A few weeks ago, I have been testing Maker DAO, the most successful “DeFi” application on the Ethereum network so far. In April 2019, a new protocol went live called Dharma, which has a similar purpose and in my opinion has the chance to become an even bigger success.

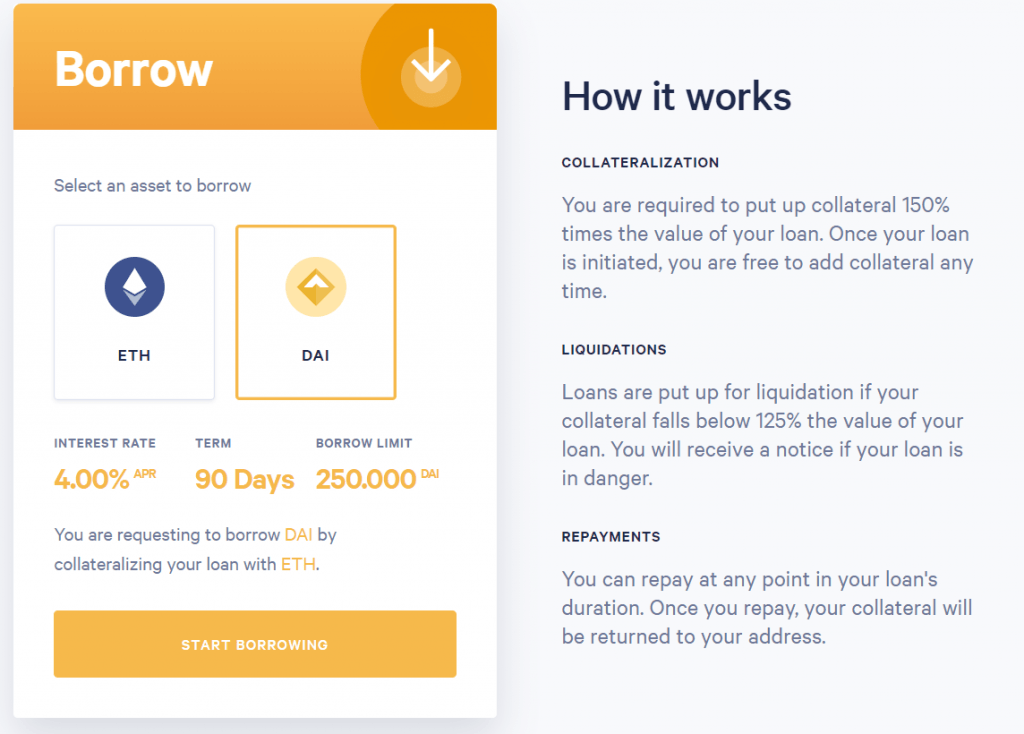

Dharma also allows you to borrow independently and without an intermediary by providing a collateral of 150%. However, it is much easier and more user-friendly than the DAO Smart Contract.

In addition, Dharma offers attractive interest rates for “lending”, i.e. for those who provide the money that is issued as a loan. I have tested both sides and I am very impressed. But first things first…

What you'll learn 👉

Remark on DAI

To understand this article, it is important to understand that DAI is a “stable coin”, i.e. a crypto currency that is linked to the dollar based on complex game theory principles, so that 1 DAI is always almost exactly 1 dollar.

Borrowing with Dharma

At first glance such an offer seems strange: “Why should I borrow 100 dollars when I have to deposit 150 dollars for it?” But the crux of the matter is that you borrow a different currency than the one you deposit as collateral. So, for example, I deposit 150 dollars in ETH and get 100 DAI for it or vice versa.

Here are a few examples where this makes sense:

- I deposit ETH as security and buy more ETH with the DAI I get from the loan! (this can be compared with classic leveraged products).

- I own ETH that I do not want to sell, but I have a temporary financial bottleneck and need cash (DAI).

- In the future all kinds of crypto assets can be deposited to get DAI, such as valuable “NFTs” (non-fungible tokens like cryptokitties).

Such cases where non-liquid assets are deposited as security for liquid assets are common in the real world. In fact, the market in which such bonds are traded is many times larger than the stock market [citation needed].

The conditions, such as the interest rate (APR = Annual Percentage Rate) and the term at which one can take out a loan with Dharma are fixed in advance:

At the moment, only DAI or ETH are being offered, but in principle, there are no restrictions regarding which Ethereum assets can be loaned and borrowed through the Dharma Protocol.

In the example above, I have 90 days to repay my loan and get my ETH loan back, minus the 4% APR. By the way, the interest benefits the lenders (see next section).

As with Maker DAO, I run the risk of selling (liquidating) my collateral to ensure that the loan is covered. This happens as soon as the value of my collateral is less than 125% of the loaned value, i.e. when the price of ETH decreases accordingly. To ensure that my collateral is not liquidated, I can always add ETH at any time, as with Maker. Dharma sends me liquidity warnings via email.

To take out a loan, you don’t even need the MetaMask browser extension (usually the default for all dApps interactions). Just register with your email address and PIN (not even an email confirmation mail is sent). After that you will see the following mostly self-explanatory screen:

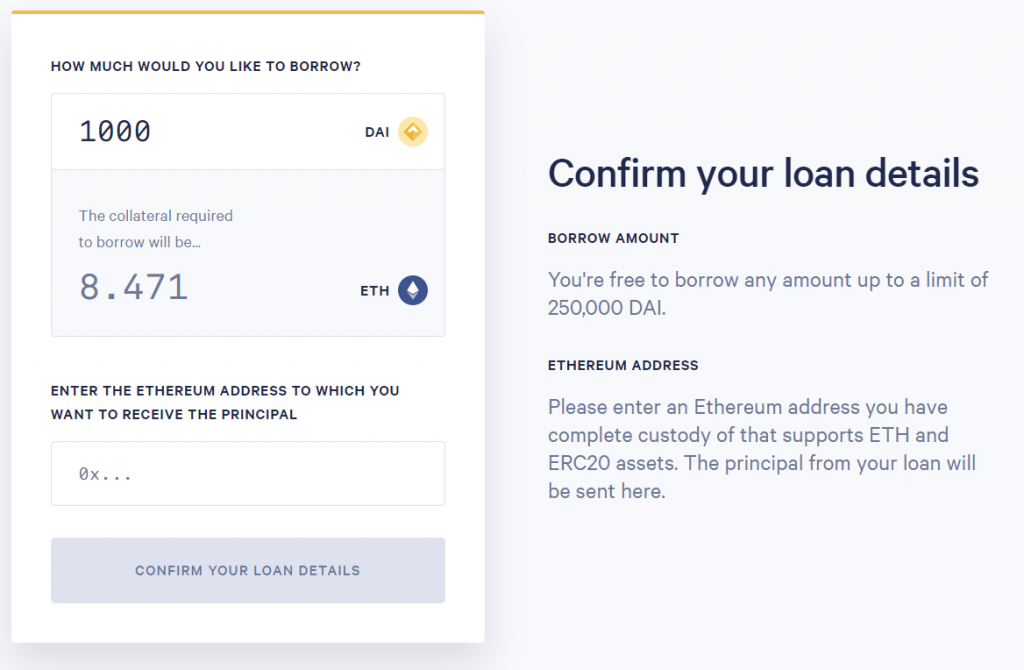

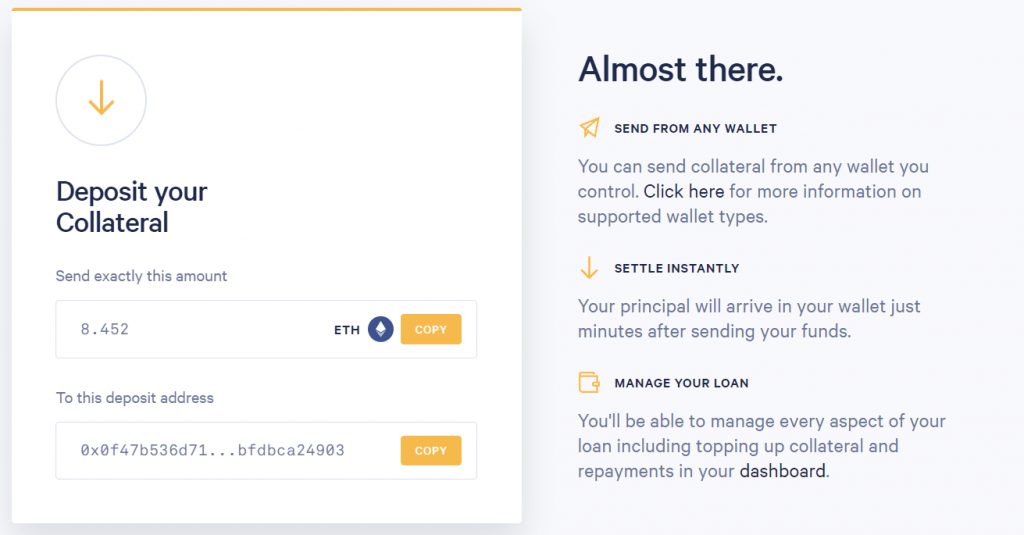

So for 1000 DAI loan I have to pay 8,471 ETH (150 dollars) into the Smart Contract. The DAI will then be sent to the address below. Then Dharma shows me the address where I have to pay the ETH insurance. I can do this with any wallet.

As soon as the ETH transaction is confirmed (usually less than 1 minute), the screen switches to a confirmation page and my loan is paid out. For comparison: With Maker DAO I had to handle 4 different tokens and know all kinds of technical terms to get my loan. From the point of view of user experience this is a difference like day and night.

But where do the DAI I just borrowed come from now? This is where the “lending” comes in.

Lending with the Dharma Protocol

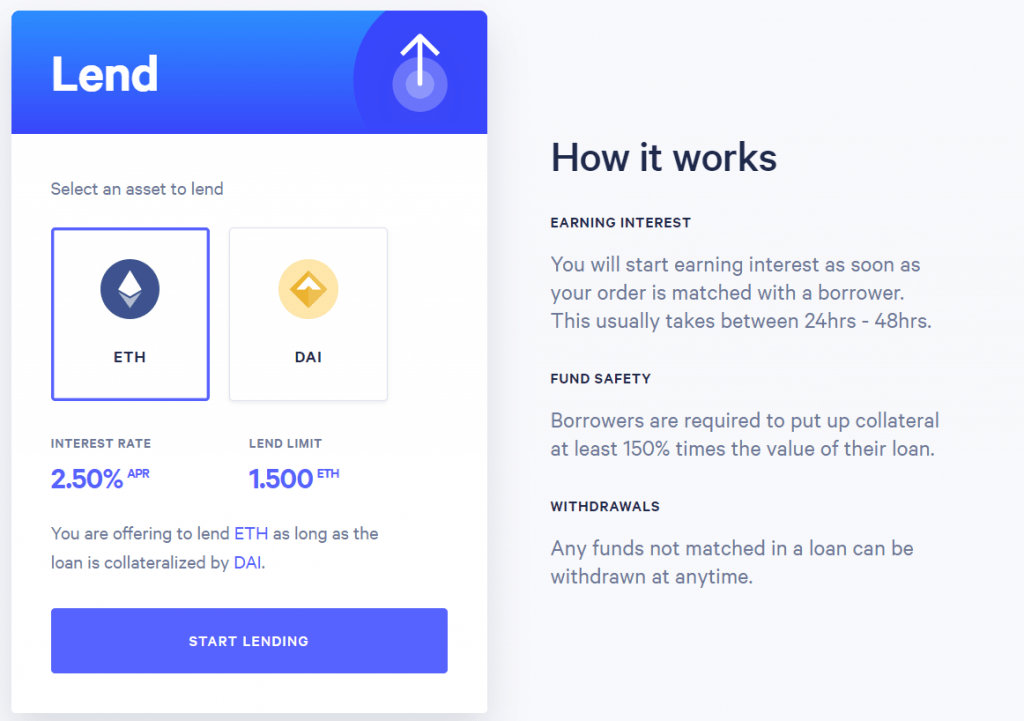

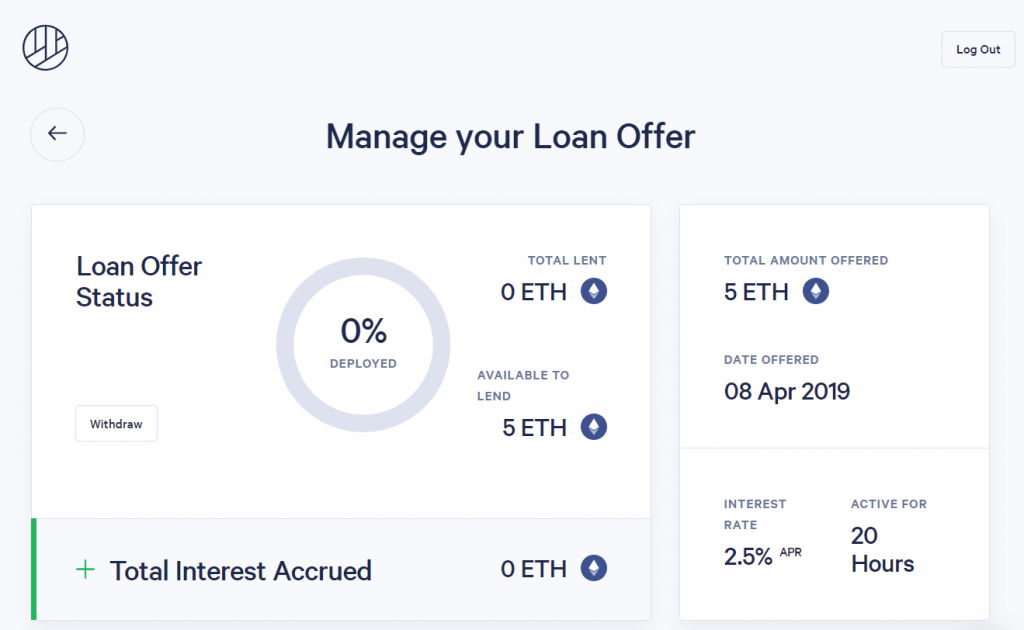

Every loan taken out with Dharma must first be offered by a lender. Currently, there is no way to influence the terms of the loan offer itself. For the provision of DAI one receives 8% interest per year, for ETH currently 2.5%.

Note: Interest rates on Dharma

These interest rates are currently subsidized by Dharma (the company that developed the Dharma Protocol). This also explains why the interest rates on loans are lower than the interest rates on borrowing. Because at the moment you can theoretically borrow DAI for 4% interest on the loan and lend it back for 8% annual interest. This is of course not a sustainable business model ? .

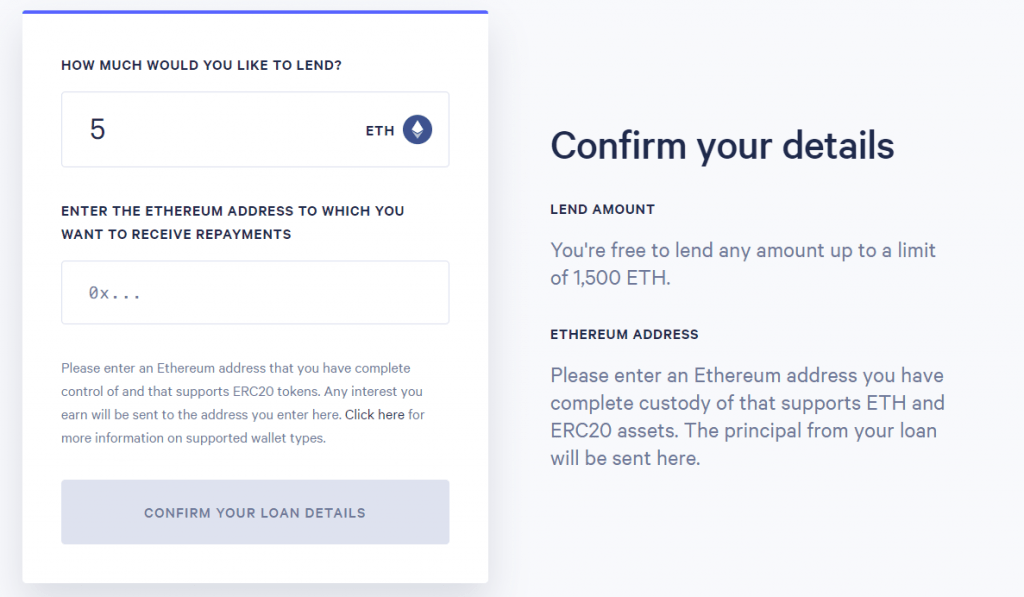

The user interface makes it even easier to place lending offers than to take out a loan. Select the currency (ETH in the example), select the amount you want to lend and enter a payout address for the interest, done.

The ETH made available in this way can be withdrawn from the Dharma Smart Contract at any time. However, interest is only paid if the loan is also claimed by a borrower. At the moment there are more lenders than borrowers (currently the ratio is about 3:2), so that I have not received anything on my lending deposit even after 20 hours:

Dharma crypto review – Conclusion

The first usage data suggest that a very successful platform is emerging here. Just 24 hours after the public launch, the Dharma Smart Contract attracted 3000 ETH. However, these figures have to be put into perspective, as the insane conditions of Dharma are currently still subsidized.

However, depending on how the conditions develop without this “kick start”, something very big could emerge here: The user-friendliness is outstanding compared to the previous Ethereum dApps. And last but not least, in combination with the other DeFi applications, Dharma brings real added value. Especially in comparison to Maker DAO Smart Contract, and that is where about 2% of all ETHs in circulation are invested!

Even though Dharma is probably not the killer app that drives ordinary people into crypto-currencies, it adds another important piece of the puzzle to the decentralized financial system that was redesigned from scratch.