The term ‘decentralized exchange’ has become a beacon for those seeking control and autonomy over their transactions. This article aims to guide you through the labyrinth of decentralized exchanges, highlighting their unique features and advantages.

As we delve into the world of decentralized crypto exchanges, we’ll also spotlight the best crypto winter tokens, a selection of digital assets that have demonstrated resilience and potential for growth during the market’s chillier periods.

Our journey will not only illuminate the workings of these decentralized cryptocurrency platforms but also provide insights into their role in shaping the future of finance. So, let’s embark on this exploration of decentralized exchanges and discover the opportunities they present in the crypto landscape.

| 🏦 Decentralized Exchange | 🔑 Key Features | 🪙 Fees | 👍 Pros | 👎 Cons |

|---|---|---|---|---|

| 💱 dYdX | Offers perpetual futures, margin trading, spot trading, borrowing, and lending. Supports trading of dozens of cryptocurrencies and prioritizes decentralization. | Varies depending on the type of trade and the cryptocurrency being traded. | Seamless transaction experience, interactive user interface. | Limited selection for margin trading pairs |

| 🔍 Apex Pro | Up to 30x leverage, Non-custodial, permissionless, decentralized | Maker Fee: 0.02% Taker Fee: 0.05% | Enhanced security and privacy Easy access, control, and use Intuitive dashboard and trading interface Unique Trade-to-Earn rewards program | Limited trading instruments Supports only USDC withdrawals |

| 🔍 Vela | Built on Arbitrum network for speed and scalability – Offers spot trading and advanced perpetuals trading – Uses Vela liquidity pools and incentivizes market makers | Funding fees to maintain balanced exposure | Built on Arbitrum Network Advanced Trading Features Multi-chain Deposits | Beta Phase Platform Fees Artificial Slippage |

| 🔄 GMX | Offers spot and perpetual listings, leverage trading, and a multi-asset liquidity pool. Supports trading pairs such as ETH/USD, BTC/USD, LINK/USD, AVAX/USD, UNI/USD, and WBTC/USD. | Trading fee is 0.1% of the position size + 0.2-0.8% of the collateral size for leverage trading. Trades also incur network gas fees on their respective networks. | Low swapping fees, zero price impact trades, permissionless trading, profit-sharing and staking options, multi-chain support. | Limited trading pairs compared to other DEXs, high trading fees, APY for GMX staking is escrowed to 1 year or users receive no rewards. |

| 🦄 Uniswap | Allows users to trade ERC-20 tokens directly from their wallets without the need for intermediaries. | Charges a 0.3% fee on each trade, which is distributed to liquidity providers. | High liquidity, wide range of supported tokens, no need for KYC, user-friendly interface. | Limited order types, potential for high gas fees during periods of network congestion. |

| 🍣 Sushiswap | Offers additional features such as yield farming, staking, and governance tokens. | Charges a 0.3% fee on each trade, which is distributed to liquidity providers. | Additional features like yield farming and staking, high liquidity, wide range of supported tokens. | Potential for high gas fees during periods of network congestion. |

| 1️⃣ 1inch | Sources liquidity from various decentralized exchanges to provide users with the best possible trading rates. | Charges a fee for each trade, which varies depending on the liquidity sources used. | Best possible trading rates, wide range of supported tokens, user-friendly interface. | Potential for high gas fees during periods of network congestion. |

| 🥞 PancakeSwap | Offers features like yield farming, staking, and lottery games. | Charges a 0.2% fee on each trade, which is distributed to liquidity providers. | Lower transaction fees compared to Ethereum-based exchanges, additional features like yield farming and staking, wide range of supported tokens. | Limited liquidity compared to larger exchanges, potential for lower security due to the centralized nature of the Binance Smart Chain. |

| ⚖️ Balancer | Allows for automated portfolio management, acts as a liquidity provider platform, uses the automated market-making mechanism to establish prices, and offers detailed crypto analytics and flash loans. | The minimum swap fee is 0.0001%, while the maximum swap fee is 10%. | Decentralization, strong liquidity, competitive features. | Limited trading features, might be confusing or intimidating for first-time users, varying fees. |

What you'll learn 👉

A Brief History of the DEX

Decentralized exchanges, or DEXs, have come a long way since their early days. The idea of DEXs originated from Hashed Time Locked Contracts (HTLCs), with platforms like LocalBitcoins and Bisq setting the stage for decentralized trading in the early 2010s.

The launch of the Ethereum blockchain in 2013 marked a significant milestone for DEXs. It paved the way for the development of decentralized applications, including DEXs. EtherDelta, one of the pioneers in this space, launched in 2016, introducing the concept of an orderbook-style exchange.

The period of 2016-2017 saw the emergence of first-generation decentralized exchanges like IDEX, EtherDelta, and ForkDelta. However, these platforms faced several challenges, including user interface issues and regulatory vulnerabilities.

The introduction of Automated Market Makers (AMMs) in 2018 brought about a revolution in the DEX landscape. Platforms like Uniswap and Bancor, which utilize the AMM model, offer a more user-friendly approach to decentralized trading. The AMM model has gained such popularity that it is now the backbone of most decentralized exchanges.

Today, DEXs are handling significant levels of crypto volume. This trend indicates a shift in the crypto landscape, with DEXs now competing with centralized exchanges in terms of users and volume.

Despite their growth and evolution, DEXs still face challenges such as regulatory barriers and concerns around the lack of KYC. However, the current trend suggests a move towards a world where everything is insured and KYC’ed.

What Do I Want From a DEX?

I merely require multiple Exotic tokens, guaranteed pseudonymity, great security, low gas fees, deep liquidity, and a great user experience. Oh, and the chance to invest my crypto for a substantial yield. That’s not much to ask, surely? In these early days of DeFi technology, it probably is a lot to ask. Most DEXs do most things well, but there are questions over hacks, rug-pulls, wallet interactions, and many other issues as yet not even thought of.

So which DEXs best fulfill the items on my wish list?

Best decentralized exchange 2025 – List

Below, we take a look at the most popular DEXs that have been around for a while, and also some of the newer platforms. The DEX you choose might be dictated by the token you are trying to buy, but you should still do some basic risks assessment. There are links for all of the DEXs, but watch some Youtube tutorials and see what the good folks at Reddit have to say about each platform.

My pro-tip is to visit the Defi Pulse website for the lowdown on all reputable DeFi apps. You can see the rankings according to the amount of value locked up in each protocol. Click on a platform and there’s a comprehensive set of charts, statistics, audits, ecosystem links, and a brief summary of the project.

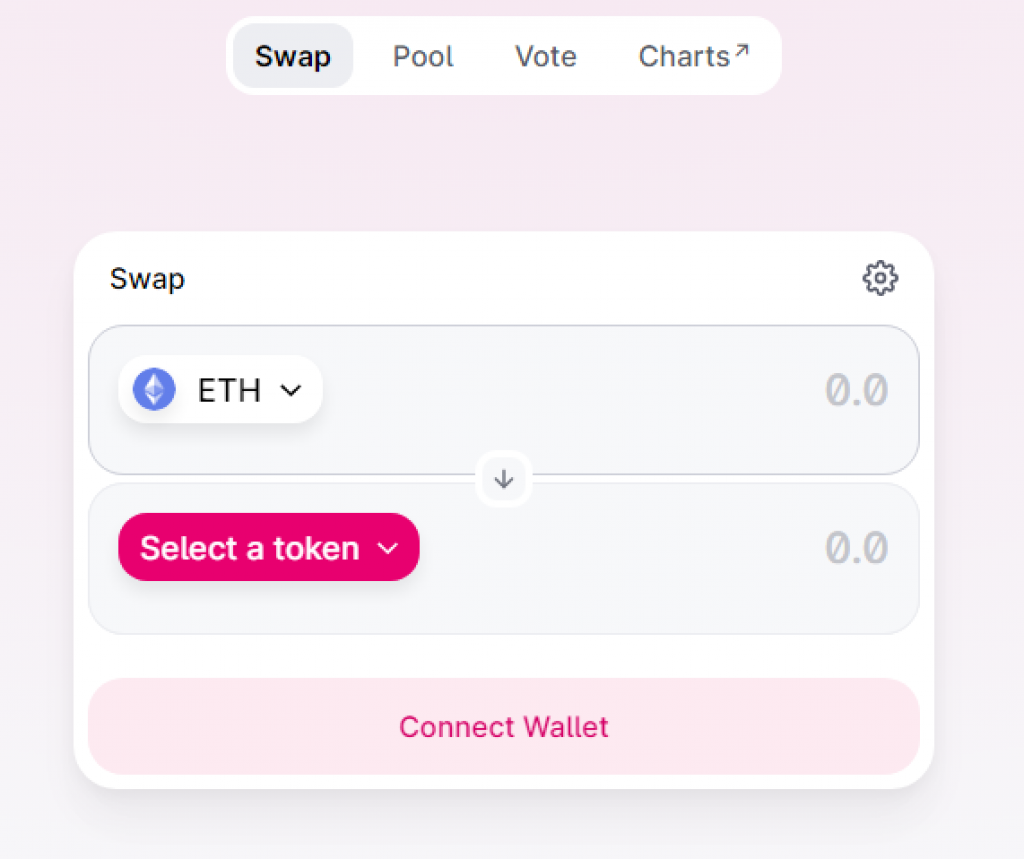

Uniswap

When Uniswap emerged back in 2018, DeFi was not on anyone’s radar. They’re one of the OGs of atomic swaps. It’s a straightforward AMM (Automatic Market Maker) that draws on global liquidity pools for ERC20 assets. You connect your DeFi wallet when prompted and you’re ready to swap your tokens. No personal details are required, just a standard DeFi wallet for ERC20 tokens. Right now, Uniswap is the most popular and probably best crypto dex by far.

Enter the ERC20 tokens you wish to swap, then set the slippage tolerance and the maximum time limit for the transaction. Once you hit swap, you authorize the transaction from your DeFi wallet and wait for it to complete.

To stake your tokens in a liquidity pool through Uniswap, click on the Pool button at the top right of the Uniswap application window. Select a pool in which to invest and select your chosen stake. Remember, you’ll need to provide the same dollar value for both of the tokens (or a predefined proportion of each). Authorize the transactions from your DeFi wallet and confirm on the Uniswap app. That’s it, you are now staking and earning rewards.

Liquidity providers are paid a portion of the 0.3% fees charged for token swaps, which is great when trading volume is high and the crypto market is surging. Again, be aware of the risk of impermanent loss as mentioned above.

Uniswap has several refreshing features, such as its hyper-minimal user interface. It didn’t initially offer a utility token like most other DEXs, so you could invest in liquidity pools without having to accumulate another potentially risky exchange token. There’s now UNI, which is a popular governance token to hold.

As with all good DEXs, it’s’ non-custodial, open-source, and doesn’t require the user to trust a middleman. Check Uniswap out on Defi Pulse.

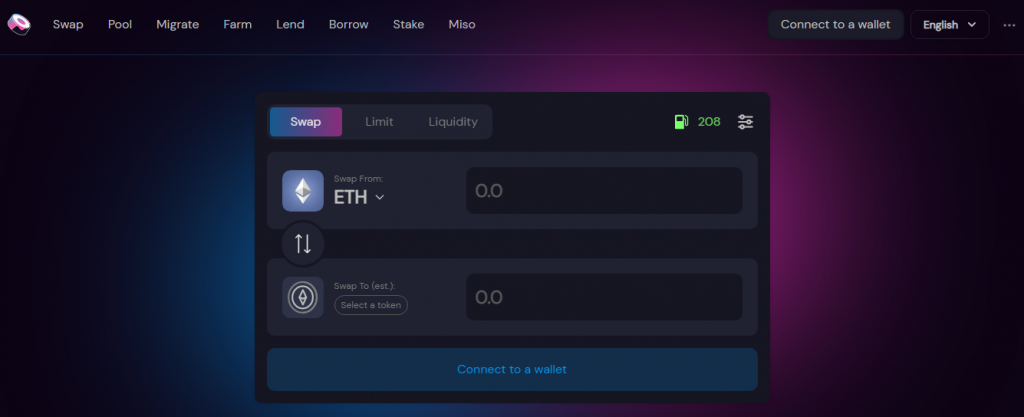

Sushiswap

Once regarded as a meme, the Sushiswap DEX is a direct clone of the original Uniswap AMM. Of course, there’s the obligatory governance token, SUSHI, but they have a different approach to earning rewards from the transaction fees. Sushiswap have also worked on their user interface, distinguishing itself entirely from the original, Uniswap.

Sushiswap’s stated aim was to make decision-making more democratic and to distribute liquidity pool staking rewards more equitably. Both Uniswap and Sushiswap charge 0.3% for their swaps, but Sushi payout a portion of this to current SUSHI holders with more SUSHI tokens. The plan was to enable early adopters to become major stakeholders rather than whales buying into the project at very little risk, once it was established.

In the early stages, Sushiswap cleverly enticed Uniswap liquidity providers to join the project with enhanced rewards. This ‘Vampire Attack’ worked and within weeks, Sushiswap was up and running. Its rapid rise to success is all the more incredible as it’s a company of which we knew virtually nothing of the founders. 0xMaki and Chef Nomi, (not their real names) pulled off something special with Sushiswap in the DeFi world.

Che Nomi very soon sold all the development funds for about 17 million dollars and bailed out. That’s what happens when the tokenomics are bad and the founders’ identities are unknown. It amazes me that Sushiswap ever got started, then managed to be successful, and remains as a ‘thing’ even today!

But whatever scandals there were, it seems to have worked. Sushiswap sits at #9 on the charts with nearly four billion dollars locked up in and providing liquidity. SUSHI token has become a favorite altcoin as its fortunes are directly tied to the DEX. Again, the ERC20 compatible DEX is great for swapping tokens, until you have to pay Ethereum gas fees.

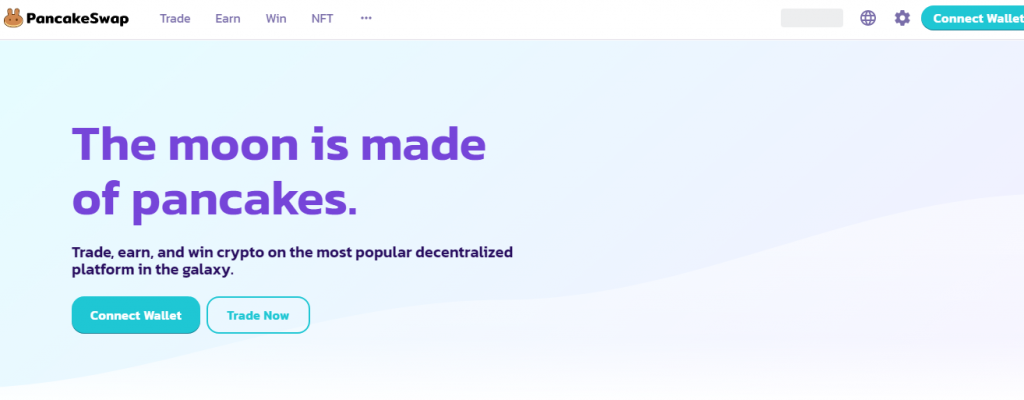

PancakeSwap

For a brief period, PancakeSwap peaked as the largest DEX of them all. Since then it has fallen away slightly but remains a significant player on the Binance Smart Chain. PancakeSwap is yet another clone of Uniswap, which explains the almost identical application. So what’s PancakeSwap’s killer app?

They offer more interesting yield farming services where you can stake your BEP20 (Binance Smart Chain) tokens in liquidity pools. You will be paid with their proprietary Cake token, which can also be staked on PancakeSwap. There’s even a Cake lottery and a limited NFT marketplace. Uniswap supports many more exotic tokens and trading pairs, so make sure your target cryptocurrencies are supported on PancakeSwap.

PancakeSwap’s Transaction fees for exchanging ERC20 tokens are around 0.2%. This is cheaper than Uniswap, but at these super-low levels, who cares? The elephant in the room is the Ethereum gas fee, paid in ETH. They make transactions of a few hundred dollars prohibitively expensive. PancakeSwap on the Binance smart chain has super-low fees and completion is wibithin seconds, rather than minutes or hours.

We are told to ignore this crippling Ethereum gas fee situation as Ethereum 2.0 will resolve everything. I hope so! In the meantime, Binance is a far more practical blockchain for most people, and PancakeSwap is a proven BEP20 DEX.

Curve

Curve FInance is yet another AMM that uses liquidity pools to facilitate token swaps between stablecoins and dollar-pegged crypto assets. There are all the standard features plus a few more options under the advanced tab, including optimization for order routing and fees. Again, all transactions are authorized through your DeFi wallet.

Curve’s edge is reduced slippage via their Bonding Curves innovation, one of the many improvements on the original AMM equation. Curve sits at number four on the Defi Pulse charts with 11.5 billion dollars locked up in their staking pools. Barely a year old, Curve is the go-to platform for swapping stablecoins. It’s interesting to note that the risk of impermanent loss is negligible as stablecoins tend to vary very little in price over time.

Balancer

There’s much more to Balancer than token swaps. They offer automated portfolio management on top of their liquidity management and price sensing tools. The impermanent loss issue is different with Balancer as you may invest any tokens in any proportions to support the liquidity pools. This is great if you intend to stake your ERC20 tokens and earn rewards, while still being exposed to the underlying token’s price action.

Balancer is ranked number 11 on Defi Pulse, with 1.85 billion dollars in staked assets. The killer application is being able to create liquidity pools, either private or public, with any tokens, proportions, and fee structure that you like. There are around 2,000 public pools already, so you will likely find the perfect pool for your portfolio.

These bespoke liquidity pools enable a greater range of trading and yield-farming options. This is all achieved by some devilishly clever mathematics, improving on the original AMM equation. There are some terms and conditions, so do your research before you enter a staking pool.

Other decentralized exchanges worth mentioning

IDEX – https://idex.market/

ForkDelta – https://forkdelta.github.io

Etherdelta – https://etherdelta.com

RadarRelay – https://radarrelay.com

Kyber Network – https://kyber.network/

DDEX – https://ddex.io

ERCDex – https://ercdex.com

Dextroid – https://www.dextroid.io/

Paradex – https://paradex.io/

Bancor – https://www.bancor.network/

Dubiex – https://dubiex.com

Trade Airswap – https://trade.airswap.io/

Oasisdex – https://Oasisdex.com

EasyTrade – https://easytrade.io/

Conclusion

If you use DEXs, try to use a reputable platform. Make sure your DeFi wallet is sound, and never give up custody of your tokens to any DeFi platform. Remember that staking for rewards and supporting liquidity pools is risky. Be aware of the potential impermanent loss, and if the rewards seem too good to be true, they probably are.

Another ever-present risk is market crashes which can put pressure on liquidity pools and can make it uneconomical to exit a position gone wrong. When markets are depressed, I would be hesitant about staking my crypto in a DEX liquidity pool.

Thoughts on DeFi and the Future

Who knows what will happen between DeFi protocols and financial regulators. Are the temptations of regulatory protection too strong for a DeFi industry that desperately craves acceptance and respectability? Will more deeply principled personalities prevail and stay true to the permissionless, trustless, financial system that Satoshi envisaged?

There are still risks associated with DeFi platforms. There are even “Unknown unknowns,” which would be a tricky paragraph to write. But that’s the thing with personal sovereignty, the responsibility is awesome. So used are we to our bank looking after our cash to the tune of $250,000, that we don’t see the changes already happening.

Consider this. When Bonnie and Clyde held up the local bank, a customer wouldn’t wander in a week later to be told how sorry the bank was, but all their money had been stolen. Yet nowadays, when money is stolen from our high street bank accounts, it’s suddenly our money that was taken, not the bank’s money! So we already have most of the downside with none of the upsides of decentralized finance.

For a few, the trade-off is worth it and the benefits of DeFi outweigh the complications and risks. For most, this is not yet the case. It’s a niche market, but it’s growing exponentially. Bitcoin could have been nipped in the bud in its first three years, but the authorities didn’t consider it a viable threat.

I’m not so sure government regulators will be fooled this time around. DeFi is a direct challenge to the banking system that the SEC is desperate to prop up. That’s what all the current S.E.C. vs Crypto hubbub is about.

You can see the dishonesty and corruption that DeFi is trying to eliminate. People are becoming wise to tech companies that treat customers like assets, and this is already a driving force behind DeFi adoption.

Recent articles have finally started to expose sharp practices by traditional exchanges and brokers to a point where Gery Gensler, head of the US S.E.C. has questioned the very legality of popular financial platforms, like Robinhood. The market makers and liquidity providers are not satisfied with the spread and trading fees. They have a deal with the exchange that for a fee, trades will be routed their way, in preference over the most efficient liquidity provider.

This PFOF system (Payment For Order Flow) was thought up by the infamous Bernie Madoff before he fleeced high net worth friends of their beloved capital. He went to jail forever, so perhaps others might follow? I doubt it. Robinhood is merely stealing from the poor. Madoff was stealing from the rich.

So which side are you on? I think there’s room for both to exist and a compromise will be reached. And if it isn’t? Well, DeFi is permissionless so… hold my beer!

I actually prefer Ethen which is really small. Wish they had more tokens trading there and volumes because it’s more convenient than most of the exchanges I’ve tried. Don’t need to register there, and it’s super easy to find orders with the highest/lowest price.