY TRADE VOLUME | MAKER | TAKER |

| 0 | 0 | 0.2100% | 0.3% |

| 1 | Greater than or equal to $10,000 | 0.2% | 0.29% |

| 2 | Greater than or equal to $20,000 | 0.19% | 0.28% |

| 3 | Greater than or equal to $50,000 | 0.18% | 0.26% |

| 4 | Greater than or equal to $100,000 | 0.16% | 0.2% |

| 5 | Greater than or equal to $1,000,000 | 0.08% | 0.16% |

| 6 | Greater than or equal to $5,000,000 | 0.07% | 0.12% |

| 7 | Greater than or equal to $10,000,000 | 0.05% | 0.1% |

| 8 | Greater than or equal to $25,000,000 | 0% | 0.09% |

| 9 | Greater than or equal to $50,000,000 | 0% | 0.08% |

| 10 | Greater than or equal to $100,000,000 | 0% | 0.07% |

| 11 | Greater than or equal to $200,000,000 | 0% | 0.06% |

| 12 | Greater than or equal to $500,000,000 | 0% | 0.04% |

| 13 | Greater than or equal to $1,000,000,000 | 0% | 0.03% |

FUTURES TRADING FEE

| LEVEL | 30-DAY TRADING VOL | MAKER | TAKER |

| 0 | $0 | 0% | 0% |

| 1 | Greater than or equal to $100,000 | 0% | 0.12% |

| 2 | Greater than or equal to $500,000 | 0% | 0.115% |

| 3 | Greater than or equal to $1,000,000 | 0% | 0.11% |

| 4 | Greater than or equal to $5,000,000 | 0% | 0.105% |

| 5 | Greater than or equal to $10,000,000 | -0.005% | 0.1% |

| 6 | Greater than or equal to $50,000,000 | -0.01% | 0.095% |

| 7 | Greater than or equal to $100,000,000 | -0.015% | 0.09% |

| 8 | Greater than or equal to $200,000,000 | -0.025% | 0.085% |

| 9 | Greater than or equal to $300,000,000 | -0.025% | 0.08% |

| 10 | Greater than or equal to $400,000,000 | -0.025% | 0.075% |

| 11 | Greater than or equal to $500,000,000 | -0.025% | 0.07% |

| 12 | Greater than or equal to $1,000,000,000 | -0.025% | 0.065% |

| 13 | Greater than or equal to $1,500,000,000 | -0.025% | 0.06% |

The figures above for spot and futures trading differ under certain conditions. For example, if you choose to use QASH, the cryptocurrency exchange’s native token to pay fees, you get 50% off. Also, you get 10% off trading fees as referral discounts when you successfully refer someone to the platform.

DOES LIQUID HAVE MANDATORY KYC?

Completing KYC registration is not compulsory on the liquid exchange. You can still enjoy some of the exchange’s features even with an unverified account. However, not all functions are open to unverified users. For example, you can’t deposit and withdraw in fiat currencies if you have not done KYC.

The documents required for KYC verification on Liquid exchange are:

- Identity document(International Passport, Driver’s License, or other Government-issued ID).

- A selfie to confirm if it’s really you on your ID document

- Proof of address. It could be a phone bill or utility bill issued within the last 90 days, and that shows your address clearly.

Interestingly, account verification can also be done via video call on the website. Here, a customer service agent will call you via a video conferencing app of your choice and request your identification documents. It is usually completed within five minutes.

LIQUID SUPPORTED COUNTRIES

Liquid exchange is available globally with an application that can be downloaded on the Play and Apple stores. However, it is restricted from operating in the following countries. Also, US residents were offboarded from the list of supported countries on March 20, 2020.

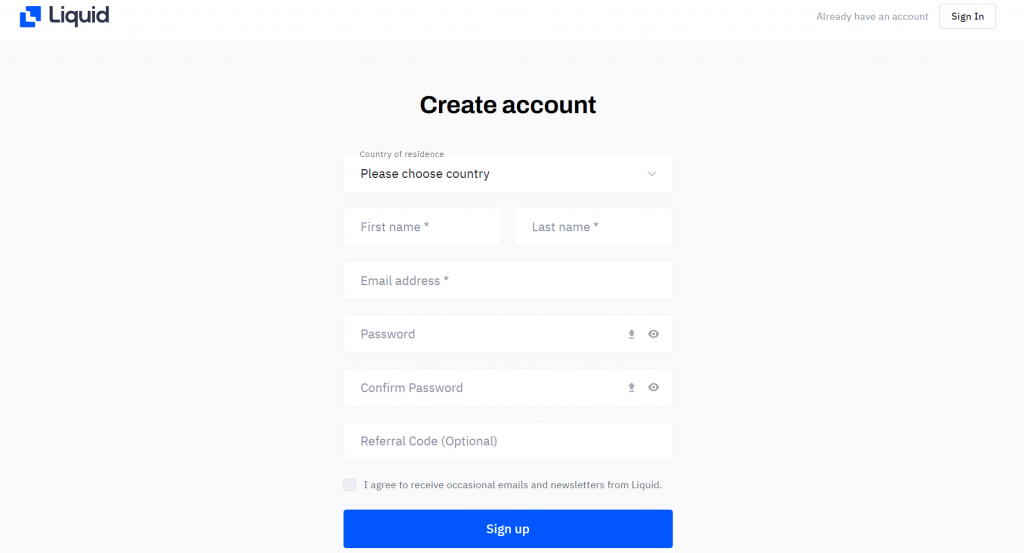

HOW TO START WITH LIQUID EXCHANGE?

On the homepage of the website, click on sign up to start an account with the exchange. Some information will be required from you, like your legal names, country, email address, password, and referral code (if any). After that, activate your account by clicking the link sent to the email address you provided.

Once activation is done, the next step is to set up two-factor authentication to secure your device further. Enable two-factor authentication on the website and link it to the authenticator app you have on your phone.

The next step after authentication is verification. It’s not compulsory, but it’s important if you want access to the exchange’s major functions. Submit the required KYC documents as explained above and wait for 24-48 hours for your application to be approved.

DOES LIQUID HAVE A NATIVE TOKEN?

Yes, the liquid exchange has its native token. It is known as QASH token and is ranked 782 by market capitalization. Its market cap is about 30.4 million dollars with a 24-hour trading volume of about 600,000 dollars.

The Qash token is utilized on the liquid crypto exchange to offer a 50% discount in trading fees and meet eligibility criteria for private sales on the exchange. Whether or not it is a good investment depends on the user’s discretion and the exchange’s credibility. If you’re a frequent user of the exchange, you might as well bag a few QASH tokens as its utility is not only tied to its price.

IS LIQUID LEGIT AND SAFE?

Being a duly registered company under the Japanese Financial Services Association, users can be assured that the exchange cannot scam them of their hard-earned funds. In addition, the exchange takes measures to ensure the safety of users’ funds by enforcing two-factor authentication and KYC registration before initiating withdrawals.

CONCLUSION

Hardly can anyone trade cryptocurrencies today without an exchange, be it a decentralized or a centralized exchange. Which one will you choose? Liquid exchange is one worthy of consideration. It is registered, protects users’ funds, is easy to use, and offers juicy APYs and trading fee discounts.

However, it is still a cryptocurrency exchange, which means that one has to be careful as crypto trading generally comes with certain risks. Do your research using the points in this article and determine if the Liquid exchange is one for you.

You can deposit without KYC but can’t withdraw. That could be misleading.

Read also:

- Cex.io review

- BitMart Review

- Coinbene Review

- Gate.io Review

- Coinbase review

- Kraken review

- Bitpanda review