A promising DeFi start-up project from a few years ago, Injective Protocol has recently become interesting again. The long-awaited launch of the Canary Chain on the Injective Protocol main net has gone live with spot trading on their decentralized exchange (Dex).

It’s still early days for Injective Protocol as an exchange, but ‘early days’ is an investor’s dream if the project is a solid one. Should we all be buying INJ, their proprietary token? There’s good news and bad news.

Our INJ price forecast suggests the token price will be around $7.48 in the next 90 days.

👉 Injective Protocol Price Prediction 2025

We predict the Injective Protocol price to hover around $40.07 in 2025 based on our analysis.

👉 Injective Protocol Price Prediction 2026

In 2026, we expect the Injective Protocol price to be approximately $50.68 according to our price prediction model.

👉 Injective Protocol Price Prediction 2027

Our INJ prediction indicates the token price will be in the vicinity of $62.70 in 2027.

👉 Injective Protocol Price Prediction 2028

For 2028, we forecast the INJ price to be around $74.72 given current trends.

👉 Injective Protocol Price Prediction 2029

Looking ahead to 2029, we estimate the Injective Protocol price will settle around $86.74.

👉 Injective Protocol Price Prediction 2030

Our INJ price prediction suggests a token price of about $86.16 by 2030 based on projected growth.

What you'll learn 👉

What is Injective Protocol?

It’s a Dex but with a few differences. Most Dexs run an AMM (Automated Market Maker) algorithm to generate the market. This maintains a pool of cryptocurrencies in pairs which are rebalanced after every trade. It’s the way that classic Dexs automated the market-making process. Injective Protocol has an order book like most Cexs (Centralized Exchanges), but more of this and a few other interesting features later.

INJ is Injective Protocol’s obligatory exchange token. The exchange is still in the early stages of release so it’s difficult to know how it will function when all the features are implemented. The initial releases’ maximum trade is $50 and there’s only a spot market at the moment. I like this cautious approach to launch, in principle. Too many times we’ve seen hastily implemented code bring down a project and lose people money.

Injective Protocol Price Prediction For The Next 3 Months

Is Injective Protocol (INJ) currently undervalued? That’s the fundamental question. Let’s look under the hood to check if the component parts are up to the job. Will Injective Protocol be fit for purpose if it does capture significant market share?

Following the landmark approvals of Bitcoin ETFs in early 2024, there has been a surge in interest from both retail and institutional investors. This could be a game-changer for crypto. However, the market has just experienced its biggest crash in history. On February 2nd and 3rd of 2025, over $2.3 billion was liquidated, marking the largest market wipeout in recent years. Following this, March was not kind to crypto either. This caused Bitcoin\\\'s price to drop to the $80k range, while Ethereum plunged to around $1.5k. Other major altcoins like DOGE, XRP, and several top projects fell over 40%, creating the highest level of uncertainty in months. Despite the turmoil, ETFs remain live and actively trading, showing continued institutional interest. However, analysts are deeply divided on the market\'s next direction. Some believe the bull run is still intact, while others argue that Bitcoin already topped at $109K in January, signaling the start of a prolonged downtrend. With the regulatory landscape beginning to stabilize and provide clearer guidelines, crypto traders are hopeful that the market will recover. Still, macroeconomic factors such as Trump’s economic tensions with major trade partners are creating additional volatility. Bitcoin ETF approvals in early January last year set a positive tone for the market, but now, the focus has shifted toward whether Bitcoin will reclaim its highs or enter a deeper correction. The BTC halving and ETH ETF approvals are already behind us, and Ripple was fined $125 million by the SEC in a recent ruling. While XRP supporters see this as another step forward, the market remains fragile. The majority of investors, traders, and influencers had hoped for the peak of the bull run to come in mid-2025, driven by ETF approvals, historical post-halving rallies, and typical 4-year cycles. However, the recent crash has thrown these expectations into doubt. Last year’s hottest sectors—memecoins, RWA, and AI projects—must now navigate a more turbulent market environment.

Below is a tabular overview of how will INJ develop in the short-term (for the next 90 days), according to our prediction model:

Fundamentals

Injective Protocol is a decentralized derivatives trading platform that offers several benefits:

- It allows anyone to create and trade derivatives markets in a decentralized, permissionless manner. This enables free and open financial markets without intermediaries.

- The protocol is highly scalable and has low operational costs by utilizing an optimized sidechain built on the Cosmos SDK. This provides an efficient foundation for decentralized finance applications.

- It incorporates a verifiable delay function to ensure fair ordering of trades and prevent front-running. This improves the overall efficiency and fairness of trading.

- The INJ token serves multiple purposes on the protocol including security, incentives for market makers and relayers, and collateral for derivatives positions. The token thus underpins the network’s operations.

- Overall, Injective brings the advantages of decentralization, scalability, fairness and strong incentives to derivatives trading.

Use Cases

Injective Protocol aims to power decentralized finance applications with a focus on trading:

- It enables the creation of decentralized spot and derivatives exchanges without limitations. Users can trade freely in any derivatives markets they want.

- There is unlimited access for users to participate in DeFi markets seamlessly. No barriers exist to entering and benefiting from opportunities in DeFi trading.

- The protocol incentivizes participation through staking rewards, governance rights, and collateral backing using the INJ token. This encourages users to actively stake tokens and contribute to the network.

- Injective brings scalability, low costs, and rich features to decentralized trading. This makes it well-positioned to become a leading protocol for DeFi applications related to derivatives, trading, and prediction markets.

- By emphasizing an open and decentralized approach, Injective unlocks the full potential of decentralized finance for trading markets.

Overall, Injective Protocol aims to be a next-generation DeFi platform that powers advanced derivatives and trading functionality in a decentralized manner.

The Tokenomics of INJ

| Current Price | $23 |

| Circulating Supply | 93,400,000 INJ |

| Total Supply | 100,000,000 INJ |

| Inflation Rate | 7% falling to 2% |

| Market Cap | $628,583,208 |

| Rank | #48 |

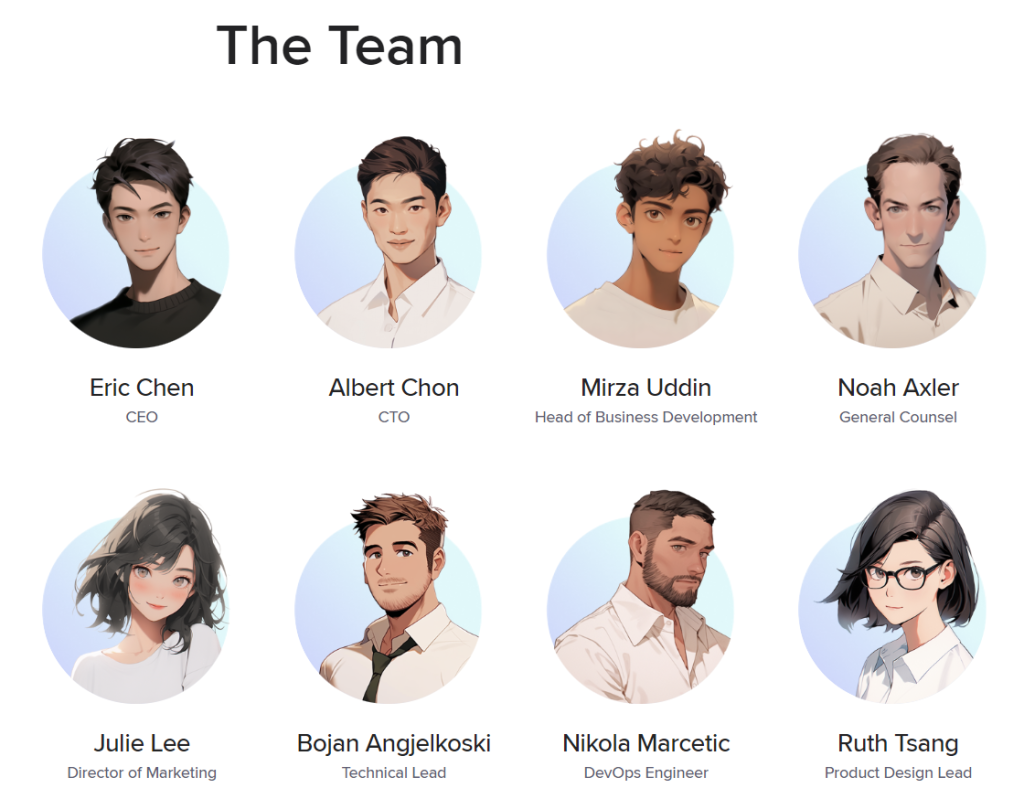

Team

CEO Eric Chen and CTO Albert Chon founded the company in mid-2018. They’re both qualified and accomplished professionals with experience working for a range of blue-chip tech and finance firms. The team boasts mainly developers and techs, which is good to see. It gives the impression that the focus is in the right place, unlike some of the more hyped nonsense we are seeing at the moment.

Social Media

The same goes for Injective Protocol’s social engagement. However, The product blogs are all well and good, talking about INJ being listed on various exchanges, and the spot market going live. But there’s nothing about why there’s virtually no action on the exchange, or about the imminent rollout of the bulk of the project.

The Twitter account mirrors their blog and has about 12k members.

Exchanges & Wallet Support

You can buy INJ at centralized exchanges Binance and Huobi. If you prefer to remain completely DeFi, swap for it at Uniswap or buy it directly on the Injective Protocol exchange with stable coins, USDC and USDT.

I connected with the recommended Metamask wallet and had no issues. The site also recommends Ledger live.

How to Buy INJ

If your intention is to hold INJ as a speculative asset, then buying on a regular exchange is fine. If your goal is to trade on the Injective Protocol exchange then transferring crypto to the exchange is the way to go.

It’s a familiar process by now, but there are a few things to note. Connect your wallet, click on a market, select your amounts, and hit the approvals on your Metamask wallet. Remember to set the total allowance – this is important. It restricts the amount that a smart contract can access from your wallet when permission is given.

Once you have deposited USDC or USDT, select whichever token pair you would like to trade. Fees for transferring should be a couple of dollars maximum, and a few cents equivalent in INJ for the actual exchange trading.

I hope this was part of a staggered release that will swing into action soon, otherwise, this exchange is deeply troubling and should be avoided at all costs. Imagine having funds in the exchange and not being able to sell.

Injective Protocol Price Prediction 2025

Injective Protocol Price Prediction 2026 – 2040

Our prediction model sees INJ reaching new highs in 2026:

$40.07Injective Protocol Price Prediction 2030 – 2040

What Injective Protocol will be worth in 2030?

Our forecasting model sees Injective Protocol reaching $100.18 in 2030.

What Injective Protocol will be worth in 2040?

Our forecasting model sees Injective Protocol reaching $200.36 in 2040.

Will Injective Protocol replace / surpass / overtake Bitcoin?

No, Injective Protocol will not replace or overtake BTC.

Can Injective Protocol reach $100?

Yes, Injective Protocol could reach $100 by the end of 2025.

Is Injective Protocol worth buying?

We are advocates of moderately risky investing – invest most of your crypto portfolio in BTC (50%); 35% in a basket of big cap coins and the rest in small projects with huge upside. So, in this context, Injective Protocol is worth buying.

Is Injective Protocol a good investment?

Injective Protocol is, just like all other cryptocurrencies, a risky investment. It does have higher probability of going up than down because of the good use case, well-designed tokenomics, active community and a solid team behind it.

How much will Injective Protocol be worth?

For the short-term future, it could reach $7.48. In the long-term (8-10 years), it could jump to $100.18 or even higher.

Why will Injective Protocol succeed and go up in price?

Injective Protocol has a good use case, well-designed tokenomics, active community and a solid team behind it. All of these are a prerequisite for success and that is why our prediction model sees Injective Protocol rising up to $100.18 in 2030.

Why will Injective Protocol fail and drop in price?

Crypto projects fail for various reasons. Some of the most common ones are: team goes rogue and abandons the project, regulators declare it illegal and press exchanges to delist it, lack of media attention, more successful competitors, lack of well designed marketing strategy, losing community support, potential vulnerability in the protocol, failing to achieve anticipated minimum developement activity on the protocol, failing to attract new developers to build on their platform.

How high will Injective Protocol go?

Our forecasting model sees Injective Protocol price exploding and reaching $200.36 in a distant future.

What is the short-term prediction for Injective Protocol?

Injective Protocol will reach $7.48 in the next 90 days, which is a 41.8% change over the current price which hovers around $12.84.

Can Injective Protocol make you a millionaire?

Yes, if you buy large enough sum of it. Do not expect to invest $100 and become a Injective Protocol millionaire. But 100x price explosions are a common sight in crypto, so a $10k investment in Injective Protocol could make you a millionaire.

Injective Protocol Price Prediction Today - What will be the price of Injective Protocol tomorrow?

Injective Protocol will hover around $13.59 tomorrow.

When to sell and exit Injective Protocol?

That depends on your trading profile. If you believe in Injective Protocol and think it has a bright future, holding the coin for at least a couple of years is a good idea. Taking profits on good investments is an even better idea. So if you are sitting on 100-200% or even more gains on your Injective Protocol, cashing out a portion of the funds is not a bad move.

Can Injective Protocol explode?

Yes, our algorithm sees Injective Protocol taking off and skyrocketing in 2022 with an increase of 11.8% over the current price.

What will be the price of Injective Protocol in 10 years?

Injective Protocol price in 10 years will hover between $100.18 and $200.36.

Injective Protocol Price Prediction 2023 - What will Injective Protocol be worth in 2023?

Injective Protocol will reach $19.78 in 2023, which is a 54% change over the current price.

Injective Protocol Price Prediction 2024 - What will Injective Protocol be worth in 2024?

Injective Protocol will reach $29.36 in 2024, which is a 128.6% change over the current price.

Injective Protocol Price Prediction 2026 - What will Injective Protocol be worth in 2026?

Injective Protocol will reach $50.68 in 2026, which is a 294.56% change over the current price.

Injective Protocol Price Prediction 2027 - What will Injective Protocol be worth in 2027?

Injective Protocol will reach $62.70 in 2027, which is a 388.16% change over the current price.

Injective Protocol Price Prediction 2028 - What will Injective Protocol be worth in 2028?

Injective Protocol will reach $74.72 in 2028, which is a 481.76% change over the current price.

Injective Protocol Price Prediction 2029 - What will Injective Protocol be worth in 2029?

Injective Protocol will reach $86.74 in 2029, which is a 575.36% change over the current price.

Injective Protocol Price Prediction 2050 - What will Injective Protocol be worth in 2050?

Injective Protocol will reach $301.75 in 2050, which is a 2249.36% change over the current price.

Summing it All Up

Injective Protocol is a layer-2 decentralized finance (DeFi) protocol built on top of the Cosmos SDK, focused on decentralized derivatives trading and exchange markets. The protocol aims to solve some of the limitations of first generation DeFi protocols by offering unlimited access, high scalability, and strong incentives.

One of the main benefits highlighted is the ability for anyone to create and trade any derivatives market in a decentralized manner. This enables open and free financial markets without centralized intermediaries or gatekeepers. Injective incorporates features like cross-chain capabilities, a verifiable delay function, and staking rewards to improve efficiency, fairness, and participation.

The INJ token serves multiple purposes on Injective, including securing the network, incentivizing market makers and relayers, and providing collateral for positions. Looking ahead, experts predict continued growth for INJ, with price targets ranging from $11 to over $300 by 2025 and 2030. Injective’s decentralized approach helps unlock the full potential of DeFi for trading and derivatives markets. Its combination of features positions it well to lead the next generation of DeFi protocols.

Also, you might want to check out other price predictions:

- Tellor Token Price Prediction

- Waltonchain Price Prediction – Future Forecast For WTC Price

- Future Forecast for XRP Price

- Tezos Price Prediction

- Zilliqa Price Prediction

- Sia Coin (SC) Price Prediction

- Future Forecast for RDD

- Orion Protocol Price Prediction

- Kava.io Price Prediction

- Telos Price Prediction