Automated trading bots are all the rage as people try to recover their portfolios after the latest market downturn. Historically, hodling and weathering the storm has proven to be the most profitable long-term approach. However, people love to try and beat the market, whatever it’s doing. These 2 platforms give you the automated trading tools to try.

Let’s take a look and see what each has to offer.

What you'll learn 👉

Setup & Experience Required

The initial setup is trivial for anyone familiar with smartphones and PCs. Gunbot is only accessed as a web app, but 3Commas also has iOS and Android smartphone applications. Once you have navigated setting up your account, head to the learning pages. In both cases, they have lots of educational material to ponder. Indeed, there’s a veritable trading bot rabbit hole to explore if you follow all the links.

The 3Commas Trading Academy has well-structured courses for every level of trader. There are around 5 hours of tutorial videos to support the 4 part course. This takes you from your first steps in trading crypto, through bot trading basics, and onto advanced strategies. It’s very impressive, although a little optimistic in outlook – more of which in the conclusion.

From the Gunbot support page, you can access the documentation wiki. Here you can find what you need to know for every option and setting. There are video courses and an active user community, so there is plenty of help at hand. If you do have a query, head to the Telegram page frequented by Gunbot experts.

Pricing

Gunbot

You can try a demo version of Gunbot before you decide on a plan. Prices are quoted in BTC, which is refreshing – one day all goods and services will be. The price is a one-off lifetime license payment with no recurring costs. This could constitute great value in the long term, but you need to be sure before you commit.

Also, notice that you get free upgrades as soon as you buy, so you can get the top-of-the-line version for the price of the Pro package. I wonder how many people still pay the full amount for the Ultimate version.

Starter – Ƀ 0.0055 = US$195

- 1 Simultaneous Exchange / changed at any time.

- Spot Trading

- 4 Trading Strategies

- 200 Gunthy Tokens

- Gunbot School

- Email and Live Chat Support

Standard – Ƀ 0.01375 = US$486 – Free upgrade to Pro

- All the above plus –

- Futures Trading

- Every Strategy

- Automatic Bot Configuration

- 500 Gunthy Tokens

Pro – Ƀ 0.020625 = US$730 – Free upgrade to Ultimate

- All the above plus –

- 3 Simultaneous Exchanges

- 750 Gunthy Token

- Back Testing

Ultimate – Ƀ 0.034375 = US$1215

- All the above plus –

- 5 Simultaneous Exchanges

- 1250 Gunthy tokens

- TradingView add-on

- Custom JS strategies

3Commas

Free Version –

- One account per exchange

- Scalping Trading terminal

- One SmartTrade

- One DCA Bot

- One GRID Bot

- One Options Bot

- One Bitmex, Binance Futures, ByBit or FTX futures Bot

Starter – US$14.50 per month, with a single annual payment of US$174

- All the above plus –

- 5 accounts per exchange

- SmartTrade (Spot, Margin, and Futures)

- Concurrent Take Profit and Stop Loss (ОСО orders)

- Paper Trading

Advanced – US$24.50 per month, with a single annual payment of US$294

- All the above plus –

- 10 accounts per exchange

- Unlimited Single pair DCA Bots for Spot Exchanges

Pro – US$49.50 per month, with a single annual payment of US$594

- All the above plus –

- Unlimited accounts per exchange

- Unlimited Multi/Single pair DCA Bots

- Unlimited Bitmex, Binance Futures, ByBit or FTX futures Bot

- Unlimited Grid Bots

- Unlimited Options Bots

Features, Trading Tools, and Strategies

There are so many features with so many variations that it’s not possible to list them all here. I selected a few interesting examples and have given a brief explanation of each.

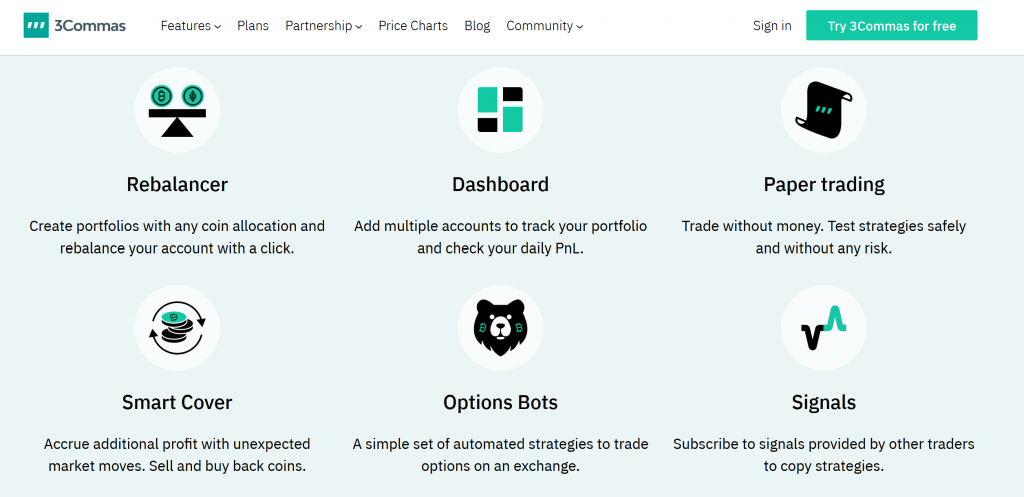

3Commas

- DCA Bot (Dollar Cost Averaging) – This is a cost-effective method of entering or exiting a trade. Your trades are automatically broken up into smaller orders and executed at pre-defined price levels. On average, it’s the cheapest way of getting into a trade and the most profitable way of getting out.

- SmartTrade – The SmartTrade Terminal integrates with TradingView, accessing technical indicators, prices, and pre-defined triggers. TradingView has some of the most reliable and quickest signals in the business.

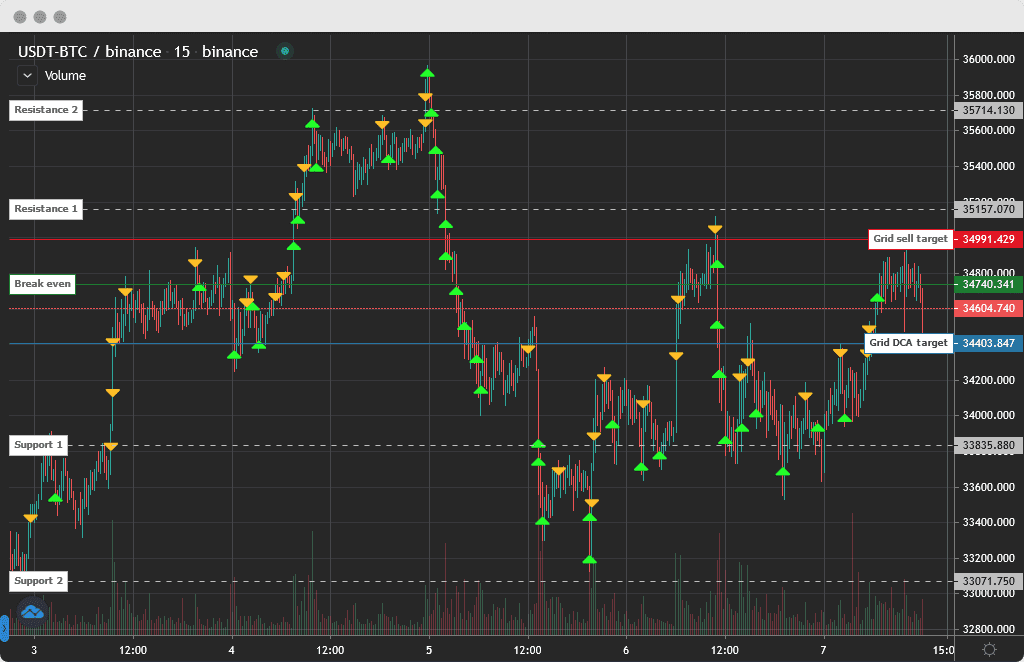

- GRID Bot – This simplest of bots calculates price channels based on the last 7 days’ movement. It tries to figure out when the price is low to make a buy, and when it’s high, to execute a sell. The clever part is balancing your investment across both sides of the trade and configuring a grid of limit orders.

- Options Bot – Knowing what you are doing is the key here if you don’t want to get REKT. 3Commas have excelled in their explanation of longs, shorts, and straddles. They even explain about using options as a hedge, just as nature intended. I’ve never heard this talked about in crypto circles. It’s definitely worth a read.

- Dynamic Trading Terminal – This is where you aggregate all your positions across multiple exchanges on one, manageable platform. From here you can set up conditional trades, leave it running, and go about your daily business. It’s the easiest way to get a snapshot of your portfolio without visiting multiple exchanges.

- Crypto-Signals – You can subscribe to a set of signals which will trigger trades from your account. Take a very close look at each one before you risk any money. I noticed that they all do well in a bull market, but most are terrible when it’s all crashing down around our ears.

Gunbot

- Browser Interface – Apart from smartphone access, you can either useyour home computer or any other web browser for Gunbot. There’s 2 Factor Authentification so you can safely view and manage your portfolio on the go.

- Off-the-Shelf Trading Strategies – You can subscribe tovarious ‘rule-sets’ that dictate when the bot buys and sells. Run as many strategies as you like on as many different trading pairs. There are strategies for futures trading and an interesting selection of limit and stop-loss variations.

- 16 Buy and Sell Strategies – This is somewhere you should spend some time learning about trading theory. There are some exotic-sounding strategies like Emotionless, MACDH, and Pingpong. They are all configurable and work across a range of timescales. Technical analysis freaks could lose themselves for a month.

- Multiple Indicators – Every week I hear of a new indicator and stare in awe at all the beautiful lines, curves, and colors. There are certainly enough on Gunbot to mesmerize yourself, so go easy. Try not to obscure your chart with your technical analysis, both literally and figuratively. Remember, what works on 4-hour candles may not work on 5-minute candles.

- Telegram Integration – Notifications and alerts arrive via Telegram, where you can track your portfolio, receive alerts, etc.

- Back Testing – With the Pro and Ultimate versions you get an add-on enabling backtesting from a TradingView account. You select the Gunbot Deluxe Black Edition from the Tuners list on TradingView and away you go. It’s all explained here.

Reliability & Security

With neither platform do you hand over any private keys – this is critical. As long as your internet hygiene is all in order, you should have nothing to worry about.

There are two important things to remember when configuring API access to your exchange accounts –

- Only allow logins from your specified IP addresses.

- Disable permissions to transfer money out of your exchange accounts.

If someone did get past your 2FA protection and broke into your account, the worst they could do is set up an inadvisable trade. Quite frankly, I regularly do that all by myself!

These platforms rely on their reputation so they invest heavily in security. I would trust both of them to manage my portfolio and execute my trades, however, I would never keep life-changing amounts of crypto on an exchange in the first place.

Supported Exchanges

Gunbot

3Commas

Most of the above and a whole lot more! There are far too many to mention here, so to simplify things –

- GridBot and DCABot run on a fair selection of exchanges.

- OptionsBot runs only on the Deribit exchange.

- Everything else runs on Binance.

Which crypto trading bot is best for you?

Clearly, it’s the one that makes you the most money. Whichever you choose, it’ll run well on these tried and tested platforms. There are a few other bot providers out there worth a mention. TradeSanta, Shrimpy, and Cryptohopper are all popular choices.

I would advise looking at how everyone else’s bots work, then creating your own. Do not rely on the hype or the claims of bot vendors, and remember that no bot performs well in all circumstances. You’ll need a battalion of bots in your trading arsenal to beat the market consistently.

Start simple and build up. Backtest your bots at each stage with historic data, but make sure to paper-trade it in the current market. Only when you are satisfied should you let it loose with your assets. You’ll find that results are generally not as good when trading with real money. Here’s why.

Both the historic test data and the paper-trading feature works on a best-case scenario. Real-life markets are less cooperative, so you may find yourself late into trades and stuck in them longer than ideal. This will all affect the bot’s profitability. Gunbot is honest enough to be upfront about this with a disclaimer about backtesting.

FAQs

Is automated Bitcoin trading profitable?

If you sell or license your strategy or bot, then yes, it can be extremely profitable. For the user, it depends on the market conditions, how you configure it, and how many other people are using the same strategy.

Millions of dollars are paid to teams of genius quants to figure out how to outsmart the market. There’s no physical law that states an amateur couldn’t be successful, but what are the odds of winning that race? Again, buying and hodling is time and again proven to be the most profitable way of playing the market in the long term.

What are the risks of using a Bitcoin bot?

There’s one fundamental risk with all trading strategies – losing money. Everyone makes profits in a bull market so your bot needs to outstrip the market to be considered effective – being profitable just isn’t enough in a bull market. Missing out on this value is costly enough, but the real damage is caused by markets on the way down.

The golden rules are –

- Never use leverage with crypto, especially when you short the market.

- Never invest money you can’t afford to lose.

- Never invest more than 5% of your bankroll on each trade.

Other than that – have at it! It’s a great hobby and teaches you more about the market than hours of reading articles about it.

Check out our other guides and trading platform comparison that can be good alternatives:

- Trailingcrypto vs Cryptohopper vs 3commas vs Coinigy

- Cryptohopper vs 3Commas: Which Crypto Trading Bot Is Better?

- Bitsgap vs 3Commas vs Quadency | What bot is the best?

- TradeSanta vs Cryptohopper vs 3Commas vs Quadency

- Coinrule vs Cryptohopper – Price, Features, ROI Compared

- Cryptohopper Alternatives – Trading Bots Similar To Cryptohopper

- Quadency vs Cryptohopper – What is the better crypto bot?

- Best Free Crypto Bots – Yes, Open-Source & Free Bots DO Work!

- 5 Best Cryptocurrency Arbitrage Bots

- Best Crypto Grid Trading Bots – Grid Trading Strategies

- Best Crypto Scalping Bots – 5 Bots That Excel in High-Frequency Trading

- Haasbot vs 3commas vs Cryptohopper