LocalBitcoins is one of the most popular P2P exchanges in the crypto industry.

This platform offers trading services in almost any place in the world, and it has long been the go-to platform for traders looking to exchange Bitcoin directly between themselves.

However, LocalBitcoins has recently made it mandatory for users to fill out KYC documents in order to trade on the platform. While this isn’t that big of a deal, P2P users aren’t very keen on the idea and have started to look for alternative platforms.

What you'll learn 👉

Intro

Launched in 2012 in Helsinki, LocalBitcoins has long maintained the position of being one of the world’s most recognized peer-to-peer (P2P) platforms.

Even in the beginning, LocalBitcoins didn’t have a problem gathering new users onto the platform. Considering the unique features it offered, it was evident that the platform was going to revolutionize the crypto market.

The platform offers more than 200 payment options, including wire transfers, cash deposits, PayPal, cash on hand, and many more.

While Bitcoin has long been the platform’s main focus, it also supports more than twenty other currencies.

But, as we said, with the update of mandatory KYC, users have started searching for other P2P platforms to use.

In this guide, we are going to go over some of the most popular alternatives.

P2P TRADING & LOCALBITCOINS

If you have been a loyal LocalBitcoins user for some time now, you may be a bit out of the loop when it comes to other P2P platforms and their features.

The most important factors to consider when picking a platform include price and security, but there are plenty more that shouldn’t be overlooked.

Researching each platform individually can take up quite some time.

But don’t worry – we did the heavy lifting for you.

Let’s check out some of the best LocalBitcoins alternatives and help you choose the ideal one.

Paxful

Paxful is a reliable alternative to LocalBitcoins, and it supports users from all around the world to trade on the platform.

It was launched in the US in 2015, and what may come as a surprise is that this P2P exchange service is actually much larger than LocalBitcoins.

In terms of payment options, it is also much more comprehensive compared to LCB. Currently, there are more than 300 payment methods that you can use to buy/sell BTC.

There is a 0.5% fee for crypto conversions, but there aren’t any fees for buying cryptocurrencies. Although, there is an exchange fee that is set by the customer who is offering BTC purchases.

Transfer fees only apply to selling cryptos, and the exact amount depends on the payment method that you use. Bank transfers stand at 0.5%, while alternative methods (debit cards, digital currencies, etc.) are fixed at 1%.

The main downside of Paxful is that it also integrates a mandatoryKYC verification. Without it, users won’t be able to deposit or withdraw funds.

LocalCoinSwap

LocalCoinSwap is a P2P crypto exchange service that was established in Hong Kong in 2017.

Aside from buying/selling BTC, you can also use it to trade 20+ cryptocurrencies, including some of the most popular such as ETH, XRP, LTC, and others.

The platform has optional KYC verification, which is also one of the main reasons it has attracted such a huge following.

More than 200 payment methods are available, including PayPal, Bank Transfer, Credit/Debit card, BTC, and more.

LocalCoinSwap operates on a taker-maker fee system. Takers, people who respond to existing offers, aren’t charged anything, while makers pay 1% in trading fees. Compared to other P2P platforms, the 1% trading fee is a bit high.

The withdrawal fee stands at 0.00025 BTC per BTC withdrawal (applies to the standard BTC wallet). However, this fee can vary for non-custodial wallets.

Currently, there still aren’t any limits regarding the withdrawal or depositing amount.

HodlHodl

HodlHodl is a P2P trading platform that was established in 2018 by two Fintech and software development experts.

The most unique feature of HodlHodl is that it provides escrow through multisig addresses, which means there is no manual escrow service.

You can connect to anyone in the world at any time to trade BTC, and there is no mandatory KYC verification. All you need is a valid email address to sign up on the platform.

HodlHodl probably has the largest variety of methods compared to other P2P platforms in terms of payment. Although, the sellers are the ones who decide whether or not they will accept a specific payment option.

Some of the payment methods included are SWIFT, SEPA, regular bank transfers, Credit cards, PayPal, Venmo, Western Union, and plenty more.

When it comes to fees, trading fees vary between 0.5% and 0.6% (depending on users’ referral and verification status). Those who signed up through a referral code are provided with a 0.55% rate, and verified users get a 0.5% trading fee rate.

This fee is split between buyers and sellers, and in situations where the two have different rates, the lower one will be applied.

The minimum BTC that you can buy or sell is 0.001 BTC.

Considering the various payment options and pretty low fees, HodlHodl is a decent replacement for those looking to change LocalBitcoins.

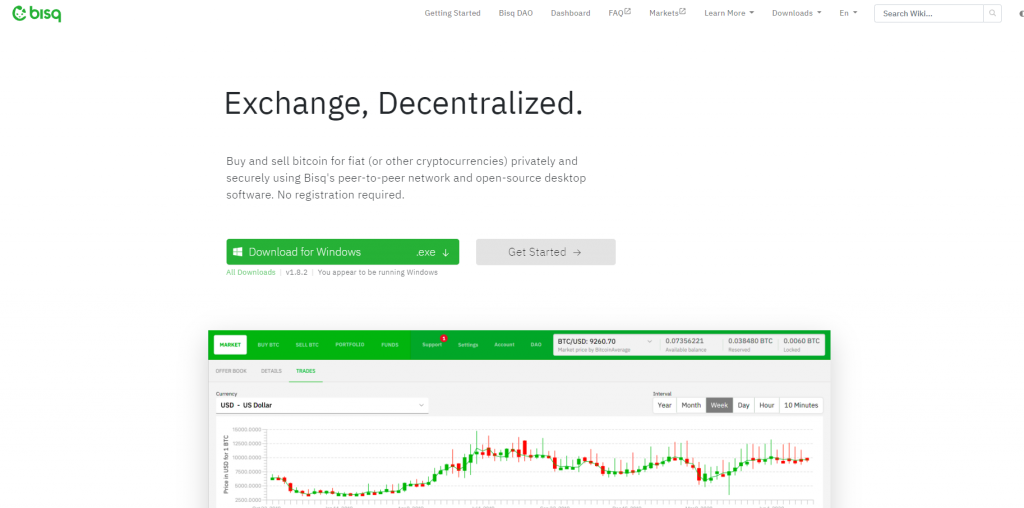

BisQ

BisQ is an open-source P2P platform that was established in 2014, making it one of the pioneers in the peer-to-peer platform community.

The platform provides users with the chance of buying and selling cryptocurrencies in exchange for their national currencies. Since it was launched, BisQ has immensely evolved, but it has always focused on offering fiat to BTC and BTC to fiat transactions in a decentralized manner.

BisQ doesn’t require any KYC information, and verification isn’t mandatory. Users are allowed to directly trade with one another without having to involve a third party.

Compared to other P2P platforms, BisQ doesn’t offer as many payment options as the others, but it does include some of the most popular such as bank transfers, credit/debit cards, and PayPal.

For this platform, fees work a bit differently.

There isn’t a clear categorization between takers and makers since both pay the same trading fee – 0.001 BTC. Also, there is a mining fee that stands at 0.0003 BTC, and it is charged three times (deposit, actual trade, and withdrawal), making it a total of 0.0009 BTC.

To make the platform safe from scheming traders, there is a security deposit that stands at 0.1 BTC.

Withdrawal fees are a third of the mining fee, which means they stand at 0.0003 BTC. This withdrawal fee is lower than the industry average, which stands at 0.0005 BTC – 0.0008 BTC.

If you are looking for an alternative platform with competitive fees for LocalBitcoin, BisQ might be the right choice.

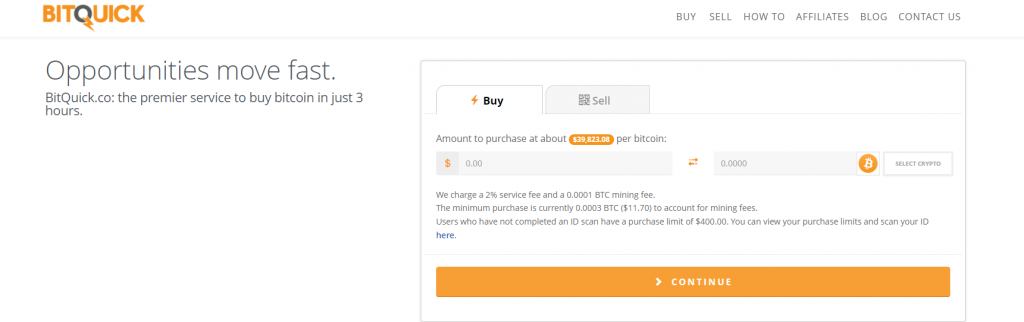

Bitquick

Those users who prefer dealing in cash and want to avoid disclosing any private details about their identity may find BItQuick the ideal alternative for LocalBitcoins.

Based in the US, BitQuick is a P2P platform that mostly focuses on allowing users to trade cash for BTC. This means that users can only buy or sell BTC through cash, cheques, or wire transfers.

The platform even allows users to register with an alias if they want to keep their identity disclosed. Once you register and find a deal that you like, you can go to your nearest bank and deposit money based on the trade conditions that you agreed upon.

When you upload the deposit receipts to BitQuick, your wallet will be funded with the coins you purchased.

KYC verification isn’t mandatory, and the platform developers have stated that this isn’t going to change in the foreseeable future.

As we mentioned, the only payment method available on BitQuick is cash. This has been the prime focus of the platform ever since it was released, and other options such as online payments aren’t featured.

✍️ The fee system on BitQuick consists of mining fees and service fees. The concept is fairly easy to understand – buyers pay 2.00% of TOV (Total Order Value) as a fixed fee to the platform. Sellers aren’t charged with anything. This gives new sellers the opportunity to divest BTC free of charge.

Mining fees stand at 0.0001 BTC for Bitcoin deals, which is very low compared to the industry average.

Trading fees aren’t included since the platform doesn’t function as the average crypto exchange. There is only a 2% service fee for buyers and a 0.0001 BTC fee for mining.

Withdrawal fees are also irrelevant due to the nature of the platform. However, the BTC mining fee can be viewed as a withdrawal fee in some way.

Read also:

- Best Crypto Leverage Trading Platform in the USA

- Best Crypto Derivatives Exchanges

- BitOffer Review

- SouthXchange Review

- LCX Exchange Review

- Is ChangeHero Safe?

- DigiFinex Review

- PocketBitcoin Review

- CoinEx Exchange Review

- Is DexTrade Safe?