NFTs or Non-Fungible Tokens are specific cryptographic tokens that cannot be replicated. In 2021, we saw a real boom in the NFT market, and interest in them continues in 2022. Many NFT projects such as CryptoPunks and Bored Apes Yacht Club have driven the crypto community crazy and further increased interest in digital art and games.

But what makes a particular NFT different from others like it? What is it that gives a certain NFT a higher value than other NFTs? Continue reading this article, and you will learn everything you need to know how to assess the price of some NTF. So, let’s get started.

What you'll learn 👉

What are the major metrics in assessing NFTs?

Today, you can find thousands of different NFT projects on the market, with new NFT projects being minted every day. And in that sea of NFTs, how to assess which of them is worth more, whose value and demand will increase in the future? There are several ways to assess NFTs, and currently, the most popular method is by using 6 major metrics.

Estimated market cap

Estimated market cap is the first metric to assess an NFT.

Unlike cryptocurrencies (fungible tokens), the NFT market has much less liquidity. A high estimated market cap means more NFTs owners and greater chance buyers will be willing to pay more money to acquire a piece of the NFT collection. And how to calculate the estimated market cap? Easy. All you have to do is multiply the total supply of that NFT project by its 7-day average price.

Diamond hand balance

The second metric is the Diamond hand balance.

This is a valuable metric for picking NFT projects with true long-term believers. Diamond hand balance represents the number of original owners who haven’t sold their NFT collection.

Number of unique holders

The number of unique holders is the third metric.

Knowing the number of unique holders helps us create an image of the community that is in a particular NFT project. A larger community attracts more word-of-mouth. And this, without a doubt, helps the NFT project reach more potential buyers.

Volume traded

The fourth metric is the volume traded.

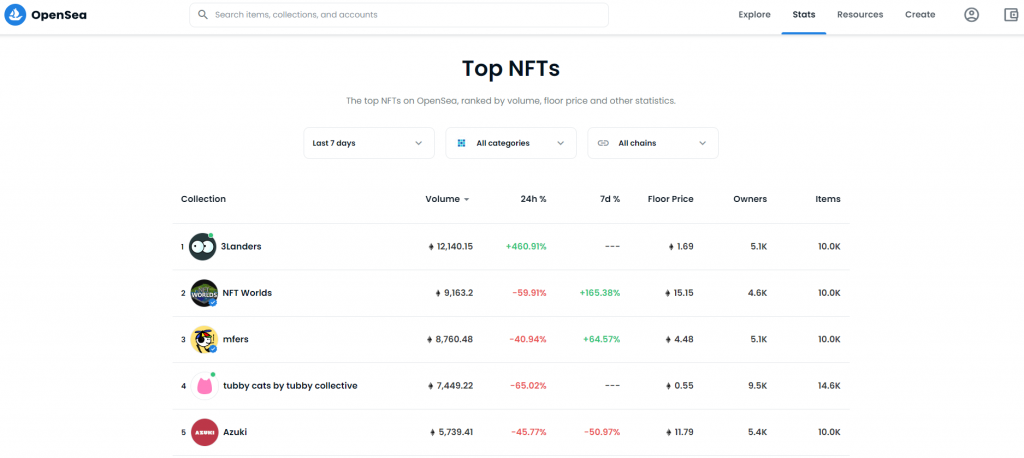

Simply put, the volume traded shows the overall demand for the NFT collection. You can see the top NFTs ranked by volume traded, floor price, owners, items in the collection, and other statistics by clicking here.

Rarity

The rarity, or uniqueness, is the fifth metric on this list.

This is probably the most useful metric. Some NFTs represent tokenized real-world assets, while others are created by renowned artists. Authenticity and ownership of NFTs can be verified by anyone anytime, and all NFTs are unique (one-of-a-kind). They can be bought, sold, traded, or gifted, but they can never be altered. Rare, scarce, in-demand NFTs attract more buyers than other NFTs.

A platform like rarity.tools can help you to get a better view of how rare some NFT really is. Taking into account characteristics like the popularity, volume, 7-day average price, and owner count of NFT, rarity.tools will quickly estimate the rarity of NFT you want to buy.

Floor price

Last but not least, the sixth metric on this list is Floor price.

The floor price of NFTs is another useful metric. The floor price represents the smallest amount of money you can spend to become an owner of an NFT in a specific project (a member of a project). The individuals who own an NFT within a project set up floor prices. The higher the floor price, the more valuable the whole collection is.

What is a price floor of an NFT?

As we said above, the floor price is the smallest amount of money you can spend to become an owner of an NFT in a specific project. Let’s clarify this with an example. Bored Ape Yacht Club is one of the most famous projects in the business. The floor price in this project, at the time of writing, is 98 ETH. This means that if you want to buy Bored Ape, you can do so for 98 Ethereum. This is the cheapest option if you’re going to get in on the project.

We also said that floor price is dictated by the individuals involved in the project. If one of the owners of NFT wants to sell his Bored Ape for, let’s say, 50 ETH, then 50 ETH becomes the new floor price.

Read also:

- Best P2E Games on Polygon

- Best P2E Games on Solana

- Binance NFT Marketplace Review

- Best NFT Projects To Invest in 2022

- Tezos NFT Platforms

- How To Find a Good NFT Project To Buy EARLY

- Best Metaverse Projects To Invest In

- Best Apps To Create NFTs (on Desktop, iOS and Android)

Why is the concept of ‘Price Floor’ important for NFTs?

Since the term flour price is taken from economics, it has a similar meaning in the crypto sphere. The weakest link in a certain system, in our case an individual in an NFT project, can, by reducing the price of his NFT, i.e., by lowering the flour price, influence others to lower their prices in order to sell their NFTs.

Reducing flour prices and the willingness of NFTs owners to sell their NFTs for lower prices may be a sign of a decrease in faith in a particular project by its members. And that can make potential new buyers think about whether they want to buy a certain NFT from that collection since its current members want to leave the project.

On the other hand, the increase in flour price means that the project members believe in it and are unwilling to give up their NFT cheaply. This makes these NFTs rare and scarce, which mostly means rising prices.

What is the Floor Cap?

The term Floor Cap is similar to the term Estimated Market Cap. However, unlike Estimated Market Cap, where the calculation is done by multiplying the total supply of that NFT project by its 7-day average price, the Floor Cap calculation is done a little differently. When calculating the Floor Cap, instead of the 7-day average price, the flour price is taken and multiplied by the total supply of the NFT project.

Where to find a good Floor Price NFT tracker

If you want to check the Floor Price of a particular NFT project, we suggest you do it on the following NFT trackers:

Can a price be below collection Floor Price on OpenSea?

It can. OpenSea works similar to eBay, which means the buyer has the option to make an offer at any price, including a price lower than the floor price. However, it’s unlikely that the owner of the NFT will accept the offer.