To cut a long story short – invest in a liquidity pool on their AMM-based DEX, while sitting back and collecting trading fees, and stacking the exchange’s proprietary tokens into the bargain. All this while your assets increase in value. Simple!

If that’s not clear, then let me break it down. First the back-story, then how it applies to Balancer. As the world progresses from centralized to decentralized financial services, one of the most visible examples is decentralized exchanges (DEXs).

Traditional centralized trading platforms need groups of market makers who provide liquidity for their exchanges. These are the people on the ‘other side’ of your trade, and there have long been shenanigans with them exploiting their position and power to manipulate markets. To become decentralized required the invention of the Automated Market Maker (AMM).

A decentralized exchange relies on this AMM algorithm to determine the price of each asset in a trading pair, removing the need for humans to be involved or paid. Apart from DEXs offering much better privacy, there’s no possibility of ‘moral hazard’ tempting greedy individuals to manipulate the market. This is DeFi at its most effective.

What you'll learn 👉

What Is Balancer?

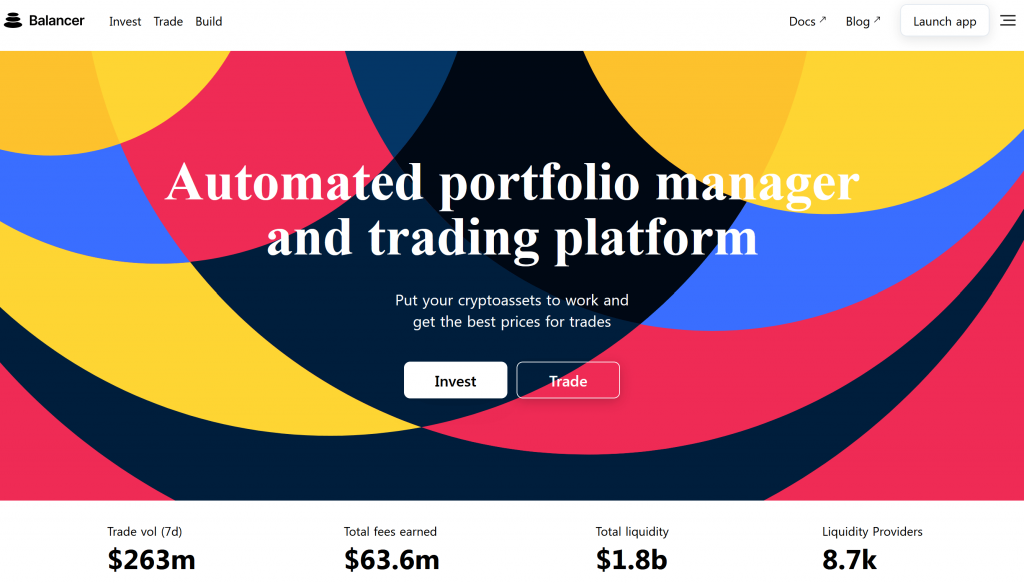

Balancer is a DeFi token swap/exchange/liquidity pool investment platform for ERC20 tokens, running on the Ethereum network. That’s a bit of a mouthful, but in other words, you can swap, invest, and earn tokens. The beauty is that you maintain custody of your assets, so you still benefit from any price increases while your tokens are locked up and working for you.

How Does Balancer Work?

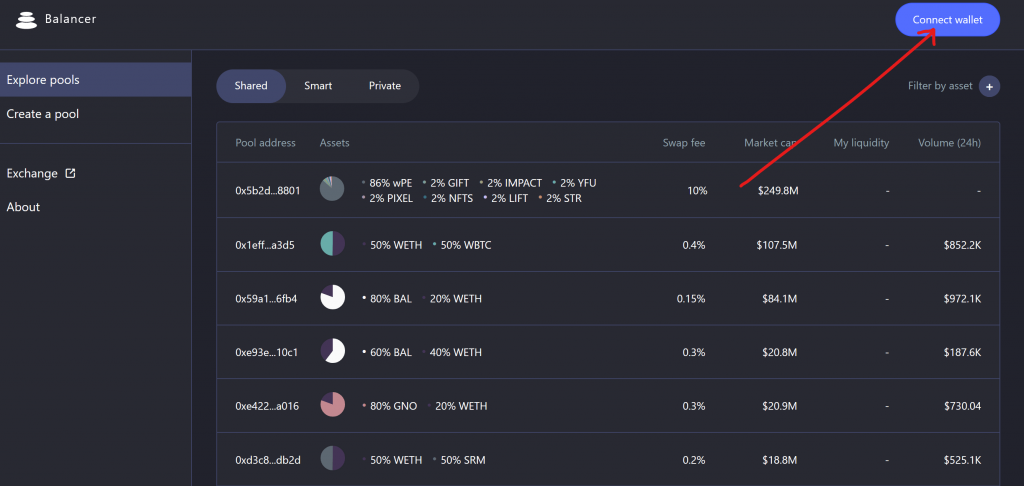

Visit Balancer and connect your DeFi wallet. Notice there is no signup or login, so none of your personal information is required. When you connect with an anonymous DeFi, Web3.0 wallet, the whole process will remain virtually untraceable.

DEX liquidity for token swaps/trading comes from, wait for it… Liquidity Pools! These are aggregations of tokens where investors can lock up their cryptocurrency in exchange for a share of the trading fees and other perks. The AMM algorithm, in its simplest form, will ensure that the overall value of a liquidity pool remains fixed, with the proportion of each asset fluctuating to compensate, as either token in the pair is bought and sold. The AMM algorithm invigilates the market, transparently, predictably, and honestly.

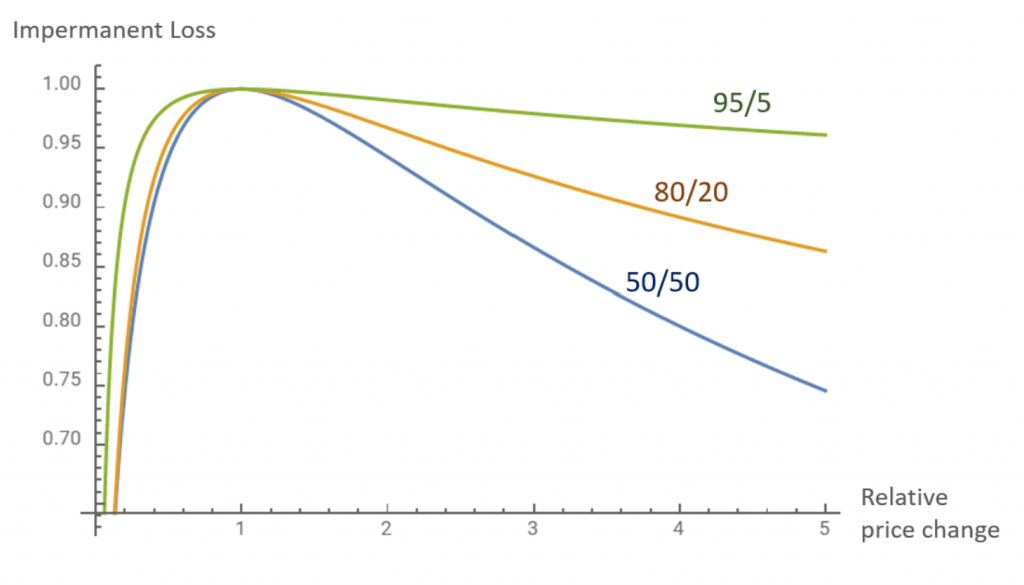

What’s the catch? The issue is supply and demand. If a large amount of either token in a smaller liquidity pool is massively oversold, the AMM algorithm will still attempt to keep the overall value of the pool constant. This is known as ‘slippage’ and can cause one of the pair to increase in value and the other to fall, much more than the wider market value. This causes dreaded ‘Impermanent Loss,’ more of which later.

How to Add Liquidity to Balancer and Earn Bal Tokens

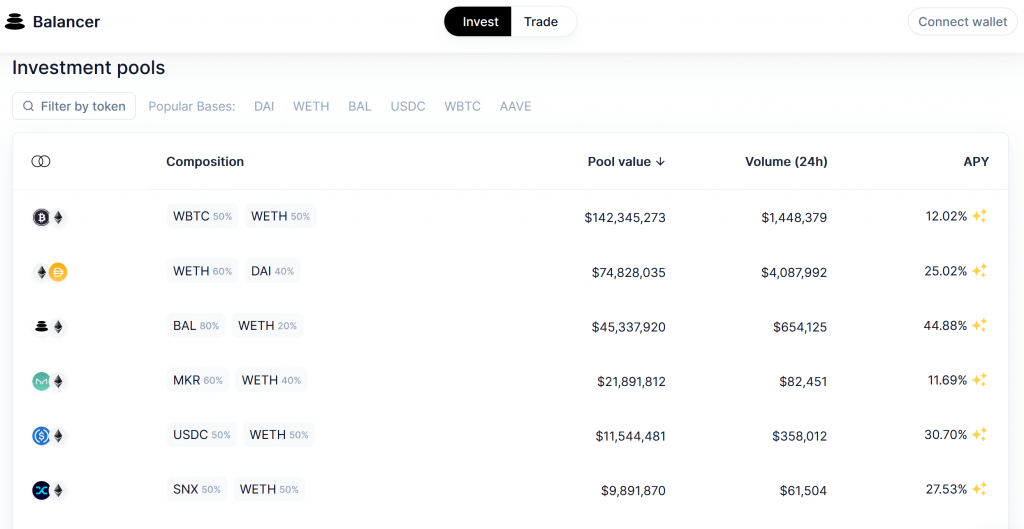

Given what we learned in the previous section, the process should be relatively understandable. Connect your DeFi wallet before choose a trading pair. You may need to swap your current tokens for the desired pair by using the swap function on the Balancer exchange page.

The slippage is displayed, so you see can how much your transaction is affecting the price. For all the major pairs, it was more than a million bucks before there was any significant impact on price. If that’s a problem, then I envy you. You can also stipulate a maximum slippage value for your swaps.

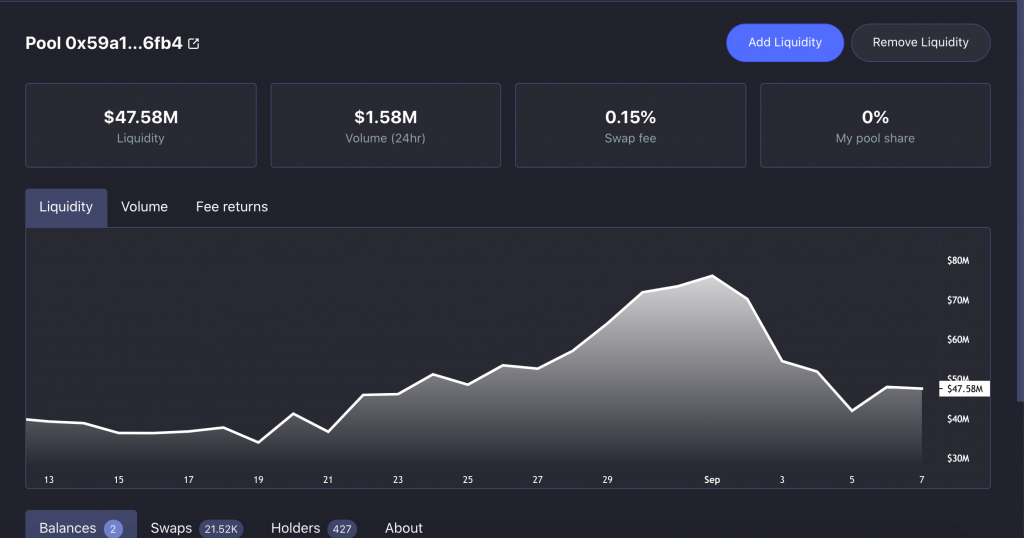

Once you hold the relevant tokens, you can commit them to a liquidity pool. From this point on you will receive a portion of the trading fees and also some BAL tokens. There is a dizzying range of pools, so some research is required. In general, the larger the pool, the less slippage, and therefore the lower the risk of ‘impermanent loss.’

How to Use Balancer with Different DeFi Wallets

If you are going ‘Decentralized’, you’ll be using a DeFi, Web3.0 wallet to manage your crypto tokens. Balancer has several options, and the process is similar for using all their supported DeFi wallets.

When you click ‘Connect’ on their liquidity pool investing page, you have 5 wallet options – MetaMask, WalletConnect, Portis, Coinbase, and Fortmatic. Curiously, MetaMask is not an option from the exchange page.

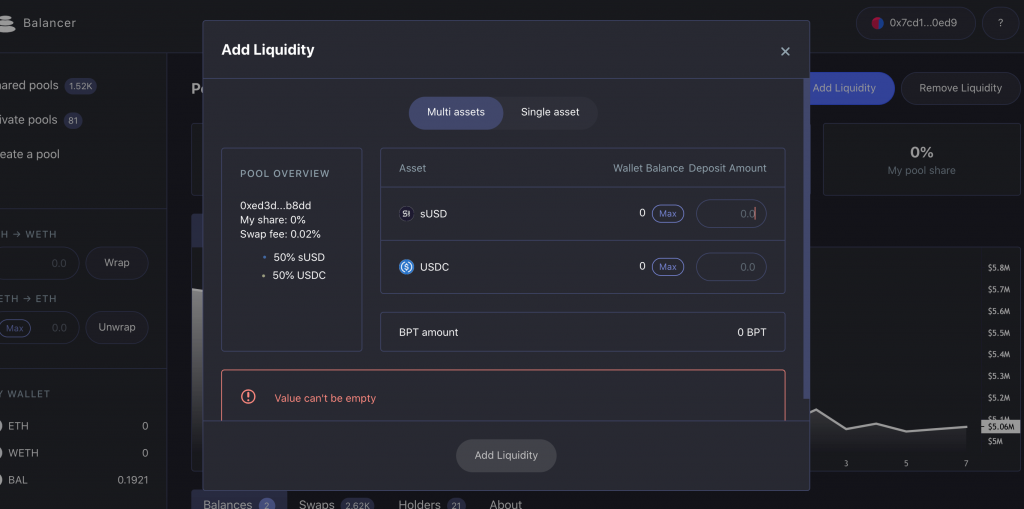

To invest in a liquidity pool (add liquidity), click on your preferred wallet. You will be asked to connect your wallet, and at each stage of the process, you’ll need to confirm the action from your wallet application.

For example, Balancer will ask you to unlock the required tokens to invest in a liquidity pool, prompting a confirmation request on your wallet. Once you have selected the tokens and the amount of each, you click ‘Add Liquidity.’ Again, you’ll be asked to confirm the transaction from your app.

Once the transaction is complete you’ll receive a confirmation on your wallet app. On the Balancer webpage, you’ll now see your percentage stake, the trading fees you will earn, and all the relevant stats for the pool. You can withdraw your liquidity at any time.

Read also:

- Reddit Moons Explained – How Do You Get Moons & Are They Worth It?

- What is Arbitrum Layer?

- Crypto.com DeFi Wallet Review – Fees, Staking, Withdrawals Explained

- Crypto.com DeFi Swap review

- How To Move ETH From Ethereum to Polygon – ETH To Polygon Bridges

- How To Make Emergency Withdrawal On Polygon (MATIC)

- Top 5 DEX on Polygon (MATIC) Network

- Best DeFi Bridges: Move Assets from ETH to BSC, Polygon & Vice Versa

- How To Buy DeFi – Is Investing in DeFi Coins Worth It?

- Best Hardware Wallets for DeFi – Use DeFi Safely

- Best Defi Portfolio Trackers For ETH, BSC, Polygon

Balancer and Impermanent Loss

Here’s the rub. They call it ‘Impermanent Loss’ but don’t be fooled. It’s pretty permanent if you take your tokens out of a liquidity pool at the wrong moment. One token has to increase in proportion and the other(s) decrease to balance the pool.

This equates to a ‘lost opportunity cost,’ as your dollar value will be the same but the number of tokens will be decreased. Balancer’s AMM algorithm has a partial solution to the slippage problem.

In a typical (Uniswap/Curve) liquidity pool, an AMM will actively buy some tokens and sell others to balance the pool. This incurs trading fees. The Balancer AMM leaves this to the market and only collects the fees.

Should a serious imbalance develop within a liquidity pool, there will be an arbitrage opportunity elsewhere in the market. Traders will scoop up the undervalued token and sell it on at a profit. This will both restore the balance of the pool and generate trading fees for the investors.

In theory, any losses from slippage should actually be impermanent. It’s a beautiful example of genuine free market forces at work, all predefined and transparent.

FAQ

How to Add Liquidity to Balancer Pools Via Zapper.fi

You can Zap-in and Zap-out of liquidity pools. Zapper.fi’s unique selling point is to manage all of your DeFi and Yield Farming action on one platform. The clever part is that for the same trading pair, Balancer and Uniswap might require a different proportion of each token. Zapper.fi will calculate this and balance your liquidity pool investments.

At the time of writing, GAS fees for ETH transactions are prohibitively expensive. The Balancer community voted to donate 30,000 BAL to reimburse GAS fees until they become more reasonable – but only for transactions made on the Balancer platform. Zapper.fi originated transactions do not qualify for the GAS reimbursement.

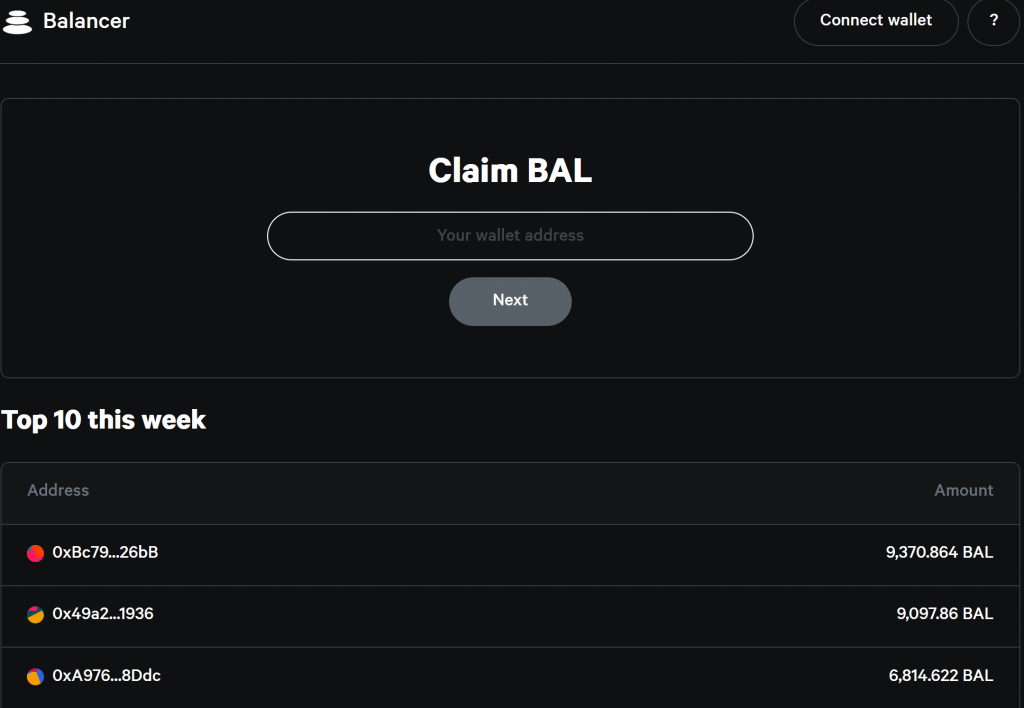

How to Make Bank With Balancer Liquidity Mining

The ways you profit from adding liquidity on Balancer are the fees and the BAL token rewards. There are some things to consider to make the best returns.

- Highly imbalanced pools receive the lowest BAL rewards.

- Pools featuring BAL tokens receive a 50% bonus on all BAL rewards.

- The lower the swap fees, the higher the BAL rewards.

- Pools containing only stable coins make the lowest BAL rewards but have almost no slippage risk. Hard pegged stable coins make the least, with soft-pegged stable coins doing much better.

So, a well-balanced pool with low swap fees, featuring BAL token as one of the assets, is the way to get the best yield from Balancer.