Coinledger.io Review – Is This Bitcoin Tax Calculator Legit and Safe?

While crypto fans wait for regulations to get better, it’s a real pain to file your taxes with cryptocurrency. Well, it is a hassle if you try doing it manually or with some outdated calculator. Luckily, this sector of crypto industry is growing strong by month, so we tested out and put up this review of one of the most popular cryptocurrency tax calculators – Coinledger.

Once you pass $20K in crypto transactions, Coinbase is required to report your crypto transactions to the IRS since you have to pay for the crypto taxes. It seems likely that tax authorities worldwide will follow suit, forcing Coinbase and the other exchanges to do the same for any of their citizens. So we should all be prepared to get taxed.

So what can you expect to see in this Cryptotrader.tax review? Pretty much everything you need to make a call – buy a license or pass and search further for a better solution.

•CoinLedger is a popular tax reporting software for cryptocurrency users. It is relatively easy to use, cost-efficient and allows users to compute their crypto taxes seamlessly.

•The platform also provides tools for tax professionals to view and edit tax reports on their client’s behalf.

•CoinLedger has integrations with major crypto exchanges and wallets, or users can upload their transactions as a CSV file.

•It also provides a directory of certified crypto tax accountants for users to hire.

•CoinLedger added integration with Polygon, a decentralized blockchain platform, in July 2022, so users can import their transaction history to generate tax forms.

•CoinLedger offers 4 pricing tiers – Hobbyist ($49/year; max 100 transactions), Day Trader ($99/year; max 1,500 transactions), High Volume ($159/year; max 5,000 transactions) and Unlimited ($299/year; no limit).

•CoinLedger is integrated with 4 tax filing softwares – TurboTax, TaxACT, TaxSlayer, and H&R Block – so users can exchange information between any of the platforms seamlessly.

•CoinLedger can also import NFT transaction data through API integration with OpenSea or wallet address.

•Data can be imported using APIs, a CSV file, wallet scan, or manual input.

•Once data is imported, taxes will be automatically calculated

•Users have the ability to manually review the taxes and make changes to the tax reports if needed.

•Tax reports can be exported to preferred tax filing platform or shared with a tax accountant.

•Portfolio tracking is also an option with CoinLedger.

•Transactions can be classified to avoid confusion come tax time.

Tax Savings Opportunities with CoinLedger

•CoinLedger provides the ability to compute the cost basis of crypto transactions, which is necessary to determine capital gains and losses.

•Tax loss harvesting is an act of selling investments at a loss to offset capital gains from other investments.

•CoinLedger can compare cost-basis of transactions with the current market price to calculate unrealized losses, which can be identified in the tax-loss harvesting tab.

•Users can grant access to their tax reports to certified accountants or professionals through the Tax Pro account feature.

•CoinLedger generates various types of tax reports and flags transactions with missing cost basis.

Comparing Crypto Tax Platforms: CoinLedger, TokenTax, and CoinTracker

•TokenTax is a significantly costlier platform than CoinLedger, with its highest plan costing up to $3,499 annually. TokenTax’s highest tier includes live consultations with tax experts, while CoinLedger doesn’t.

•CoinTracker is a more affordable tool than CoinLedger, but it has limited functionality in terms of transaction imports, and only has direct integration with DeFi exchanges at higher priced plans.

•For just $299, CoinLedger allows you to import your transaction history from multiple wallets and exchanges and have it perform the tax calculations for you. It is ideal for frequent but not enormous transactions.

•CoinTracker has a free tier that allows users to analyze 25 transactions at most, making it suitable for users with a few transactions.

•CoinLedger is safe to use as it only requests read-only access to exchange accounts or wallet addresses, and does not store users’ transaction data on its database.

•Data sent to and from CoinLedger is encrypted using 256-bit encryption to protect unauthorized access and theft.

What you'll learn 👉

What is Coinledger (previously called Cryptotrader.tax) and what makes it a good bitcoin tax software?

In a nutshell, CryptoTrader.Tax is a cloud-based software that integrates with crypto exchanges to collect trading data and then uses that data to compile tax reports – all done automatically with couple of button clicks.

How does Coinledger/Cryptotrader.tax work?

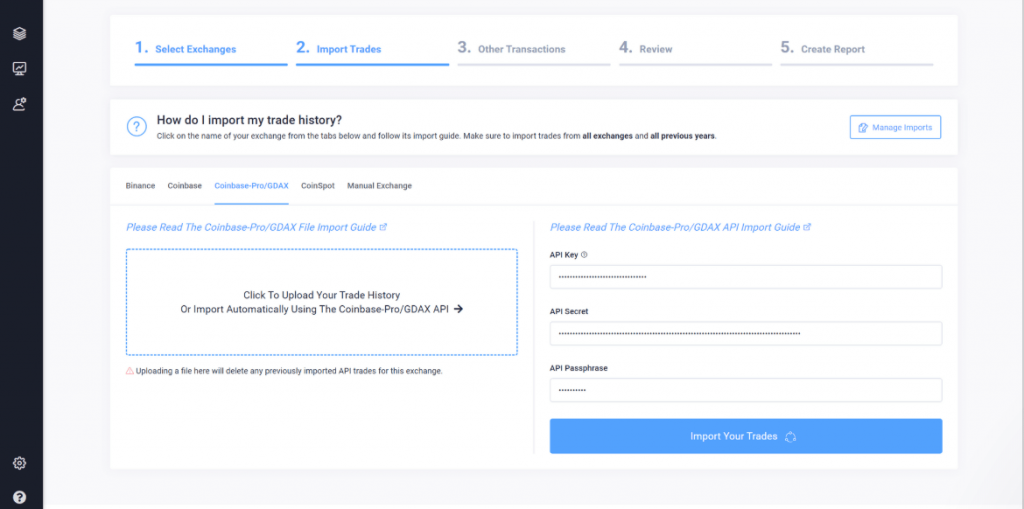

First step is to collect your trading data by either importing it through API keys that you connect to Cryptotrader.tax or by downloading that data from the exchanges and manually uploading it to the tax platform. CryptoTrader.Tax integrates with all major exchanges so you probably won’t have any manual work to do, unless you traded on some small, obscure crypto exchange.

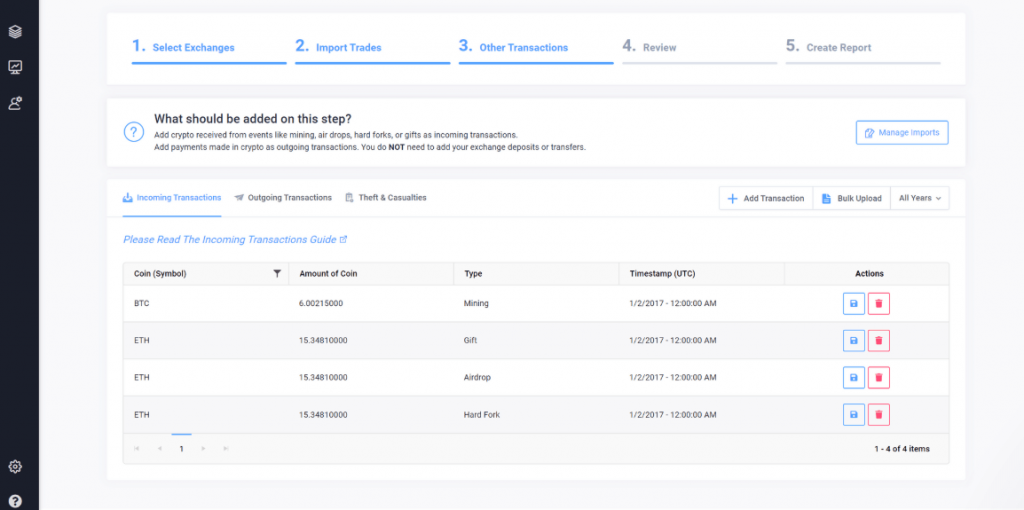

Since people acquire crypto assets differently, you need to “explain” that to the software in the second step when you add your sources of cryptocurrency taxable income. CryptoTrader.Tax can calculate your crypto taxes from mining, staking, gifts, airdrops, and forks.

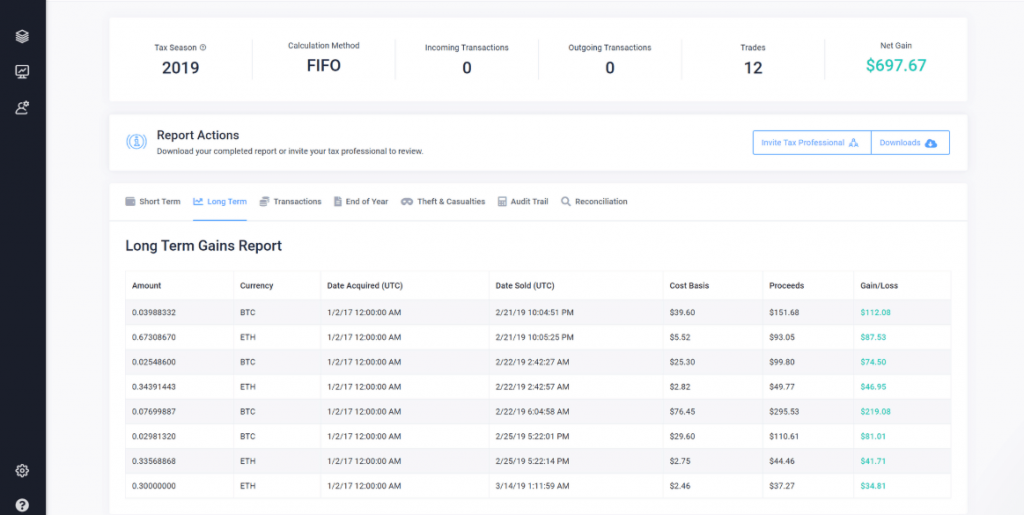

Third step is the final one – you check if everything got imported and calculated correctly and download your completed crypto tax report. For each tax year, the following documents are automatically created:

- Cryptocurrency Income Report

- Short & Long Term Sales Report

- IRS Form 8949

- Audit Trail Report

- End of Year Positions Report

- TurboTax Online Direct Import

Another top-notch feature that separates CryptoTrader.Tax from its competitors is its integration with the biggest tax tools – like TurboTax or TaxAct. This makes it easy to file reports yourself or send them off your your accountant to handle them for you.

What exchanges are supported by Coinledger?

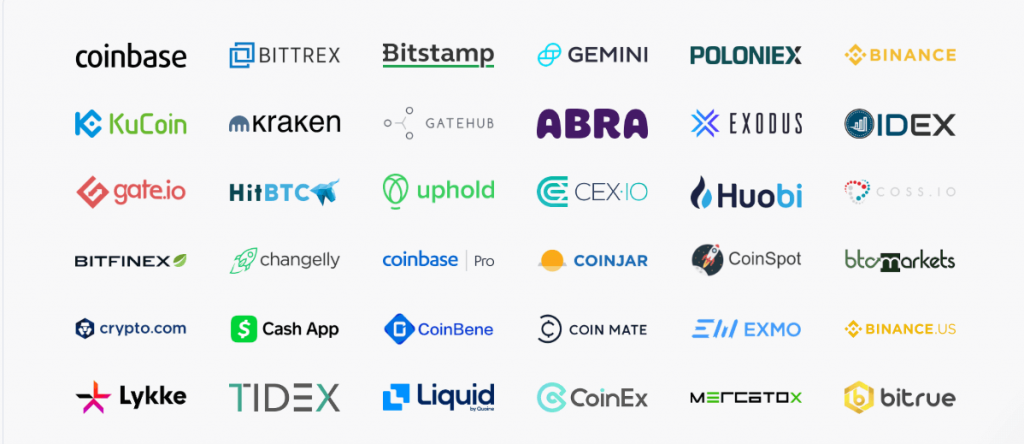

Having an ability to integrate with major exchanges (the more, the merrier) is one of the major selling points and criteria in deciding if some crypto tax software is good or not.

Coinledger shines in this aspect with integration to almost every known exchange in crypto world – from the big ones like Coinbase, Binance, Krakento the small ones like Mercatox, Lykke or Bitrue.

And if the exchange you used is not on the list of supported exchanges, you can still use Cryptotrader.tax by importing your trades from these crypto platforms using the Generic CSV Import template.

What countries are supported by Coinledger?

Right now, only US tax reports wit plans for expansion to other countries and continents.

CryptoTrader.Tax Review – Demo account

You can see CryptoTrader.Tax at work before shelling out money for a license. CryptoTrader.Tax allows you import your crypto trading data and income for free. You only have to buy the license when you want to view and download your full report.

CryptoTrader.Tax Price

The licenses you buy are for one tax year. There are four different pricing packages that range from $49 to $299 and they all include full features of the platform. The only differentiator is the number of transactions you can import into the tool.

You can buy your report with credit cards like Visa, MasterCard, or American Express. Plus, they offer a full money-back guarantee for all purchases, within 14 calendar days of your purchase.

Is CryptoTrader.Tax safe and secure?

The team behind the tool is very transparent with solid record track in IT and accounting history. The site itself uses SSL encryption on every single web page to ensure your data stays private.

Can I export my reports?

CryptoTrader.Tax lets you export and download all of your crypto trading history and tax reports, including the IRS Form 8949.

CryptoTrader.tax vs competitors

Main competitors of CryptoTrader.tax are listed below. We reviewed all of them and can safely say that crypto tax tools are a neck and neck race with all tools following each other in a lockstep when it comes to features and pricing.

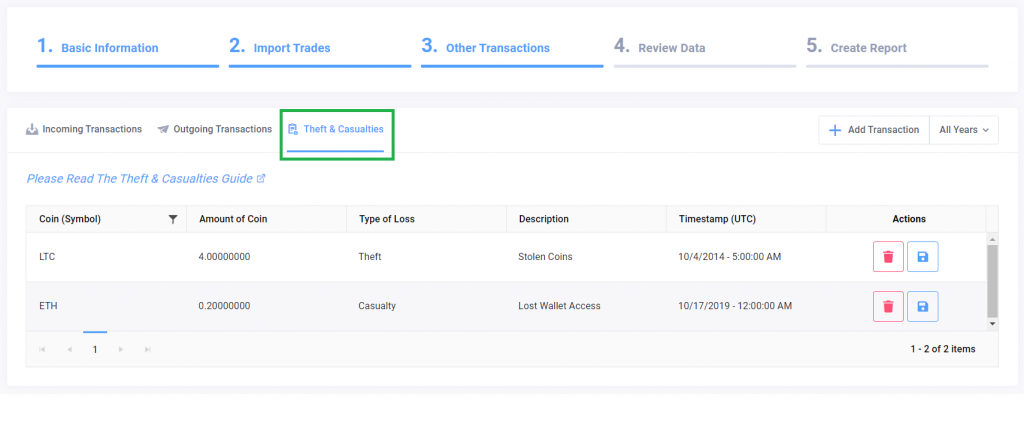

How does CryptoTrader.Tax manage stolen or lost coins?

There is a separate option in the software for such cases.

You need to navigate to the step 3 – Other transactions and then click on the Lost & Stolen Coins tab.

On this page, you add coins that you have lost or got robbed off. For each entry, you need to fill out all of the following fields:

- Coin – The ticker symbol of the coin lost

- Amount of Coin – Amount that was lost

- Type – Theft, Casualty, or Investment Loss (See more in this post)

- Description – Description of the lost coins (Will NOT impact the calculation)

- Timestamp (UTC format) – The date that the coin was lost

CryptoTrader Tax Review – Final verdict

Overall, this is a great tool – broad selection of exchanges, seamless integration with popular tax software for automatic filing of reports + tiered pricing to fit everyone’s taste make CryptoTrader Tax one of the, if not THE, best cryptocurrency tax calculators.