Binance Earn Review – How Do Binance Fixed & Flexible Savings Work?

Are you considering dipping your toes into the world of cryptocurrency investment and wondering what is Binance Earn? As one of the most popular platforms in the crypto space, Binance Earn has piqued the interest of many investors.

But is Binance Earn worth it? Is Binance Earn safe? These are common questions that we’ll address in this comprehensive Binance Earn review.

In this article, we’ll delve into the specifics of Binance Earn and Binance Savings, two key features of the platform that have revolutionized the way we can grow our crypto assets. We’ll explore the ins and outs of these services, helping you understand their benefits and potential risks. By the end, you’ll have a clear picture of whether Binance Earn aligns with your investment goals. So, let’s dive in and unlock the potential of your cryptocurrency investments.

Binance offers several ways for members to not only earn from their crypto assets but also maximize output thanks to a variety of investment opportunities available. The multiple investment options available are all grouped under the Binance Earn banner.

Binance Earn refers to a number of features that allow Binance users to invest in Bitcoin and other crypto assets. These investment products may be in the form of lending, staking, buying, and selling. Users can select a set of products that is compatible with their coin and also maximizes yield.

| Topic | Summary |

|---|---|

| 💰 Binance Earn | Binance Earn is a platform that allows users to earn interest on their cryptocurrency holdings. It offers a variety of products including flexible savings, locked savings, activities, and locked staking. The platform supports a wide range of cryptocurrencies and offers competitive interest rates. However, the rates can fluctuate based on market conditions. |

| 🔒 Binance Savings | Binance Savings is a part of Binance Earn, offering flexible and locked savings accounts. Users can earn interest on their crypto assets with the flexibility to access their funds at any time in the flexible savings account, or lock them for a fixed period for higher interest in the locked savings account. The platform is user-friendly and offers high deposit limits. However, it is not accessible in certain regions, notably the U.S. |

Key features in Binance Earn are;

- Dual Savings

- Liquid swap

- Launchpool

- DeFI staking

- Locked staking

- Fixed savings

- Flexible savings

Below is a brief overview of each of these products;

What you'll learn 👉

Dual Savings

Dual savings or dual investments allow users to invest in one cryptocurrency and earn interest based on two assets. In this case, users lock up their funds in yield pools and earn more when the value of the committed assets goes up. It is a strategy used by investors to minimize risks.

At the expiry of the products, users have a choice to select one of the products committed. The product selected offers the highest possible non-guaranteed floating earnings without exposing the user’s assets to many risks.

Binance Liquid Swap

The Binance Liquid Swap is based on the principle of Liquidity Pools which combine the advantages of centralized and decentralized financial services and allow users to maximize yields and offer liquidity on the Binance Lending platform.

Users can also exchange their tokens in liquidity pools and benefit from low landing fees and low slippage. This platform is very flexible and users can remove their assets at any time.

Launchpool

Users stake their cryptocurrencies in DeFi and offer liquidity in liquidity pools in rewards for rewards paid on top of their staked assets. Not enough, users can also participate in Yield Farming by reinvesting their earned rewards to earn even more rewards.

Binance launched the Lauchpool to enable users to farm new digital assets and staking cryptos like BNB and BUSD. The assets deposited in the Launchpool can be accessed by the owner at any time.

DeFi Staking

Decentralized Finance (DeFi) uses smart contracts built on a blockchain to offer decentralized services to users. Binance allows users to participate in decentralized projects through DeFi staking using an intuitive, user-friendly, and straightforward platform.

With DeFi staking, crypto holders can earn from their digital assets without acquiring resources, managing private keys, making trades, or performing other complicated tasks. It is a way to earn the highest returns in the simplest and safest way.

Locked Staking

Locked Staking allows users to gain rewards by staking their crypto assets on the blockchain. The rewards earned can be redeemed after a successful subscription. To redeem their rewards, users need to give a certain unlocking period which may differ depending on the asset held.

Binance Savings Interest Account Overview

Binance Savings is a cryptocurrency interest account where users deposit their crypto assets and earn interest. Currently, the platform offers four different types of accounts;

- Flexible Savings

- Locked Savings

- Activities

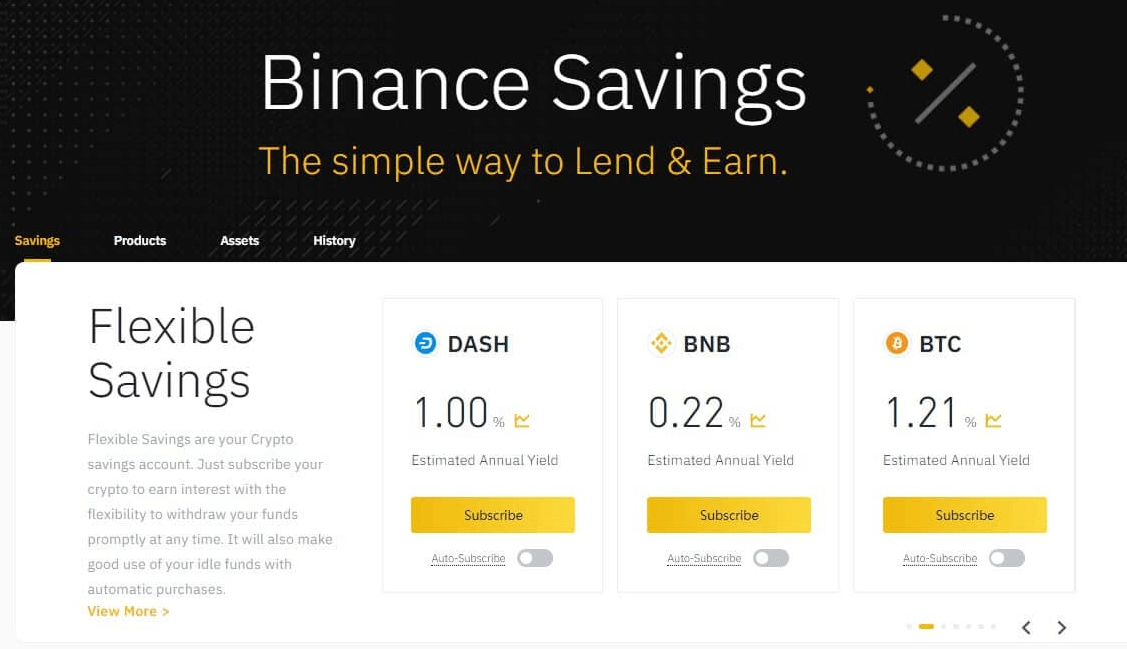

Binance Interest Rates (APY) – Flexible Savings

Users earn interest on assets held in Flexible Savings accounts on a daily basis. The earned interest can be withdrawn at any time without attracting penalties or fines.

Flexible Savings Binance Account Information

Binance Earn users can use the Flexible Saving feature to lend and earn interest from their idle crypto assets. Flexible Savings is the holder’s Crypto savings account and where loanable crypto assets are held as they earn interest.

The account is very flexible meaning users can access and withdraw their funds at any time. Users can withdraw their loaned amount plus the interest accumulated in real-time funds credit. Below are terms associated with the Binance Flexible Savings account;

Depositing Funds

To subscribe to Flexible Savings accounts, users are required to specify a deposit amount. The amount stated is deducted from the user’s Binance crypto exchange wallet. From the wallet, the funds are locked in the Flexible Savings account for the entire period selected. Funds are usually locked up for a day and unlocked the following day plus the earned.

Automated Transfer

The Flexible Savings auto-transfer feature allows Binance spot traders to earn interest on their idle crypto assets. Using this feature, Binance automatically transfers users’ available balance from the wallet Binance exchange wallet to their Flexible Savings wallet. This feature can be activated for all listed cryptos.

Redeeming Funds

Flexible Savings account holders are required to choose between two categories to redeem their earned interest; ‘Standard Redemption’ and ‘Fast Redemption’. With Fast Redemption, the funds are immediately made available after requesting a withdrawal. However, the user does not earn interest on the day the money is retrieved. For ‘Standard Redemption’, the requested withdrawal is completed the following day and the money continues to earn interest until the transaction is fully executed.

Daily Deposit Limitations

All deposits on Flexible Savings are disabled every day from 23:50 to 0:10 UTC by Binance Savings are disabled. The platform disables specific crypto assets after daily subscription quotas for Flexible Savings accounts are achieved. Users who subscribe to a particular field quota are advised to subscribe the following day.

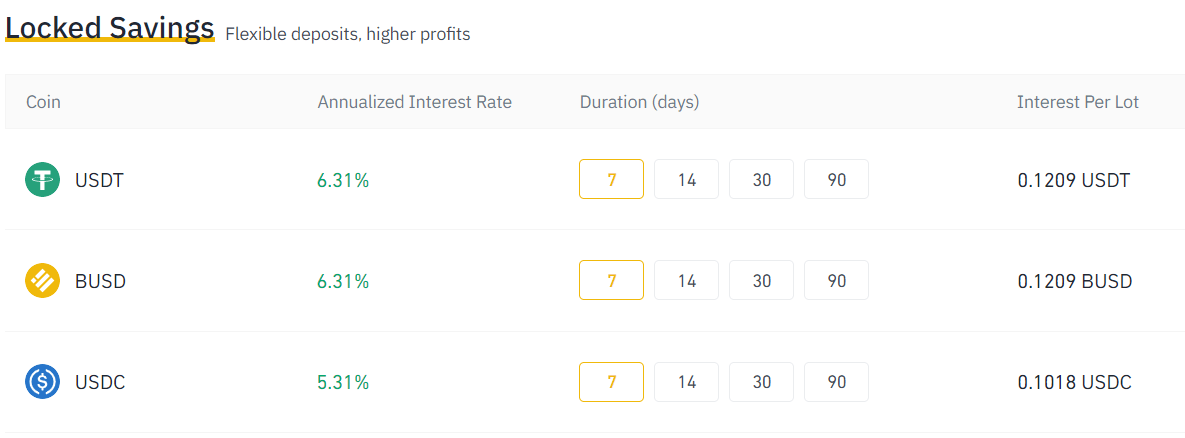

Binance Interest Rates (APY) – Locked Savings

Funds locked in a Locked Saving account earn interest for a specified fixed period of time. With Locked savings accounts, longer periods offer higher APY. While Binance seems committed to expanding its flexible savings and subscription savings, the company seems not to be doing much with the locked savings. Below is key information on a locked savings account;

Depositing Funds

Funds in a Locked Savings account are locked for a fixed period of time with options of 7, 14, 30, or 90 days. The selected amount is transferred from the user’s Binance Spot Wallet to their Locked Savings account.

Deposit Limits

Funds locked in Locked Savings accounts are bundled in units called “lots”, which the user purchases. Currently one ‘lot’ is equivalent to 100 Binance USD (BUSD). There is a ‘lot’ subscription limit for every user. Each individual user is allowed to hold a maximum of 5,000 BUSD ‘lots’, which amounts to a maximum deposit of 50,000,000 BUSD in a ‘Locked Savings’ account.

Early Withdrawals

Those with funds in Locked Saving accounts have the option of transferring part of it to a Flexible Savings account if there is a need to access the funds before the end of the fixed term.

Redeeming Funds

The fixed term of a Locked Savings account expires on the ‘Redemption Date’ upon which they are made available to redeem. Binance automatically unlocks the funds and sends the total amount consisting of the principal and the accrued interest from their Locked Savings accounts to their Binance ‘Spot Wallet’.

Read also:

- Binance Staking Review – How to Stake Coins on Binance?

- Binance Coin (BNB) Price Prediction

- Binance Tax Calculators – 3 Steps to Calculate Binance Taxes

- Best Wallets for Binance Coin (BNB) – Beginner’s Guide

- Binance Crypto Debit Card Review – When Do We Get It?

- Binance Alternatives & Competitors

Terms of Flexible Savings products

Average Annual Return (AAR)

The Average Annual Return (AAR) is the daily interest that a user is entitled to every day . This figure does not necessarily need to equal the exact interest you get and it is mainly used to project future earnings using past trading data. The AAR is calculated by multiplying the average daily interest rates from the last 7 days by 365.

Interest per thousand

The daily interest per thousand tokens of a certain cryptocurrency is determined by the daily interest rate.

Subscription and redemption

Flexible Savings account holders can access and redeem their funds at any time and the funds are credited in real-time. In addition, the funds are made available immediately after redemption. Interest is calculated from the day of subscriptions and the interest earned is distributed two days after subscribing. The subscription day is not included when calculating interest earned.

Interest calculation

Binance Earn is able to pay its users interest from the income of Margin. The income is calculated and distributed according to rules put in place by the platform. The software is able to calculate and distribute interest on Flexible Saving products to users within the set time period. The principle and the accrued rewards are paid into the user’s exchange wallet.

Minimum accountable interests

The interest earned is distributed to members’ wallets every day and the total amount earned is dependent upon the number of redeemable tokens. The amount of interest earned is rounded off to 8 decimal places.

Interest distribution

The interest is calculated between 0:00 and 8:00 (UTC + 0) on the second day after the day of subscription. Sometimes system calculations, network delays, and other issues may cause delays in distributing the interest.

Binance Savings Interest Account Alternatives

The cryptocurrency has been growing and evolving and savings accounts have emerged as one of the easiest, safest, and most convenient ways to earn from their crypto assets. Below are top alternatives to the Binance Savings account;

BlockFi

BlockFi offers some of the highest interest rates in the cryptocurrency industry for crypto assets held in its savings accounts. Users earn interest of up to 8.6% on assets held in their BlockFi Flexible Savings accounts. This rate is average and the exact rate is reliant on each cryptocurrency selected by the user.

Coinbase

Coinbase is one of the leading players in the cryptocurrency industry with a main mission of streamlining the buying and selling of cryptocurrencies. The company recently entered into the crypto savings industry where account holders can earn up to 1.25% interest.

Voyager

Voyageris also a key player in cryptocurrency investment where users can invest in more than 50 coins and tokens through buying, selling, and swapping. The company has a mobiles app that is available for Android and iOS users.

Crypto.com

Compared to its counterparts in the crypto savings industry, Crypto.com offers access to a larger number of crypto assets to invest in including Bitcoin, Ethereum, Chainlink, and stablecoins like TrueUSD and Tether.

Nexo

Nexo users earn daily interest from their coins. The platform is very flexible and holds users’ funds for only 24 hours after which they become available for redemption. Users can have an interest of up to 12% APY and the platform protects members’ investments with more than $100 million in insurance.

Other popular crypto lenders include YouHodler, Coinloan, Spectrocoin loans, and other major exchanges that offer crypto loans and savings accounts (like Kraken, Gemini, and FTX).

Flexible Savings vs Locked Savings

| Interest Account Type | Interest Rate | Pros | Cons | Best For |

| Flexible Savings | Interest rates vary | – Users can access their funds at any time – The auto-subscribe feature enables users to automate their interest earnings | – Lower interest rates compared to Locked Savings Binance accounts – Rates keeps changing in response to user demand and market conditions | – Well-suited for users who want the flexibility to access their funds at any time. |

| Locked Savings | Offers fixed interest rates for 7, 14, 30, or 90 days. | – Higher interest rates compared to flexible savings accounts – Rates are much stable and don’t keep fluctuating | – Users are required to lock up their funds during the entire duration | – Users who don’t mind trading easy access to liquidity for higher interest |

Activities and Locked Staking

In addition to savings accounts, Binance Savings also offers two additional products;

- Activities

- Locked Staking

Activities have a limit on the number of crypto assets eligible for interest earning. Users subscribe to this product on a rolling basis. This means they are not guaranteed of renewing their subscriptions for a certain asset.

Depending on the type of asset held, some users earn higher APR through Activities compared to putting their funds in Binance Savings interest accounts. However, the product offers a much shorter-term option of between 7 to 30 days.

With Locked Staking, users earn additional staking rewards on top of regular rewards earned supported Proof of Stake assets. The term of lock up and the interest rates vary depending on the type of asset. Generally terms range between 7 and 90 days.

Binance is not a regulated platform. They are not transparent with their official location and regulatory status. This means that you are handing over your funds to an entity that is not subject to any major jurisdiction and, in case of an issue, it would be very hard to legally force Binance to return your money. Your funds could end up being frozen or your account banned (which happens to some people, check Reddit to read their experiences) for no apparent reason. Since Binance customer support is pretty slow and often quite unhelpful, keep this in mind before you pour large amounts of money into Binance Savings account.

Is Binance Savings safe?

All Binance accounts support whitelisted withdrawal addresses, two-factor authentication (2FA), and anti-phishing codes. Users must authorize all devices that try to access the accounts.

Are user funds on Binance Savings insured?

Crypto assets stored in Binance Savings are not insured by traditional insurance policies. Instead, the company takes 10% of the fees charged on Binance.com and uses it offers insurance.

Does Binance Savings require KYC identity verification?

Binance Flexible Savings and Locked Savings account holders do not undergo KYC verification. Users can deposit any amount undergoing KYC. However, the platform limits withdrawals to2 Bitcoins (BTC) every 24 hours. Additional withdrawals above 2 Bitcoins main require the users to complete KYC verification.

Can I earn interest on my Bitcoins with Binance Savings?

Binance Savings supports Bitcoin (BTC) deposits and interest payments

What is the Redemption Date for Binance Locked Savings accounts?

This is the date on which the term of a Locked Savings account ends. Users can choose from various terms including EOS (7 days), or DASH (7 days), USDC (7, 14, 30, or 90 days), USDT (7, 14, 30, or 90 days), and BUSD (7, 14, 30, or 90 days).

Summary of Binance Flexible Savings Review

Binance has stamped its position as a global leading cryptocurrency exchange with the introduction of Binance Savings and other financial products. With the industry still picking up steam, this product is expected to be developed further to improve usability, include additional features, and increase its efficiency.

The Benefits

Here are the top benefits you stand to get by using the Binance Earn accounts;

- The account offers a high limit for most supported cryptocurrencies. Most cryptos have limits of $50,000,000 and above.

- There are no fees charged on the platform on deposits, withdrawals, and interest.

- The platform is friendly to beginners who can use the auto-transfer feature to automate interest earning from their cryptocurrencies.

- Users have the option to choose between Locked Savings and Flexible Savings based on their needs.

The Drawbacks

- To earn higher interest, users need to choose the Locked Savings account where fund are locked up for 7, 14, 30, or 90 day.

- Interest rates keep fluctuating due to changes in demand and supply as well as market conditions.

- Binance Saving is not available to users in the U.S. This has opened up competition with other platforms like BlockFi, Celsius, and Nexo, which are available in the U.S.

Legal & Regulation – Facts & Figures

| Legal Name | Binance Holdings Limited |

| Incorporated Country | Malta |

| Headquarters | Singapore |

| Year Founded | 2017 |

| CEO | Changpeng Zhao (aka. CZ) |

| Total Employees | 251-500 |

| Regulators | Malta Financial Services Authority, Malta Digital Innovation Authority |

Yes I would love to invest in locked savings. I surely love your way of doing things and I trust you so much.