Crypto.com Card Review – Fees, Earn, Tiers, Perks

According to Coingecko.com, Crypto.com exchange is the #4 crypto exchange out of a total of 507 exchanges that we can currently find on the market. In addition to buying and selling Bitcoin and other cryptocurrencies, Crypto.com offers us many other quality options that catch our eye, and their cards are one of those great options.

A popular argument for fiat currencies against cryptocurrency is that you cannot use digital currencies to buy groceries or other everyday items with them. But using a cryptocurrency debit card, like Crypto.com Visa Card, you can do that….and much more.

This article reviews Crypto.Com Visa Card, one of the best crypto cards out there, pros and cons, card type of available prepaid cards, and many, many more. So let’s get started.

What you'll learn 👉

Crypto.com Debit Card Review: Intro

Crypto.com Visa Card is, in our humble opinion, one of the best crypto debit cards that you can find on today’s market. It’s unique, easy-to-use, beginner-friendly, with great payment options, high speed, and low fees prepaid debit card. Crypto.com Visa Card converts the crypto funds that you have on this card into spendable currency when you pay with it.

| Crypto.com Visa Physical Card | |

| Supported cryptos | Supported fiat |

| BTC, ETH, LTC, XRP, TUSD, PAX, EOS and many more | USD, GBP, EUR, HKD, JPY, SGD and AUD |

It is available in the United States, Europe, the United Kingdom, Canada, and Singapore. Crypto.com Visa Card gives you up to 8% cashback and a bunch of other benefits.

What Is the Crypto.com Rewards Visa Card?

Crypto.com Rewards Visa Card (former MCO Rewards Visa) is a prepaid debit card made specifically for crypto enthusiasts who want to use their digital assets as a spendable currency.

Instead of waiting for several days for your cryptocurrencies to be available for spending, Crypto.com Rewards Visa Card allows you to have your digital assets available to you instantly. And that is the main advantage of this card.

When you, as the owner of your Crypto.com Rewards Visa Card, add crypto-assets to that card, that crypto-asset becomes a spendable currency that you can use practically anywhere. Depending on what tier of card you own, while spending money from the card, you are at the same time earning rewards for that spending.

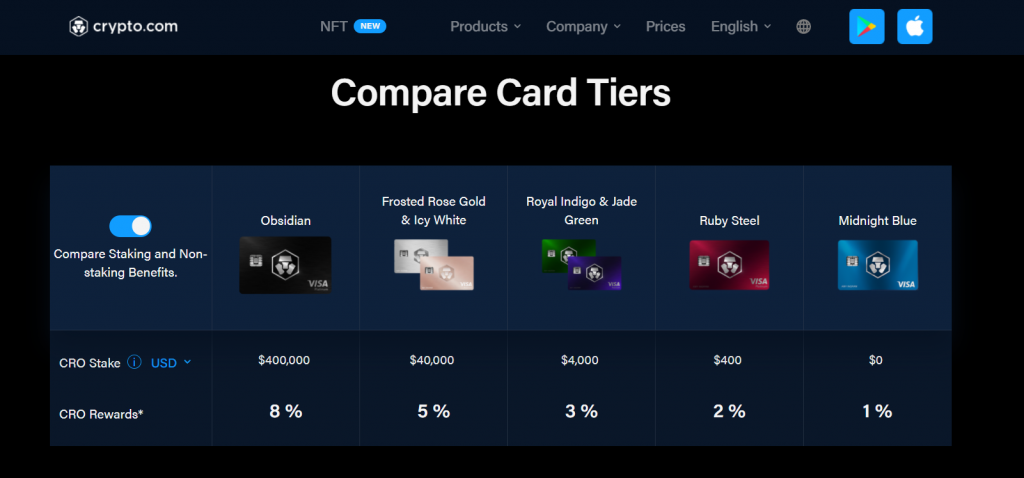

Types of cards – tiers

With the lowest staking requirements, you can get the lowest card tier card that comes with the least amount of rewards. On the other side, with higher staking requirements you get more and more benefits and rewards.

Based on staking requirements, in the text below, we will explain the card types that you can qualify for and the rewards you can get.

Obsidian

It is a top-tier premium card with a large staking requirement – $400,000. With Crypto’s Obsidian card, you earn 8% CRO rewards on card spending.

Other benefits of the Obsidian card:

- 100% cashback on Amazon Prime, Netflix, and Spotify

- 10% cashback for Expedia and Airbnb

- $1,000 per month fee-free ATM withdrawals

- Airport Lounge Access for cardholders and one additional guest for free

- Crypto.com Private

Frosted rose gold and Icy white

It is the second-highest card with a still high staking requirement – $40,000. You can choose between the Frosted Rose Gold or Icy White. With these prepaid cards, you earn 5% CRO rewards on card spending.

Other benefits of the Crypto’s Frosted Rose Gold and Icy White cards:

- 100% cashback on Amazon Prime, Netflix, and Spotify

- 10% cashback for Expedia

- $1,000 per month fee-free ATM withdrawals

- Airport Lounge Access for cardholders and one additional guest for free

- Crypto.com Private

Royal Indigo and Jade Green

Mid-tier cards with acceptable staking requirement – $4,000. It also comes in two options, the Royal Indigo, and Jade Green. With these cards, you earn 3% CRO rewards on card spending.

Other benefits of the Crypto’s Royal Indigo and Jade Green cards:

- 100% cashback on Netflix and Spotify

- $800 per month fee-free ATM withdrawals

- Airport Lounge Access for cardholder

Ruby Steel

It is a penultimate level card with a very low staking requirement – $400. With Crypto.com Rewards Visa’s Ruby Steel Card, you earn 2% CRO rewards on card spending.

Other benefits of the Crypto’s Ruby Steel card:

- 100% cashback on Spotify

- $500 per month fee-free ATM withdrawals

Midnight Blue

For Crypto.com Rewards Visa’s Midnight Blue card, there is no staking requirement – it is a free option. Because of that, this card has just 2 benefits. With the Midnight Blue card, you can earn 1% CRO rewards on card spending, and your monthly fee-free ATM allowance is $200.

How Does the Crypto.com Rewards Card Work?

Spend crypto

Since it is not an exclusive condition that you have to stake CRO to get some of the benefits of the Crypto.Com Visa Card, however, to receive some of those benefits, you will need to spend crypto from your card. And the more you spend, the more you earn.

You can use your Crypto.com card anywhere that Visa usually is accepted and more than 50 million ATMs worldwide and countless online shops.

Earn rewards

The Crypto.com Rewards Visa card enables cardholders to earn cashback in the form of CRO and other benefits and privileges.

As we said earlier, Crypto.com’s Rewards Visa is not just one card – it is actually a series of different types of cards. Each card level depends on how much you stake – with a higher level of stake, you unlock more benefits. The Obsidian (highest card) card offers 8% CRO back and various other benefits, while with the Midnight Blue card (lowest card), you get just 1% CRO back.

For the majority of crypto enthusiasts, the amount they need to put up for an Obsidian card ($400,000) is out of reach for most of them. So maybe we can say that a rate of “up to 8%” is slightly misleading.

Stake CRO

Unlike other crypto debit cards, the Crypto.com Rewards Visa card requires you to stake funds (except the Midnight Blue card). In the case of these cards, that would be Crypto.com‘s CRO token. Keep in mind that the staking requirement is fixed in USD (not in CRO).

Also, the more CRO you stake the better tier of card you’ll order, and thus you get much better benefits and privileges at your disposal.

Crypto.com Card supported coins

Crypto.com currently supports 170+ cryptocurrencies, with more and more every month. Just in September 2021, Crypto.com added 15 new cryptocurrencies.

Crypto.com card fees

on pos

| Fees | Amount | Details |

| POS PIN debit purchase | No charge | No charge to use card to make purchases. |

| POS signature purchase | No charge | No charge to use card to make purchases. |

| POS PIN purchase (declined) | No charge | No charge if card is declined at the Point of Sale (POS) |

| POS SIG purchase (declined) | No charge | No charge if card is declined at the Point of Sale (POS) |

on ATM withdrawals

| Fees | Amount | Details |

| ATM withdrawal | No charge or 2% Fee | In accordance with the type of card you have and the restrictions for monthly ATM withdrawal ($200-$1000), there is no withdrawal fee. If the ATM withdrawal is exceeded during the month for a certain type of card, 2% of the fee will be charged for subsequent withdrawals. |

| ATM withdrawal (declined) | No charge | No charge if your card is declined at the ATM. |

| ATM balance inquiry | No charge | No charge to check balance at an ATM. |

on online purchases

There are no fees for online purchases made with your Crypto.com Visa debit card.

Intuitive Mobile App

Using the Crypto.com mobile app, you can buy/sell/store/trade more than 170 different cryptocurrencies. This includes BTC, ETH, LTC, and many other popular cryptos.

The app is available for both iOS and Android devices. After verifying your identity, you can buy crypto with a local currency like USD, EUR, or GBP.

This mobile app has a modern, easy-to-use interface designed to be highly user-friendly. Overall, Crypto.com mobile app is a simple yet powerful product.

Supported Countries

Crypto.com Mobile App is available worldwide.

Crypto.com cards are currently available in the United States, Europe, United Kingdom, Canada, and Singapore.

You can get your card in 30 European countries:

- Austria

- Belgium

- Bulgaria

- Croatia

- Cyprus

- Czech Republic

- Denmark

- Estonia

- Finland

- France

- Germany

- Greece

- Hungary

- Iceland

- Ireland

- Italy

- Latvia

- Lithuania

- Luxembourg

- Malta

- Netherlands

- Norway

- Poland

- Portugal

- Romania

- Slovakia

- Slovenia

- Spain

- Sweden

- Switzerland

Spending Limits

| Limit | $ Card | € Card | £ Card |

| Max Card Balance | 25,000 | 25,000 | 22,000 |

| Topup Limit (Daily) | 10,000 | 25,000 | 22,000 |

| Topup Limit (Weekly) | 25,000 | 25,000 | 22,000 |

| Topup Limit (Yearly) | – | 250,000 | 220,000 |

| ATM Withdrawal Limit (Daily) | 500* | 2,000 | 1,800 |

| ATM Withdrawal Limit (Weekly) | 5,000* | 10,000 | 9,000 |

| ATM Withdrawal Limit (Yearly) | – | 75,000 | 66,000 |

| ATM Withdrawal Frequency (Daily) | 3 | 3 | 3 |

| ATM Withdrawal Frequency (Monthly) | 30 | 30 | 30 |

* Amounts marked with an asterisk are limits for the Midnight Blue Card. There are higher limits for other card tiers.

How to apply and verify cards on Crypto.com?

To apply for Crypto.com Visa Card, you need to follow the next steps:

⚡️ Step 1: Sign Up – Download and install Crypto.com mobile App. Complete their KYC.

⚡️ Step 2: Apply – You will find the “Card” button at the bottom right corner. Click on it. Select your preferred card tier.

⚡️ Step 3:

I Accept the Terms & Conditions

II Send the required amount of CRO tokens to your App Crypto wallet and stake them for a 6-month lock-up period.

III Submit and confirm your delivery address.

⚡️ Step 4: Shipment – You will be notified when your card is sent. You can then track the status of your card in your App.

The usual time required for delivery is 7 to 14 business days.

After you receive your card, log in to your Crypto.com App and click on “Card.”

Go to “Activate My Card.” Enter the CVV number located on the back of the card you received.

Set the 4-digit PIN number you want to use …. and poof … your card is activated.

What other benefits does Crypto.com card offer?

Loungekey access

Cardholders of the Obsidian, Frosted Rose Gold, Icy White, Royal Jade, and Indigo cards are allowed to use this privilege. Except for cardholders of Royal Indigo and Jade Green cards, you can bring with you an additional guest for free.

Bonus rewards

Suppose you qualify for Crypto.com Private (cardholders of Obsidian and Frosted Rose Gold/Icy White cards). In that case, you can earn an additional 2% interest on fixed-term deposits in your Crypto.com account.

Private jet membership

Obsidian cardholders can become qualified for a private jet membership. This benefits Obsidian cardholders for upgraded perks when they fly with Crypto.com’s selected private jet partner.

How Does the Crypto.com Card Compare?

#1. vs. BitPay Card

BitPay charges for the issuance of their card, have higher fees and fewer features than Crypto.com cards. That is why Crypto.com Visa card is our choice between this too.

#2. vs. BlockFi Card

Both BlockFi and Crypto.com provide excellent and reliable cards. Because of the great benefits for high-tier cardholders, the Crypto.com Visa card is a better choice for them. But for most crypto users who do not have large amounts on their wallets, BlockFi cards offer better benefits.

You can see a detailed review of the BlockFi Card by clicking here.

#3. vs. Coinbase Debit Card

Same thing as with a BlockFi card. For smaller amounts, the Coinbase debit card is definitely more beneficial, while for larger amounts of available crypto funds, the Crypto.com card is a better choice.

#4. vs. Gemini Credit Card

Definitely a Crypto.com card. Except it is only available for U.S. residents, the Gemini Card has only 3% cashback when spent on dining (just 1% on other things), more and higher fees.

You can see a detailed review of the Gemini Card by clicking here.

Other notable competitors are Crypterium, AdvCash card, Binance card, Blockcard, Wirex, Spectrocoin card, ClubSwan card, Nexo card.

Bottom Line

If you are searching for a place to store your digital assets and need easy access to spend that funds, then Crypto.com Rewards Visa Card is the right choice. Don’t forget that the Crypto.com Rewards Visa has to be topped up with cryptocurrency in the first place so you can use it and that you need a lot of CRO to access the high-tier benefits that these cards provide.

FAQs

Read also: