Crypto trading bots allow investors to buy and sell cryptocurrencies automatically allowing them to generate a semi-passive income. Trading bots help the user make a profit by employing a number of different strategies that work well in the cryptocurrency markets. The way these bots work is by monitoring the market around the clock. The bot will then make trades following a set of rules that are set by the user. The user has the freedom to program the bot to make trades following certain market conditions. This article aims to outline how bots work and what tasks they are good for.

What you'll learn 👉

Trading Bots – A Brief History

Richard Donchian came up with the concept of an automated trading system in 1949 when he came up with a set of rules to follow when trading the stock market. It took another 30 years until famous traders began to use this rule-based trading system commonly. In the modern-day, trading bots have been becoming more popular in the market.

Trading bots are useful for two things. Firstly, investors can use a bot to make the trading process a lot more straightforward. Bots can handle things such as portfolio diversification, index construction, and portfolio rebalancing, all of which can be very time-consuming when done manually.

The second way in which bots are often utilized is a lot more complicated. In this case, the bot will try to beat the market to make consistent profits. This approach requires a lot of research and can be complicated to set up.

With the emergence of cryptocurrency, the trading space has completely changed. Unlike traditional markets, the crypto market is open around the clock, and it is also highly volatile, making bots more appealing to investors.

What Makes a Good Bot?

All trading bots usually have the following features in common:

- Backtesting

- Strategy Implementation

- Execution

- Job scheduling

Below is a list of the best crypto bots currently available on the market:

- Cryptohopper bot review

- Quadency crypto bot review

- Zignaly bitcoin bot review

- Coinrule bot review

- Bitsgap bot review

- Review of 3Commas trading bot

- Margin review

- Gunbot crypto bot review

- Shrimpy review

- Haasbot review

- CryptoTrader.org review

- 3Commas review

Backtesting

Before you start running any bot, you should run tests against historical market data. You must make sure that your backtest is thorough and efficient. Multiple factors should be taken into consideration when testing a bot; things such as latency, slippage, and trading fees are important to take into consideration

High-quality data is available through exchange API’s. Libraries such as CCXT allow you to pull data from multiple exchanges helping to gather a more precise dataset.

Strategy Implementation

Setting some rules to follow is essential. In this stage, the user must program the bot to help it understand when and what to trade. After coming up with a strategy, you should test the bot to see how well it performs against historical data.

Execution

After backtesting a strategy and getting positive results, it’s time to test it in the real-time market.

The trading preferences coded into the bot must run as API requests that the exchange can understand. Some more sophisticated bots will allow the user to test a strategy in the real-time market on a practice account. Testing a bot with a practice account is recommended, as it means there is no risk involved when the user wants to try a new strategy.

Job Scheduling

After testing and making the bot as efficient as possible, the next logical step is to automate the process. Making use of a scheduler is the best way to go about this.

When Should Bots Be Used?

Bots are useful for almost any process; they work well for things such as rebalancing, portfolio management, and smart order routing.

When it comes to choosing a bot, some basic rules apply:

Choosing a bot can be a challenge as there is no all-in-one solution that meets everyone’s needs. You may need to try a few options before finding a bot that works with your goals. It is also important to note that automation doesn’t make this entirely passive; the user should still take care of the basics to ensure smooth operation. Bots are ideal for the completion of time-consuming tasks; we will take a look at some jobs that a bot can complete efficiently.

Repetitive Tasks

Repetitive tasks consume a lot of time and can be tedious. A trading bot allows the user to automate specific chores to make particular trades with ease. One of the best uses for a bot is to automate periodic rebalances.

Timing

Timing is an essential part of trading, and something often hard to execute with exact precision. The use of a bot will allow the user to make precise trades, meaning they won’t miss out on any profitable trades. Suppose the price of Bitcoin is free-falling, and you want to make a sell at the $10,000 support line. If you wanted to do this, you’d need to watch the price chart closely and try to make the sell at the correct time. The use of a bot allows the user to make this process hassle-free, giving them more time to focus on something else.

Day trading can be time-consuming.

The process of building a diverse portfolio can be time-consuming. Managing this portfolio is something that could turn into a full-time job. The use of bots cuts down work times through the automation of repetitive tasks and trades. What’s great is that the user has full control over what is automated and what is manual, meaning that day trading can go from being a full-time effort to semi-passive by using a bot.

The cryptocurrency market runs all day, meaning that the price of your assets can change around the clock. Unfortunately, this makes it extremely hard to keep track of your portfolio as you cannot be awake all the time. The use of a bot will allow you to automate trading strategies while you sleep, meaning that you won’t miss out on any profitable opportunities.

Let’s have a look at a real-world example through smart order routing.

The concept works by routing trades through several trading pairs.

Each trading pair needs management.

This process needs to be complete within a specific time limit before a change in the market.

The execution of a trade like this could be nearly impossible, even for a skilled investor.

Trading bots allow users to make use of such strategies without stress and risk.

What are The Best Trading Strategies?

Here are some strategies that you can use with a bot.

Mean Reversion

This strategy is relatively simple and works on an assumption. In this method, the investor assumes that if an asset’s price changes in relation to its average cost, it will eventually move back towards the average. This assumption works well in both traditional and cryptocurrency markets. This strategy works due to the psychology of the market. For example, if the average price of Bitcoin is $10,000 and it goes on a rally to $20,000 investors will likely sell in bulk which then reduces the cost towards the average of 10,000

Similarly, if the price drops to $8,000, the market will see this as a bottom, and people will start to buy, this again brings the price back towards the average of $10,000

Momentum Trading

Momentum trading involves monitoring the EBB and flow of the market based on its momentum. The investor aims to ride a stream of positive momentum and then make a sell when the market momentum reverses. Bots are useful here as the timing of buys and sells is crucial when making this strategy profitable.

Arbitrage

Arbitrage is something that is commonly associated with sports trading; however, the same process is possible in the cryptocurrency market.

The price of cryptocurrencies can vary in different exchanges.

Arbitrage involves making a profit by buying on one exchange and selling on another. Bots are great for this as markets can change unpredictably. When utilizing arbitrage, the user must purchase and sell at the same time, using bots makes this relatively straightforward and lowers the risk that the price could move unfavorably while making a trade.

Naïve Bayes

This strategy uses machine learning in an attempt to read the market’s movement. Through providing information to a bot, it can make calculations in order to make buys and sell at profitable times.

Natural Language Processing

The cryptocurrency market often reacts to news and other factors, such as social media attention. Using NLP programming, the user can train a bot to react to certain words it picks up from news sources. For example, training a bot to pick up bullish terms such as partnership news can allow someone to enter the market before the price starts to increase.

Types of Bots

Trading bots can be split into four categories.

- Arbitrage bots

- Market making bots

- Technical trading bots

- Profile automation bots

Arbitrage Bots

When it comes to finding a good arbitrage bot, Bitsgap is one of the best in the market

The Bitsgap trading bot is a trading system that completes arbitrage trades between exchanges. It does require some coding knowledge, but there is a lot of information online about how to with it. The Blackbird bot is free for use. Blackbird works through making short sells on the short exchange.

This strategy means that the user doesn’t have to transfer funds between exchanges.

Market Making Bots

These bots place buy and sell orders automatically in an attempt to make a quick profit. These are also called scalping bots, and we did a separate guide on the best scalping bots you can buy and use currently.

For example, if the price of TRX is $0.1 the bot will place a buy order at $0.09 and a sell order at $0.11

If both the orders get filled, you will earn some easy profits.

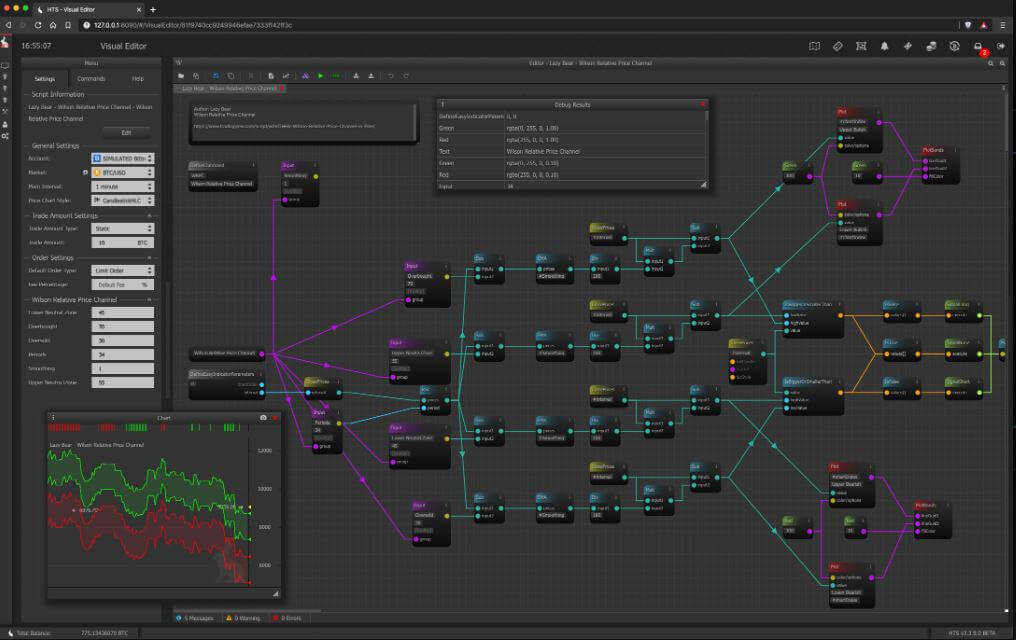

If this kind of trading interests you, then HaasBot is one of the best bots to help you get started as it has many trading options. The bot was made with beginners in mind, as no coding knowledge is required to get the bot up and running. The bot requires a subscription, so there are some upfront costs to get started; however, it provides a hassle-free experience for the user and maybe something you want to consider if you are new to using bots.

Portfolio Automation Bots

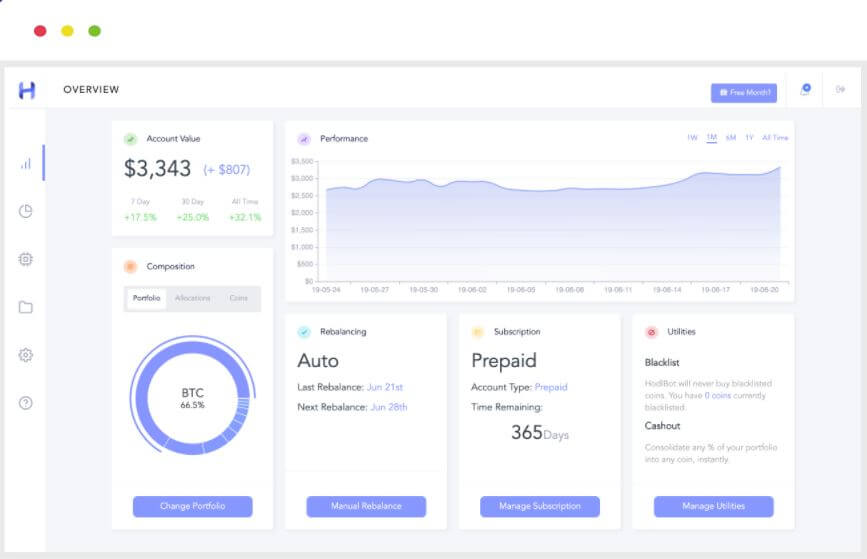

Portfolio bots help the user create and maintain a diverse portfolio.

If you are looking at building a portfolio, then Shrimpy or Hodlbot are probably the best options. The bot has a multitude of features that can help users build a strong portfolio with the goal of making long-term gains. Hodlbot is user-friendly, and they offer a free trial. After the trial, subscriptions start at just $3 per month, making it an affordable option for investors.

Technical Trading Bots

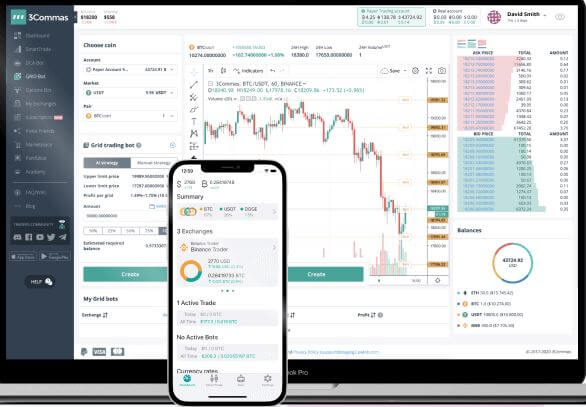

Technical trading bots are perhaps the most popular and widely-used bot. These bots use indicators and signals to predict price movements, allowing the user to automatically enter the market before a price increase. 3Commas is one of the most popular technical trading bots.

The bot is user-friendly and requires no coding knowledge; prices start at just $25 a month. The bot offers multiple trading strategies, all of which are based on technical analysis. If technical trading is your thing, then this bot is sure to make your life a lot easier.

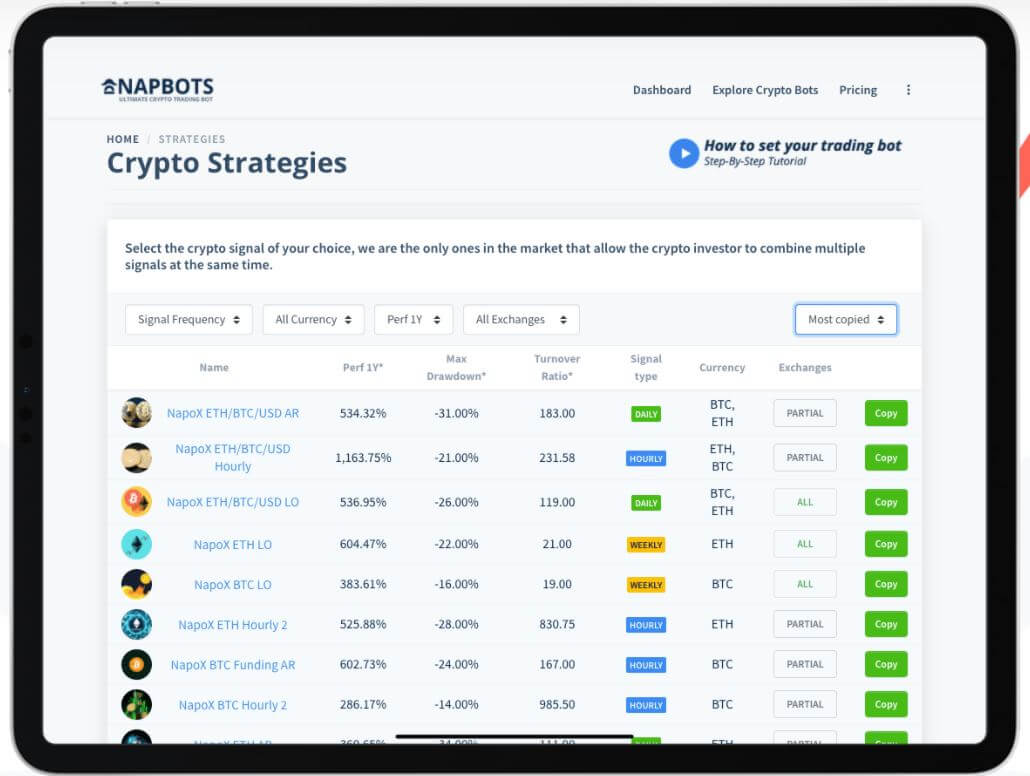

Automated Crypto Trading

These bots have been designed by investors with a lot of experience. They allow the user to trade like a pro in a hassle-free manner. Napbots is highly recommended and will automatically execute trades for you based on what strategy you are running.

The platform currently supports 15 strategies, suitable for any level of trader. All of the strategies on the platform have been tested thoroughly and work well. The platform is also extremely simple to use, making it a great option for beginners or advanced traders.

How do I pick the best crypto trading bot?

Choosing a bot will depend on what kind of trading interests you the most; there are a lot of options. Here are some things you should think about before choosing a bot.

How Trustworthy is The Software?

It’s important to do some research about any bot you are considering using, looking into the company that provides the software can give a good indication of how trustworthy the bot will be. Some questions you should consider are:

- How experienced in trading are the team offering the bot?

- Has the team ever maintained a strong trading portfolio?

- How much information is there online about the bot?

Is the bot suitable for my strategy?

Finding the best bot for your strategy is essential. Thoroughly research what the advantages of each bot are. It’s also important to make sure you will be able to work with the bot. Some trading systems will require some technical knowledge to get started, whereas others are user-friendly and can be used by someone of any skill level.

How Good is the Customer Support?

Check the bot’s website to see if they have reliable customer support. Also, check if there is an online community where other users can discuss their experiences with the bot. This way, if you have any trouble with running the bot, you will be able to get help from more experienced users.

Ease of Use

Even though bots can save you a lot of time in the long run, they are often tricky to get set up and running exactly how you want them to. The reality is that most trading bots can be incredibly complicated. Any beginners should focus on finding a bot with a friendly user interface before moving on to anything more complicated.

Conclusion

Cryptocurrency trading bots can be extremely useful tools that can help to generate a profit from your investments. These bots save the user a lot of time and hassle, giving them more time to focus on what they may invest in next. We recommend that everyone that is invested in cryptocurrency trading check out some bots and see how they can incorporate them into their trading setup. The only negative is that there is not currently an all-in-one package, and it could take some time to find a bot that is tailored for your individual needs.