Arbitrum has been in the news a lot recently with their surprise Main Net launch on May 28th. It’s an Ethereum network-based Layer 2 scaling solution being developed by Offchain Labs. So what does all that mean? Well, let me break that down for you before we take a look at the Arbitrum project. It’s really not that complicated.

What you'll learn 👉

What Is Arbitrum Rollup Ethereum Layer 2 Solution?

Just so we’re all on the same page, here’s a quick primer on Layer 2 solutions. Think back to the good old days before the Federal Reserve went feral. Gold was layer one and cash was layer 2. Why did we need cash? Because it’s terribly inconvenient to carry around a block of gold and shave bits off to pay for your groceries.

Cash was backed by gold but was merely a representation of it. The required infrastructure was just too cumbersome to use gold for everyday transactions. Commerce happened in cash-money, and final settlements occurred, if at all, much later at the level of gold reserves held by banks.

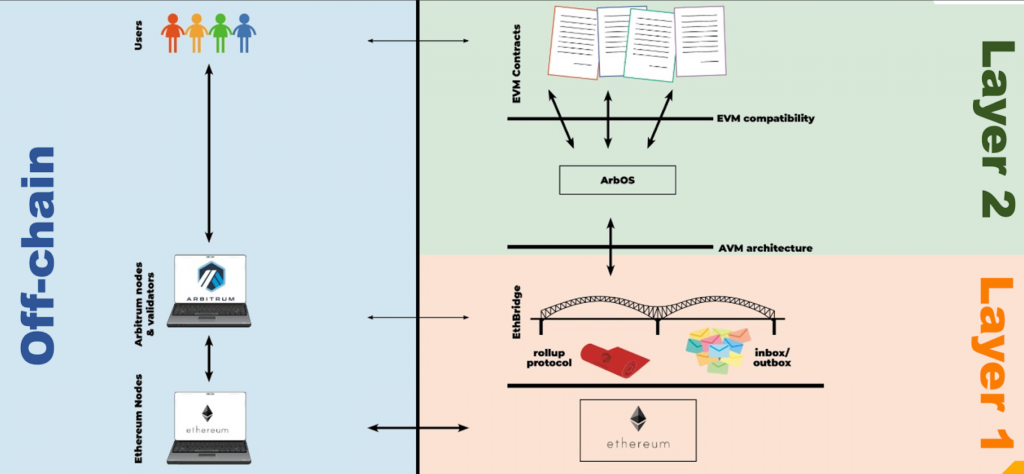

Ether on the Ethereum network is layer 1 gold. Applications operating off-chain are layer 2 money. The Etheruem network becomes clogged and expensive when we try to use it for everyday purposes. As with gold, the infrastructure is too cumbersome to support billions of small transactions. It can only be used effectively for larger, more important settlements.

Arbitrum’s project is a classic instance of Layer 2 technology.

Offchain Labs

Who are they?

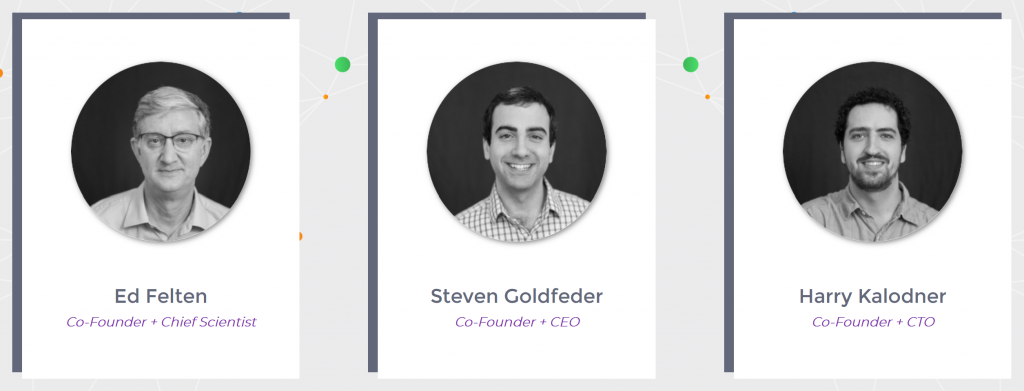

They’re one of the largest accumulations of brainpower ever to found a company. There’s a reassuring blend of experience and youthfulness, with top ex-governmental advisors, Ivy League professors, and a shower of PhDs in cryptography-related mathematics. Notice the complete lack of holistic strategists and PR gurus here. That’s also reassuring.

The three founders are –

- Ed Felten – Chief Scientist

- Steven Goldfeder – Chief Executive Officer

- Harry Kolonder – Chief Technical Officer

If that wasn’t enough smarts to throw at it, they also have developer support From Alchemy. This is about as healthy a recommendation as a project can have. Alchemy already works with the likes of OpenSea, Aave, and Dapper. Indeed, they support the majority of the biggest apps on the Ethereum network.

Who Are the Investors?

Venture capitalists find Arbitrum interesting. Some of the most innovative funds have invested, placing them in an elite group of Layer 2 DeFi projects.

- Coinbase ventures – Investors in Compound, BlockFi, Dharma, EtherScan, Synthetix, Audius, and DapperLabs

- Pantera Capital – Pantera has been around longer than cryptocurrency itself. Its portfolio is a who’s who of great projects like 1Inch, Coinbase, Coinme, Bitsamp, Ripple, and Zcash.

- Compound – They invest in artificial intelligence and machine learning, biotechnology, robotics, the Internet of things, and fintech, all in the context of blockchain technology.

- BlockNation – Targeting their capital at financial services and security startups, they own pieces of a dozen or so tech startups.

Arbitrum vs Optimism vs Polygon

So how does Arbitrum hold up against other network scaling projects in the space? Optimism and Polygon (MATIC) were always leaders in the race to provide Layer 2 solutions. There are technical differences, for example, Polygon is not a genuine Layer 2 solution. It’s a sidechain that verifies transactions using its separate consensus mechanism. Arbitrum and Optimism are fully secured by the Etheruem main network.

Why is all this important? Mainly because to use Polygon you must deposit ETH and swap it for Polygon’s native token, MATIC, that powers their sidechain. Your ETH is locked into a smart contract until you want to withdraw. To release your ETH, you burn your MATIC tokens, but this is all run across chain bridges which can take hours or days to process these outward-bound transactions.

Arbitrum started life as a fork of Optimism – the inventors of the Optimistic Rollup technology. Optimism recently delayed its main net launch until July, which prompted the largest decentralized exchange, UniSwap, to jump ship to Arbitrum. That’s a big feather in their cap.

There’s not much practical difference between Arbitrum and Optimism, apart from the method of detecting fraud. The consensus is that Arbitrum is faster, but Optimism has better fraud detection.

Optimistic Rollups use the existing Ethereum development toolset via a compiler, so it’s trivial for teams to start building projects on these platforms. This is their killer application, and Arbitrum seems to have the jump on Optimism.

How to Buy Arbitrum

One of the most intriguing aspects of Arbitrum is the decision not to create a native token. Hosting fees on their sidechain are paid in ArbGas, their wrapped Ethereum gas fee equivalent. This is so refreshing and it makes sense long term.

When a network is assessed on the value of its coin, and that coin is supported entirely by the value of the network, there may be trouble ahead. The potential non-linear self-referential feedback loops in the tokenomics are bad Ju-Ju. But it’s how new altcoins are leveraged to raise capital for projects, now that everyone got wise to ICOs.

How Arbitrum Rollup Works?

The technical term for Arbitrum is an “Optimistic Rollup,” which already sounds kind of appealing. Off-chain transactions are (optimistically) published with no security checks for increased speed. Anomalies can be flagged during a 7 day Challenge Period, and any provably erroneous transactions are rolled back. The bad actor is then punished according to the network protocol. Arbitrum uses the term ‘Slashed.’ Virtually, one hopes.

The goal is to disincentivize bad behavior and this has 2 elements. How likely are you to be caught, and what are the consequences? Arbitrum has tried to balance security against transaction speeds and costs. This less scrupulous approach to fraud-checking would be a security risk on Layer 1, but it works well for less critical Layer 2 applications. It promises about 100 times the transaction volume of the main Ethereum network and no super-expensive Gas fees.

The phrase ‘rollup’ refers to multiple small transactions being aggregated into a single, larger transaction on the Arbitrum sidechain. This bundle is then verified as a solitary transaction on the main Ethereum network at a later stage. Pressure is taken off the main network and transaction fees are shared and reduced, but security is lessened. This is the logical option for retailers who handle large volumes of smaller transactions.

What Features Make Arbitrum Rollup Unique?

The lack of a native token is a refreshing approach. The business model seems to be providing a service and charging a competitive fee. That’s pretty radical in both the DeFi and traditional financial spaces at the moment. We need to see more of it.

I don’t need to own Beercoin to avail myself of the services at my local hostelry. Nor do I need to hold Foodcoin to enjoy a nice steak pie with gravy on the way home. Quite rightly, Arbitrum doesn’t insist that I hold their altcoin coin to use their Layer 2 services.

Again, I hope this approach catches on as we are starting to look a bit silly as a community, with more than 4,000 tokens and counting. Arbitrum’s revenue comes from offering much lower transaction fees and pocketing a slice of that action.

How to Use Arbitrum Rollup?

As a retail investor, we would most likely be using a Dapp that runs on Arbitrum. Arbiswap is a good example. It was forked from Uniswap by Offchain Labs and offers similar Dex (Decentralized Exchange) services. You are hardly aware that you are using Arbitrum. Just as, when you use your mobile Youtube app, you’re not aware that it’s running on Android.

First, you need to send ETH over a Chain Bridge by connecting your wallet (Metamask is my preferred choice). Select the Kovan Test Net to enable the Ethereum network end of the transaction. Click on ‘add/switch to Arbitrum Network’ to connect your wallet at the destination end of the bridge. Confirm the details are correct from your wallet, and you are ready to transfer your ETH. Once it arrives, you can start swapping tokens.

Arbitrum Chainlink Partnership

When you need an Oracle to feed you price data for your Dex and smart contracts, there’s one obvious choice – Chainlink. They are the finest purveyors of off-chain data to all the very best DeFi projects. An Oracle provides real-world facts to the decentralized universe, but untainted by human interests, bias, or control.

Disclaimer – I have a soft spot for Chainlink. A fair chunk of my humble altcoin portfolio grew from Chainlink dust I rediscovered in an old exchange account from 2017. I often like to tell people what a genius I am for buying it at 20 cents, but the truth is that I lost money on that trade. Nothing really changes.

Pros and Cons of Arbitrum Rollup

The pros are simple. 100 times the throughput with only 2% of the fees. They have also stolen the first-mover advantage from Optimism.

There are all the usual beautiful aspects of DeFi, of course, but these are not exclusive to Arbitrum.

Refreshingly there are no KYC requirements to use Arbitrum as it’s a genuine decentralized platform. Beware of any company with DeFi in their name that demands your personal information. They are not in the spirit of DeFi and should be avoided.

The only drawback is the challenge period necessary for the Optimistic Rollup security protocols to be enacted. It’s currently 7 days, which is a long time to wait for Main Net confirmation. This wouldn’t affect retail customers, but Dapp developers might find it an issue.

Apart from that, I love it!

Also, check out our other decentralized finance platform reviews: