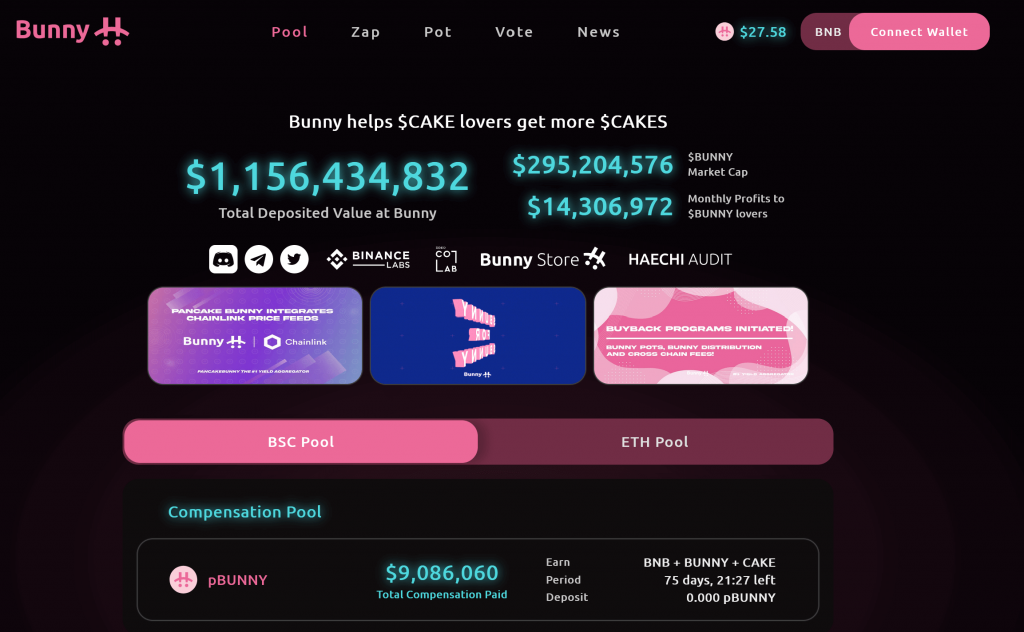

Pancake Bunny is a food-themed De-Fi protocol listed on Binance Smart Chain Network with over $600 million in total value locked (TVL) in locking pools. It is a new and rapidly growing DeFi yield aggregator used for PancakeSwap.

Farmers can leverage PancakeBunny protocol’s yield-seeking tendencies to optimize their yield compounding strategy. The platform offers customized strategies to meet various needs of farmers.

What you'll learn 👉

What is PancakeSwap?

PancakeSwap is among the many food-themed projects launched in decentralized finance. Other projects that have food tokens include BakerySwap and SushiSwap. PancakeSwap’s native token is the CAKE, a BEP-20 token on the BSC.

The PancakeSwap exchange allows users to access fast transactions and lower fees compared to other Ethereum projects. Asset holders can use the platform to perform several functions among them exchanging BEP-20 tokens and offer liquidity in return for rewards. Users can also stake their tokens to earn from additional staking rewards.

Users can use the platform to;

· Offer liquidity on the exchange and earn rewards

· Trade BEP 20 tokens

· Stake CAKE to earn more CAKE

· Stake CAKE to earn tokens of other projects

· Stake LP (liquidity provider) tokens to earn CAKE token

Key advantages of PancakeSwap include;

· Allowing users to earn more tokens through staking.

· Access fast transaction and low fees

· Avoid long and tedious KYC requirements.

BUNNY Price Prediction For The Next 90 Days

As the first part of 2024 concluded, we can say that this year has started on a high note for the cryptocurrency industry, marked by significant milestones and growing enthusiasm. Following the landmark approvals of Bitcoin ETFs, there has been a noticeable surge in interest from both retail and institutional investors, signaling a robust period of growth and acceptance for digital assets. These developments have not only bolstered investor confidence but have also hinted at a maturing market that is increasingly aligning with traditional financial systems. With the regulatory landscape beginning to stabilize and provide clearer guidelines, the cryptocurrency market is poised for a transformative year, potentially setting new benchmarks for adoption, innovation, and investment. Bitcoin ETF approvals were done in early January, setting a positive tone for the market. Analysts had predicted the SEC would decide on Bitcoin ETF applications potentially catalyzing industry growth. The approvals have been seen as a significant step towards mainstream acceptance and have sparked optimism among investors and traders alike. Now, attention is turning towards post-halving rallies, with the BTC halving now behind us. Bitcoin has almost tripled in price since last summer, with the recent Wall Street earthquake and the upcoming halving expected to further boost Bitcoin, Ethereum, and the broader crypto market. Bitcoin is trading around $65k now, after it hit a new ATH of $73k in March. Ethereum also had its own ETFs approved by SEC. The ETH price is currently around $3,500 and still has not broken its ATH from the 2021 bull run. Investors are hopeful this will happen soon. The majority of investors, traders, and crypto influencers are hopeful that the real crypto bull run will finally commence, bolstered by the recent ETF approvals and anticipation of the upcoming Bitcoin halving event. ETFs, a growing meme coin, AI crypto coins, and RWA mania have helped the bull run to gain momentum. The total market cap (TMC) is now $2.3 trillion.

Below is a tabular overview of how will Pancake Bunny develop in the short-term (for the next 90 days), according to our prediction model:

Pancake Bunny Price Prediction 2024

Our prediction model sees a temporary switch to a bear market at the beginning of 2023 before we move onto another leg up in Q3 & Q4 of 2023.

BUNNY Price Prediction 2025 – 2030 – 2040

Our prediction model sees BUNNY faltering in 2025 and dropping down to $0 or almost $0.

BUNNY price in 2030 & 2040 could be close to zero as we don’t see a bright future for it in the distant future. The project offers no unique value to set itself apart from countless competitors, hence we don’t think it is worth investing in this coin for the long term.

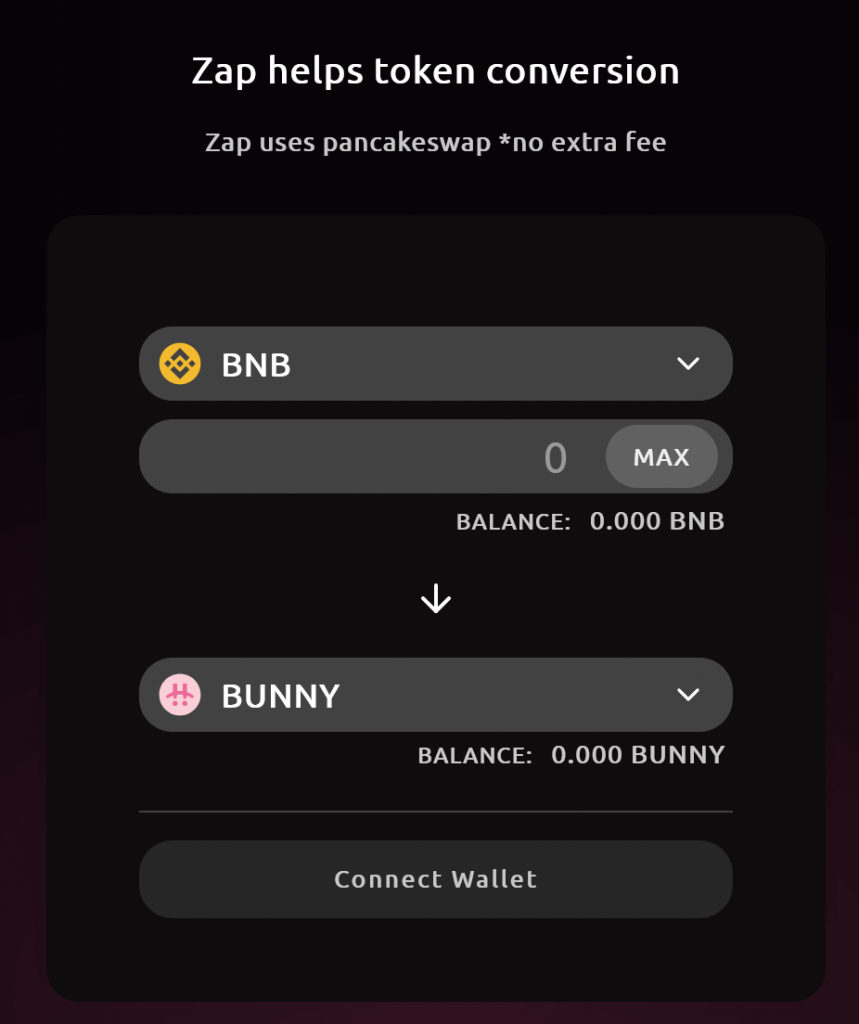

Liquidity Zaps

One of Pancake Bunny’s key features is the “Zap”, a function that allows users to create any desired LP tokens with a click, allowing for quick and constant supply of liquidity. The protocol has an AMM (automated market maker) which saves users the hassle of having to create one.

Users can create their own LP tokens by selecting the pair to be created, depositing the amount, and then clicking on Zap. The formed LP tokens can be left to compound in the Pancake Bunny vaults or used to farm additional tokens.

Bunny Token

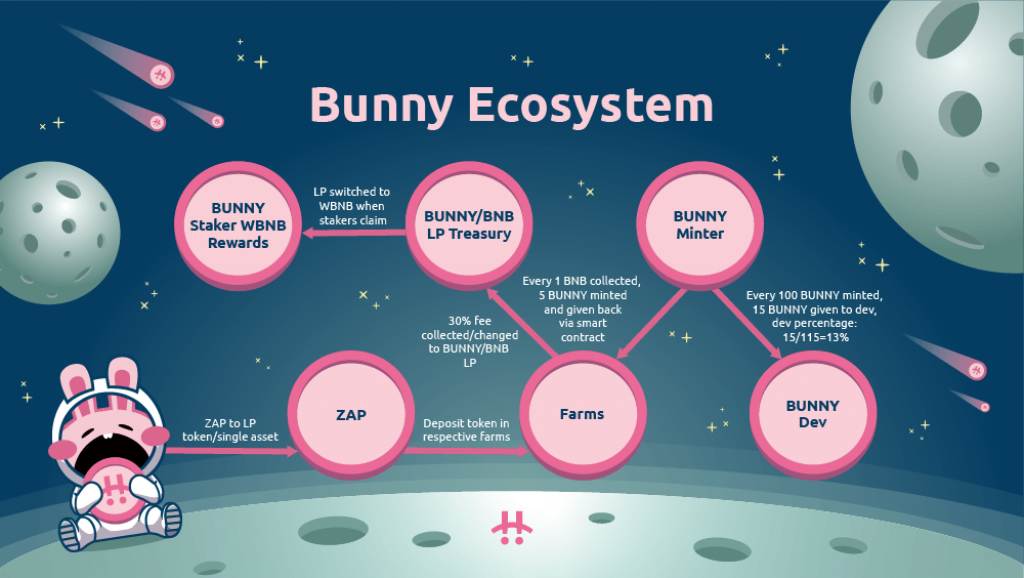

The Pancake Bunny project has a governance token called the $BUNNY token which is minted in relation to the fees generated. Currently one $BNB in fees generates $BUNNY tokens. The tokens were previously pegged at one $BNB generating ten $BUNNY tokens.

Currently there are 482,926 $BUNNY tokens under circulation with no capped maximum supply. This is because the protocol is always creating new tokens to make up for the reduced emission as a result of changing the token’s value in relation to the generated fees. In addition, new tokens are constantly created for the reward program in the vaults.

Cross-Chain

The Pancake Bunny platform is developing an Ethereum-based protocol that will be used for cross-chain farming. Ethereum users can use the new protocol to dual mine through PancakeSwap and UniSwap liquidity and tap into the benefits of BSC without having to interact with the BSC platform. While setting up a BSC wallet is simple, easy, and straightforward, cross-chain allows users to maximize yields through dual mining.

The platform is especially expected to resonate well with crypto holders that have for long been hesitant to switch from Ethereum to BSC due to lack of bridging assets. Cross-chain farming is expected to make it easy to move tokens between PancakeSwap and the Ethereum Network.

On top of the Binance Smart Chain, Pancake Bunny has three additional products that fully support services and operations;

· Vaults

· Zap

· Governance

Vaults

Users can lock up their assets into smart contract-powered vaults to earn interest without risking their assets in any investment. Bunny users earn even more interest with the in-built auto-compounding feature that enables users to plough back their earned tokens to compound interest. The yields are auto-compounded every 24 hours into the vault. Auto-compounding saves users the hassle of having to redeposit the earned tokens manually.

ZAP

Zap is an innovative feature that allows De-Fi users to create LP tokens with a single click and without having to go through any third-party website or paying additional fees. Zap is integrated in PancakeSwap to perform the required job in the backend. The product was introduced to improve user experience by allowing users to tokenize their crypto asset without leaving the screen or moving to another platform.

Governance

Pancake Bunny users can earn BUNNY tokens in two ways; participating in yield farming activities in the vaults or buy the tokens using the Zap feature. BUNNY is Pancake Bunny’s native governance token used in decision-making on the development of the platform.

Users earn token rewards by participating in governance and decision-making on the platform. To access the extra rewards need to stake their assets in governance/liquidity pools.

Currently there are 19 farms which are categorized into four categories;

· BUNNY Staking Farm; users can use this farm to stake their BUNNY while getting WBNB back. There are no fees charged on using this farm.

· BUNNY/BNB Farm; users can deposit BUNNY/BNB tokens in return to BUNNY tokens. This farm charges a 0.5% fee on all withdrawals. The fees are charged only on transactions completed within 72 hours.

· Auto Compounding Farms; the platform has a total of 8 farms that allow auto-compounding. These are USDT-BUSD, VAI-BUSD, USDC-BNB, DAI-BNB, USDT-BNB, BUSD-BNB, BTCB-BNB, ETH-BNB, and CAKE-BNB. The platform charges a withdrawal fee of 0.5% plus a performance fee of 30% of the profits from the vaults.

· Maximizer PancakeSwap Farms; this platform allows users to auto-compound their profits and earn more rewards.

Tokenomics

As opposed to most yield aggregators’ tokens on the Binance Smart Chain that have a cup on their maximum supply, $BUNNY is not capped. The team mints 5 BUNNY tokens for every 1 BNB earned on the farm in performance fee. The development team will be allocated 13% of the total token supply to ensure continuous innovation and development of the protocol.

The Pancake Bunny team

Pancake Bunny is a product of the MOUND team. The team is composed of entrepreneurs and developers with vast experience in social platforms, games, blockchain applications, and quantitative financial services. The MOUND team is dedicated to ensuring that that crypto holders have access to compounding, high-yield returns.

The team is focused on value for their users through product innovations and refining users’ experience. Other projects that the team is working on include Smart Vaults.

Depositing and Staking on Pancake Bunny

Pancake Bunny users can farm the governance token BUNNY while earning while accumulating interest on the stored value. The protocol’s website has step-by-step explanations on how to deposit and stake on Pancake Bunny.

Users can stake their $BUNNY in the Bunny stake farm to earn WBNB. With staking, assets holders contribute their assets in smart contracts to be used in validating transactions on the network. Users earn return for staking rewards which depends on the number of staked tokens.

Users also need to stake up a significant amount of tokens to increase their chances of being selected as validators. In addition to the amount of tokens held, the timing of staking and the rate of inflation also determines the level of staking rewards. Pancake Bunny users can stake BUNNY into the BUNNY farm that is not compatible.

First, users need to select their preferred wallet to hold their assets in Pancake Bunny. The website has a long list of crypto wallets to choose from including Metamask.

Depositing at Pancake Bunny

· Users can deposit assets in Bunny by visiting the ‘Farm’ page on the Pancake Bunny website

· Click on wallet to connect your preferred wallet

· Click on Farm and scroll down to access available yield-farming protocols

· Click on the specific farm which will direct to a separate page where you access step-by-step procedure on setting up the wallet.

· Click the ZAP feature to directly swap your held assets into LP tokens. The feature automatically does the token switching.

· The swapped tokens are deducted from the Metamask Wallet Balance

Can you manually compound profits into the Pancake bunny vaults?

As opposed to Pancake Bunny, Pancake Swap does not have auto-compounding capabilities meaning users need to manually reinvest the earned profits to earn compounded returns. The manual process is not only costly but also time-consuming.

Determining Daily % Gains

The Compounded APY on the Bunny Platform is always fluctuating in response to the ever changing APY. In addition, the APY is calculated through exponential growth and not in a linear manner. This means token holders can continuously earn exponential returns on their assets as long as they keep them deposited on the platform.

Transaction fees

While there are no fees charged on deposits, the platform charges a fee on all withdrawals but only paid if the transaction is completed in 72 hours. Users who want to withdraw freely can do so by selecting a transaction period outside the 72 hours.

An additional 30% performance fees is charged on all farms and channeled in the rewards pool where the company draws rewards for staking BUNNY.

There is a relatively higher Gas Fees intentionally designed so to ensure no transaction bounces. Transaction failure can occur due to the complexity of the smart contracts that have to execute billions of instructions within a short time.

Risks associated with farming on Bunny

There are mainly two risks associated with farming on Bunny; Systematic Risk and Idiosyncratic Risk. Systematic Risk mainly involves the drop in value of the deposited assets while Idiosyncratic Risk is risks associated with the actual project.

Is Bunny Audited?

Bunny is audited by Haechi Labs, which recently completed the first audit and released very positive results. The audit did not reveal any threat of major issues that could compromise the network’s security.

PancakeSwap’s Social Media Presence

PancakeSwap is working on building a strong and sustainable community and social media is one of the target points. The project creators are very active on social media and the company is always running promos and give-aways on its Twitter account.

With more than 5,700 active users, PancakeSwap is ranked the largest DeFi protocol on Binance Smart Chain. In addition, the platform has over 8,000 yield farmers in its Telegram channel.

Future

The Pancake bunny project is still new and undergoing additional development. The platform is expected to attract more investors, developers, and additional innovative features. The platform is becoming fully integrated into the BSC ecosystem. This is in addition to other single asset vaults.

Also, check out our other decentralized exchange reviews:

- 1inch exchange review – Is 1 inch a good investment?

- Best DeFi Coins – DeFi Projects Worth Investing In

- Aave Price Prediction

- Aave vs Compound

- Synthetix Price Prediction

- Belt Finance Price Prediction

- Badger DAO Price Prediction

- Reef Finance Price Prediction

- Helium Price Prediction

- Injective Protocol Price Prediction

- Tellor Token Price Prediction

- Waltonchain Price Prediction – Future Forecast For WTC Price

- Future Forecast for XRP Price

- Tezos Price Prediction

Pancake Bunny Partnerships

Pancake Bunny signed a partnership with Pancakeswap through the new farm and syrup pools. The new partnership will enable users to stake cake on Pancakeswap and earn $BUNNY. The partnership is especially important to Pancake Bunny as it is built to aggregate yields from Pancakeswap. The partnership is additional support and endorsement for BUNNY.

The MOUND team recently announced raising $1.6 million in funding, part of which will go towards revamping their farming aggregator Pancake Bunny. The funding was led by Binance Labs with other participants including IDEO CoLab and SparkLabs Korea. According to the team, Pancake Bunny has been growing rapidly and currently has more than 30,000 users and has accumulated over $2.1 billion in total value locked (TVL).

The MOUND team intends to use the new funding to expand the yield aggregator and launch new products. Products already launched by the team include Smart Vaults and Cross-Chain Collateralization. The team has developed these products to bring the startup closer to its mission of covering several DeFi use cases.

Smart Vaults are used to farm single asset yields on lending products. The system automatically checks to confirm the leveraging costs against the projected returns. On the other hand,

Cross-Chain Collateralization is cross-chain yield farming used by farmers to keep assets on their native blockchain without using a bridge token. In this case, the user’s original assets are used as collateral by the Bunny protocol to borrow funds from the Binance Smart Chain. This way, users can keep their assets on the native blockchain and also access liquidity to generate returns on the Binance Smart Chain