What you'll learn 👉

What is an IDO?

IDO stands for Initial DEX Offering; it is a token that represents an asset hosted on a decentralized exchange (DEX) for crowdfunding purposes. When a new project launches on a decentralized exchange in the form of a coin or a token, it is referred to as an IDO and is a means of crowdfunding the project.

Projects need money in order to come to fruition within a reasonable timeframe, otherwise, it could take so long that the problem they are trying to solve becomes either irrelevant or solved by another party. So, once the planning stage is over, they proceed to the funding stage.

Traditionally, funding, in general, has taken place privately, and it wasn’t until the rise of the internet that everyday people had such an opportunity to invest in and contribute to promising projects, as time went on, this accessibility to such opportunities grew through decentralization, eventually leading to concepts like the IDO.

This is how they work

When a crypto project is ready to receive funding to begin development, they launch their coin or token as an IDO. Here, on a decentralized exchange, traders can buy these tokens and trade them in an environment where liquidity pools and quick trades are available. This helps fund the project, and people of all backgrounds can participate due to its decentralized nature.

On the other end, as the project starts achieving results, the implications of their success could increase the value of these coins or tokens, which translates to profits for early contributors. This level of mutual benefit incentivizes both parties to participate in IDOs, and if all goes according to plan, everyone walks out with a win.

How large are ROIs?

IEO ROIs are, on average, much larger than that of IDOs, most likely due to their larger audiences. IDOs are still relatively new and therefore are not as big or common as their counterparts.

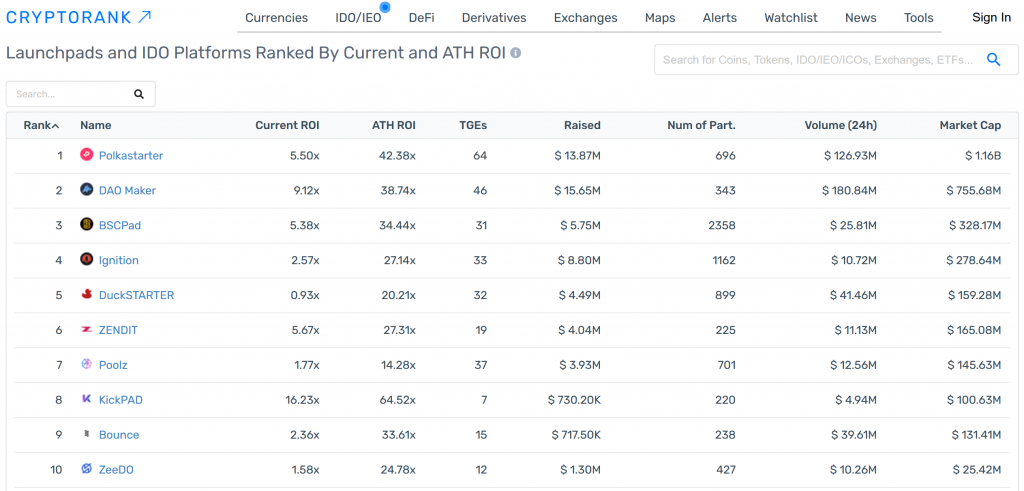

Here we see the ROIs for IEOs, and we can contrast them to this chart that presents the ROIs of IDOs.

As of writing, IDOs on average enjoyed a 484% average ROI and an all-time high average of 3861%, IEOs on the other hand enjoyed an 847% average ROI and an all-time high average of 2440%.

Although much smaller, IDOs still witness an impressive ROI of over 400%, and an average all-time high that surpasses that of IEOs.

Advantages of IDOs

IDOs are decentralized, and as a result, offer a variety of advantages:

- Lower fees than centralized exchanges

- Freedom of listing on multiple exchanges

- No required permissions for listings

- No restrictions imposed by a centralized exchange

- Immediate access to liquidity via liquidity pools

- Instantaneous trading

- Multi-wallet support

A lot of these advantages are the result of less control, which is the defining feature of decentralization. Regulations can lead to higher costs and more restrictions, which aren’t inherently bad but may lead to a level of inefficiency that may not be optimal enough for some projects to get the funding they need.

Similarly, small investors appreciate thin barriers of entry that allow them to get in on a project from very early stages. The additional freedoms that they have on decentralized exchanges are as useful to them as they are to the projects.

Disadvantages of IDOs

Decentralization isn’t perfect however and can present some difficulties like:

- A lack of control mechanism

- A narrower target audience and a smaller reach

- Proneness to scams and price manipulation

Navigating through these difficulties can be challenging for beginners of cryptocurrency, as it takes a while to learn how to identify legitimate projects from scams, and to spot weaknesses and shortcomings of different exchanges.

Due to these factors, centralized exchanges remain the platforms with the bigger audience, which is a very important aspect of crowdfunding. This leads to projects having to weigh their options carefully to figure out what their best course of action is.

The Whitelist

Whitelisting refers to a phase where potential investors who are interested in a project are offered to participate, provided they meet the specific requirements. Upon doing so, they can find themselves on the whitelist, which assures them they will be able to take part in the upcoming IDO.

Different platforms have different requirements for their whitelist; some might require nothing more than KYC documents (Identification cards, place of residence… Etc), whereas others might have a list of criteria that need to be met.

In general, the more decentralized a platform is, the fewer requirements it has for whitelisting. Usually, on top of KYC, they might require users to stake their native tokens to a certain degree, but the more requirements they have, the more centralized they become. There is a trade-off, however, as sometimes in return for higher requirements, exchanges may offer better services of a wider variety that could set them apart from their competitors.

Picking the best opportunities and platforms

Determining the target audience

In order to seize the best opportunity to launch an IDO, prior to locating a platform, the project must first understand what they are offering and whom they are offering to. Knowing your target audience is crucial, not just for choosing a platform, but for the overall success of the IDO.

The wider your target audience is, the easier the funding will be, and it can also give you an idea of how wide or niche your project is, and how applicable, and by extension, successful, it could be in a real-world scenario. This is not to say that niche projects can’t be successful, but the extent definitely varies.

Understanding their preferred platform

Once the project has determined its target audience and has ensured the IDO will appeal to them, they can now begin the process of looking for a suitable platform. In order to do this, they must understand what their audience would look for in one.

This is where they need to look at the platform from the lens of the investor and evaluate it based on what it offers to the trader. These can range from practical features like trading fees, available liquidity pools, whitelisting requirements, and so on, to the vision of the exchange and how it aligns with that of your target audience.

Picking the best IDO platforms for Crypto

Choosing a platform requires paying attention to which blockchain the project chooses to support their IDO on, otherwise, they might not be able to offer a good trading experience to their audience. Additionally, one should examine a platform’s statistics, reputation, and history before making a decision, as the last thing they’d want is to have a terrible launch on a shady exchange.

The kind of exchange a project chooses can affect their image, which affects how their target audience may perceive them. Conversely, the kind of project an exchange accepts affects the image of the platform, which leads to an interesting cycle that temps platforms to adopt some level of control in exchange for better security.

Final checkups

The final step ahead is ensuring the project is secure and works as advertised, this process involves independent reviews and auditing to ensure everything is smooth for sailing.

When unexpected errors appear down the line, if serious enough, they could shake the confidence of supporters. Unfortunately, there exist a lot of media that sensationalize news and events, who could take these opportunities and portray them in an exaggerated tone to garner reactions. Among these media, groups could exist biased people who are invested in different projects, who see it in their best interest to portray competing projects in a negative light.

To prevent unnecessary paranoia and panic from spreading in the crypto community, it is necessary to make sure that everything is done orderly and as properly as possible. This may come at a cost, but it can be considered as an investment in security and stability.

IDO platforms as an investment

For investment purposes, thorough research into the project is highly emphasized, for as credible as an IDO may sound, the difference between an ambitious project and a scam lies in the details. Because there is no centralized authority that can guarantee projects with malicious intent don’t end up on their platform, caution must be exercised before making a serious investment in a decentralized environment.

On the flip side of that coin, projects must exercise caution as well, because although they are relatively safer than the investor, their tokens or coins may be vulnerable to price manipulation if certain precautions aren’t in place.

The point is negative experiences originating from the platform can send ripples that reach the investor first, and eventually, the project.

Polkastarter (POLS)

Perhaps one of the most popular platforms for IDOs, Polkastarter is fueled by two primary elements: decentralization and interoperability.

The former allows for permissionless listings, and smooth access to useful features like smart contract token swaps, private pools, and whitelisting.

The latter enables and fascilitates cross-chain swaps which results in faster and cheaper transactions while staying connected to the Ethereum network and other blockchains for liquidity, and is all powered by the Polkadot ecosystem.

DxSale (SALE)

DxSale is a decentralized crypto-asset ecosystem that currently utilizes Ethereum, Binance Smart Chain, and Polygon for its IDO platform: DxLaunch.

DxLaunch allows any coin to be instantly listed on their platform, which is generated with ERC20 standards. DxLaunch can be found in the DxSale App, along with DxMint and DxLock.

DxMint allows anyone to create tokens without any coding experience, and DxLock can be used to lock for liquidity or token locking.

TrustSwap

With a focus on security and protection, TrustSwap offers its launchpad with a variety of services aimed to ensure a safe and successful launch.

IDOs from all chains can have access to marketing tools, expert consultation and crypto influencers, as well as technical and operational support. On top of a full package, coming soon are features such as SmartMint (cryptocurrency creation) and Swappable (P2P swaps and NFTs).

PaidNetwork

Utilizing their PAID token, PAIDNetwork offers its PAID Ignition Launchpad for new and upcoming projects. Within this ecosystem there exist all the basic features to ensure a smooth funding and trading process.

The PAID token can be used for purchasing agreements, paying subscription service fees, staking for rewards, lending, insurance, voting, and more.

The Launchpad is where users can find, read about and participate in the funding of the latest projects.

BSCPad

BSCPad is the first decentralized IDO platform for the Binance Smart Chain network, with a mission of empowering cryptocurrency projects with the ability to distribute tokens and raise liquidity.

It tries to reduce the barrier of entry for investors with a fixed tier system, all of which are guaranteed an allocation spot; this is done to promote fairness and eliminate luck, lotteries and bots.

There are currently six tiers, the lowest of which, the bronze tier, has a staking requirement of 1000 native tokens.

To Summarize

IDOs are a great way for new projects to come to life without having to go through lengthy, costly, and uncertain processes while enjoying freedoms that centralized exchanges don’t offer. Although its future looks bright, it is still a relatively new concept that has some room for improvement.

It has positive implications for the crypto space as it gives a chance for small projects to take off and small investors the chance to become a part of that process. But on the other hand, new investors may be at the risk of investing in scams that could leave them with worthless tokens.

Although IDOs enjoy relatively high ROIs, they’re not exposed to as wide an audience as other fundraising models such as IEOs, so there’s still a significant amount of untapped potential that could make IDOs the go-to model.

Until then, centralized exchanges remain the biggest channels to a mass audience, and not necessarily without good reason. Control and regulation lead to better security and accountability, and these benefits matter to a lot of people. It is not a competition, however, but a matter of options, which are necessary for innovation.

References & Resources:

2- Academy.binance.com/whitelist

3- Coinmarketcap.com/ido-guide

4- Cryptorank.io/ieo-platforms-roi

5- Cryptorank.io/ido-platforms-roi

7- Dxsale.app

10- Bscpad.com