What you'll learn 👉

CEX.IO Loans

Cex.IO is a multi-functional crypto exchange offering a wide array of products such as trading, staking, and crypto collateralized loans. Founded in 2013 it now serves over 4 million customers all around the globe.

Getting into the crypto space so early CEX.IO is a pioneer in offering fiat-to-crypto transactions, by card payments and bank transfers.

The exchange currently offers trading tools for Bitcoin, Bitcoin Cash, Ethereum, Ripple, Stellar, Litecoin, Tron, and other crypto-assets that you can buy with USD, EUR, GBP, and RUB.

CEX.IO employs a team of over 250 employees based in offices all around the world: in the United Kingdom of Great Britain and Northern Ireland, United States of America, Ukraine, Cyprus, and Gibraltar. The company is always regulated and holds licenses in reliable jurisdictions registering with Money Services Businesses (MSB) with the Financial Crimes Enforcement Network (FinCEN), part of the US Department of the Treasury, among others.

So it is safe to say that CEX.IO is as legit as they come with a proven track record and regulatory compliance.

Now let’s take a closer look at the CEX.Io loan function.

How can I get a loan?

Fortunately, CEX.IO makes this step as easy as possible.

- If you are new to the platform, register to CEX.IO

- Just like with a bank to take out a loan you need collateral. So transfer Bitcoin, Ethereum or any other

- The interest and total owned is calculated automatically. You can then agree to the terms and get a loan.

What coins can you use as a collateral?

As of now, CEX.IO supports ETH, BTC, XLM, LTC, and LINK.

Does Cex.io require KYC?

To do anything your account is always required to be at the Address Stage. But you’ll need to include further verification if you plan to withdraw your loan. For information about withdrawal limits and upgrade the verification when necessary.

Does Cex.io Loans check your credit score?

There’s no credit scoring or checks on CEX.IO

Supported countries

Crypto collateralized loans on CEX.IO are available in all countries other than the USA, UK, Germany, Netherlands, Singapore, American Samoa, United States Minor Outlying Islands, Japan, and the sanctioned countries that are listed in the CEX.IO terms.

How can I withdraw the loan?

Users can withdraw their funds by bank payment, instant withdrawal to your credit card, or send them to a Skrill. To learn more consult https://cex.io/trade/withdrawal.

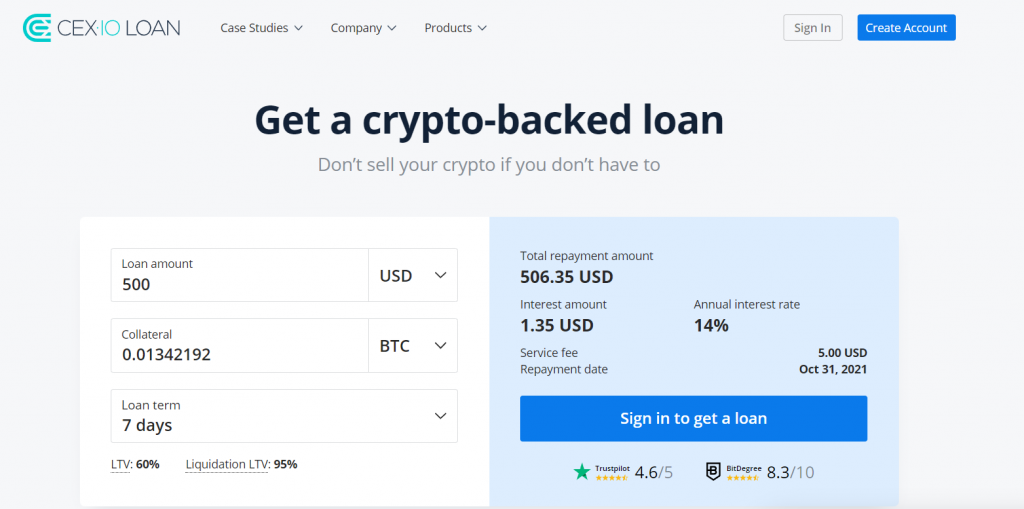

What are the minimum loan terms?

Interest rates start at 8% with a minimum loan amount of USD 500 or EUR 500. Once the loan is taken the minimum repayment term is 7 days. LTC varies between 30% and 60%, depending on the currency.

What is the maximum loan size?

The maximum loan size is USD 100,000 or 100,00 EUR. Higher loans are possible but you have to request a higher loan limit to customer service or your account manager.

What happens if I do not repay the loan on time?

CEX.IO will repeatedly notify users of their loans, in days upcoming the repayment date. If you are unable to pay the date will automatically be extended by 7 days. If this happens you will be charged 0.25% in overdue interest, which is approximately 13%.

Once you miss a payment after the extended period, you’ll get 7 more days for credit. So the loan is extended as many times as you need, as long as you offer enough collateral. But of course, your loan debt increases after each extension and so does the overdue interest.

What will happen, and what should I do, if the collateral value drops?

The collateral has to always be bigger than the loan debt. But as long as there’s only a small drop in the collateral price, for example, 5%, nothing happens. But in case of a bigger drop in value the risk of it not being able to cover the debt grows.

This could lead to the collateral value exceeding the liquidation LTV of the loan debt, and unfortunately, that means CEX.IO will liquidate your assets. The LTV liquidation rate varies from 65% for LINK to 95% for BTC.

Additionally, you will also be charged a liquidation fee. The amount retrieved from the liquidation is used to repay the loan debt. This is of course not the best, so to reduce the risk of liquidation you can always add a collar and increase the value of the loan collateral and reduce LTV.

Can I get a crypto loan without collateral?

Like with all loans that are unfortunately not possible. The collateral secures the loans and protects the business, so it’s necessary.

Read also:

- Best Bitcoin Lending Sites – Crypto Loans Explained

- Coinloan review – Is CoinLoan Safe & Legit?

- BlockFi vs Nexo – Fees, Interest Rates & Security Compared

- Blockfi Review: Pros & Cons, Fees, Security Examined

- Binance Earn Review – How Do Binance Fixed & Flexible Savings Work?

- YouHodler Review – Is YouHodler Scam or Legit?

- Celsius Network Review – How Legit Is This Crypto Loan Provider?

- Can You Get a Bitcoin Loan With NO KYC & Collateral?

- Best Bitcoin Savings Accounts – Are Crypto Savings Accounts Safe?

Verdict

CEX.IO is a legit company with a proven track record of success and is a veteran in the space. Bursting into the scene in 2013 has led the way for multi-function crypto exchanges.

That being said, the interest CEX.IO offers on loans is competitive with much bigger competitors such as Nexius and Celsius. The interest tends to be higher on CEX.IO, but so does the LTV.

Unfortunately, though

In conclusion, CEX.IO is a decent platform if you prefer higher LTV and do not mind paying a bit more for it.