C-Trade Exchange Review – Fees, Supported Coins & Countries, KYC, Leverage

In order to increase the choice and availability of services provided by exchanges, there are many of them with different characteristics. In today’s article, we will try to bring you closer to C-Trade, to present its advantages and disadvantages and main features.

What you'll learn 👉

C-Trade Overview

C-Trade is a new-generation derivatives exchange of digital assets founded in 2019 in the British Virgin Islands. As they say for themselves, experts who work for C-trade are very committed to their work and strive to introduce new technologies into the world of derivatives trading. Although it was founded quite recently, this platform strives to advance and provide services at the highest level.

Services & Features

Buy & Sell crypto

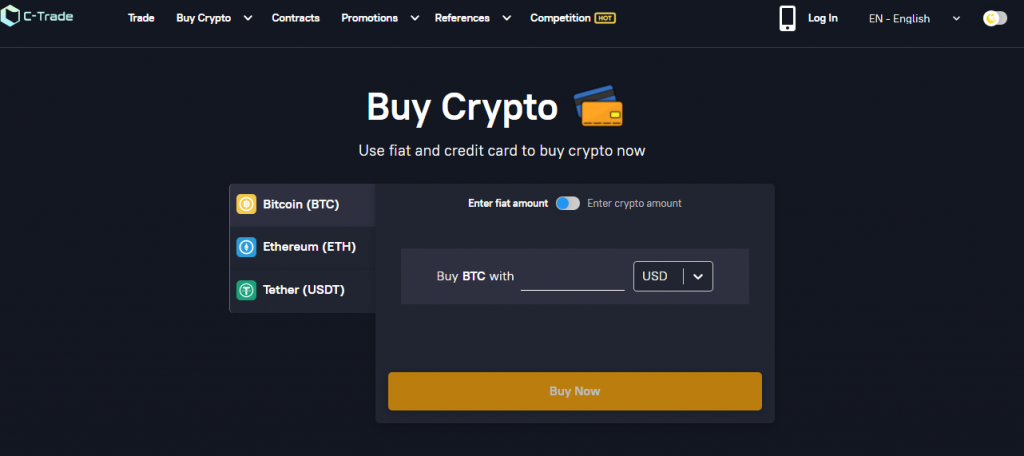

In addition to changing fiat currencies into crypto, C-Trade also enables market monitoring as well as setting certain parameters and orders for buying and selling crypto. After registration or login, a chart will appear on the home screen that monitors the market situation, which facilitates trade. On the right side of the screen, you can put desired amounts of fiat or crypto for trading.

Perpetual contracts

Perpetual contracts are financial derivative contracts that can be used for an indefinite period of time because they do not have an expiration date. Perpetual contracts are becoming increasingly popular in the crypto world because they allow traders to maintain their leverage position for as long as possible.

C-Trade USDT perpetual contract is a linear contract, and it uses a USDT margin. The P&L calculation is represented by a linear curve on the chart. USDT perpetual contracts use stablecoin as margin, unlike inverse perpetual contracts that use the underlying cryptocurrency.

Min. order quantity for BTC/USDT is 0.001 BTC, and 1000 BTC is max. order quantity.

For ETH/USDT, min. is 0.01 ETH, and max. is 1000 ETH.

C-Trade supported coins

For now, C-Trade supports 5 cryptocurrencies: Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), Dogecoin (DOGE), and Tether (USDT), but there are efforts to introduce other coins in the near future.

C-Trade deposits & withdrawals

5% cashback reward

How does earning a 5% refund on your first purchase via C-Trade fiat gateway sound like? It is very attractive, but that’s not all, because there are 100 other prizes that you can win, and those are the iPad Pro, Apple smartwatch, iPhone 13 Pro, as well as the Tesla Model 3 car.

There is also a cash prize of 50 USD bonus. To be eligible for the award, there are certain conditions and terms that must be fulfilled. First of all, only purchases made for the first time through a fiat gateway come into consideration, in the amount of between 100 and 15,000 USD, so the maximum cashback is 750 USD. There are other conditions that you can find on the C-Trade official site.

Fees

Deposit and withdrawal fees vary from exchange to exchange. There are no deposit fees on this exchange, nor for withdrawals (only the network fees). On C-Trade, takers are charged 0.075%, while makers fee is 0.025%.

Methods

Payment methods that are accepted at C-Trade include Visa and MasterCard, ApplePay, Electronic Fund transfer (such as SEPA and SWIFT).

Limits

There are limits when buying cryptocurrencies with selected fiat currencies. The minimum amount is 50 USD, and the maximum is 20,000 USD for one order. These amounts are converted into the currency in which you want to make a purchase.

C-Trade Trading Fees

Each exchange charges fees for trading, these amounts are individual and not the same for all platforms. However, the percentages of fee amounts do differ from exchange to exchange.

In addition, there are differences between taker and maker fees. Makers are the ones who put their orders in the order book, and takers are those who take them from the order book, which means the opposite of the previous one.

Trading fees

The percentage for the maker fee is 0.025% for each order. This means that for placing an order of buying cryptos for $ 1,000, in fact, $ 999.75 will be paid. The system rewards makers, in essence. The taker fee is 0.075%.

There is a 15% discount for 3 months for new clients if they register using a current affiliate link.

Compared to other trading platforms, C-Trade trading fees are very tempting for potential clients.

Does C-Trade require KYC?

Essentially, C-Trade as itself doesn’t require KYC. But, when buying some digital assets using C-Trade’s fiat gateway, KYC is obligated by third-party service partners (Banxa, Xanpool, Simplex).

For those unfamiliar with this, Know Your Client (KYC) is a common process conducted by banks and other financial institutions to identify users and verify them. It can be conducted live or via video call, but it is also necessary to submit certain documents that confirm that it’s you. Considering that this is about finances, it is clear why this is necessary, especially in the crypto world where everything takes place online.

C-Trade supported countries

C-Trade supports trade from almost all countries, except in 2 cases.

The first of them is if the country belongs to the FATF (Financial Action Task Force) list or it is marked as a high-risk country. Some of these countries are Afghanistan, Turkey, Cuba, Albania, Morocco, Panama, Haiti, the Democratic People’s Republic of Korea, etc. There is a full list on C-Trade’s website.

The second case is if you are a US citizen. It’s forbidden for US investors to open accounts on C-Trade. Below you will read why.

Are US investors allowed on C-Trade?

US investors are not allowed to trade on this platform. The reason is that the USA, more precisely the Securities Exchange Commission (SEC), does not allow foreign companies, in this case, exchanges, to do business in the USA if they are not registered in the USA as well.

Therefore, it is forbidden to look for US investors, otherwise, the SEC has the right to sue them. There are examples that there was a lawsuit and certain exchanges lost the dispute, which led to damage to the reputation and loss of trust in them by users.

How to start with C-Trade? (steps like registration, activation, verification etc)

Getting started on the C-Trade only takes a couple of minutes from registration to actually place your first trade.

First of all, in the upper right corner, you click on the “Register” button, and on the screen will appear the “Sign Up” window. Here you have to enter your e-mail address, pick your country, set your password, and enter a referral link if you have one. Click again on “Register” and you will receive an email to confirm your account.

Now, you are ready to deposit some money and start trading.

Does C-Trade have a Native Token?

At the present, C-Trade doesn’t have a Native Token.

Is C-Trade legit and safe?

Like any other significant company, C-Trade has a very thorough approach to safeguarding other people’s goods, in this case, digital assets. All deposits are kept in cold multi-signed wallets, but there is always some amount in hot wallets if users need an instant withdrawal.

The client’s safety and security are taken seriously because customer trust is the most important.

Is C-Trade Regulated?

During our research, we did not find any information on whether this exchange is regulated or not. We have not found information on the C-Trade official website related to the legal framework in which this exchange operates.

Conclusion

After all the above, we can agree that C-Trade is a platform that satisfies clients’ criteria in almost all aspects. Given that it is relatively recent, it is necessary to work on improving services in order to stand out among the competition. The only major complaint is that there are only 5 coins they work with, but we hope that they will expand to others.

All in all, C-Trade is something that is recommended to users of crypto services.

Read also:

- Bit2Me Review

- Mandala Exchange Review

- CoinOne Review

- Liquid Exchange Review

- Aofex Review

- ZT Exchange Review

- VCC Exchange Review

- FTX Leveraged Tokens Explained

- The Fastest, Cheapest & Safest Ways to Send Crypto Between Exchanges

- Probit Exchange Review

FAQs

What fiat currencies does C-Trade support?

C-Trade supports a large number of fiat currencies, actually, 94 of them are supported. Some of them are EUR, USD, RSD, AED, TRY, CHF, SEK, MXN, INR, IDR, CAD, and many others.

Does C-Trade have Fiat Deposit? (yes, via third-party services)

Specifically, C-Trade doesn’t manage fiat deposits. But their partners do that instead of C-Trade. Those partners are Simplex, Xanpool, and Banxa.

Can I trade with leverage on C-Trade?

Yes, this is a possible and remarkable benefit of derivatives is exactly trading with leverage. C-Trade offers its clients up to 150x leverage on derivative commodities.

Where is C-Trade exchange based

C-Trade is based in the British Virgin Islands.

How do I get crypto on C-Trade

After registration or logging in on your account, there is an option “Buy crypto” on C-Trade’s home page; when you click on this button, you have to select the cryptocurrency you want to buy and enter the amount of fiat or crypto for paying. Then choose your service provider and continue with paying. In the interval between 2 – 30 minutes, coins should be on the account.