What you'll learn 👉

What is Mirror Protocol

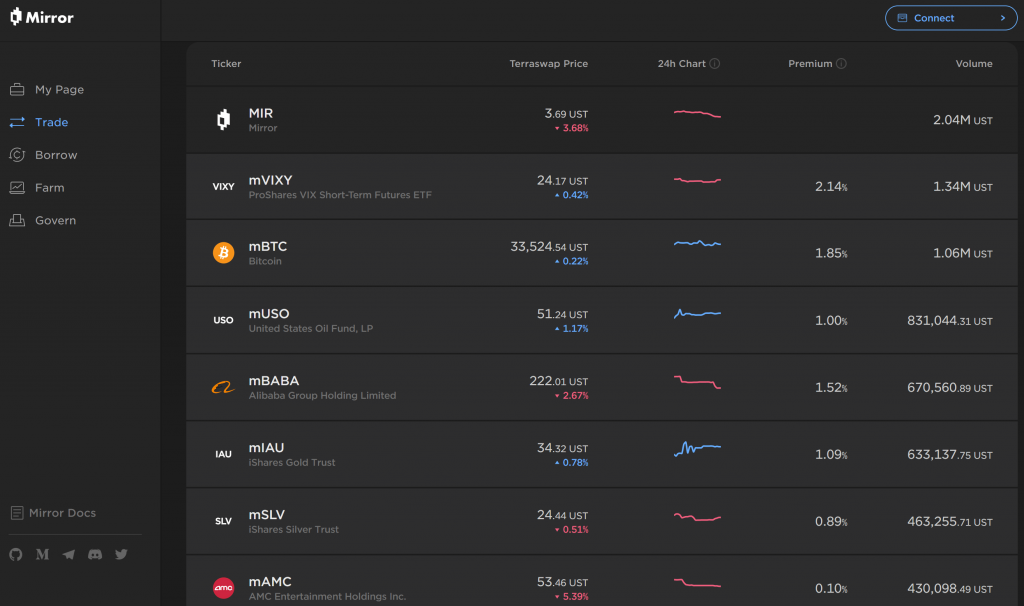

Mirror Protocol is a project used to create synthetic alternatives to real-world assets in simple terms. These synthetic assets are called mAssets and mimic exactly the price of the asset they have been bound to and can, of course, be traded on secondary markets such as Terraswap AMM and Ehtereum’s Uniswap. The project is from a company named Terraform Labs.

mAssets currently mirror US equities and ETFs but likely be added in the future.

Mirror Protocol is a decentralized project that is governed by the community via the MIR token that is also used for staking.

Our MIR price forecast suggests the token price will be around $0.0115 in the next 90 days.

👉 Mirror Protocol Price Prediction 2024

Our MIR price forecast suggests the token price will be around $0.0260 in 2024.

👉 Mirror Protocol Price Prediction 2025

We predict the Mirror Protocol price to hover around $0.0395 in 2025 based on our analysis.

👉 Mirror Protocol Price Prediction 2026

In 2026, we expect the Mirror Protocol price to be approximately $0.0423 according to our price prediction model.

👉 Mirror Protocol Price Prediction 2027

Our MIR prediction indicates the token price will be in the vicinity of $0.0542 in 2027.

👉 Mirror Protocol Price Prediction 2028

For 2028, we forecast the MIR price to be around $0.0660 given current trends.

👉 Mirror Protocol Price Prediction 2029

Looking ahead to 2029, we estimate the Mirror Protocol price will settle around $0.0779.

👉 Mirror Protocol Price Prediction 2030

Our MIR price prediction suggests a token price of about $0.0850 by 2030 based on projected growth.

Fundamentals

Use case

Mirror Protocol prides itself in being decentralized and community governed. Even though Terraform Labs founded it, they have no privileged function. The team at Terraform didn’t even premine the token.

The project initially connected its ecosystem with the Ethereum Network to give users the possibility to trade on Uniswap. As the project grew, it also joined itself with the Binance Smart Chain (BSC). Today even the BSC community can create tokenized synthetic assets coined on Mirror Protocol.

All assets that are as of now on the platform are tokenized U.S. equities. However, this will not always be the case. Mirror Protocol gives users the possibility to create the synthetic equivalent of any asset. In the future, mAssets could include artwork, real estate, precious metals, commodities, fiat and cryptocurrencies, and a lot more. There has already been much talk and interest in the community about minting bonds, futures, and other derivatives as mAssets.

At launch, Mirror protocol had these 14 assets on offer: MIR (Mirror), AMZN (Amazon), TSLA (Tesla), MSFT (Microsoft), GOOGL (Alphabet), BABA (Alibaba), AAPL (Apple), NFLX (Netflix), TWTR (Twitter), IAU (iShares Gold Trust), SLV (iShares Silver Trust), QQQ (Invesco QQQ Trust), VIXY (ProShares VIX), and USO (United States Oil Fund LP). And in January 2021, a governance vote decided to also add BTC, ETH, ABNB (Airbnb), GS (Goldman Sachs Group), and FB (Facebook) to the original 14.

As the whitepaper states, almost anything with a price, be it an asset, could theoretically become a synthetic asset on Mirror. But what are the benefits of users trading mAssets instead of the actual underlying asset? Well, a lot:

- 24/7 trading without the need of permission from anyone and from anywhere in the world

- No intermediaries; all transactions are done on the blockchain ledger.

- Users can trade just a fraction of a mAsset, instead of having to own it all necessarily.

- Mirror Protocol, with its tokenization, allows for better and more liquidity.

- By trading assets using smart contracts, traders will incur a lot less legal and operational costs.

- The world of trading is more accessible; by exchanging fractional assets, fewer liquid users will finally be able to participate.

Like we said before, synthetic assets created on Mirror Protocol are also called mAssets. So Tesla (TSLA) will be called mTSLA, and Apple (AAPL) becomes mAAPL, and so on. And mAssets all have the same shared characteristics:

- users create mAsset by locking up 150% of the price of the assets in USDT or 200% if traders decide to use other mAssets as collateral.

- Once traders reach a minimum collateral ratio, as with any equity, more has to be added. If the trader doesn’t do this will have his positions liquidated.

- When traders take out mAsset, the same amount of mAssets issued when opening the CDP must be burnt. The measure repays the collateral used.

- mAssets are listed and exchangeable on many AMM DEXs such as PancakeSwap (BSC), TerraSwap (Terra), and Uniswap (Ethereum). The low trading fees that users will incur serve as rewards for liquidity providers.

- Mirror protocol will update the Oracle every 30 seconds. A measure necessary to guarantee that the mAsset is pegged to the underlying assets. If the oracle and asset price are not the same, traders are incentivized to arbitrage, so the mAsset price goes back to what it should be.

mAssets are bought to be day traded but not only that. The synthetic assets can be held or used for adding collateral in creating new mAssets, creating synthetic stable pools, creating liquidity pools for decentralized exchanges, and a lot more.

And to top everything off, the smart contracts used by Mirror Protocol are incredibly safe, having been audited and secured by a cyber-security firm called Cyber Unit.

Tokenomics

Mirror Protocol has its own native MIR token, used mainly for governance, for staking, and as rewards for liquidity providers. In particular, the tips for liquidity providers come from the fees that users pay.

Mir operates with a fixed supply of 370,575,000 tokens that are slowly and gradually released over four years.

Other than buying it on an exchange, MIR can be earned in three different ways:

- Users can stake $LUNA, the native token of the Terra project

- By providing liquidity to the MIR/UST pair.

- By providing liquidity to any mAsset/UST pool pairs other than BNB

It should also be noted that Mirror Protocol did not offer a pre-mine or ICO. All of the starting circulating supply of 18.3 million MIR tokens was airdropped to holders of LUNA and UNI, projects with whom Mirror has connected.

Team

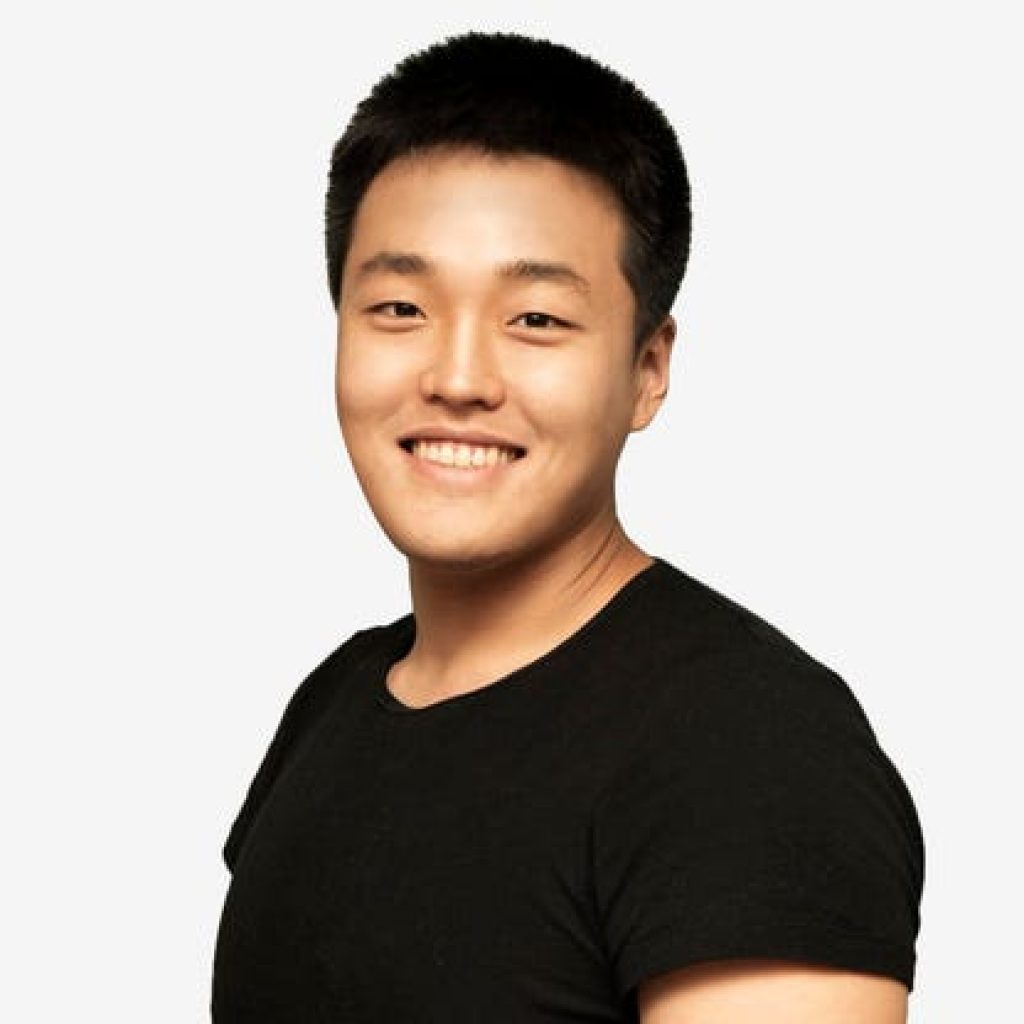

Mirror Finance was launched by a South Korean technology company named Terraform Labs. Founded by Kwon and Daniel Shin at the start of 2018, the firm launched its first project Terra (LUNA). And it has since seen massive success, as of today, is the 42nd biggest coin per market cap.

Soon, on the 4th of December 2020, they launched their second major crypto project, Mirror Finance. And their track record doesn’t lie. MIR is in safe hands with the Shinat brothers and Terraform Labs.

Community

As we mentioned earlier, MIR being an utterly decentralized project means that the community plays a significant role in its governance. All users have to do to participate in the decision-making process is stake the MIR token. The more a user locks up in the system, the more voting power he has.

All members can propose new governance changes to the protocols. To do so, users have first to stake some MIR. And if the community rejects your proposal, the staked MIR will be burnt.

On the other hand, if the proposal is accepted, the Mirror Governance Contract automatically implements it.

The whole process is entirely decentralized. Not even the Terra Labs founders have any executive powers. Truly permissionless and completely decentralized, what crypto is supposed to be.

Proposals are discussed in the platforms Telegram group that counts more than 8 thousand members on Mirror Protocol’s forum and subreddit. Proposals are displayed and can be voted for on their website.

Market price prediction

Below are some projections for MIR’s price trajectory in 2024 and beyond:

- DigitalCoinPrice anticipates that MIR will commence 2024 at $0.0424, fluctuating around $0.0523. The minimum price is projected to lie between $0.0307 and $0.0367, stabilizing approximately at $0.0358 by 2024’s end. Furthermore, they foresee MIR attaining a peak of $0.0634 or $0.0656 in 2026, potentially marking it as MIR’s pivotal year. By 2030, MIR is projected to surpass an average price of $0.15.

- PricePrediction.Net forecasts that MIR could attain a peak of $0.039, with an average predicted price of $0.036 in 2023. In 2024, MIR’s price is expected to hit a minimum of $0.050, maintaining an average trading price of $0.051 throughout the year. In 2025, MIR’s price is anticipated to hover around a minimum of $0.072, with an average trading value of $0.074 in USD. By 2028, MIR’s price is expected to achieve a minimum of $0.22, with the potential to reach a maximum level.

- BTCC provides an optimistic forecast for MIR prices in 2030, ranging from $0.636754 to $1.39. There is a consensus among market experts that MIR represents a sound investment 4.

Mirror Protocol Price Prediction 2024

Following the landmark approvals of Bitcoin ETFs in early 2024, there has been a surge in interest from both retail and institutional investors. This could be a game-changer for crypto. However, the market has just experienced its biggest crash in history. On February 2nd and 3rd of 2025, over $2.3 billion was liquidated, marking the largest market wipeout in recent years. Following this, March was not kind to crypto either. This caused Bitcoin\\\'s price to drop to the $80k range, while Ethereum plunged to around $1.5k. Other major altcoins like DOGE, XRP, and several top projects fell over 40%, creating the highest level of uncertainty in months. Despite the turmoil, ETFs remain live and actively trading, showing continued institutional interest. However, analysts are deeply divided on the market\'s next direction. Some believe the bull run is still intact, while others argue that Bitcoin already topped at $109K in January, signaling the start of a prolonged downtrend. With the regulatory landscape beginning to stabilize and provide clearer guidelines, crypto traders are hopeful that the market will recover. Still, macroeconomic factors such as Trump’s economic tensions with major trade partners are creating additional volatility. Bitcoin ETF approvals in early January last year set a positive tone for the market, but now, the focus has shifted toward whether Bitcoin will reclaim its highs or enter a deeper correction. The BTC halving and ETH ETF approvals are already behind us, and Ripple was fined $125 million by the SEC in a recent ruling. While XRP supporters see this as another step forward, the market remains fragile. The majority of investors, traders, and influencers had hoped for the peak of the bull run to come in mid-2025, driven by ETF approvals, historical post-halving rallies, and typical 4-year cycles. However, the recent crash has thrown these expectations into doubt. Last year’s hottest sectors—memecoins, RWA, and AI projects—must now navigate a more turbulent market environment.

Below is a tabular overview of how will MIR develop in the short-term (for the next 90 days), according to our prediction model:

Essential tools you need to succeed in crypto

Wallets

Hardware wallets are the safest! Pick one of the three:

✔️Ledger Nano X

✔️Trezor

✔️CoolWallet Pro.

Tax Calculators

Don’t get in trouble with the government let these magic tools do all the heavy-lifting when it comes to your crypto taxes:

✔️Koinly

✔️Cointracking

✔️ZenLedger.

Trading Tools

A good charting tool is a must if you want to try yourself out as a day-trader. ✔️Tradingview is best known but

✔️Bitsgap

✔️Coinrule

✔️Cryptohopper

are also excellent plus they allow automated trading.

Mirro Protocol Price Prediction 2024

The cryptocurrency market has shown promising signs for gains in the first few months of 2024, with Bitcoin leading the charge. BTC first saw an impressive gain, hitting a new ATH of around $73K in March, but then retraced during the summer. However, the BTC price again had a strong rally in late 2024 and hit an all-time high of over $109K in January this year. Total market capitalization is currently at around $2.50 trillion (it was around $1 trillion in June 2023).

Bitcoin halving happened in April last year, and historical data tells us the BTC price starts to rally 6-12 months after the halving, but we are not seeing that rally yet.

Despite the previous market optimism, the crypto market just suffered its biggest crash in history in early February this year with multiple crashes in March and April. Bitcoin dropped below $80k, while Ethereum fell below $2k Many altcoins plunged by over 50%.

CaptainAltcoin’s prediction model takes market sentiment into an account and reacts accordingly. Below is a month-by-month breakdown for the next 12 months:

MIR Price Prediction 2025

Our prediction model sees MIR reaching $0.0395 in 2025.

What will MIR be worth in 5 years?

The price of MIR in 5 years could lie around $0.0252, according to CaptainAltcoin’s prediction model.

Mirror Protocol Price Prediction 2030 – 2040

What Mirror Protocol will be worth in 2030?

Our forecasting model sees Mirror Protocol reaching $0.0988 in 2030.

What Mirror Protocol will be worth in 2040?

Our forecasting model sees Mirror Protocol reaching $0.1976 in 2040.

Will Mirror Protocol replace / surpass / overtake Bitcoin?

No, Mirror Protocol will not replace or overtake BTC.

Can Mirror Protocol reach $10?

Yes, Mirror Protocol could reach $10 by the end of 2025.

Can Mirror Protocol reach $100?

No, our prediction model sees no possibility for Mirror Protocol to reach $100 in the short or mid-term period.

Can Mirror Protocol reach $1000?

No, our prediction model sees no possibility for Mirror Protocol to reach $1000 in the short or mid-term period.

Is Mirror Protocol worth buying?

We are advocates of moderately risky investing – invest most of your crypto portfolio in BTC (50%); 35% in a basket of big cap coins and the rest in small projects with huge upside. So, in this context, Mirror Protocol is worth buying.

Is Mirror Protocol a good investment?

Mirror Protocol is, just like all other cryptocurrencies, a risky investment. It does have higher probability of going up than down because of the good use case, well-designed tokenomics, active community and a solid team behind it.

How much will Mirror Protocol be worth?

For the short-term future, it could reach $0.0115. In the long-term (8-10 years), it could jump to $0.0988 or even higher.

Why will Mirror Protocol succeed and go up in price?

Mirror Protocol has a good use case, well-designed tokenomics, active community and a solid team behind it. All of these are a prerequisite for success and that is why our prediction model sees Mirror Protocol rising up to $0.0988 in 2030.

Why will Mirror Protocol fail and drop in price?

Crypto projects fail for various reasons. Some of the most common ones are: team goes rogue and abandons the project, regulators declare it illegal and press exchanges to delist it, lack of media attention, more successful competitors, lack of well designed marketing strategy, losing community support, potential vulnerability in the protocol, failing to achieve anticipated minimum developement activity on the protocol, failing to attract new developers to build on their platform.

How high will Mirror Protocol go?

Our forecasting model sees Mirror Protocol price exploding and reaching $0.1976 in a distant future.

What is the short-term prediction for Mirror Protocol?

Mirror Protocol will reach $0.0115 in the next 90 days, which is a 13.6% change over the current price which hovers around $0.0133.

Can Mirror Protocol make you a millionaire?

Yes, if you buy large enough sum of it. Do not expect to invest $100 and become a Mirror Protocol millionaire. But 100x price explosions are a common sight in crypto, so a $10k investment in Mirror Protocol could make you a millionaire.

Mirror Protocol Price Prediction Today - What will be the price of Mirror Protocol tomorrow?

Mirror Protocol will hover around $0.0141 tomorrow.

Can Mirror Protocol explode?

No, Mirror Protocol price will not explode and record 5-10x pumps; but grow more modestly with an increase of 23.6% in the next year.

What will be the price of Mirror Protocol in 10 years?

Mirror Protocol price in 10 years will hover between $0.0988 and $0.1976.

Mirror Protocol Price Prediction 2023 - What will Mirror Protocol be worth in 2023?

Mirror Protocol will reach $0.0183 in 2023, which is a 37.24% change over the current price.

Mirror Protocol Price Prediction 2024 - What will Mirror Protocol be worth in 2024?

Mirror Protocol will reach $0.0260 in 2024, which is a 95.04% change over the current price.

Mirror Protocol Price Prediction 2026 - What will Mirror Protocol be worth in 2026?

Mirror Protocol will reach $0.0423 in 2026, which is a 218.03% change over the current price.

Mirror Protocol Price Prediction 2027 - What will Mirror Protocol be worth in 2027?

Mirror Protocol will reach $0.0542 in 2027, which is a 307.13% change over the current price.

Mirror Protocol Price Prediction 2028 - What will Mirror Protocol be worth in 2028?

Mirror Protocol will reach $0.0660 in 2028, which is a 396.23% change over the current price.

Mirror Protocol Price Prediction 2029 - What will Mirror Protocol be worth in 2029?

Mirror Protocol will reach $0.0779 in 2029, which is a 485.33% change over the current price.

Mirror Protocol Price Prediction 2050 - What will Mirror Protocol be worth in 2050?

Mirror Protocol will reach $0.3060 in 2050, which is a 2199.52% change over the current price.

Market Price Predictions

Where to buy MIR and how to store it

The best place to exchange MIR are:

- Uniswap (buy and sell with: ETH, UST)

- Coinbase Pro (buy and sell with: BTC, EUR, and GBP)

- Gate.io (buy and sell with: USDT and ETH)

And the best places to store KAI are:

Read also our other predictions worth looking into this year:

Great article, thanks mate