Looking to make a smart investment in the burgeoning Arbitrum ecosystem? You’ve come to the right place! Our comprehensive guide will walk you through the best Arbitrum coins to buy this year. From DeFi platforms to innovative Layer 2 solutions, Arbitrum is quickly becoming a hotbed for promising projects.

But with so many Arbitrum coins popping up, how do you know which ones are worth your attention and investment? That’s where we come in. Dive into our article to discover the Arbitrum coins that are not only gaining traction but also have the potential to revolutionize the crypto space. Don’t miss out on the next big thing in the Arbitrum coin market!

| Arbitrum Coin | Description |

|---|---|

| 💰 Mux Protocol | A leverage trading platform with zero price impact trading and up to 100x leverage. It has a total volume of $6.5 billion. |

| 🎮 Pepe’s Game | A game with complex underlying mechanics that involves spinning to land on BTC or ETH. |

| 🗳️ PlutusDAO | A governance-focused project offering high APRs and versatile forms of Generalized Liquidity Provision (GLP). |

| 🆕 GND Protocol | A new project offering a yield-bearing, fully-backed stablecoin. It has a TVL of $23 million. |

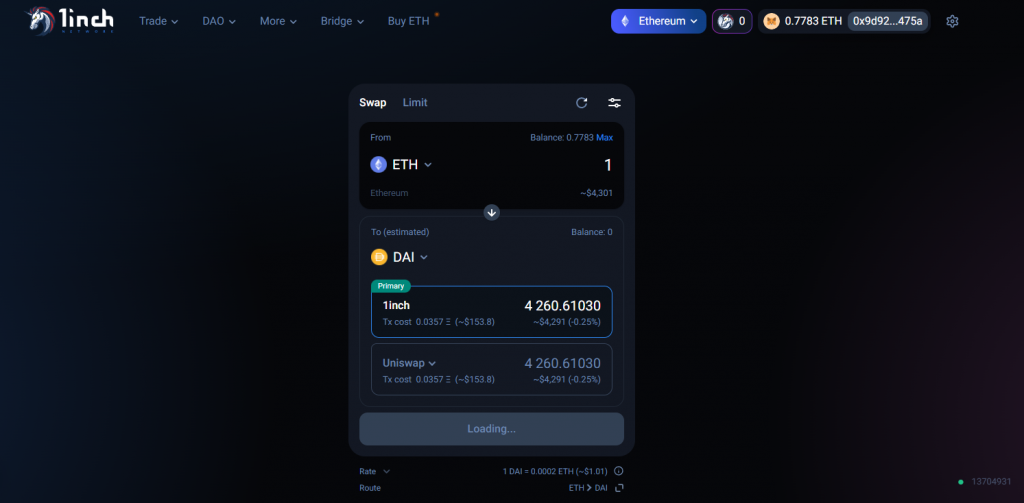

| 🔄 1inch | A DEX aggregator that finds the best trading rates across multiple platforms. |

| 🏦 Abracadabra | A lending platform that allows users to earn interest while also taking out loans. |

| 🌉 Synapse | A bridge project that enables easier and cheaper transfers between blockchains. |

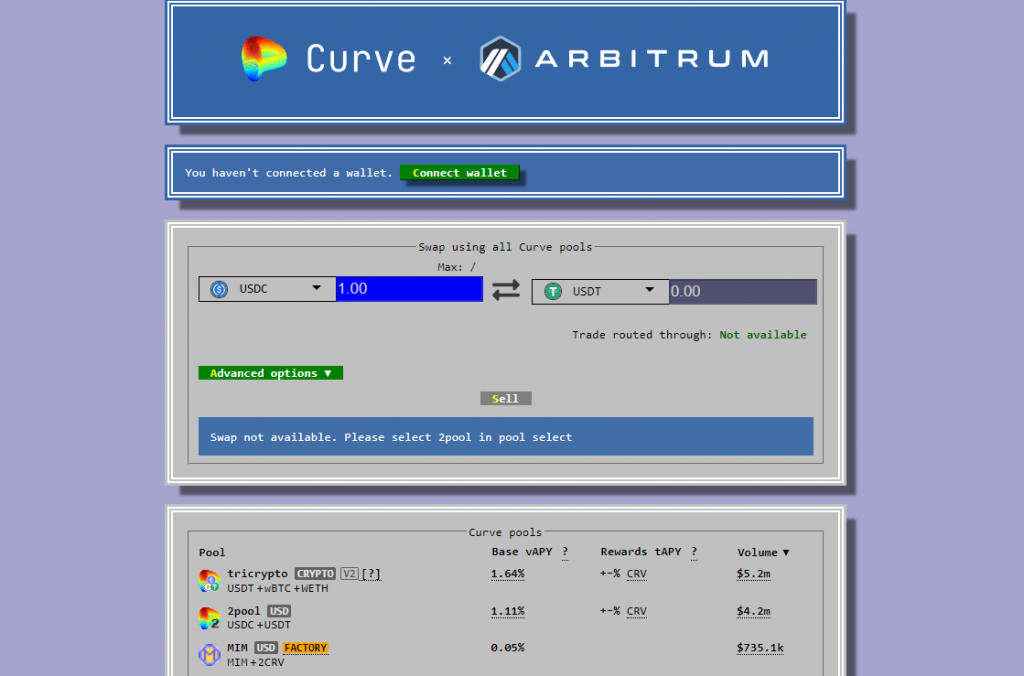

| 💹 Curve | An Automated Market Maker (AMM) focused on stablecoins, aiming to reduce user costs. |

What you'll learn 👉

What is Arbitrum blockchain?

As we all know ETH is a great project that has many followers and many projects on its blockchain. It is by far the most technologically advanced “idea” in the crypto market and everyone loves it. However, this technologically advanced idea ended up being congested because of how amazing it is. All of us being in love with ETH meant that we made it work too hard, and that is why ETH increase its value but also the gas fee.

Nowadays we are facing many projects that are working on scaling solutions for this situation. Arbitrum is solving exactly this problem. As you have seen, things like Solana and similar are working on the same thing, so Arbitrum does have some competition for sure. It is a project that needs to gain a lot more attention if it wants to succeed.

However, with 120 million dollars funding, they are in no rush and could definitely build a project that could last for years before it runs out of money for developing further. The only aim they have is to build a product that could sustain a much heavier load than ETH and could sustain without a problem and have very cheap transactions and fast pace.

DeFi and Layer 2

With ETH becoming a lot more expensive to use, there are a lot of people who keep on paying exorbitant fees just to move money around. With some swap/stake costs reaching as high as $100+ so it is definitely not sustainable. This resulted in new projects to create something called “Layer 2”.

Taking ETH as Layer 1, this means Layer 2 creates an additional layer of the ETH chain and only gets back in whenever you want to. For people who deal with simply one withdrawal or one deposit, this method is not really that important. After all, you are doing it just once, however, for people who use it daily, this is a lifesaver.

Imagine spending $3000 for 30 moves (could be swaps, could be LP, could be staking, anything in DeFi world), whereas you could spend $200 for getting in and out, and a maximum of $20 for the other 28 moves, making it simply just $220 for them all. Basically, it is just making all the moves you want off-chain and then going back on-chain when you are doing it, making it much cheaper and faster.

Best projects that are already live on Arbitrum?

Mux Protocol

Mux Protocol, symbolized as $MCB, is one of my preferred leverage trading platforms. There’s an abundance of these platforms out there, but what sets Mux Protocol apart is the zero price impact trading, the possibility of up to 100x leverage, and the absence of counterparty risks for traders. All of these are expertly intertwined with an optimized on-chain trading experience. @jediblocmates offers an extensive analysis on this platform.

The platform’s statistics are quite impressive:

- Total volume stands at $6.5 billion.

- Volume in the last 7 days is $420 million.

Their growth in April was noteworthy:

- MUXLP TVL (Total Value Locked) rose from $18.8 million to a new all-time high of $33.3 million.

- MUXLP Trading volume increased from $860 million in March to $1.6 billion in April.

Pepe’s Game

Pepe’s Game is a seemingly simple game that holds a complex underlayer. The goal is to spin and land on BTC or ETH, up or down, and on 20s, 30s, or 40s. However, the intriguing question is, what is the plan with all the accumulated $PLS?

Is the objective to collect all the tokens to amass all the voting power? It’s an exciting prospect to ponder, with a hint of mystery when it comes to the “Purple Frog x Green Frog”.

PlutusDAO

In my opinion, PlutusDAO is one of the most undervalued projects in the crypto world, and it stands out not just on Arbitrum. It’s the governance blackhole of the Arbitrum ecosystem and offers the best and most versatile form of GLP (Generalized Liquidity Provision).

PlutusDAO’s plvGLP has grown swiftly to become a top choice. The APRs (Annual Percentage Rates) on pls Assets are significantly higher than other platforms.

Key Features:

- Governance blackhole for the best L2 (Layer 2).

- Best and most versatile form of GLP.

- Highest APRs.

Yet, its rank in Marketcap is 1205. It’s an oddity that certainly needs some further explanation.

GND Protocol

The GND Protocol is the newest project on the list, being only a couple of weeks old. This protocol is the parent of $gmUSD, a Yield-Bearing, Fully-Backed Stablecoin built on top of Uniswap V3.

In just two weeks, it’s generating more revenue than established platforms like Balancer and Sushi. The Total Value Locked (TVL) stands at a robust $23 million, placing $GND in the top 20 in TVL on Arbitrum.

As the protocol matures, we can anticipate:

- Increased revenue

- Expanded TVL

- Happier users

1inch

As a product that searches for the cheapest possible swaps 1inch gain the love of many people. In a world of DEX it is highly difficult to find the best possible trading rates. Considering liquidity issues in many, it becomes even a bigger challenge.

By using 1inch people could find the best rates in many DEX all around and swap with benefits. Using Arbitrum means you could also spend a lot less for all these moves, giving people both cheap fees, fast transactions, and best rates altogether.

Abracadabra

Using lending in crypto is not a new idea. However, using interest-bearing tokens to both earn while also getting a loan is a brand new idea. You could use your USDT to get yvUSDT and then use that to get MIM which is another stablecoin, then you could turn that into USDT and create even bigger debt.

As a project aiming to create more secure and safe lending in the crypto world, Abracadabra took in Arbitrum as a way to eliminate all the mid-level problems. This way they could connect with their users directly without having the cloud of high expenses residing over the top.

Synapse

Bridges are getting more and more famous in the crypto world. Since moving your tokens or coins from one blockchain to another became a little bit harder, bridge projects allow you to do that directly without spending too much and making it easier.

Synapse took Arbitrum road as well, allowing them to get more liquidity for their bridging offers. This way they could provide a lot more to people with the funds they get. It certainly brought a good amount of liquidity allowing them to bridge more funds all at once.

Curve

Last but not least, we have Curve. As a project working towards becoming the biggest AMM for stablecoins, Curve has a big load that costs users high fees. Implementing Arbitrum as an alternative use, they are aiming at dropping this down. AMM world is filled with constant returns and investments. Making it based on purely stablecoins makes it even harder.

This is why Curve moved towards Arbitrum and managed to increase their volume by a lot as soon as they moved over. Meaning this move helped both Curve and Arbitrum together and was loved by both communities as well.

What Platforms Will Use Arbitrum?

Aave, Band, Biconomy, Covalent, DFYN, DXDAO, HaloDAO, LIQUALITY, Loopring, Okex, Perpetual Protocol, and a few others are the ones that we know of right now. If you would like to follow up on which of them are already uses Arbitrum and which ones are coming soon, you could visit the website; https://portal.arbitrum.one

They share all the live projects and share the upcoming projects on the website. You also could click on those projects and learn more about them or even go to their websites, telegram channels, Twitter accounts, and more.

Read also:

- Best Projects on Polygon

- Best Projects on Polkadot

- Best BSC DeFi Projects

- Best Projects on Cardano

- Best Projects On Tron Blockchain

- Best Projects on Cosmos (ATOM)

- Best Projects on Fantom

- How To Buy DeFi

- Best Projects on Terra Blockchain

- Best Projects on Heco Chain

Why Arbitrum is a Game Changer

So far the world has expected Ethereum to find a solution to the gas fee problem. We are talking about the ETH 2.0 as the nearest solution that might help, and even that is at least one year away, maybe even more. This has been causing a lot of stress and discomfort in the ETH world.

People love to invest in projects based on ETH blockchain, but we also would like to not pay that much fee as well. This resulted in many people still moving on with their investment, but not being happy with the fees they pay, or even worse maybe even deciding not to participate because of high fees.

Arbitrum is a scaling solution that allows ETH to continue as it is, while still managing to drop the costs down. This way, off-chain movements would allow people to participate in the ETH ecosystem, use any projects they want in the ETH world that has Arbitrum connection, and still use it for very cheap. This means that all those people who were afraid of participating, and all those who complained but still participated could end up spending much less and enjoying ETH without any problems.

This means people could finally stop worrying about the insignificant part of the investment, transaction costs, and could finally focus on the investment itself. Which will change the crypto investment approach many people have and could open up a whole new world to investors.

What are Layer 2 Solutions on Ethereum?

We have so many projects on the Ethereum blockchain right now. And with each passing day, we are getting a lot more as well. This means that ETH reached a level where it is incapable of scaling further to include all of these projects without charging high fees.

Layer 2 Scaling solutions come in right there. Taking all the movements off the mainnet of ETH, building their own Layer 2, then making all these moves there, and getting back into ETH (or not if you do not want to), allows people to be both on ETH but also not. Many projects based on ETH blockchain could also be found in other layer 2 projects right now, this allows people to use the same project, but with cheap fees off the mainnet.

Right now there is a big interest in Layer 2 projects, which is evident with their market cap and their ranking. This has caused an increase in new projects building better methods and scaling solutions on top of each other to perfect it as well. It has created fierce competition in the Layer 2 world and gave users/investors good alternatives to ETH.