ByFi Review (ByBit Earn Review) – How Good Are Interest Rates on ByBit Earn?

Trading is a well-known method of earning profit from the crypto world. It doesn’t seem like there is much to it. You simply buy when the price is low and sell when the price is higher. However, those who have been in the crypto world will tell you that it is not as simple as it sounds.

However, the boom of decentralized finance in recent years has introduced other ways of earning from crypto apart from trading. This article will treat some of the ways of earning passive income as presented by ByFi center, a subsidiary of Bybit exchange.

What is BYFI Center? How can it be of help to you? Allow me to answer those questions in this article.

What you'll learn 👉

WHAT IS BYFI CENTER?

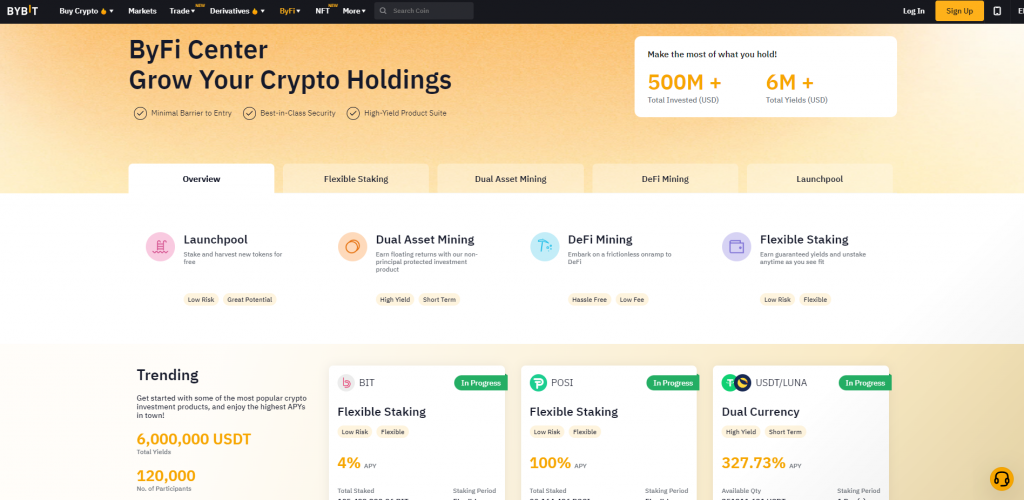

BYFI Center is a cryptocurrency asset management platform developed by Bybit in May 2021 that helps investors grow their cryptocurrencies and offers a competitive APY(annual percentage yield). Its services are flexible staking, DeFi mining, launchpool, and dual asset mining. Let us discuss these services in detail one after the other.

KEY SERVICES

LAUNCHPOOL

This is a service offered on Byfi by Bybit whereby investors are invited to deposit some of their tokens in exchange for newly listed coins. Most times, you stake BIT, the native token of the Bybit exchange, and get the new tokens. The APY is higher than those of other exchanges but usually depends on the number of participants.

You may wonder, though, if the launchpool is available to everyone. Well, all you need to do is to have a Bybit account and complete level 1 KYC (know your customer) verification. How can you do that? Follow the steps below:

- Sign up for a Bybit account ( for new users) or log into your account(for old users).

- Tap on profile account and security

- Click ‘verify now’ under account information

- Tap ‘identity verification.’

- Verify.

Now you are set!

As with all investments, Bybit launchpool no doubt has benefits and risks. Some of the benefits are

- It generates passive income for investors

- You gain exposure to alternative tokens

The main risk of investing in ByFi launchpool is that there is no guarantee that the new tokens you’ve gained will have much value. This is not much of an issue, though, as your capital is protected.

DUAL ASSET MINING

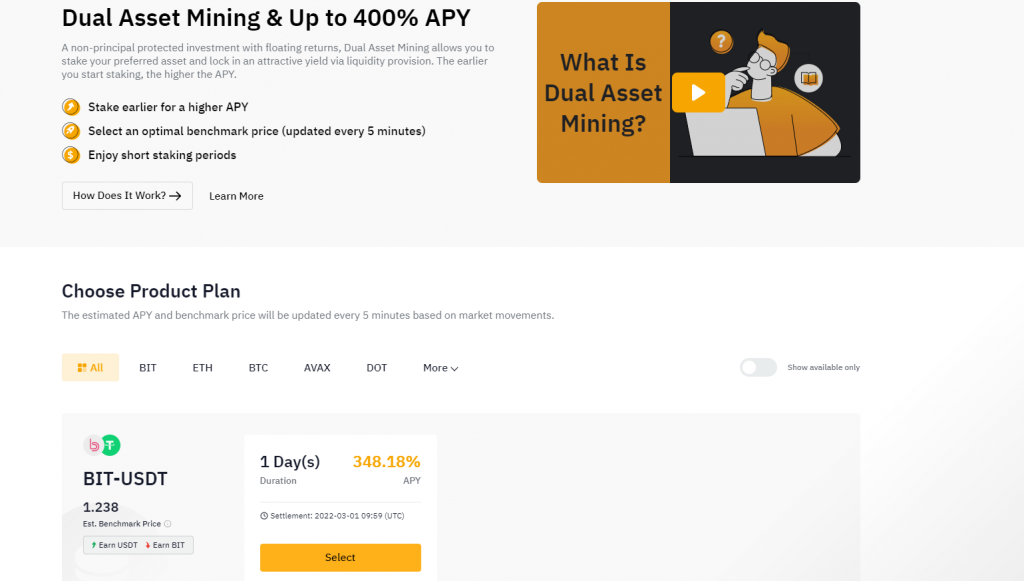

This is an investment with high-end returns allowing traders to deposit cryptocurrency assets and, in turn, get enhanced yield in a different currency or the same currency deposited.

In dual asset mining, you can make a bet on your primary assets market movement (above Benchmark or below Benchmark price). You can also stake or lock your assets for a favorable yield. By doing so, the market settlement price has no adverse effect on your assets and your earnings.

The varying returns of dual asset mining are based on two key factors

- Settlement Price: The specific price of a coin (USDT) when chosen product plan ends

- Benchmark Price: The specific price of a coin (USDT) when the chosen product plan begins.

When the settlement price for an asset (crypto token) goes above the benchmark price, the principal and yield will be automatically converted to stable coins. This move sells your token at a higher price giving you more stablecoins.

However, when the settlement price goes below the Benchmark price, you will receive an equivalent of your staked asset and yield in the form of cryptocurrency tokens. With this, you will earn more tokens than you originally staked.

As we have seen, either way, you earn high yields. No matter the position of the market settlement price.

DeFi MINING

A major type of DeFi mining is liquidity mining. Let’s know what it entails. It is a DeFi mechanism where traders deposit their cryptocurrency into different mining pools and are, in turn, rewarded with a fraction of the trading fees when traders swap from such liquidity pools.

It is well known among crypto investors because it provides passive income to traders without making active investment decisions. APY (Annual percentage yield) refers to the interest rate generated by such pools yearly.

The APYs vary based on the number of liquidity providers in the pool and the length of time such liquidity will be locked into the pool. The interests are also compounded, ensuring that investors get even more earnings from the DeFi pools.

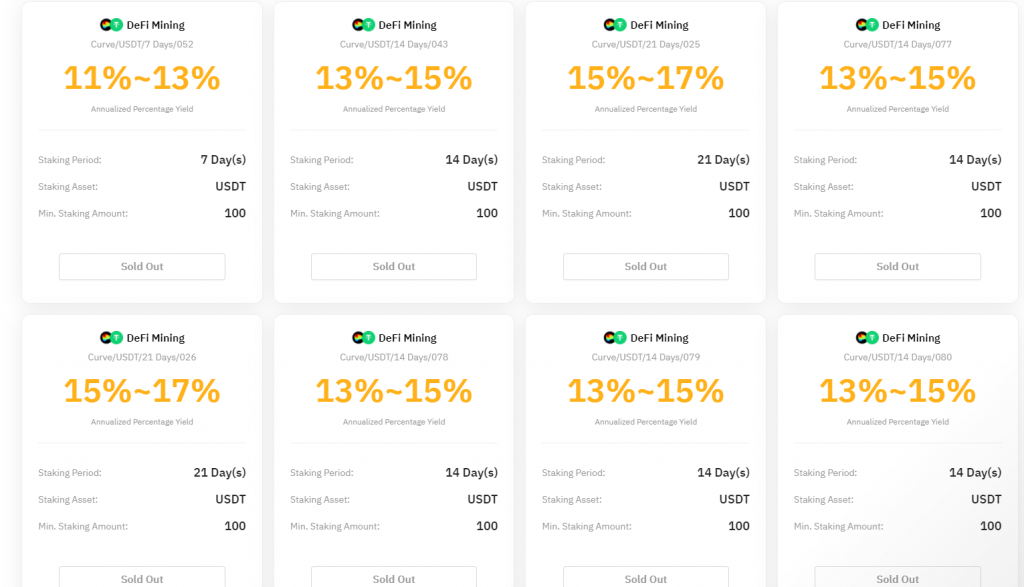

At present, the only coins on the DeFi mining page of ByFi are Curve and USDT liquidity pools. There are three different plans divided by the number of days. They are:

- Curve-USDT 7 days plan APY ranges from 11-13%.

- Curve-USDT 14 days plan APY ranges from 13-15%

- Curve-USDT 21 days plan APY ranges from 15-17%.

The advantages of liquidity pool mining are:

- There is a low barrier to entry, ensuring that even those with minimal funds can participate

- Potentials for high yield

- You have the opportunity to earn two tokens as rewards.

It also has some disadvantages, which include

- The risk of impermanent loss

- The project may fail, even though it may be genuine.

- Potential rugpulls.

FLEXIBLE STAKING

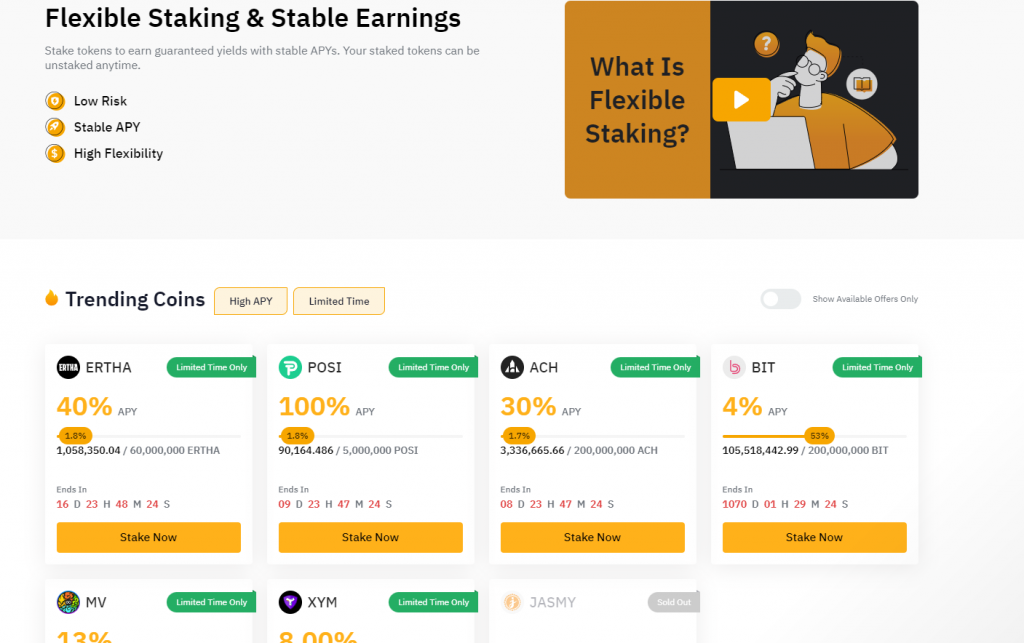

As its name implies, flexible staking is another service Bybit offers that allow traders to stake and unstake assets anytime they like. Staked assets provide yields to investors just as opening a savings account in a traditional bank yields interest.

The only difference is that you save fiat currencies in a traditional bank while Bybit flexible staking deals with cryptocurrency assets. Also, the interest rates are higher with flexible savings. Once unstaked, the assets are automatically refunded to the account of the trader.

To get started on Bybit flexible trading, you need to:

- Choose a coin to stake: new coins are updated now and then, and you can choose to participate in any event depending on the coin you have or the one you wish to stake. However, some coins are labelled ‘limited time only’, meaning they may not be there for long.

- Staking the coin: now that you’ve selected the coin you want to stake, you will be taken to a confirmation page, and there you will see more information about things like

- Yield calculation start time

- Yield distribution start time

- Maximum staling amount

- The total amount staked by all users

- Estimated APYs which vary depending on the token and market condition.

Next, you will be asked to click ‘stake’ and after this ‘proceed’. After you will be taken to a screen showing successfully purchased. That’s it; you are done!

Currently, there are only six tokens available on ByFi flexible staking. The coins and their APYs are listed below

- XYM with an APY of 8%

- JASMY with an APY of 7%

- BTC with an APY of 1%.

- ETH with an APY of 1%.

- USDT with an APY of 3%.

- USDC with an APY of 2.50%

Read also:

- Best Bitcoin Savings Accounts

- Binance Earn Review

- Celsius vs Voyager

- How to Make Money With DeFi?

- Can You Get a Bitcoin Loan With NO KYC & Collateral?

- Coinbase Loans Review

- What Are NFT Loans?