Even though PancakeSwap is a decentralized exchange, trades and swaps (and other activity on it, like earn or NFT trading) is not exempt from taxes. This is how you handle taxes on your PancakeSwap trades.

What you'll learn 👉

What is PancakeSwap?

Decentralized exchanges (DEXs) allow anyone to buy and sell cryptos without having to trust a third party. DEX is essentially a GUI (graphic user interface) for a smart contract that automatically matches buyers and sellers based on certain conditions.

PancakeSwap, which works on Binance Smart Chain, (and is in the process of expanding to other popular blockchains) is the largest decentralized exchange on this chain that lets you swap BEP-20 tokens plus other features such as earning through liquidity pools, buying and creating NFTs, and playing the lottery, etc.

The native token of the PanCakeSwap is CAKE which is used as the main fuel for all major features of the DEX.

Do you pay taxes on PancakeSwap?

Crypto trading platforms like PancakeSwap are becoming increasingly popular. However, there’s one thing many people don’t know about crypto — trading on them is taxable, just like on regular centralized exchanges. If you traded crypto on platforms such as PancakeSwap, you’ll likely owe some income tax.

Crypto trading is considered a capital transaction, meaning you incur capital gains every time you trade one crypto asset for another.

You must report the gain/ loss on each token swap in your tax return. PancakeSwap also provides liquidity pools where traders can stake their coins and earn interest or rewards. These are also taxable events in the US since they offer an opportunity to make money off your investment.

How are crypto-to-crypto swaps on PancakeSwap taxed?

Token swaps on decentralized exchanges are taxable events in the United States.

Tokens swapped on PancakeSwap are subject to capital gains tax. Each token swap, essentially a crypto-to-crypto trade, must be reported. The IRS requires traders to report the gain or loss on the sale of one crypto to another. If you sold $100 worth of Bitcoin for Ethereum, you’d need to report the transaction to the IRS.

The Internal Revenue Service requires every trader to file Form 8949, “Sales and Other Dispositions of Capital Assets.”

How is adding/removing liquidity on PancakeSwap taxed?

There is no official IRS position on whether or not transactions that add or remove liquidity from decentralized finance (DeFi) protocols like PancakeSwap are taxed. Despite widespread curiosity, no clear answer has yet been found to this puzzle.

The conservative approach is to treat the addition/removal of liquidity as a taxable crypto swap. In this situation, you would incur a Capital Gain or Loss based on how much the price of the crypto you’re trading has changed since you first acquired it. For example, if you get $1 in Ethereum and sell it for $2, you will have a $1 capital gain. If you acquire $3 of Ethereum and then sell it for $1, you will have a $2 capital loss.

One may take a more aggressive approach and treat the addition or removal of liquidity from DeFi platforms as a tax-free occurrence. As this would be viewed as a deposit/withdrawal rather than a sale/purchase, no taxes would be owed. Nonetheless, there are costs involved, such as commissions and fees.

Do you pay tax on liquidity pool tokens on PancakeSwap?

PancakeSwap doesn’t give you new liquidity pool tokens when you make trades. Instead, the value of your existing liquidity pool tokens increases every time someone else uses the liquidity pool you’ve contributed to – so you never actually ‘earn’ new tokens.

This means you won’t owe income tax on PancakeSwap tokens because you aren’t earning new ones. Realized profit is only possible if liquid assets are sold. If you sell your PancakeSwap tokens for another crypto, you’ll realize a capital gains tax liability.

Do you pay tax on staking liquidity pool tokens on PancakeSwap?

As of yet, the Internal Revenue Service has not published definitive rules on the taxation of staked awards. Since this is a means of acquiring additional tokens, though, it is to be seen as income. In other words, the fair market value of the CAKE you receive from staking your liquidity pool tokens is subject to Income Tax at the time you receive it.

Do you pay tax on staking cake in SYRUP pools?

Yes. Any incentives that are earned through the staking of a token, regardless of the type of token, are taxable income. At the time you receive your new tokens, you will be required to make an income tax payment based on the worth of those tokens according to the current fair market.

Do you pay tax on PancakeSwap NFTs?

NFTs are treated like coins or tokens from a tax perspective. If you sell an NFT, you’ll generally incur a capital gains tax on profits. So, for example, if you bought an NFT for $1,000 and sold it for $2,000, you’d normally have to pay income taxes on the extra $1,000 earned.

However, when it comes to buying NFTs because you almost never buy them with fiat currency, this is seen as a “crypto to crypto” transaction, and any capital gain is taxable.

How are yield farmings on PancakeSwap taxed?

Rewards earned through yield farming on PancakeSwap are taxable in the United States. Staking your liquidity pool tokens on farms operated by PancakeSwaps can earn you crypto rewards, which can be recorded as interest on your tax return. The awards you receive are considered taxable income and must be reported at their full fair market value (in US dollars) upon receipt.

Staking your liquidity pool tokens provides crypto rewards that add up to your total yearly earnings, and unlike typical token swaps, these crypto awards are not taxed.

How to keep track of PancakeSwap trades for taxes?

If you are a crypto trader, keeping track of your trades can become quite difficult. There are many exchanges out there, each with hundreds of trading pairs. Not only do you have to remember what exchange you used for every trade, but you also have to remember whether you bought or sold. This is where crypto tax software can help.

For example, ZenLedger is a tool that allows you to import your PancakeSwaps trades. All you have to do is enter your Binance Smart Chain address, and CoinTracking does the rest. Once imported, you can see all your transaction history in a single place, including fees and amounts.

Learn more about how to report taxes on other crypto activities:

- How to do DeFi taxes

- How to report NFTs on your tax return

- How to report your crypto staking rewards in your tax returns

- How to do taxes for Trust Wallet trades

- How to do MetaMask taxes

How to do your PancakeSwap taxes?

To calculate how much Pancakeswap taxes you need to pay, you need to know how much money you made trading on the platform.

There are two ways you can do this:

1. Connecting to the Binance Smart Chain and PancakeSwap via their API and using crypto tax software.

To use the crypto tax app, all you need to do is enter your BSC Public Address or Key from the wallet you use to access the Pancakeswap Platform, and the app will import your transaction history, sort it by kind, and compute your taxable gains, losses, and income.

2. Using a third-party tool such as BSCscan to export your transaction history in a CSV format.

The Pancakeswap platform does not offer a CSV download option, but third-party services such as BSCScan can let you export your transaction history to a CSV file. Then, you can use this CSV file to manually tally your taxable purchases, sales, losses, and gains.

Koinly

Your purchases, sales, swaps, income, etc., are all imported. Then, it will convert your purchases into the currency of your nation at the current market rate.

Which of your transactions are taxed and which are not is ultimately decided by it. It functions by calculating your profits or losses on PancakeSwap, crypto earnings, and so on. All of the information is crucial in ensuring that your tax return is complete and accurate for submission to the appropriate authorities.

ZenLedger

ZenLedger, a tax calculation program, connects with popular crypto exchanges (both CEX and DEX) like PancakeSwap and wallets to aggregate transaction data, compute taxes, and automatically prepare tax reports. It also integrates seamlessly with popular tax software like TurboTax.

Its software was developed with certified public accountants and other accounting professionals in mind and may be used to centrally administer a large user base. It offers a distinct, handy tool for tax loss harvesting on top of the many tax forms for various countries and areas that it supports.

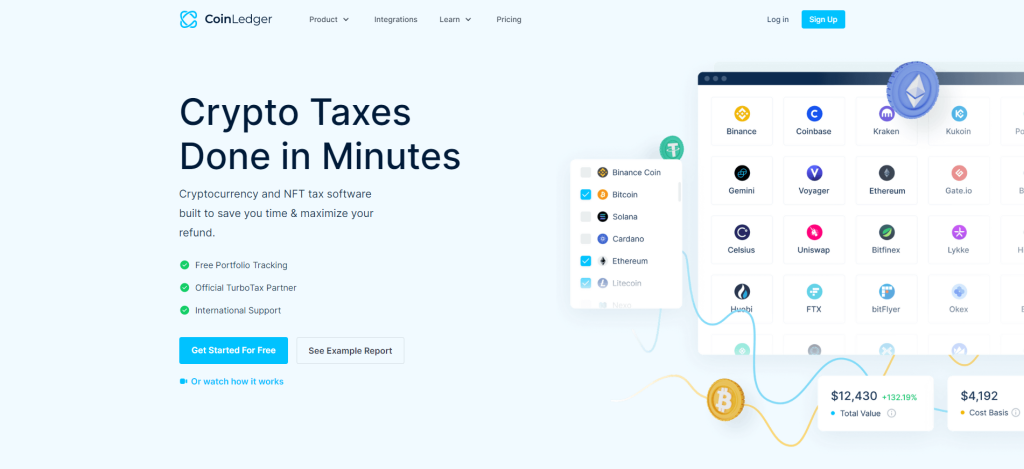

CoinLedger

Coinledger is a web service that connects to crypto wallets and exchanges like PancakeSwap in order to compile records of purchases and sales and then uses this information to prepare tax returns at the press of a mouse.

There are two ways to import data from the exchanges into the tax platform: either manually by entering the information into the platform or automatically by linking the public address used on PancakeSwap. It connects to all the major markets so that you won’t have any manual data entry.

FAQs

No, PancakeSwap does not provide a tax report, but you will be able to obtain a tax report by importing the history of your transactions into a crypto tax program through the use of an API provided by PCS or a CSV file import.

No, PancakeSwap does not supply a financial statement.

To generate a PancakeSwap tax form, you have two ways to do this, dependent on whether or not you use crypto tax software.

PancakeSwap’s whole transaction history for the fiscal year is required if you’re handling your own taxes. You must use Form 8949 for capital gains and losses, Schedule D for net capital gains and losses, and Schedule 1 for crypto income to report any taxable transactions and their associated income or capital gain/loss to the IRS after downloading a CSV file (and potentially Schedule C too for income).

You can save a ton of time and effort by using a crypto tax app. Syncing your PancakeSwap transactions via API is all that’s required. Then, your crypto tax app will tabulate your earnings, deductions, and gains or losses. The localized tax report is available for download and submission to the appropriate authorities.

No, PancakeSwap does not directly report to the IRS. The terms and conditions page or the privacy policy makes no mention of sharing with tax authorities. Your trading record, however, is publicly available on the BSC blockchain and one would only need to know your public address to figure out your trading moves and gains/losses.

Each crypto-to-FIAT or crypto-to-crypto trade must be reported in the United States. As a result, if you trade tokens on PancakeSwap, you must declare all gains and losses for those exchanges. Keep track of your transactions and submit them on Form 8949 and Schedule D of your Form 1040.

Yes, PancakeSwap swap is a taxable event. On PancakeSwap, every time you exchange one token for another, you experience a taxable event and are liable for capital gains taxes. The IRS must be informed of each token exchange, which is essentially a crypto-to-crypto trade, and you must calculate the gain or loss for each transaction.

Yes, BNB Smart Chain is taxable. Transactions conducted using the Binance Smart Chain, like those conducted using other blockchains, are subject to taxes on both capital gains and income.