What you'll learn 👉

Intro

Buying bitcoin without a credit card is possible as there are hundreds of other payment methods that are cheaper and safer for crypto purchasing.

❌ WARNING – be careful as all P2P marketplaces are full of scammers that are creative in their ways and tactics. Do your due diligence on the seller before going into the transaction process.

Buying Bitcoin with a credit card is a costly and risky endeavor, with more problems than advantages.

Credit card companies typically treat bitcoin purchases differently from conventional purchases. Since buying cryptos is sometimes regarded as a dangerous move, the credit card company may decide to cancel the credit card or lower the credit limit.

Buying with other payment methods other than credit card

Many people in the United States prefer to use their credit cards or debit cards when making purchases online. When making purchases online, however, there is always the chance that your personal and financial details will be stolen and used for fraudulent purposes.

Many alternative trustworthy and convenient options for making financial transactions are available. Online payments can be made through a variety of channels, including third-party services (like PayPal, Amazon Pay, Google Pay [how to buy BTC with GPay guide is here], or Apple Pay [how to buy BTC with ApplePay guide is here), wire transfers, electronic checks, and online bill pay.

Buy on exchanges that support direct bank transfers

There are a number of options for getting your hands on crypto, but the simplest is probably just to buy some Bitcoin with a bank transfer.

To save your time, in the text below, you can find the best crypto exchanges that support direct bank transfers.

Kraken

Kraken, situated in the United States and founded in 2011, is the oldest crypto exchange for trading bitcoin and altcoins. Because of its self-regulated nature, extensive safety precautions, and regular security assessments, it is also among the most secure exchanges.

It has one of the most affordable fee structures, with no deposit fees and low trading and withdrawal fees. Trading on its website or via one of its mobile apps allows you to do business from virtually anywhere.

It supports numerous deposit and withdrawal methods. Depending on the deposit method, fees range from free to $50.

Fiat deposit bank transfer options are supported, such as SEPA (0-5 days), SWIFT (2 -5 business days), Silvergate Exchange Network (close to instant), InterFin (0-10 min), CHAPS (same day), SIC (during working hours on business days, almost immediately), FewWire (1-5 business days), Canadian domestic wire transfer (1-3 days), via Canada Post (30-60 minutes), etc.

Also, you can buy cryptos using digital wallets (3 days), or you can buy using Google Pay and Apple Pay wallets (instantly).

Uphold

Uphold was created in 2014 by American entrepreneur Halsey Minor and is a trading platform for buying and selling different assets, including crypto. The platform has been granted licenses in both the United States and Europe.

Over 200 cryptos and utility tokens, 37 fiat currencies, 50 U.S. stocks, foreign exchange trading, four precious metals, and other assets can all be traded on Uphold’s comprehensive platform. Over 1.5 million people from more than 150 different countries utilize Uphold’s services regularly.

Users can store and trade cryptos like Bitcoin, Litecoin, Ethereum, Bitcoin Cash, and many others in a digital wallet on the platform.

It does not charge any fees for receiving deposits other than those associated with the use of a debit or credit card.

It supports various deposit methods, such as ACH (4-7 days), SEPA (2-3 days), Wire Transfer (2-5 business days), Faster Payments Service, SWIFT, and Crypto.

Binance

Binance, headquartered in the Cayman Islands, is the most popular crypto trading platform in the world. Established in 2017, it was created by crypto industry veteran Changpeng Zhao.

It offers some of the lowest pricing on the market for trading in excess of 500 different cryptos. Binance Coin, its own crypto, is one of these (BNB).

It has the most competitive trading costs of any major market. Fees of 0.1% are assessed to both buyers and sellers. If you trade more than 50 BTC worth of crypto in a 30-day period or hold more than 50 BNB in your account, this fee can be decreased. Except for the network fee, depositing an asset to your account is always free.

It supports deposit methods, such as ACH (1-3 days), Wire Transfer (1-3 days), SEPA (1 – 3 business days), PayID, Debit card, SWIFT, and Crypto.

KuCoin

Launched in 2017, KuCoin has its headquarters in Seychelles. It was started by a group of experts with experience in the financial sector who wanted to make it easier for people all over the world to trade cryptos in a secure environment. It now boasts a user base of over 10 million.

It serves customers in over 200 countries worldwide. Users in the United States can access it as well (KuCoin does not ban them openly, but there are a bunch of restrictions and risks associated with it). More than 600 different digital currencies can be traded on the platform right now.

There is a 0.1% trading cost across all of the exchange’s markets, however, customers who possess KuCoin Shares coins get a special discount. With every 1,000 KCS tokens an investor has, they will pay 25% less in fees. Fees can be discounted by a maximum of 30%. KuCoin does not charge any deposit fees.

It supports deposit methods, such as Bank Transfer (ACH), Wire Transfer, SEPA, Skrill, PayPal, Apple Pay, Debit Card, and Crypto.

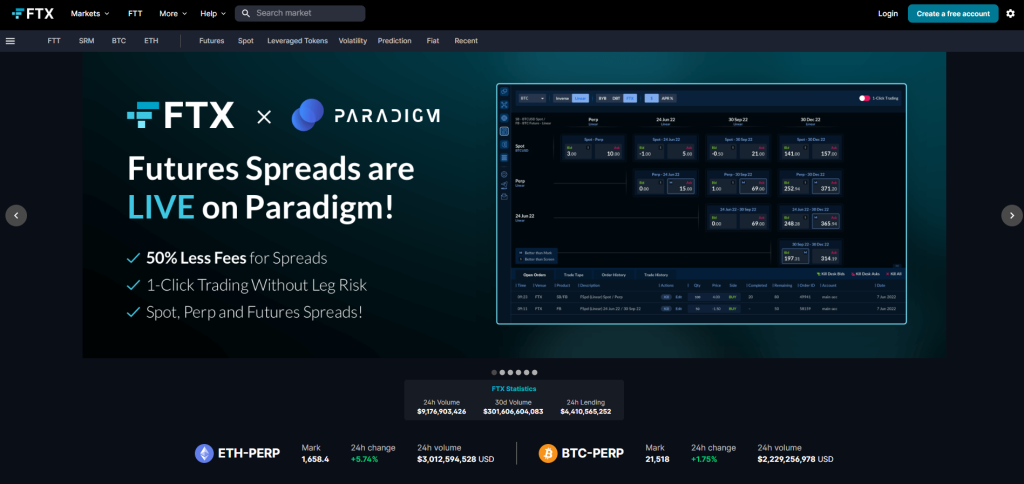

FTX

Founded by crypto enthusiasts Sam Bankman-Fried and Gary Wang in May 2019, FTX is a rapidly growing crypto trading platform. Their headquarters can be found in Nassau, The Bahamas. It swiftly filled a need in the crypto trading environment due to its concentration on futures and leveraged trading.

It presently supports over 300 different cryptos and is available in over 200 different countries, but unfortunately, the United States is not one of them. They have a separate entity for the US users, the FTX US platform.

The exchange facilitates deposits and withdrawals in fiat currency and numerous cryptos, including Bitcoin, Ethereum, Litecoin, and a few stablecoins.

It supports deposit methods, such as Wire Transfer, Silvergate Exchange Network (SEN), Signature SIGNET, SEPA, PayID, and Crypto.

Buy with exchanges that support SEPA (for EU users)

Buying bitcoin with SEPA is a fast and easy way to invest in digital currency in bulk. It’s more convenient than a standard international bank transfer because it’s simpler to set up and process transactions almost instantly. We’ve compiled a list of some of the best places to acquire bitcoin using a SEPA transfer:

Bitpanda

BitPanda is an Austrian crypto exchange that focuses on the European economic market. Since its inception in 2014, the exchange has become one of Europe’s most popular places to buy and sell Bitcoin and other cryptos.

Bitcoin, Ethereum, and Cardano are the most popular digital currencies traded on the platform. It’s compatible with over 100 coins and over 200 trading pairs.

Traders can choose from a variety of funding methods, such as SEPA, Neteller, Mastercard, Visa, Sofort, Giropay/EPS, Skrill, and Crypto.

The deposit method is a major factor in the transfer speed. Instantaneous transfers are possible with online deposit methods like SEPA, Giropay, Neteller, Visa, and Mastercard. The processing of bank transfers takes one business day.

eToro

eToro is a global leader in social trading and multi-asset investment. Its clientele includes big banks, hedge funds, family offices, and high-net-worth individuals, and it has over 20 million registered users in 140 countries. The organization began operations in 2007, and its current marketable assets include equities, commodities, indices, ETFs, FX, and cryptos.

In addition to the $5 withdrawal cost, which is quite modest in comparison to other brokers, eToro charges overnight and weekend fees for CFD positions. Since the US dollar is EToro’s base currency, the platform requires a conversion fee for deposits made in any other currency. After 12 months of inactivity, your account will be hit with a harsh inactivity fee of $10 per month.

It supports deposit methods, such as SEPA, PayPal, Online Banking (2 business days), Debit Card, and Wire Transfer (3-8 business days).

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

Coinmama

Coinmama, established in Israel in 2013, is a crypto exchange that facilitates the purchase and sale of digital assets via a variety of payment methods, including but not limited to Apple Pay, Google Pay, bank transfer, and wire services such as SWIFT and SEPA.

Since its inception, the company has spread to more than 190 countries and now serves over 3 million consumers. Besides Bitcoin, ten other cryptos are just as simple to purchase.

Despite the comparatively high costs, around 5.9% per transaction, the exchange does not charge a fee for depositing or withdrawing cryptos.

It is secure since it never saves customer funds or payment details on their own servers as it sends the coins you bought directly to your wallet you need to provide upfront before starting the purchase process. You always retain complete control over your digital and fiat funds.

Cex.io

CEX.IO is one of the longest-running Bitcoin exchanges today. It launched in London in 2013, and since then, it has attracted 3 million users.

You can fund your account with ACH, SEPA, or SWIFT bank transfers, or you can use your Visa or MasterCard to make a direct purchase of cryptos.

It does not charge a fee for using bank transfer methods like ACH and SEPA for making deposits and withdrawals. However, your bank may impose a charge for currency conversions.

It has earned a trustworthy name when it comes to safety, and it is authorized to conduct business in a variety of nations.

Buy on crypto ATMs

As of the time of writing, there were approximately 36,600 crypto ATMs installed worldwide. Of these, most are located in the U.S., where there are 32,598 devices, but Mexico has only 10.

Please be sure to know that ATMs are by far the most expensive way to buy cryptocurrency, charging over 10% for the transaction.

Buying coins in ATM without a credit card is easy and works like this:

- Step 1 – Get a Bitcoin Wallet, such as Ledger Nano X or Trezor T (or software wallets like Exodus, Guarda, Coinomi)

- Step 2 – Find the Nearest ATM. Use https://coinatmradar.com/ to find the closest one to you.

- Step 3 – Scan Bitcoin QR Code provided by your wallet on the ATM scanner

- Step 4 – Purchasing Your Bitcoins by inserting the USD bills into the machine and confirming the amount and other details

- Step 5 – Receiving Your Bitcoins into the wallet address you provided.

Buy on P2P exchanges using various payment methods

By connecting directly through the P2P platform, users of this type of crypto exchange can purchase and sell digital currency without the need for a third party like a bank. The finest peer-to-peer crypto exchanges offer an ever-growing variety of cryptos and buying options.

Paxful

Paxful is a centralized, peer-to-peer exchange platform that was launched in 2015 by a group of engineers with the intention of making Bitcoin more accessible. The platform is an intermediary exchange where buyers and sellers of cryptos can meet and conduct business without the need for a third party.

It is accessible anywhere in the world and has a low $10 minimum purchase requirement.

Over 350 payment alternatives, from fiat currencies to cryptos, are available through on the platform. Bank transfers, payment apps (like PayPal), gift cards, other cryptos, cash, etc., are some of the most common ways to pay on Paxful.

Buying crypto is free of charge. However, there is a price associated with making a crypto sale, and that fee varies according to the chosen payment processor. It charges a 0.5% fee for crypto exchanges.

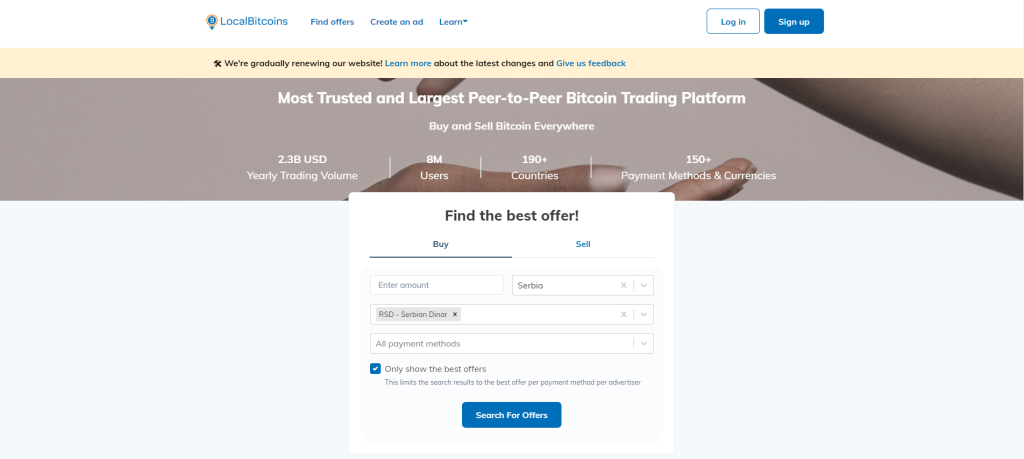

Localbitcoins

Among the many peer-to-peer crypto trading systems, LocalBitcoins stands out as one of the largest and most secure. It was started in 2012 by Nikolaus Kangas in Finland.

It aids in connecting those looking to acquire Bitcoin with people willing to sell Bitcoin in their area, allowing for face-to-face and online transactions. Bitcoin buyers and sellers can publish ads detailing their preferred payment methods and exchange rates. Interested parties can then respond to the ads with specific requests, starting the negotiation process.

It does not impose any fees associated with registration, purchases, or sales. A 1% transaction fee is charged to users who post adverts. Users incur various fees depending on the mode of payment they select.

Users can buy and sell with a variety of different payment methods. Bank/Wire transfers, PayPal, Cash, Western Union, WebMoney, Skrill, debit cards, and more are just some of the options.

FAQs

You can buy Bitcoins without a debit card or ID using peer-to-peer exchanges such as Bisq or HodlHodl. Also, you can use Bitcoin ATMs (require KYC for larger purchases).

Yes, you can buy Bitcoin with Google pay but only via P2P platforms where you interact with other Google Pay users.

No, you can not buy crypto with someone else’s card. All major exchanges require your name on their platform and name on the card to match.