When talking about cryptocurrencies, the first things that pop into most people’s minds are generally Bitcoin, Ethereum, and the most recently popular, Dogecoin. This is completely understandable, considering the number of success stories you can find everywhere online regarding these cryptocurrencies.

However, with the recent circling value of the above-mentioned cryptos, more and more cryptocurrencies are trying to find their place in the spotlight. This is exactly what happened with the so-called stablecoin Terra.

What you'll learn 👉

What is Terra Blockchain

Terra is essentially a blockchain project that was created by Terrafarm Labs in January of 2018. It works as a payments-focused financial ecosystem that relies on algorithmic and upgradable stablecoins. The stablecoins are typically regarded as “Terra currencies” and the other key feature of this crypto is the utility token known as LUNA.

Although a lot of people still haven’t heard about Terra, it actually presents one of the most successful cryptocurrency investments over the last 12 months. One of the main purposes of a stablecoin such as Terra is to reduce the unstable nature of cryptocurrencies such as Bitcoin and Ethereum.

Top 5 Terra (LUNA) Altcoins in 2021

Despite the numerous invigorating and compelling crypto projects that made headlines over the last 12 months, Terra can easily be segregated as one of the best investment-wise standouts. Since it started gaining its first wave of popularity in late 2020, Terra has established and initiated numerous fresh projects and tokens.

Anchor (ANC) and Mirror (MIR) are some of the most popular ones in the crypto community. And, although every project has its own compelling charm, if they are combined in certain bigger ecosystems, they become a very interesting plot to follow.

Loop Finance

Loop Finance is a project that was established on the Terra Network. When talking about the ideas Loop Finance has for the future, it is noticeable that they have very similar objectives as Terra when it comes to encouraging crypto adoption in a user-friendly fashion.

The AMM DEX unification is supposed to be projected into a non-custodial crypto wallet that is still in the early beta stage of development (Loop Wallet). The vision is to make purchases easier and more beneficial for each side of trade, both established consumers and small companies.

The LOOP Token ($LOOP) is another part of this project and it represents the endemic governance token of Loop Finance in its Decentralized Exchange, which is considered to be their main product offering. The purpose of the LOOP token is to let the holders be involved in protocol governance.

Chai

In the last couple of months, Chai holds a top spot being one of the most used and most popular payment applications used in South Korea. Chai allows its users to easily accept payment through two dozen different alternatives (such as debit, credit, PayPal, Payoneer, etc.) with very low transaction fees and a speedy settlement.

On the back-end is where we can see the connection between Chai and Terra blockchain. That is where Chai utilizes Terra’s blockchain in order to sort out transactions in a much faster fashion and in a very cheaper way compared to other legacy counterparts.

Also, Chai users are never in direct contact with Terra. The interface works very smoothly and it’s easily applicable for mass adoption.

Mirror Protocol

One of the most interesting on-going projects on Terra Blockchain is definitely the Mirror Protocol. Mirror protocol is basically a decentralized finance platform (a DeFi platform) that allows its users to get a hold of synthetic assets. These synthetic assets are technically crypto tokens that trail real-world asset prices (e.g. stocks).

These tokens have the purpose of supplying investors with an outlook of the current prices of real-world assets that they represent, without actually needing the investors to purchase or own the assets.

This allows traders who are generally kept out from trading these assets due to lack of money or some geographic reasons to benefit from the price variations. Also, synthetic assets can be traded amongst each other on AMMs (automated market makers) like Terraswap.

Mirror Protocol was actually built on the Terra network via synthetic assets known as Mirror Assets (mAssets). These assets are also available on Ethereum and BSC (Binance Smart Chain) through different bridges.

The Mirror Protocol project has been envisioned to be decentralized and community-driven from the very beginning with MIR token holders managing the on-chain treasury and codes latest updates.

LoTerra

LoTerra represents one of the newer Terra Blockchain projects. It is an entirely decentralized and open-source lottery gaming platform. The ecosystem of LoTerra is fully controlled by a DAO (Decentralized Autonomous Organization) that conducts the policy of the game through a voting system maintained by different possibilities approved by smart contract.

Essentially, LoTerra is a self-executing contract in which the consensus between the player and the lottery is written directly in the code lines. The code and the agreements it contains exist on Terra LUNA’s distributed blockchain network.

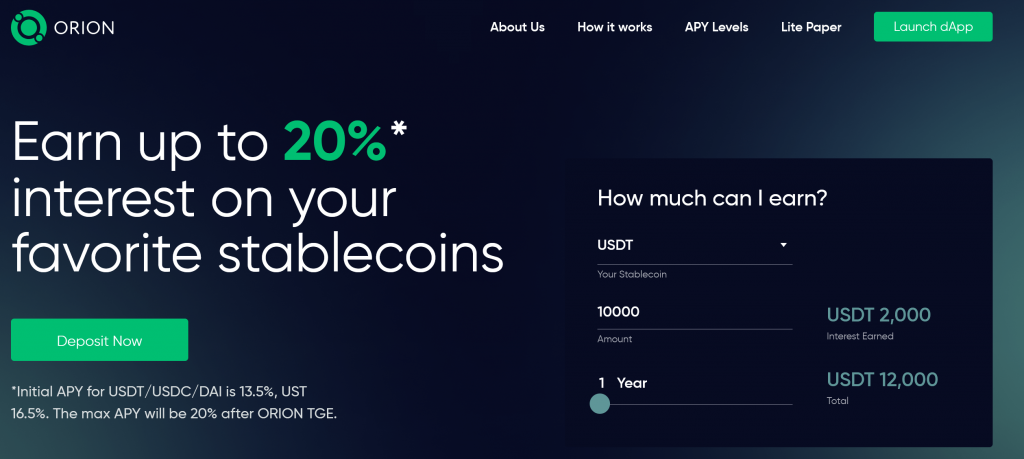

Orion Money

A relatively new cryptocurrency savings platform and a DeFi ecosystem, Orion Money (ORION) is developed to allow its users to maximize income on the stablecoins that they own. Orion Money is intended to provide a cross-chain bank for stablecoins while also working as a hub of different DeFi products that can help users maximize the use of their assets.

Orion Money is also working on developing a set of dApps and infrastructure both on and off the Terra Protocol that is intended to draw more funds and more users into the Terra ecosystem, thereby making Terra assets more prolific inside the network itself.

Pylon Protocol

Pylon is basically a project that contains a set of payment and savings products in DeFi (Decentralized Finance). It is formed through stable protocols like the Terra Anchor Protocol with the goal of issuing services that are accelerated by user deposits. The customizable deposit contracts and yield redirection is what Pylon Protocol uses to authorize viable exchanges between consumers and their abiding value providers.

The goal of Pylon is to change incentive arrangements between consumers and creators, payers and payees, patrons and artists, and investors and entrepreneurs. The numerous independent platforms are responsible for preserving the protocol, and the holders of Pylon’s governance token are the ones governing it.

StarTerra

StarTerra is a gamified Launchpad that was developed on the Terra Ecosystem. It consists of features such as Play2Earn, gamified NFTs, and asset staking.

It is a project that establishes a gamified system of different rivalries between the tiers and it allows the users to stake a bigger amount of $STT native tokens than it is minimally required.

The special unit called “StarTerra Energy” is what calculates each player’s activity. This special unit has a direct influence on the player’s chances of winning allocation in order to purchase IDO tokens over the faction members that are less committed. By doing this, StarTerra develops a competitive environment inside the tiers as well, and not only between them.

In order to participate in the StarTerra project, the players have two choose one of two options: winning group and lottery.

FAQs

Read also:

- Best Projects on Polygon – Best DeFi Coins On Polygon

- Best Projects on Polkadot – Top dApps on Polkadot To Invest In

- Best BSC DeFi Projects

- Best Projects on Cardano – Upcoming DeFi Coins on Cardano

- Best Projects On Tron Blockchain – Top DeFi Apps Built on Tron

- Best Projects on Cosmos (ATOM) – DeFi Projects Built On Cosmos

- Best Projects on Fantom – DeFi Coins On Fantom Blockchain

- How To Buy DeFi – Is Investing in DeFi Coins Worth It?