As more and more retail banks start to embrace cryptocurrency, crypto on-ramps are much more common than they used to be. That should be great news for everyone, but remember that banks are in direct competition with decentralized cryptocurrencies. The saying goes, “If you can’t beat them, join them!”

Some banks are happy to charge a commission for customers to hold their account balance in BTC, ETH, and a few of the more popular tokens. Other banks take a different view, restricting card payments to crypto exchanges and even closing accounts associated with the crypto activity.

The trick is to choose the right bank and the right on-ramp. You might want to trade off pseudonymity against cost, for example. It depends on your circumstance. We outline the 7 best ways to buy crypto from your bank and answer some of the most common questions.

What you'll learn 👉

7 Ways to Buy Bitcoin With a Bank Account

All the platforms we look at are well known, of a certain reputation, and are regarded as safe. They all have their unique selling points, but I’ll concentrate on the buying and selling of Bitcoin using fiat money. We’ll compare the BTCprice, fees, and restrictions and check the small print for each platform.

Cex.io

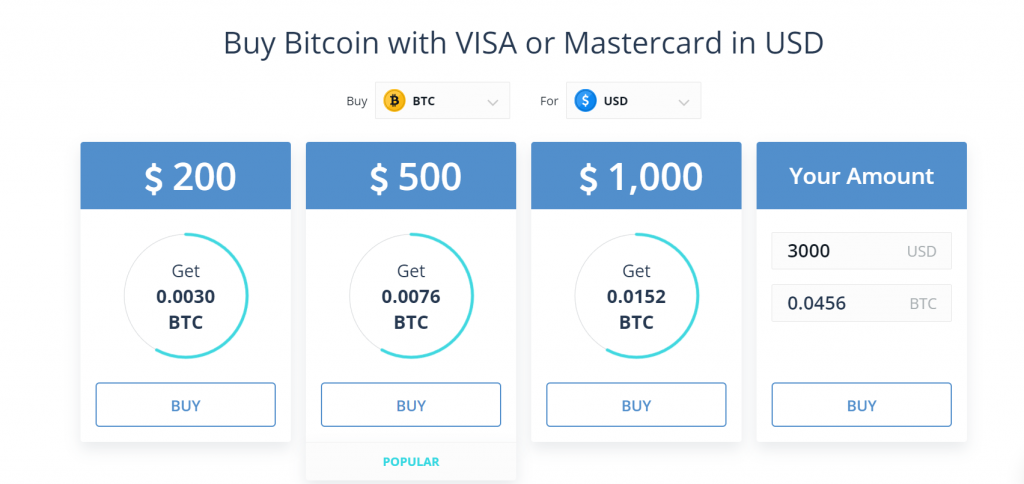

As an on-ramp, Cex.io is pretty typical. From the welcome page, select the ‘Products’ dropdown menu and navigate to ‘Instant buy,’ where you can use debit and credit cards to buy Bitcoin. You choose the US$ you would like to spend, and Cex.io tells you how much BTC you will receive. It’s straightforward enough, but what about the cost of BTC? How does it compare to the real-world spot price?

The price of Bitcoinon CoinMarketCap at the time of writing is $56,900. Buying $200 of Bitcoin at Cex.io nets you 0.0032 BTC. This equates to a BTC price of $62,500, a massive premium of almost 10% on the actual spot price!

It’s almost as bad for larger amounts. The markup is 8.4% for $500 worth and 7.8% when you spend $1000. That’s $78 lost to Cex.io profits for buying $1000 worth of Bitcoin at their inflated price.

But that’s not all. Cex.io accepts MasterCard and Visa for a transaction fee of 1.49%. Worse are the withdrawal fees at 2.5% + $1.20 commission. To recap, you are paying around 11% on purchases and 3% on sales. This is too much.

To start buying and selling Bitcoinat Cex.io, you need to fulfill KYC requirements (Know Your Customer). Using a company regulated in the UK and US means your personal information is available to the authorities, including your transaction history and your current holdings.

This is a custodial centralized platform, so you do not have control of your Bitcoinon the site. This is similar to how Binance and Coinbase operate.

Overall, Cex.io seems like a pricey option to buy Bitcoin. It’s possible to withdraw your BTC to an external wallet, although it’s not clear if there are charges on top of the standard network fees. Never buy Bitcoin on an application that does not let you withdraw it as BTC on the Bitcoin Blockchain. If you can’t, then you are at the mercy of the platform and its operators.

Kraken

Buying crypto with fiat money is straightforward on Kraken. There’s a list of deposit options for each region of the world. From a US perspective, depending on the bank you use, the fees are somewhere between zero and 10 dollars.

For example, using FedWire from MVB Bank or Signature Bank, you can deposit a minimum of 1 dollar for free. It should clear in your account in one business day. Silvergate-based purchases will incur a $10 fee which is a lot if you buy the minimum of $100. It works out better if you buy a larger amount.

Be aware that these are the Kraken fees and your bank may add on its own charges depending on their policy. It’s a good idea to check whether your bank is happy for you to transfer money to cryptocurrency platforms.

An increasing number of banks have blocked these transactions, and some even charge extra fees. Some banks have blocked the transfer of cash from all crypto platforms, which will be inconvenient when you try to withdraw your gains.

Kraken is well respected and regarded as a safe place to trade cryptocurrency. From what I can tell, Kraken does not gouge its customers too much for buying crypto.

Coinmama

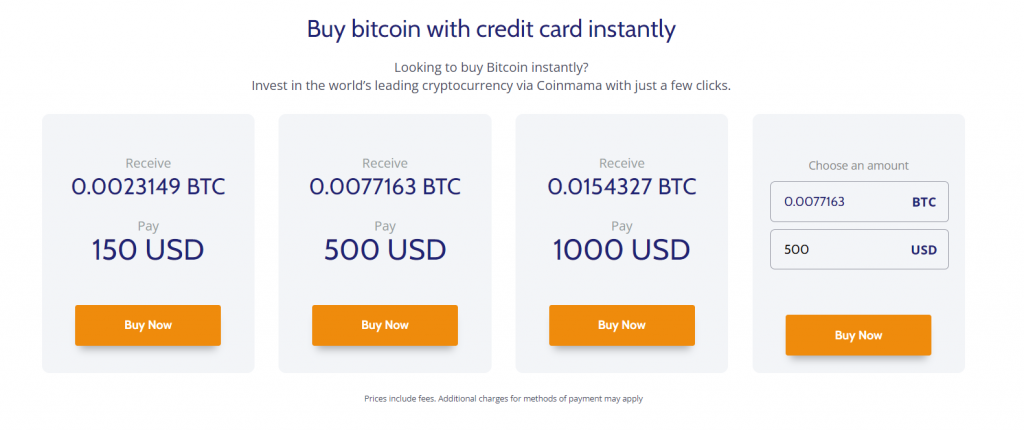

From the Coinmama welcome page, you can see their Bitcoin price. Doing the math reveals that there is a 5% markup on the spot price, which is pretty good compared to some other on-ramps. For $1000, you will receive 0.0151 BTC, but you don’t pay the penalty for buying less.

You pay the same 5% premium should you choose to buy the 30$ minimum. That’s pretty good if you are a modest retail investor, buying a little each month from your paycheck.

Reading the FAQs on Coinmama, you get a breakdown of the fees. They claim that there’s a 2% markup on BTC sales, plus a commission of 3.9% for purchases and 0.9% on sell transactions. This works out close to what the Coinmama BTC purchase calculator tells us, so we have to assume the commission is included in their sales price.

The point here is that some platforms charge a flat fee, and some charge a percentage of the transaction value. If you are buying a lot of cryptocurrencies, the flat fee works out better than a percentage rate.

Coinmama offers the option to buy Bitcoin with bank transfer using SEPA (Europe), SWIFT (worldwide), or Faster Payments (UK).

Conversely, when you buy a small amount of BTC, it’s preferable to pay a percentage commission. You can figure this out for yourself from the links in this article, but overall, it’s a thumbs up for Coinmama and their rates/fees.

Coinbase

Considering Coinbase is the number one choice of the on-ramp for cryptocurrency, their fees are not obvious. They’re based on the faster payment method, the amount you spend, and market conditions, such as liquidity and volatility. Exactly why Coinbase can’t be more open and straightforward, I have no clue. They used to have a bad reputation for customer service, but they were taking steps to fix this.

Coinbase is the most heavily regulated exchange and has a strong presence in the market as one of the most mainstream platforms, and millions of customers can’t be wrong. It would be hard not to recommend the market leader, but personally, I want to know before I sign up what the charges will be. It’s a basic courtesy.

Crypto.com

Crypto.com claims that you can buy and sell more than 150 coins and tokens with over 20 different currencies via bank transfer, or your credit/debit card. This sounds great but it seems that Crypto.com is based in Austria and warns that international transfer fees may be applied by your bank. Confirm with your bank whether you will be charged extra international transfer fees before proceeding.

What makes me nervous about a platform is when they don’t make it easy to find their fee policy. After a little searching, I found the Crypto.com fees page in their support section. In summary, it states that Crypto.com ‘may’ charge an admin fee, but it doesn’t tell you how much.

You will only be made aware of the fees at the time of purchase, and they will depend on volatility, liquidity, and market conditions. Translated, this means they could add on arbitrary fees, depending on how they are feeling at the time.

When I can’t establish what fees I’ll be charged, I generally run a mile as it means I can’t plan ahead. For one-off purchases, it might suit some people. As a crypto exchange, Crypto.com looks fine, but that’s not the subject of this article. In terms of buying crypto with fiat money, this is just not good enough.

Bitfinex

Buried halfway down a help center page, you’ll find the deposit fees for Bitfinex. There’s a 0.1% fee for bank transfers, but I could find no information about debit card or credit card deposit charges. I suspect I know why.

Bitfinex targets derivatives traders, and these are not the kinds of people that experiment with a couple of hundred bucks. They’re serious investors with an appetite for high-risk trading strategies.

You can, of course, load up your Bitfinex account with crypto for no charge, but there are fees for withdrawing certain tokens from Bitfinex, and these appear to be on top of any standard network fees.

Bitfinex is not the first port of call for buying cryptocurrency with fiat money. You go to Bitfinex for exposure to exotic derivatives and daredevil leveraged trading. But if you must, you can buy Bitcoinat a low cost with a bank transfer. Just don’t lose it all in a flash-crash margin call.

SwanBitcoin

As advertised by the irrepressible Max Kaiser, Swan Bitcoin is a great option for those that want to pay Dollar Cost Average (DCA). This is accepted as the most efficient way to invest in a volatile asset like Bitcoin, as it smoothes out the considerable ups and downs of the market. You set up a fixed automatic daily transfer and BTC purchases directly from your bank account.

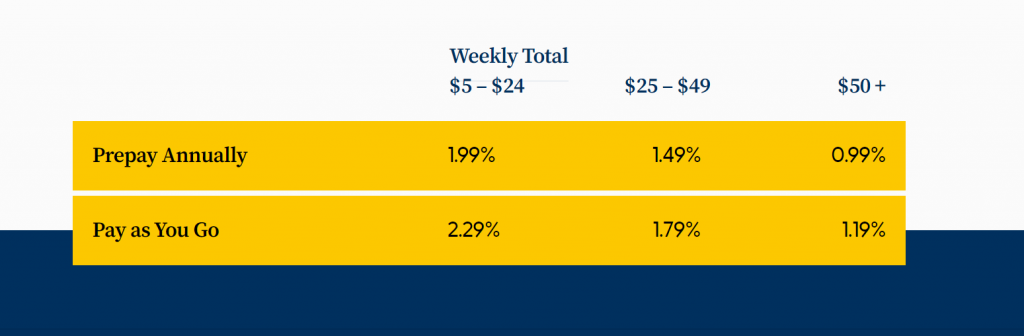

The fees are better than the vast majority of on-ramps. There are no spreads or withdrawal/deposit fees. There’s only a percentage commission on Bitcoin sales. Check the fees out here, but in essence, the more BTC you buy, the lower the fees.

Paying fees upfront earns you a discount, but you can opt to ‘pay as you go.’ For the minimum weekly total of $5 to $24, you pay 1.99% for pre-paid fees and 2.29% for the ‘pay-as-you-go fees. That’s pretty cheap compared to the other platforms on this list.

The great thing is that you only need to increase your investment to $50 per week to cut those fees in half. If you pre-pay your fees for one year and invest $50 per week, you will pay less than $26 in fees in total. That is a great deal considering the benefits of holding Bitcoin.

You can also set up a regular withdrawal to your private Bitcoinwallet for better security. Other platforms encourage you to hold your crypto on their exchanges after you buy it. This is solely in their commercial interests, not yours!

That’s the thing about Swan Bitcoin – it’s run by crypto fanatics for crypto fanatics. They inspire a level of trust and good business ethics unrivaled by the more mercenary platforms. Their main concern is onboarding as many people as possible and evangelizing the gospel of Bitcoin. I thoroughly recommend Swan Bitcoin for people in the US. They seem like good people.

Summary and Thoughts

The best options of wide range options are wire transfers, debit, and credit cards, They all work ok, depending on the bank, card issuer, and crypto platform. You can click on the links above for the detail in each case, but the most important thing has an account at a retail bank that allows transactions with cryptocurrency platforms. You should check your bank’s policies before attempting to buy crypto directly from your bank account.

The fact that we can still buy cryptocurrency at all with our fiat money is remarkable. Banks were initially happy to accept the merchant fees from cryptocurrency businesses to increase their turnover.

Things have changed, and banks now appreciate that, in the long term, cryptocurrency is a threat to their very existence. The take-home message is to buy crypto now – before it gets discouraged and then banned by the banks and the governments that support them.

However you buy your Bitcoin, it’s going to cost you more than it’s worth. Given the overall upwards direction of the market, this is not a big problem. A 5% premium will be overcome in 28 days, on average, but it’s still frustrating.

US residents can invest gradually with Swan Bitcoinfor a very reasonable fee, then withdraw regularly to safeguard their assets. Swan Bitcoinwins this race, and it’s my first choice on the list for the smaller retail investors.

Read also:

- How to buy Bitcoin with ACH instantly (in the USA & Worldwide)

- Buy Bitcoin with Wise – Where & How To Buy Crypto With Wise

- How to buy bitcoin with eCheck [Routing and Account Number]

- Where to Buy Bitcoin With Gift Card – Convert Gift Card To BTC

- How to Buy Bitcoin With IMPS?

- How To Buy Bitcoin With N26 – Can You Buy Crypto With N26?

- How To Buy Bitcoin With Skrill – 5 Ways To Do It!

- How To Buy Bitcoin With Google Pay? [Instantly]

- How To Buy Bitcoin With iTunes Gift Card | Convert Gift Card To BTC

- How To Buy Bitcoin With VISA Gift Card[Instantly!]

- Buy Bitcoin With Apple Pay – Can You Buy BTC with Apple Pay

- How to Buy Bitcoin with MoneyGram

- How to Buy Crypto with Neteller INSTANTLY

- How To Buy Bitcoin & Crypto With Prepaid Cards