Gemini is one of the biggest cryptocurrency exchanges on the market. Founded by the Winklevoss twins, Cameron Winklevoss and Tyler Winklevoss. Famous for creating ConnectU, Facebook’s predecessor.

Gemini was founded in 2014 and operates from New York. It’s one of the few cryptocurrency exchanges regulated by the U.S. government. Specifically the New York State Department of Financial Services (NYSDFS).

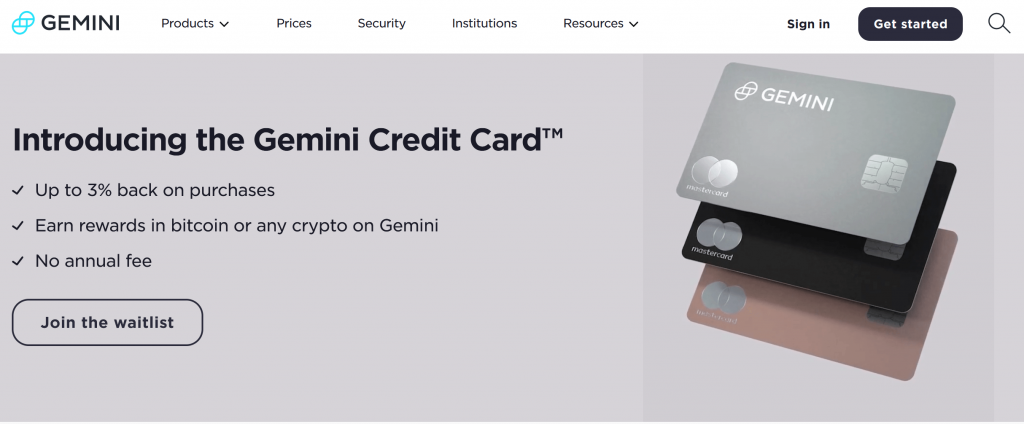

So with the introduction out of our way, let’s take a look at the newly launched Gemini Credit Card.

What you'll learn 👉

Gemini Credit Card Rewards

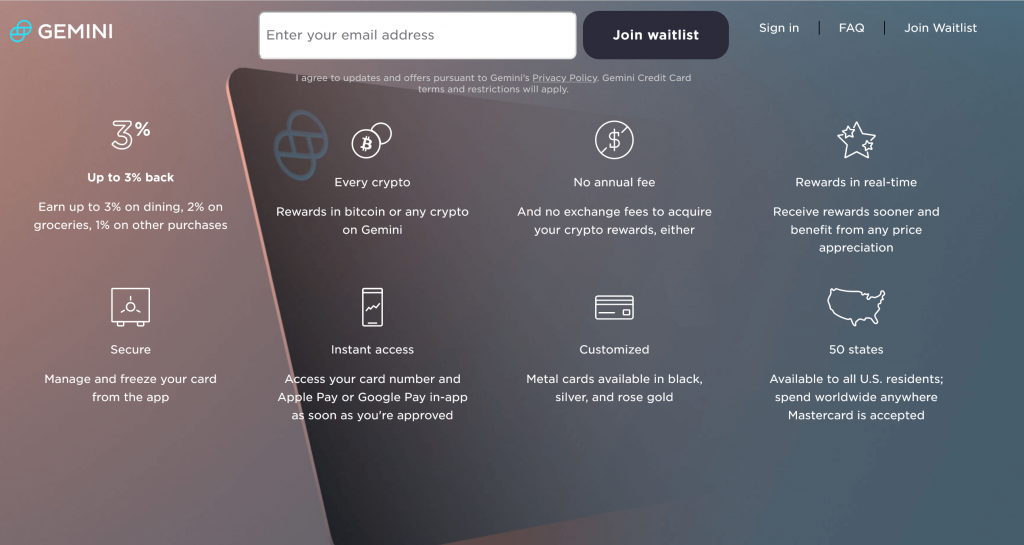

The Gemini Credit was created by working with WebBank and will run on the Mastercard payment network. The best benefit of the Gemini Card is that it can earn clients rewards in Bitcoin and the more than 30 other cryptocurrencies available on Gemini. The cashback includes:

- 3% back on dining.

- 2% back on groceries.

- 1% back on all other purchases.

The card is accessible instantly upon approval. No need for any history with Gemini customers to get it. Although once you apply, a Gemini will open a crypto trading account if you don’t already have one.

Gemini will transfer the gained rewards into your trading account, which is excellent if you intended to reinvest them. A clear advantage over most other rewards credit cards is that payout rewards after the end of each billing cycle. The best thing about it is that your crypto rewards may appreciate it. Meaning that you can benefit from the moment you did the transaction, although there is, of course, a risk of depreciation.

Another great option is that Gemini gives you the ability to decide which cryptocurrency to earn rewards in. Once you decided to change, you can easily switch between cryptocurrency, which is best for diversification.

Users also have the chance to choose to transfer their crypto rewards into Gemini Earn. The interest-bearing account can earn you up to 7.4% APY, but it all depends on which crypto asset you hold in your deposit. The earned interest can then be moved back into your Gemini trading account whenever you want.

So Gemini Earn is high-yield savings account for crypto. And the Gemini account for cryptocurrency trading works like any brokerage account.

Lastly, with Gemini Credit Card also comes with benefits from Mastercard.

Background on the Gemini Credit Card

They created the Gemini Credit Card thanks to their recent acquisition of Blockrize. Blockrize had a crypto credit card in the workings.

Users that had signed up for the Blockrize crypto credit card waitlist have priority in receiving the Gemini Credit Card. The Gemini credit card is part of an emerging market of credit cards which rewards are in cryptocurrency. Cashback and travel rewards may be on their way out.

Why Bitcoin Rewards and Not Cashback?

Bitcoin is not touched by inflation. Satoshi Nakamoto, the creator of Bitcoin, programmed in the code when and how many new bitcoins are created. And in total, only 21 million Bitcoins can be made, meaning that Bitcoin has a fixed supply.

If enough people buy Bitcoin, then, of course, the price of it will go up. And throughout its history, Bitcoin has only appreciated. But, on the other hand, central banks can print cash, and the more they print, the less it’s worth. So why would you want a cashback?

Gemini Card vs. Crypto.com Card vs. Coinbase Card

Coinbase

Pros ✅

- Quick and easy to spend your crypto.

- Accessible connection to your Coinbase crypto wallets.

- Available in U.K., Europe, and the U.S.

- Clients have all the advantages of a Visa Card.

- Clients can earn up to 4% in cash backs.

Cons ❌

- Clients pay a card issuance fee of £4.95 or €4.95.

- The cryptocurrency exchange fee is 2.49% which is very high.

- No PIN code to access the Coinbase Card app, which leaves clients a lot more vulnerable

- Nexo Card Fees

Crypto.com

Pros ✅

- No annual or monthly fees

- No withdrawal fees

- Instant access and process funds

- A complete reimbursement each month on subscriptions such as Amazon Prime, Netflix, and Spotify and discounts on Air BnB if you hold a good enough tier.

- An 8% cashback on what you spend

Cons ❌

- High staking requirements to access higher card tiers.

- Low monthly ATM limits if you’re holding a lower-tier card.

Gemini Mastercard Card

Pros ✅

- From 1-3% cashback on purchases done with the Gemini card

- One of the few and best crypto credit cards

- Manage the card and even freeze it from your mobile app.

Get rewards in any cryptocurrency that users can find on the Gemini exchange, perfect for diversification.

- Gain rewards instantly after every purchase.

- The Gemini Earn option is excellent for earning crypto passive income.

Cons ❌

- The Gemini Card is only available in the U.S.

- Users currently only access it via a waitlist as it is not entirely out yet.

- The 3% cashback is only earned when spent on dining, which is quite limiting.

- The usual cashback rate is only 1%, lower than their competitors.

- The usual cashback rate is only 1%, lower than their competitors.

FAQs

To learn more about crypto debit and credit cards, read the guides below:

- AdvCash Card Review

- Bitpay Card Review

- Spectrocoin Card Review

- BlockFi Card Review

- Binance Crypto Debit Card Review

- Wirex Review