What you'll learn 👉

Where do exchanges get their coins from?

It’s referred to as an “exchange.” People will sell their Bitcoins to the exchange in exchange for fiat currency, but they will pay a premium for using the service.

However, the ability to buy or sell coins depends on whether or not other participants want to sell or buy fiat currency. The exchange, similar to a bank, owns enough coins to act as a “float” in order to ensure liquidity. Additionally, the exchange uses a portion of the profits from a fiat-to-coin exchange in order to buy coins (and receives some coins directly during coin-to-fiat exchanges).

The great majority of the coins that are traded on an exchange do not belong to the exchange itself but rather to the users who are trading them.

| Topic 📝 | Details |

|---|---|

| Source of Coins 🔄 | Crypto exchanges acquire coins primarily from users who sell their coins in exchange for fiat currency. The exchanges maintain a “float” of coins to ensure liquidity and use profits from fiat-to-coin exchanges to buy additional coins. |

| Own Coins 🪙 | Some exchanges have their own intermediary coins to facilitate trade processes and ensure operational efficiency, avoiding reliance on fiat currency for the majority of transactions. |

| Coin Generation ⛏️ | Cryptos are generated through a process called ‘mining,’ which involves powerful computer hardware and software to confirm transactions and create new units. |

| Cost to Build Exchange 💰 | Building a functional and secure crypto exchange can cost around $1 million outside of the United States, with additional costs for centralized exchanges in the United States supporting fiat deposits and withdrawals. |

| Revenue Streams 💵 | Crypto exchanges make money through various means such as commissions, listing fees, market making, and fund collection during Initial Exchange Offerings (IEOs). |

Do crypto exchanges have their own coins?

Not all exchanges are linked or offer the option to convert fiat currency for cryptos. These exchanges are based on trading different cryptos available on the platform.

An intermediary coin is employed to make the system operational and to make some trade processes easier. These are the native coins from the exchange. It avoids relying on fiat currency for the majority of transactions. It aids in the automated execution of trades.

In DEx-es, the native coin also serves the objective of being independent of the traditional fiat market and its financial services in order to ensure the anonymity on which many cryptos are constructed.

How are crypto coins generated?

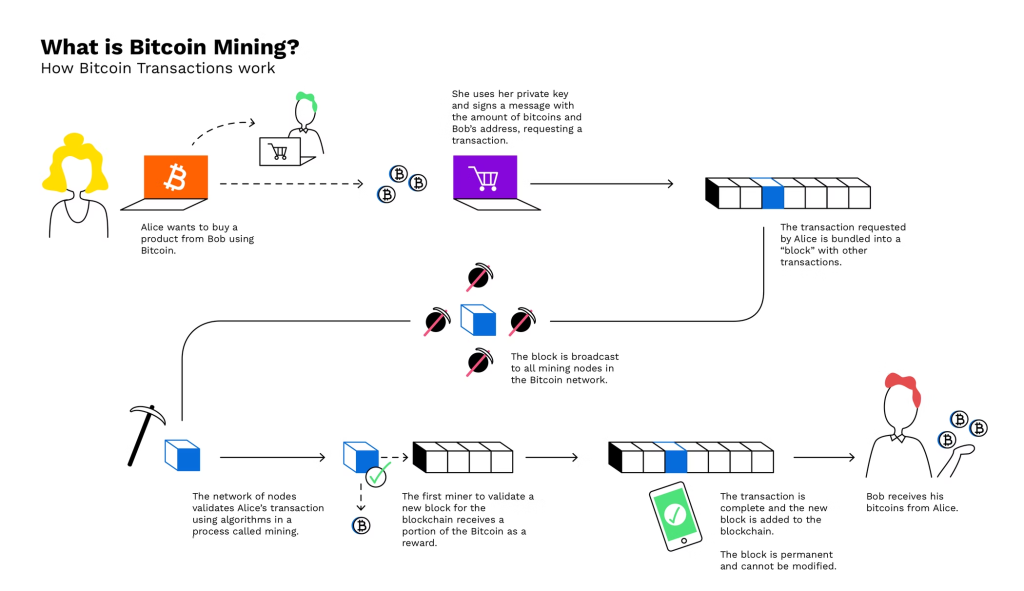

Cryptos are ‘mined’. For a better grasp of how cryptos are formed, we may look at Bitcoin, which is created by mining. The ‘Mining‘ process requires powerful computer hardware and durable software. It is the process through which Bitcoin transactions are confirmed and new units are created.

When a Bitcoin transaction occurs, a miner, who is also a node on the blockchain, tries to decode the transaction block. Miners on the Bitcoin network compete to decrypt the transaction block when Person X sends 0.1 Bitcoins to Person Y.

Decrypting the block authenticates the transaction and shows who sent how many Bitcoins and when. Once decoded and accepted by most nodes on the blockchain, the block is appended.

How much does it cost to build a crypto exchange?

We may calculate this estimate in a variety of ways depending on the level of detail we want to go into, but in order to establish a no-frills functional highly-secure crypto exchange that can compete with the best of the big exchanges today, we’re probably looking at:

- Two full-time security engineers with extensive experience. With a total compensation and benefits expense of around $300,000 per, we’re looking at a salary of around $600,000.

- In the United States, the expected regulatory additions if we promote fiat exchange will cost us roughly $100,000 in legal and regulatory expenditures.

- Other expenses include computer gear, charges, utilities, and a safe office location that will cost at least $25,000, if not more.

- When traffic goes up, we’d also be looking at hosting and infrastructure bills of at least $10,000 per month with respected cloud service providers like AWS.

- Finally, in the real world, we could bootstrap our marketing, advertising, and most administrative chores, as well as some customer service, at least $50,000 for all of them.

- Add 20-30% for unknown unknowns, technical obstacles, and the time spent dealing with IRS and Treasury department harassment, defending against competitors, and dealing with numerous acute security concerns.

We’re talking about $1 million for a centralized exchange outside of the United States. We should budget at least twice as much for a centralized exchange in the United States that supports fiat deposits and withdrawals.

What is a cryptocurrency exchange?

A crypto exchange is a service/platform where people buy and sell cryptos. There are many types of platforms out there, some specialized and others general purpose. Some specialize in fiat-to-crypto trades, while others focus on crypto-to-crypto transactions. Others still offer both.

You can use exchanges to trade between different types of cryptos, such as Bitcoin and Ethereum, or to purchase crypto using traditional currencies, like the U. S. Dollar.

Exchanges reflect current market prices for each coin, so you’ll see fluctuations in price throughout the day.

You can also convert cryptos back to the U. S. dollar or another currency in exchange for depositing into your account (for future trading) or withdrawing to your regular banking system.

There’s no one exchange that’s best for everyone.

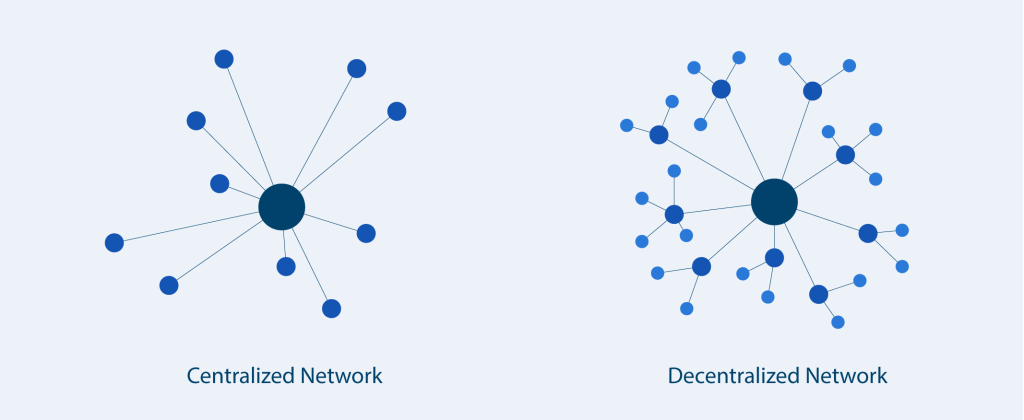

Centralized and decentralized exchanges

Centralized exchanges, which allow people to trade cryptos for fiat currencies like the dollar, have been around for a long time and have proven themselves to be safe places to store your money. They’re also convenient ways to purchase cryptos.

A centralized exchange is run by a profit-driven company that gets revenue from its platform’s fee structure. They charge fees to traders and investors based on how much volume they generate. Some of the famous centralized exchanges are Binance, OKX, FTX, Coinbase, KuCoin, etc.

In contrast, decentralized exchanges don’t rely on a third party. Instead, they use smart contracts to facilitate peer-to-peer transactions without a central authority. This makes them less vulnerable to price manipulation and other fraud activities because there is no central entity controlling the money.

However, they have some drawbacks too. For example, they cannot offer margin lending, futures contracts, and other financial instruments. Also, since they don’t use a third party to handle transactions, they are not anonymous. To make matters worse, users must go through Know Your Customer (KYC) procedures. Some of the famous decentralized exchanges are Uniswap, PancakeSwap, Defi Swap, Curve, 1inch, etc.

How do exchanges set their prices?

A common misconception is that exchanges determine prices. This is not true. Instead, there are many factors involved in determining the price of cryptos. These include the amount of liquidity, how much interest people have in a particular coin, and how active the market is.

There isn’t an official, global price for cryptos. Different exchanges use different methods to determine prices. Some use the average spread between bids and asks, while others use the median value of bids and ask.

Prices for cryptos vary depending on the activity of both buyers and sellers on an exchange. If there’s a lot of buying, prices may go up; if there’s a lot of selling, they may drop.

Each exchange calculates the prices based on its trading volumes, provided there is enough supply and demand for its users.

How does an exchange match order?

Electronic matching is in all key marketplaces. Each exchange has its own order-matching mechanism. First-in-first-out (FIFO) and pro-rata are two categories.

FIFO

The earliest active buy order at the greatest price has priority over any subsequent order at that price, which has priority over any active buy order at a lower price.

Pro-Rata

The system prioritizes active orders based on the relative size of each order, using a basic pro-rata algorithm.

Why do crypto exchanges have different prices?

Bitcoin and other cryptos can be bought and sold through online exchanges. Some exchanges charge transaction fees, while others do not. Because each exchange calculates the value of currencies differently, there is no single accurate price for Bitcoin.

Today, there are over 250 crypto exchanges available online. Some of these exchanges are very large, such as Coinbase, Gemini, and Binance. Others are small, local businesses. All of them calculate the price of Bitcoin and other cryptos based on the volume of trades they make, the supply and demand from their customers, and the current state of the markets.

Another reason why prices differ among exchanges is that some exchanges charge transaction fees while others don’t. Finally, some exchanges report a single price, while others show several different prices.

What are makers and takers?

It is common to compare online Bitcoin exchanges to stock markets. Bids and offers are exchanged between buyers and sellers. In order to purchase Bitcoins, a bid indicating the price per coin may be submitted. People who are selling bitcoins may offer a lower price than they paid for them.

Various trades necessitate different approaches, which is why it’s critical to understand the buyer and seller differences. Sellers typically charge less than buyers, whereas buyers typically charge more than sellers. For significant purchases, traders often employ limit orders, which allow them to declare a maximum amount they’re willing to spend before the order is executed. We refer to these investors as “makers”. On the other side, traders attempting to profit from minor changes in the market are referred to as takers. Most of the time, they do business without mentioning a definite price.

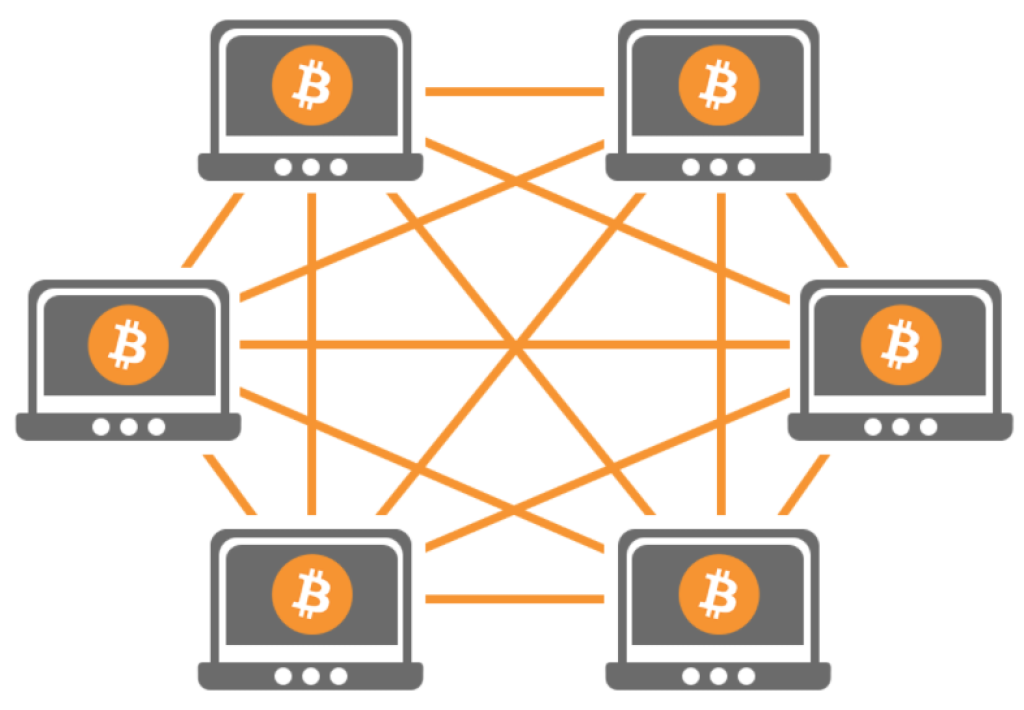

How does peer-to-peer bitcoin exchange work?

Peer-to-peer Bitcoin trading platforms allow individuals to trade Bitcoins directly with one another. They do not take custody of the funds, nor do they provide fiat currency conversion services. Instead, they act as facilitators, matching up buyers and sellers based on their preferences and requirements.

The most well-known of these platforms is LocalBitcoins, which allows users to post offers to sell Bitcoin and accept bids to buy bitcoin. Users must have accounts set up on both sides of the transaction, and they must complete some verification steps before being allowed to conduct transactions. Once completed, however, the process is fairly straightforward: the buyer posts his offer, the seller accepts it, and the money is transferred. LocalBitcoins is relatively easy to use.

Other popular peer-to-peer exchange platforms include Paxful and BitQuick.

These platforms have been around for several years, but recently, they have gained popularity due to increased demand for peer-to-peer trading. This is because peer-to-peer platforms are generally safer than traditional centralized exchanges, especially for small amounts of bitcoin. In addition, they are much cheaper than centralized exchanges.

How do crypto exchanges make money?

Exchanges make profits from different types of revenue sources, including commissions, listing fees, market making, fund collection, and more. Some exchanges charge a flat fee per transaction, while others use volume-based pricing. Fees may vary depending on how much activity there is at any given time, where you trade, and whether you pay using fiat currencies or cryptos.

Commission – trading fees

Charging commissions in exchange markets is the most common method of generating revenue for crypto exchanges. These commissions pay for the trade facilitation services between buyers and sellers. In most cases, it’s only a very small fraction of one percent. They have a high volume of transactions because their costs are minimal.

Listing Fees

Exchanges are looking to make money off crypto projects. But it isn’t easy. In fact, many exchanges still rely on traditional sources of income like advertising and trading fees.

However, there are some newer ways of making money. One way is through “listing fees.” These are paid to exchange platforms in return for hosting listings of tokens and coins. This allows exchanges to generate additional revenue streams while helping projects reach potential investors faster.

Market making

Another way to make money off cryptos is to create a market. A market maker creates a market where people are willing to buy and sell a certain type of crypto. They do this by purchasing the tokens at low prices and then quickly reselling them at higher prices. These profits come from the spread, which is the difference between the bid and ask prices. Market makers use algorithms to determine what price to offer the token.

Fund collection

One way to use blockchain technology to generate revenue is to allow startups to sell their token directly to investors without having to rely on third parties. This is called Initial Exchange Offering (IEO).

The idea behind IEOs is simple: you offer a startup a chance to raise capital by selling its tokens to investors. You act as a middleman, collecting funds on behalf of the startup and charging a fee for doing so.

In return, the startup gets access to additional funding while investors enjoy a cheaper price and better terms.

How does swapping in this process makes money?

When the exchange collects funds on the startup’s behalf, it charges a percentage as a commission. Depending on the final amount collected, such a percentage could make for a significant income stream for the exchange.