Navigating the intricate landscape of cryptocurrency can be a daunting task, especially when it comes to finding the best Litecoin mining pool. With a plethora of options available, it’s crucial to identify the best Scrypt pool that not only maximizes your earnings but also aligns with your mining strategy.

Litecoin, known for its Scrypt mining algorithm, has a vibrant community of miners who are constantly on the lookout for the best Litecoin pool. This article aims to guide you through the maze of options, providing insights into the top Litecoin mining pools that have proven to be reliable, profitable, and user-friendly.

From understanding the nuances of Scrypt mining pool operations to identifying the best LTC mining pool that suits your needs, this comprehensive guide is your one-stop resource. So, let’s dive in and explore the world of Litecoin mining pools, helping you make an informed decision and optimize your mining efforts.

| Mining Pool 📍 | Key Features 🔑 | Pros 👍 | Cons 👎 |

|---|---|---|---|

| 🔨 Poolin | Multi-currency support, High mining hash rate, Global presence, Regular payouts, Advanced mining software | Offers a wide range of cryptocurrencies to mine, High mining hash rate ensures better chances of earning rewards, Global presence allows miners from different regions to join | Being a Chinese-based pool, the majority of miners are from China, which may lead to potential language and communication barriers for non-Chinese miners, The pool may have higher fees compared to other options |

| 💰 LitecoinPool.org | Pay-per-share (PPS) pool, Merged mining support, Global server distribution, Secure mining over TLS-encrypted Stratum connections | Well-established and trusted pool with a long history, Merged mining allows miners to earn additional rewards from mining secondary coins, Global server distribution ensures low latency for miners from different regions, Secure mining over TLS-encrypted Stratum connections protects against potential attacks | Registration may require approval due to high demand and limited capacity, The pool’s hash rate may not be as high as some other options |

| 🌐 viaBTC | Combined pool for multiple cryptocurrencies, Multiple payment methods (PPS and PPLNS), Cloud mining option available, No transaction fees, only small maintenance fees | Offers merged mining, allowing miners to earn additional rewards from mining multiple cryptocurrencies simultaneously, Multiple payment methods provide flexibility for miners, Cloud mining option is suitable for those who don’t want to deploy their own hardware | The pool may not have as high a hash rate as some other options, Maintenance fees apply, which may reduce overall profitability |

The original Bitcoin core’s algorithm of SHA-256 was changed to the Scrypt algorithm. The Scrypt algorithm is very memory-consuming and makes it difficult to operate concentrated mining pools.

Let’s remind ourselves of a short definition of mining:

Litecoin mining is the processing of a block of transactions into the Litecoin blockchain. Litecoin mining requires solving for algorithms, and being the first to reach a solution is mining rewards with tokens as payment.

Click here if you want to read more on how and where to store Litecoin tokens.

What you'll learn 👉

Types of crypto mining algorithms

A hashing algorithm is a cryptographic hash function that maps data of any random size to a hash of a fixed size.

The most popular ones are:

- SHA-256 Algorithm: Algo generates a unique 32-byte (256-bit) signature for text strings. The block time in SHA-256 varies between 6 to 10 minutes and the hash rate is measured in Giga hashes (GH/s). Popular digital currencies that are based on SHA-256 include Bitcoin, Bitcoin Cash, Peercoin, Terracoin, JouleCoin, and several others.

- Scrypt Algorithm: This is a much faster Algo than the SHA-256 algorithm. You can mine on CPUs and GPUs using Scrypt. The hash rate is measured in kilo hashes (KH/s). Litecoin, Dogecoin, Latium, and Bitmark are a few among several more that are based on the Scrypt algorithm.

- X 11 Algorithm: It is highly energy-efficient, and the GPUs can run on 30% lesser wattage. The XII algorithm runs a sequence of eleven hashing algorithms for PoW (Proof of Work). The hashrate is measured in megahashes (MH/s). Some of the cryptocurrencies that use the X11 algorithm are Dash, StartCoin, CannabisCoin, XCurrency, etc.

- CryptoNight Algorithm: This algo was created with home miners in mind – it is designed to support mining on a personal computer CPU. This is the Algo most of the privacy-focused coins use. CryptoNight hashrate is measured in Hashes (H/s). Popular cryptocurrencies that are based on CryptoNight are Monero, Dashcoin, Bytecoin, FantomCoin, etc.

- Ethash Algorithm: Dagger Hashimoto is a proposed mining algorithm meant for Ethereum. It is a combination of two currently used works.

A] Dagger algorithm that comes as an alternative to the memory-intensive algorithms like Scrypt. But the dagger was susceptible to pressure in shared memory hardware acceleration.

B] Hashimoto algorithm meant to attain ASIC resistance by being IO-bound.

Dagger Hashimoto’s hash rate is measured in Megahashes (MH/s). The popular cryptocurrencies that are based on it include Ethereum, Ethereum Classic, and Expanse.

Solo Mining vs. Pool Mining

Solo mining used to be a thing in the dawn of cryptocurrencies. Right now, as the mining industry gets professionalized and corporated, solo miners are endemic species. But, the differences are still worth explaining.

It completely depends on the “pool fee”. If you do solo mine Litecoin, the blocks you mine will be completely random. You could mine two blocks in a day. You could go three weeks without a block.

If you mine in a pool, you take the pool fee right off the top. A 3% pool fee means you make 3% less. Also, most pools don’t pay transaction fees. But your revenue is more predictable. You’ll get paid on a regular basis, and your payments won’t vary much.

One disadvantage of a mining pool is its centrality – most pools today have central nodes that can be DDOSed, and if not configured accordingly, when a DDOS happens, the miner will just sit idly instead of reverting to a different pool or to Litecoin solo mining.

Unless you have a lot of computing power (several ASICs), you should probably mine in a pool.

How to choose a mining pool?

What are the criteria you should consider when choosing the right mining pool to join? Well, most of the below-listed criteria points are rooted in basic common sense, like fees (the lower, the better), pool reputation, and uptime.

Trustworthy pool operator ties into the pool reputation factor that we mentioned above. You don’t want to mine for people that will scam you out and run away with your money. This is probably the most important criteria to examine: do your research on the internet, ask questions in mining and crypto communities to see if there are negative reports and personal experiences with the pool.

Fees are self-explanatory; the lower the fees a pool charges for itself, the more money is left for you. Industry-standard is around 1% so anything around that figure is basically the norm.

When joining a pool, you certainly don’t want to be part of a pool that has just a bit more hash power than you. You want the pool to have a big hashrate to make sure it will mine a lot of blocks, and your minimum payout will be regular.

Server location and uptime – location plays a role because of the latency – you need to be quick in broadcasting that found block, especially when mining a coin with a huge hashrate and big mining difficulty.

Uptime is a big deal. Just like with regular websites, if it is offline when someone visits, the owner loses money. Same with mining pool servers – if they are offline, all miners in the pool lose money as nothing gets broadcasted to the blockchain.

Payout schedule is also a minor factor. It is an individual preference as some people like few bigger payments while others like a lot of smaller payments. If you need to choose, the latter is better just in case something happens with the pool – you don’t lose too much in that case.

Payout schemes are also a condition to pay attention to. There are numerous payout designs, some of the most common are

- PPS – Pay Per Share. Each submitted share is worth a certain amount of BTC. Since finding a block requires shares on average, a PPS method with a 0% fee would be 50 BTC divided by. It is risky for pool operators, hence the fee is the highest.

- SMPPS – Shared Maximum Pay Per Share. Like Pay Per Share, but never pays more than the pool earns.

- ESMPPS – Equalized Shared Maximum Pay Per Share. Like SMPPS, but equalizes payments fairly among all those who are owed.

- CPPSRB – Capped Pay Per Share with Recent Backpay.

- Prop. – Proportional. When block is found, the reward is distributed among all workers proportionally to how much shares each of them has found.

- PPLNS – Pay Per Last N Shares. Similar to proportional, but instead of looking at the number of shares in the round, instead looks at the last N shares, regardless of round boundaries.

- Score – Score-based system: a proportional reward, but weighed by time submitted. Each submitted share is worth more in the function of time t since start of current round. For each share score is updated by: score += exp(t/C). This makes later shares worth much more than earlier shares, thus the miner’s score quickly diminishes when they stop mining on the pool. Rewards are calculated proportionally to scores (and not to shares). (at slush’s pool C=300 seconds, and every hour scores are normalized)

Best Litecoin Mining Pools

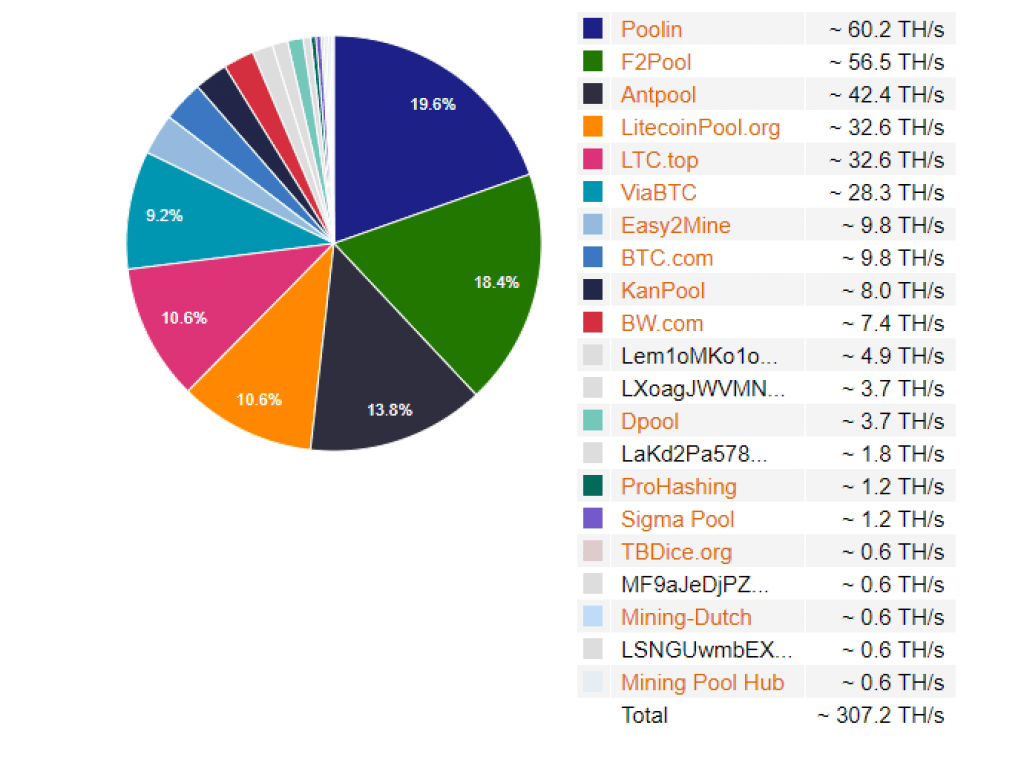

Similar to bitcoin mining, Litecoin mining is concentrated within the three biggest mining pools that constitute more than 50% of the hashing power.

Litecoinpool.org

LitecoinPool is one of the most renowned and oldest Litecoin popular mining pool, launched in November 2011 by one of the main Litecoin developers that goes under the moniker Pooler.

It’s a pay-per-share (PPS) pool that also supports merged mining as well, which can yield the best results at times thanks to the mining of the secondary coin (payouts for both coins are carried out in LTC). Plus, with the PPS system, you are paid even if a block gets orphaned by the Litecoin network.

One of the main reasons to pick this pool is due to its eight servers spread all over the world.

It’s also worth noting that this is one of the first pools to offer secure mining over TLS-encrypted Stratum connections.

It is currently the 4th largest LTC pool by hashrate, producing 32.6 TH/s of hashes.

ViaBTC

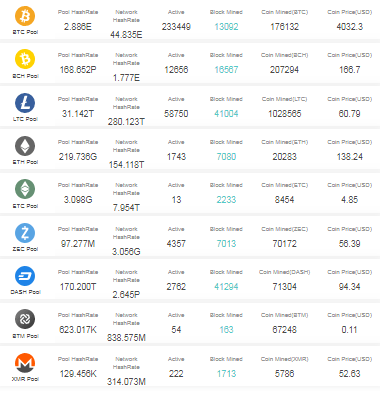

ViaBTC is a Bitcoin, Litecoin, Ethereum, Ethereum Classic, Zcash, Dash, Monero, BTM, and Bitcoin Cash mining pool that always hovers at the top of the hash rate percentages. ViaBTC.com opened its mining pool in 2016.

The pool initially mostly utilized the Antminer S9 hardware, at the time one of the most powerful ASIC mining devices. Since its establishment, ViaBTC has managed to maintain an uptime of greater than 99.9%, signaling consistency and dedication.

The pool takes a percentage of the mining income to acquire funds for managing the accounts and covering all normal maintenance, including costs for the mining farm, deployment, repairs, staff salaries, risk prevention, and any other necessary expenses. 4% fee is charged for the PPS payment system and a 2% fee for the PPLNS. Profits are distributed daily at 0 AM Beijing Time (minimum payout offered by the ViaBTC site is 0.0001 BTC). Their user UI is also lauded for its simplicity and usefulness.

ViaBTC is currently the 5th largest LTC pool, behind Litecoinpool.org and the three big ones we mention below.

BTC.com

Owned and operated by Bitmain, the world’s largest mining hardware producer, the pool was launched in 2015. The pool is said to be the one utilized by past Bitcoin community members and the current most famous Bitcoin Cash promoter, Roger Ver. The pool is one of the most prominent ones out there and offers a native Bitcoin wallet as well as a related forum with an active community.

The pool operates on a Pay per Share model where the operator gives an instant, guaranteed payout to a miner for his contribution to the probability that the pool finds a block. regardless of how many valid blocks the pool finds. This model allows for the least possible variance in payment for miners while also transferring much of the risk to the pool’s operator. The pool lets its user’s mine currencies like Bitcoin, Bitcoin Cash, Ethereum, Litecoin, Ethereum Classic, Grin, Beam, and Decred.

BTC.com has fees that range from 1.5% to 4%. The pool offers three types of cloud mining contracts and there is usually a requirement to join a waiting list to get one. It is one of the available pools that offer a chance to profit from Bitcoin mining. The payments miners get based on their contracts are delivered daily. Overall, the pool is considered legitimate by the community even though there are split opinions on Bitmain and its business practices.

BTC.com sits at the 8th spot of the Litecoin pool rankings.

ProHashing

Prohashing is a multi-cryptocurrency mining pool that pays miners in any coin. You can mine hundreds of coins on ProHashing, as they support SHA-256, X11, Scrypt, CryptoNightV8, and many other algorithms.

It uses the PPS payment model and was founded back in 2014 by three engineers. Prohashing also takes it a step further by merging mining at the same time to further increase profits. They offer other detailed statistics such as mining efficiency, miners count, hash rate, etc. For anyone who owns a Scrypt miner, this is one pool that is recommended, the ability for payout in any cryptocurrency or even USD via Coinbase is excellent.

It is currently buried down in the rankings as the 15th largest Litecoin pool.

3 large pools to avoid

The pools listed below are all big pools that we do not recommend joining because it would go against the ethos of the whole cryptocurrency idea which rests on the premise of decentralized, leaderless, peer-to-peer power relations. The three pools below already control more than 50% of the hash power which makes them central points of failure/control and possible threats to the long-term continuance of the Litecoin network and Litecoin token. Additional hashrate you would provide the pools with, would only cement their power and make Litecoin network suspect to a 51% attack by these three pools.

Poolin

One very young mining pool was created in 2018 in China. Launched by Blockin, a global online platform focused on developing blockchain-related technologies and enterprises. Poolin.com is a multi-cryptocurrency mining pool, supporting mining of Bitcoin (BTC), Bitcoin Cash (BCH), Litecoin (LTC), Dash (DASH), Ethereum (ETH), Monero (XMR), ZCash (ZEC), Monero Classic (XMC), and Decred (DCR).

Pooling offers a website with extensive FAQs and instructions on how to configure your mining setup and on pretty much anything mining-related that would interest you. Each of the minable coins comes with its own fee and payment method which are detailed here. Pooling might not be among the oldest and most talked about pools out there, but their hash rates speak for themselves.

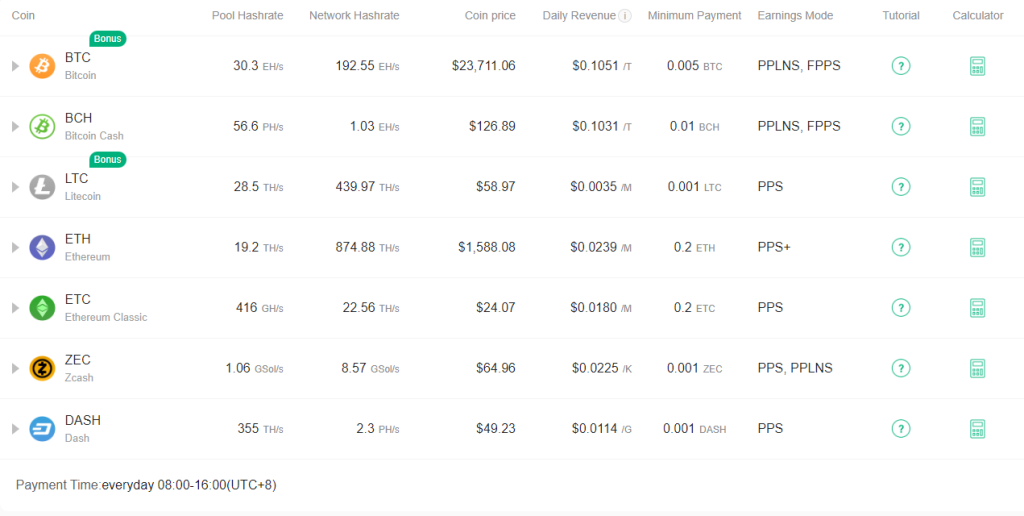

As we can see from the diagram, Poolin controls 60TH/s of hashing power on the Litecoin network as of March 30th, 2019.

F2P Pool

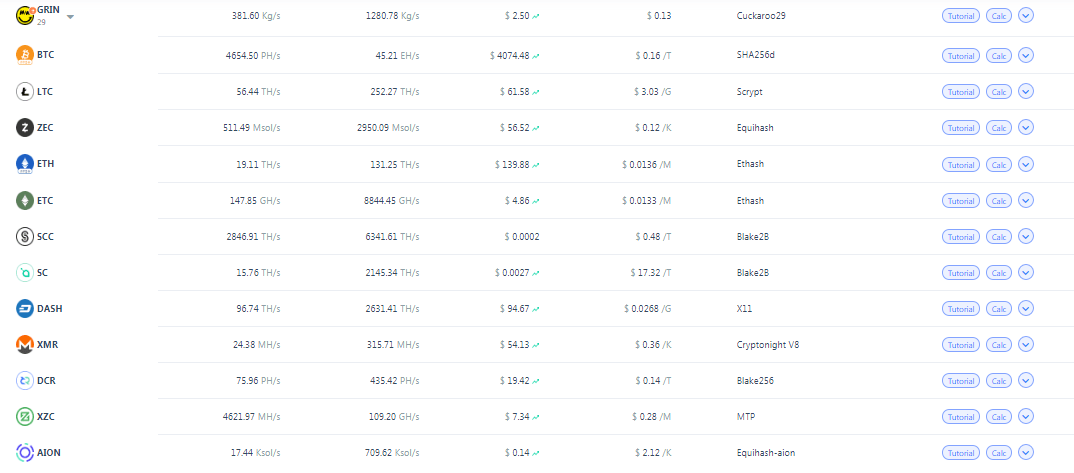

F2Pool is a Chinese mining pool that was created in 2013. Also among the network hash-rate heavyweights, it lets its users mine Grin, Litecoin (LTC), Ethereum (ETH), and Zcash (ZEC) besides Bitcoin. But the list doesn’t end here, below are all the coins you can mine on F2PPool:

It also offers merged mining with Namecoin, Syscoin and Dogecoin. Called the “Discus Fish” mining pool, which is a nickname stemming from their Coinbase signature. As the website was in Chinese and had no official English name people decided to call it 七彩神仙鱼 (Discus Fish), which was the nickname of one of the operators. Since then they’ve introduced the English interface option.

The website utilizes PPS payment method with 4% fees on transactions. The pool uses the Stratum mining protocol and offers port 25/80 mining, with daily automatic payouts enabled. It has minimum withdrawal limits which sit at 0.001 BTC, 0.01 LTC, 0.01 ZEC or 0.1 ETH. Their website is HTTPS protocol ready and can be criticized for not having 2FA enabled. The UI is simple and well presented, thus being suitable for beginners.

F2pool is currently the second-biggest Litecoin pool by hashrate, controlling 56.5 TH/s of the blockchain.

AntPool

Another one of the largest mining pools, AntPool, was founded in 2014. The pool was founded by Xu Lingchao and Tian Xin and operates from China. The pool currently lets you mine a fairly solid number of cryptocurrencies, including BTC, BCH, LTC, ETH, ETC, ZEC, DASH, SC, XMC & BTM. There have been very few complaints about the legitimacy of this pool throughout the past.

The pool is said to be supported by 2000 servers running all across the world to ensure it remains up all the time. The pool markets itself as “the most advanced mining pool on the planet” and currently supports 4 payment methods: PPS (2.5% fee), PPS+, PPLNS (0% fee), and SOLO (with daily settling of payments if they exceed 0.001 BTC).

AntPool offers three types of mining contracts. It also offers a wide variety of tools including a native phone app, APMiner Tool, Worker IP configuration Tools, and AP connectivity. Finally, the pool has a variety of security options, including two-factor authentication, email alerts, wallet locks, as well as a sleek interface suitable for beginners.

Overall AntPool is also seen as a trusted mining pool that will let you profit by mining coins. Some people cite their fees as being on the higher side but they justify this with the quality of mining service they offer. Overall, another solid pool to be a part of, whether you are an up-and-coming miner or a mining veteran.

Is Litecoin mining still profitable?

Depends on your gear, but if you don’t own an ASIC miner, it is not worth the setup and electricity. GPU and CPU mining are long unprofitable on the Litecoin network. According to coinwarz.com, mining Litecoin is only barely more profitable than bitcoin (assuming you can produce the same hashrate on both networks).

Conclusion – Best Litecoin Pool

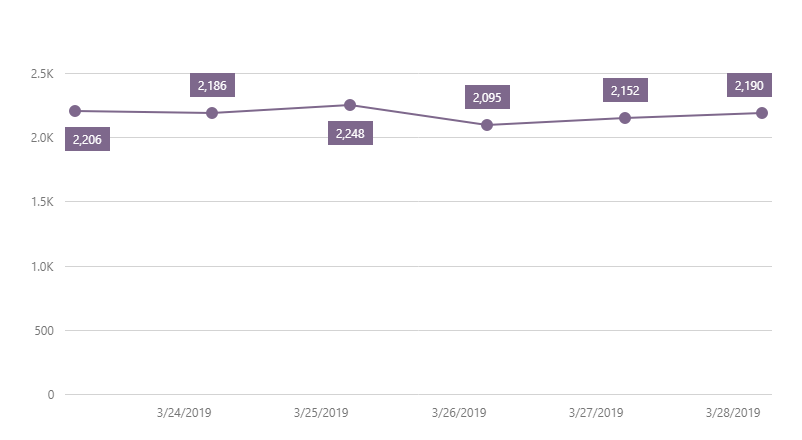

After a big slump in hashrate, back in January, the Litecoin network is back up in terms of TH/s capacity (above 300 TH/s). However, we personally don’t see any long-term future for Litecoin (read our prediction to see why) and would recommend you join pools that mine bitcoin instead, as that is your safest bet when it comes to cryptocurrencies’ survival.