“They’ve really lost their minds this time,” was the response from my mom after my first attempt to explain NFTs. We got there eventually, and the ‘Crypto Grandma’ is now convinced that NFTs not only could exist, but that we’d have to invent them if they didn’t exist. She even bought some ETH last week.

The problem was trying to justify spending a record US$69.3 million on the digital image, “Everydays: the First 5,000 Days,” by artist Mike ‘Beeple’ Winklemann – especially when she realized that the purchaser didn’t own the art, merely the NFT. The solution was to explain use cases and to identify traditional analog equivalents of NFTs.

So here it goes!

What you'll learn 👉

What are NFTs?

A Non Fungible Token is a unique crypto-asset associated with an item of value. NFTs guarantee several things – proof of NFT ownership, authenticity, scarcity, and provenance. These are all immutably baked into the coding of a smart contract, sitting on a decentralized blockchain.

The only esoteric part is ‘ownership,’ and here’s why.

You may own the NFT, but you don’t own the underlying asset. That’s right! Unless otherwise coded into the smart contract, you own neither the object itself nor the associated intellectual property rights. Depending on the underlying object, this can get weird very quickly.

Well-publicized recent cases of apparent weirdness include –

- A “Moment” of Lebron James’ genius selling for $210,000. You can watch this video clip here for free. The owner is contractually forbidden from making commercial use of the video clip.

- This lovable CryptoKitty called Dragon is on sale for a mere 600ETH (about $1.2 million). The owner is contractually restricted to monetizing the underlying CryptoKitty for no more than $100,000 per year.

Sounds crazy? Well try this. Ownership is fundamental to our society and culture. To a visiting alien, our generally accepted human norms of ownership must seem equally “Illogical, Captain!” I expect a curious Vulcan might wonder –

- Why is the original Mona Lisa worth a billion times more than a practically perfect copy?

- Why do people spend ten times more on their sneakers just because they’re authentic?

- Why did I buy original music albums rather than make perfect digital copies?

- Why do book collectors pay fortunes for first editions?

There are lots of reasons to own valuable and unique things. Some objects are useful or just nice to own. Some of them are an investment, and others are status symbols. When the same socially constructed ownership conventions are applied to digital assets, it naturally throws up new and interesting circumstances.

The fundamental reason for this is that, unlike physical objects, we cannot move digital objects from one place to another. We can only copy them at one location, paste them to another, and (maybe) delete the original. This makes the very nature of their existence fundamentally different from physical objects. Herein lies the essence of the double-spend problem which blockchain set out to solve.

Naturally, when our old-world social norms and accepted ownership conventions collide with the new digital world, there will be anomalies. Interestingly, it’s generally Boomers and Gen X’ers that struggle with NFTs. Millennials and Zoomers get it straight away.

For those that grew up in virtual environments like World of Warcraft, Call of Duty, PUBG, and Fortnite, owning a digital in-game weapon has real meaning. It’s valuable and has utility. It takes time and effort or money to acquire, and it can have a real-world cash value.

If it all still seems like a scam, then you need to sit back and embrace the weirdness. Check out the examples below and it might start to make more sense.

7 NFT Projects You Need to Know About

SuperRare

SuperRare is a commercial gallery for digital artists. At this early stage, you must be selected by the owners to show your work in their virtual space. In the future, they plan to open the platform up to more artists.

The process works like this. An artist will supply and authenticate a single edition digital art piece. This will be verified and tokenized on the Ethereum network by minting an NFT. A collector will buy the NFT either for the reserve price or a winning bid at auction. Ownership of the NFT will then be transferred to the collector in exchange for the agreed quantity of cryptocurrency.

As a collector, you can display your art collection and resell pieces in the SuperRare marketplace. Substantial amounts of ETH are changing hands, enriching artists and canny collectors, not predatory gallery owners and artist’s agents.

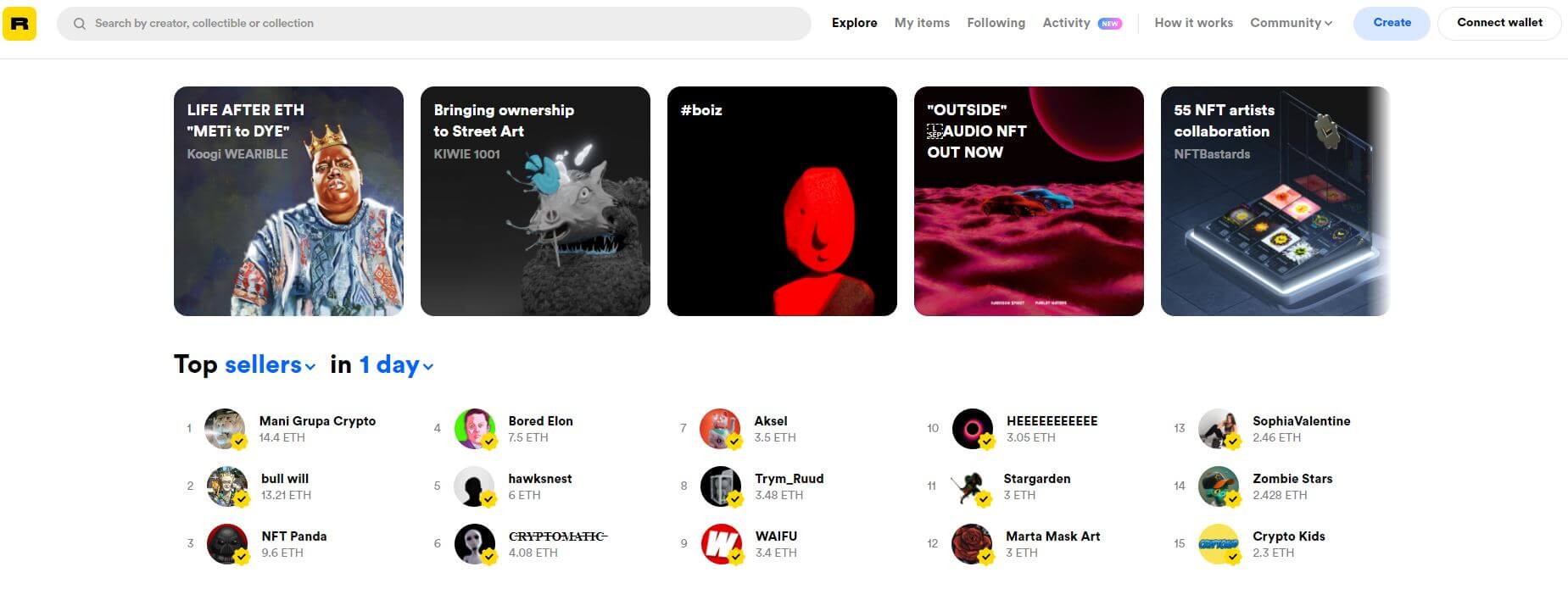

Rarible

One of the market leaders, Rarible is another platform for artists to sell their digital creations by minting NFTs and displaying their work on the website. Gallery and agent fees are notoriously high in the traditional art market, with new artists typically receiving less than 50% of revenue from sales. The decentralized approach of Rarible evens the playing field by enabling art sales with no middleman.

Rarible is built on the Ethereum network using ERC-721 tokens, more of which later. These layer 2 tokens can encode various contractual obligations associated with the artwork, beyond provenance and ownership. For example, the artist can stipulate a royalty payment whenever the NFT is sold on. Extra content and access to further work can be unlocked once the NFT has been transferred.

I recommend taking a look at the website just to see the amazing art on show.

CryptoPunks

I regard this entire project as both a digital artwork and a powerful ideological statement about the nature of ownership itself. 10,000 unique characters were created by Larvalabs’ John Watkinson and Matt Hall. Initially given away to Ethereum wallet holders in 2017, they have become collectibles and now sell for thousands of dollars.

CryptoPunks are 24 x 24-pixel images of algorithmically generated punky-looking characters, with various common features such as sunglasses, hats, pipes, and beards. The rarer versions have alien, zombie, and ape-like traits, and are much more sought after.

That’s all fine, but the real significance of Cryptopunks is their place in history. Larvalabs were instrumental in developing the concept of ERC-721 tokens and popularizing NFTs in general. “From humble acorns, great oaks grow,” and for sure these funky little avatars are not the killer app of NFTs. They are the conceptual saplings from which the DeFi forest will emerge.

Aavegotchi

Pixelcraft Studios based in Singapore, have gamified decentralized NFTs. Aavegotchis are described as unique digital ghosts that haunt the Ethereum blockchain. Cute as they may be, there is a deeper technological breakthrough going on here.

Each Aavegotchi ERC-721 token is associated with an ERC-20 token which generates a yield in A-tokens from the Aave lending pool. You can further accessorize your Aavegotchi using ERC-998 Composables, which generates and manages a ‘child NFT.’

The important innovation here is that there exist many layers of tokens used for various functionalities, depending on the structure of the project at hand. The technology is based on the Ethereum network, but by employing layers, the Ethereum network should never be overwhelmed as it was with CryptoKitties.

Gods Unchained

Presented as a trading card game, Gods Unchained is another project with much deeper significance than a mere card game. The key here is their statement, “If you can’t sell your items, then you don’t own them.”

You maintain custody and control of your virtual cards and can trade them on the open market, realizing the profit yourself in actual money. The whole decentralized process is managed by layer 2 tokens on the Ethereum blockchain.

The concept of P2E (Play to Earn) is interesting in itself. You earn cards by playing the game to build up your perfect deck. As you develop your deck, you may want to replace redundant cards according to your evolving strategy. This is where the marketplace comes in.

Yes, it might be fun to play the game, but the point of Gods Unchained is to empower and enrich the game players, not the gaming company’s shareholders. This is a recurring trope of NFTs and DeFi – to remove the parasitic middlemen siphoning off the value created by others.

Decentraland

Decentraland has created an entire decentralized virtual world with land ownership rights, voting rights, and guaranteed autonomy. You can buy plots of virtual land, develop them how you like, visit other people’s environments, and trade your possessions on the open market.

Inhabitants create games, art-spaces, and applications within this virtual environment, all supported by NFTs on the Ethereum blockchain. It looks really cool, but again there is a deeper philosophical aspect to Decentraland.

Their DAO (Decentralized Autonomous Organization) enables a form of democracy, with users voting on important issues such as land rights, auctions, protocols, fees, servers, and security council membership. Is this tamper-proof polling system a model of how our voting rights might be implemented in the future?

If it’s configured for one member, one vote it might be. However, if voting rights are assigned based on the value of your assets, then this would be a terrible retrograde step for humanity. It would emulate the undemocratic corporate governance model that DeFi and NFTs aim to replace; where the rich can buy more influence than the poor. We shall see how this decentralized democracy evolves.

Ethereum Name Services

And finally, a use case we can all understand, ENS (Ethereum Name Services).

You mint an ERC-721 NFT on the Ethereum blockchain, inside which is embedded your chosen domain name, EG, CyptoGrandma.eth. But why would anyone want to do that? Well, you can attach crypto wallet addresses to the name, so no more protracted public keys to worry about for your customers. But there’s much more to it than that.

You can also associate decentralized websites, subdomains, and even encode a personal profile into your NFT. It’s all decentralized, so you need only supply the information you wish to make public. ENS is privacy-focused so it integrates well with the TOR network and gives you complete control of your data, free from interference – guaranteed.

A practical use for NFTs at last, but there are more. Concert tickets could be minted as NFTs, forbidding resale. This would cut out the touts, the ticket agents, and the other 10 percenters. Deeds, wills, and land registries could all be rendered immune to counterfeiting. Most of the applications will probably be practical and mundane.

So What Does it All Mean?

Digital art, games, virtual land, trading cards, and cute avatars are not the point here.

NFTs are about the true ownership of your digital possessions. What these innovations demonstrate is that it’s possible to own something digital, not because an unelected centralized authority sanctions your ownership, but because there’s an uncensorable, immutable record of your ownership.

Counterfeiting, corruption, theft, and rent-seeking will no longer be possible in the decentralized world. Innovators, artists, and value creators will reap the full benefits of their own efforts. No trust is required and no permissions need be sought. It’s about an individual’s sovereignty over their life, their work, and their possessions.

It might eventually force institutional and corporate parasites to actually get out there and create some value for humanity. It’s the best hope we have for functioning, sustainable capitalism.

Consider This…

The trustless nature of decentralized blockchain technology means not only that we don’t need to trust anyone, but also that nobody can ever abuse another’s trust. It transforms the world from “Dog Eat Dog,” to “Dog Trades With Dog.”

And at the risk of mixing my metaphors, it elevates the “Rat Race” into the “Human Race.” The Confucian philosophy of “The Golden Rule” is genetically encoded into the technology. It will be impossible to “do unto others, what you wouldn’t want them doing unto to you.”

Perhaps it’s a sad indictment of humanity that it had to come to this, but it’s still gratifying knowing the same humanity can change itself for the better, collectively, and from within.

I’ve been wondering if NFT technology could be utilized to make voting integrity bullet proof enough to not only make all forms of fraud impossible but also claims of fraud meaningless.