What you'll learn 👉

What is Liquidity?

Liquidity in capital markets refers to the speed at which an investment can be exchanged without adversely affecting its valuation. Liquid assets are quickly sold at a fair market value or the current market price. Thus, assets with higher liquidity are sold at a premium. However, in cryptocurrencies, the term liquidity is defined as an ability of an asset to be easily converted into cash or coin. Liquidity is critical for all tradable properties, including cryptocurrencies.

Low liquidity levels indicate that market volatility is present, resulting in price fluctuations in cryptocurrencies. On the other hand, high liquidity suggests that the demand is steady, with little price swings. Furthermore, high liquidity is an optimal situation because it leads to improved pricing for all parties involved. A thriving economy with a high degree of trading operation provides a desirable market price to everyone. Plus, high liquidity facilitates technical analysis by providing precise charting and price information.

In a crypto market, several factors affect liquidity. One of the significant factors is the trading volume. A greater number of cryptocurrency exchanges allows more users to sell their coins, and the number of exchanges has increased in recent years. The increased frequency and volume of trade contribute to increased liquidity.

A common term that is highly used in crypto is “liquidity pool.” It is a fully automated pool and differs from the normal exchange, where a price is determined by a change in demand and transactions being recorded in an order book.

When a liquidity pool is created, the Liquidity provider sets an initial price. Plus, a liquidity pool always trades in pairs of tokens that are of equal value.

Cryptonomics: What Is Impermanent Loss?

Impermanent Loss occurs when an investor provides liquidity to a liquidity pool. The asset’s price varies from the time he/she deposited it—the more significant the difference, the greater the impermanent loss.

Loss means the difference in the dollar value between the time of deposit and withdrawal. It is usually observed in standard liquidity pools where the liquidity supplier (LP) must have all assets in the correct ratio. One of the assets is volatile compared to the other. For example, the price of ETH goes high. The sudden fluctuation in the price creates an irresistible opportunity for arbitrage because the cost of ETH in the liquidity pool now doesn’t reflect what’s going on in the real world.

👉 To ensure that the pool reflects the real-world prices and maintains the equilibrium, the pool must rely on arbitrageurs. The traders will buy the ETH at a discounted rate until the equilibrium is reestablished. The impermanent loss can be converted to a permanent loss if the liquidity provider decides to withdraw its liquidity for good. However, if the liquidity provider decides to stay within the ecosystem, there are chances that the assets will return to their original price.

The question to ask here is, How to mitigate the risk of impermanent loss? Providing liquidity for pairs where the relative price of each commodity stays consistent with the other in the pair is an easy way to minimize impermanent loss.

On the other hand, the downside is that providing liquidity with stablecoins is limited in terms of potential price increases, and the number of pools available is much fewer.

Other ways by which liquidity providers can mitigate impermanent loss are, Balancer and Hummingbot. Liquidity providers use Balancer to build custom ratios for assets within a pool, enabling users to gamble on which asset to outperform. LPs will then offset their risks if the economy swings in the direction they predicted.

The Hummingbot Miner is a specialized liquidity mining bot that allows users to automate liquidity mining on multiple Binance markets.

Liquidity Providing on PancakeSwap – step by step

After PancakeSwap opened its door, over $1billion in total value locked (TVL) has shifted to this platform. Launched on 20 September 2020, It uses an Automated Market Maker (AMM). It implies that liquidity pools are permissionless, fully automated, and run entirely through algorithms. Much like Uniswap DeFi AMM protocol running on Ethereum, Pancake Swap is a decentralized exchange built on Binance SmartChain, for swapping BEP-20 tokens.

It enables users to swap between cryptocurrency assets by tapping into user-generated liquidity pools. Those pools are filled with other users’ funds. They deposit them into the pool, receiving liquidity provider tokens in return. These tokens are used to reclaim their share, plus a portion of the trading fees. In short, a user can trade BEP-20 tokens or add liquidity and earn rewards.

Unlike Ethereum or Bitcoin, PancakeSwap is a blockchain with a lesser transaction cost.

- PancakeSwap charges a modest 0.2 percent trade rate, with 0.17 percent going to liquidity suppliers and the remaining 0.03 percent going to the PancakeSwap Treasury, which is burned to keep supply low.

- Before proceeding, it is essential to understand the difference between yield farming and adding liquidity. Providing liquidity means that users’ original asset amounts increase as the pool they’re in is used for exchange transactions. Yield farming implies that users deposit one set of tokens to mint another token altogether.

- The next question that arises is how to add liquidity on PancakeSwap?

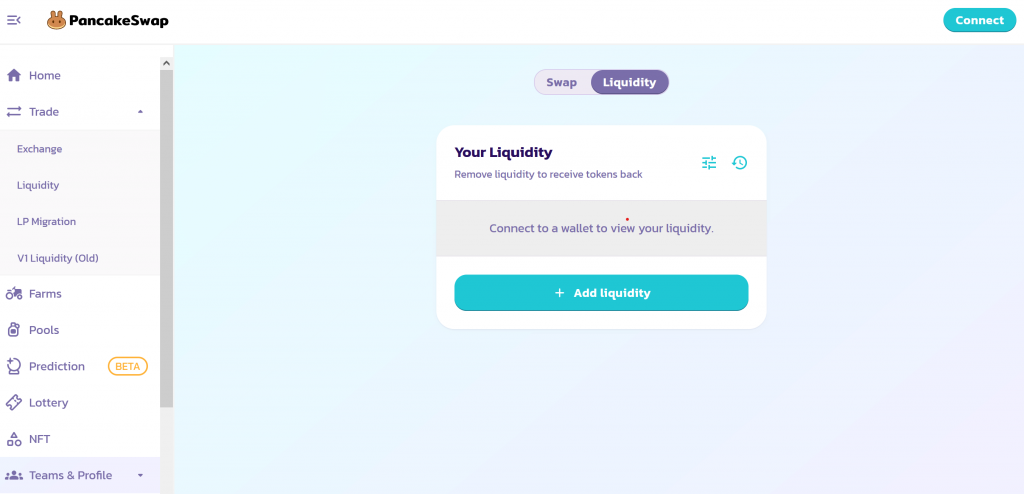

- The first step is to unlock and connect with the wallet.

- Then, go to the Liquidity tab and click the Add Liquidity option.

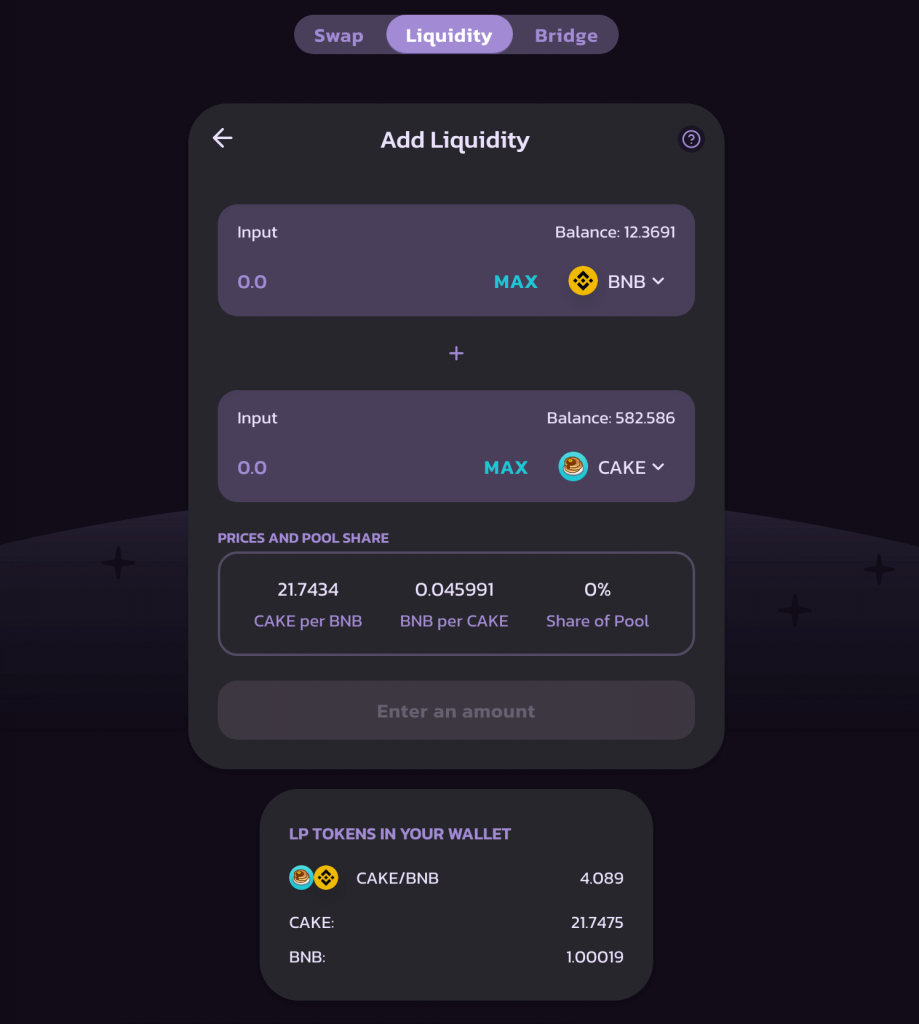

- The third step is to select your tokens (for example USDT and BNB) and enter the amount you want to add to the liquidity pool. But, one thing to ensure is that the pair of tokens is in an equal ratio of the value. This means that if a user is selecting token 1 for $10, token 2 should also be worth $10.

- Note, a user can provide liquidity in an existing pool or can create a new pool. Creating a new pool is an option that is mainly opted for by new projects looking for a debut in cryptocurrency tokens. However, regular users usually opt for depositing in existing liquidity pools.

- Once the user has selected a specified pair of tokens, deposit the amount and confirm the transaction.

- After completing the transaction, the user will receive a FLIP; an LP token represents a user’s stake in the pool. Furthermore, the user will be able to see their liquidity at the bottom of the page.

- The benefit of holding the FLIP LP token is that every time an exchange happens that taps into your pool’s liquidity, you receive a portion of the rewards. To claim those rewards, you simply redeem your FLIP tokens to unlock the underlying assets, which, by now, have grown in value.

- Once the liquidity is added to the account, the user can navigate the farm tab and choose an option that matches their LP tokens. One can witness several ways to yield their tokens.

- As of late February 2021, there are 69 different liquidity pools where you can stake and earn yields that range from 23.52% to 378.19% APY for supplying the pools with liquidity. Impermanent loss imposes a significant challenge to users; meanwhile, Pancakeswap users can prevent themselves from Impermanent loss by staking CAKE in a single asset pool.

- Unlike other liquidity pools that require that a liquidity provider supplies two assets at the same ratio, staking CAKE for many of the pools on PancakeSwap involves providing just a single token — Cake — which is the native token of PancakeSwap.

- Since the pool contains only one token, any divergence in the CAKE price would not result in an Impermanent Loss because there is no need to preserve equilibrium with any other token in the pool.

- Furthermore, regardless of the disparity between the price of CAKE at the time of staking and the cost of CAKE when a liquidity provider wishes to unstake, the liquidity provider receives the same amount of CAKE when he or she unstakes. This ensures that a liquidity supplier who stakes CAKE earns regular yields based on the annual percentage yield of the pool he or she picks and an upward movement in the market.

- And hence, it provides an opportunity to earn passive income without fear of Impermanent loss.

The PancakeSwap on the Binance Smart Chain is the largest and most widely used AMM for yield farming and staking. It has a daily trading volume of over $650 million, which is more than twice that of SushiSwap and almost as high as Uniswap (v2). To sum up the discussion, the biggest challenge liquidity miners face is Impermanent Loss. However, Pancakeswap is a secure and legit website that is receiving audits from a cyber-security firm Certik. It receives protection through Security Oracle, Certik Shield, DeepSEA, and the Certik Virtual Machine. Furthermore, it also supports a number of popular wallets like Trust Wallet, TokenPocket, WalletConnect, MathWallet, and MetaMask. Overall it’s clear that DeFi is continuing to grow, both on Ethereum and the BSC, and PancakeSwap is creating a name for itself as the place to come for yield farming.

Read also:

- Reddit Moons Explained – How Do You Get Moons & Are They Worth It?

- Crypto.com DeFi Wallet Review – Fees, Staking, Withdrawals Explained

- Crypto.com DeFi Swap review

- Best Cardano DeFi Projects

- Best Polkadot DeFi Projects

- Best DeFi Coins – DeFi Projects Worth Investing In

- Best Low Cap DeFi Coins – Best Upcoming DeFi Projects

- Best Crypto IDO Platforms (on ETH and BSC chains)

- Best Hardware Wallets for DeFi – Use DeFi Safely

- Best Defi Portfolio Trackers For ETH, BSC, Polygon

My account in the Pancakeswap platform mining pool has been locked unable for withdrawal