What you'll learn 👉

How to Do Your Trust Wallet Taxes?

For those just getting started with crypto, Trust Wallet is a noncustodial (you own the keys), open-source mobile (both iOS and Android supported) wallet. In June of 2018, Binancebought it.

Trust wallet is one of the finest out there and especially popular among holders who like to access DeFi apps, store their NFTs or stake their coins because it supports 160K+ different assets and blockchains. Over 5 million people throughout the world regularly use it. There are no sign-up or monthly fee costs for users of Trust wallet.

Trust Wallet is right behind the leading MetaMask crypto wallet, which is undoubtedly the most popular web wallet. Here is a guide on how you pay taxes on your MetaMask trades.

The IRS classifies crypto held in Trust Wallet or elsewhere as property, making it liable to capital gains and ordinary income tax when sold or exchanged. This includes NFTs as well, which need to be taxed similarly to the ‘regular’ crypto tokens. Here is a guide on how to report tax on your NFTs.

Every time you sell some of your cryptos, you’ll either make a profit or a loss. Buying or selling crypto for another crypto or fiat cash is a taxable event, and you will pay capital gain tax. One must pay regular income tax on crypto gains. This includes things like getting an airdrop or staking rewards on your Trust Wallet.

While Trust Wallet does not directly supply tax paperwork, you may export your Trust Wallet trade history and import it into third-party crypto tax software to have reports created for you.

If you want a trustworthy tax report, it’s best to sync your Trust Wallet transactions with dedicated tax software such as Zenledger or Koinly. The tax software compiles your financial data into a report that can be submitted to the government without more input from you.

How to get your transaction history from Trust Wallet

Integrate with a crypto tax tool via Trust wallet address

You will need your wallet addresses and public (XPUB) keys to combine Trust Wallet with a crypto tax application. To get (XPUB) keys, follow the steps below:

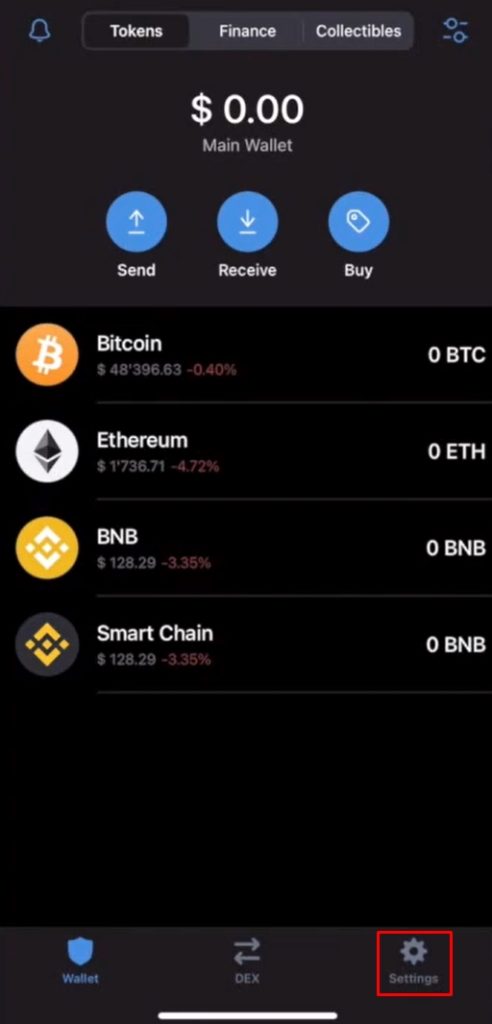

- Access the “Settings” page by clicking the cog in the rightmost corner of the screen.

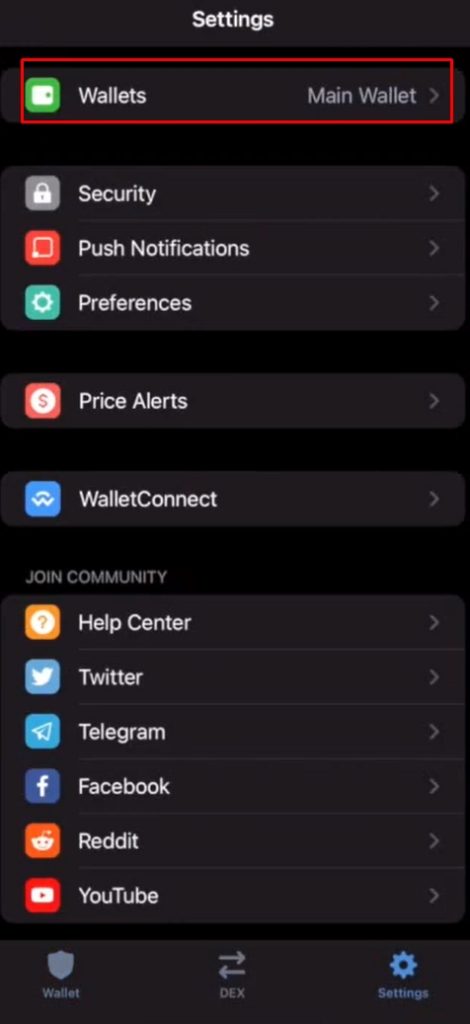

- Then select “Wallets” from the menu that appears.

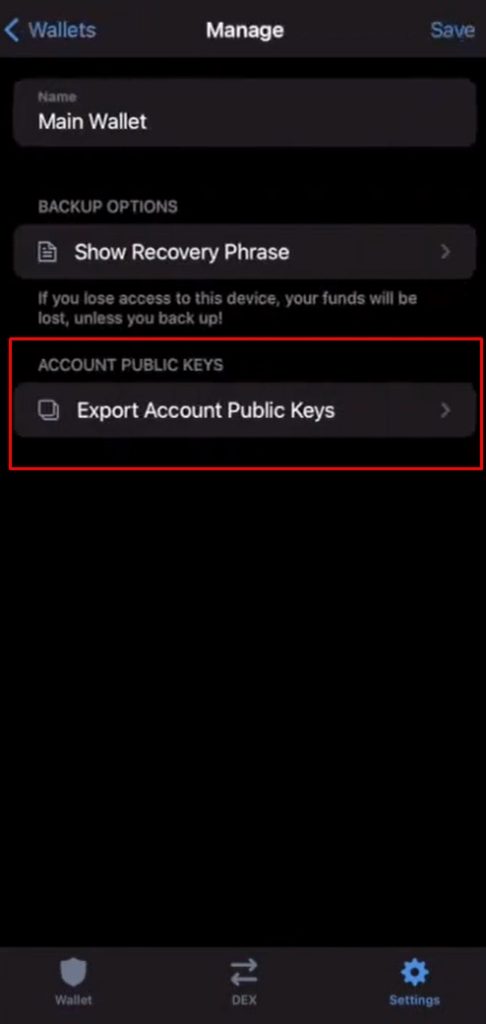

- Press the “Info Sign” button.

- Next, click on “Export Public Keys of your Account“

- Select the necessary Public Key for export, and then copy it.

Getting your wallet addresses from your Trust wallet

It only takes three easy steps to obtain the wallet addresses for each of your blockchains:

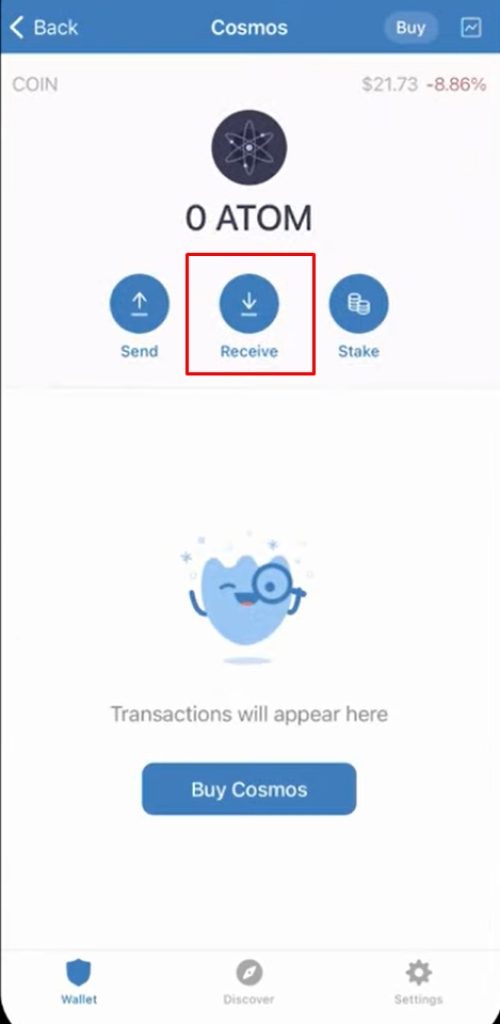

- To acquire the address for a particular chain, click on the one you’re interested in.

- Select “Receive” as the next step.

- When you are finished, select “Copy” to copy your wallet’s address.

Entering your Trust wallet keys/addresses into a tax tool

When making a new wallet, you can choose between two distinct approaches. One alternative is to utilize a separate instance of the general blockchain wallet for each additional chain. Another choice is to make a new Trust wallet, which provides access to various chains without needing additional wallets.

Here are the measures that must be taken to accomplish the goal:

- Coin type and address/key must be entered in the appropriate boxes

- You can add additional coins for each address you own in your trust wallets.

- Once you’ve added the necessary coins, you may wrap up the connection by saving the connection.

Integrate with a tax calculator via the Trust wallet CSV/XLSX file

A CSV file detailing your trade, withdrawal, and deposit history may be imported into the tax calculator in place of directly linking your Trust wallet. To do this, follow the steps in the text below.

Downloading CSV Files from Trust wallet

Unfortunately, the Trust wallet does not include an in-built option to download CSV files. So, there are two options for exporting your transactions to a CSV file:

- by using some public explorer such as Etherscan or Bscscan (or other chain-specific explorers)

- by making a manual file containing all of your deposits and withdrawals

Importing CSV files into a tax tool

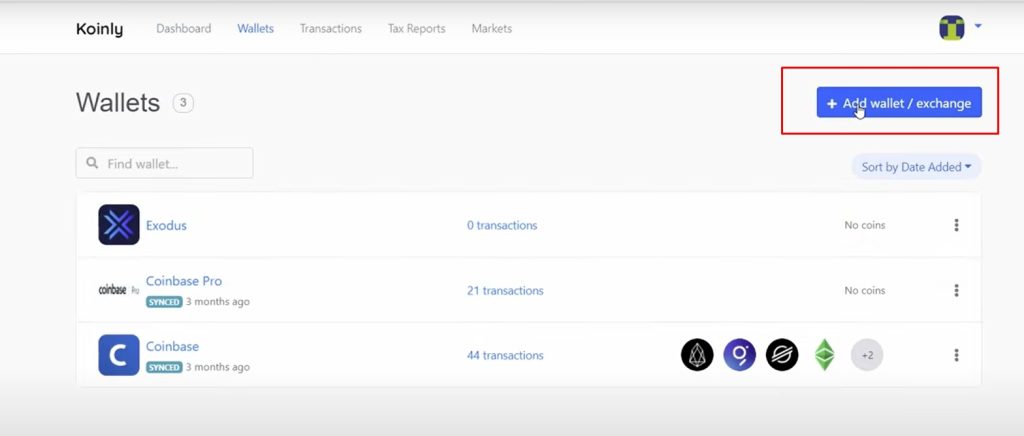

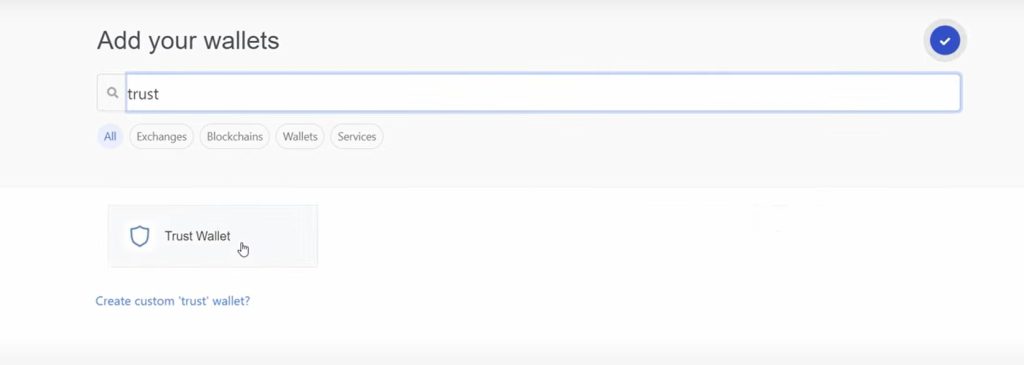

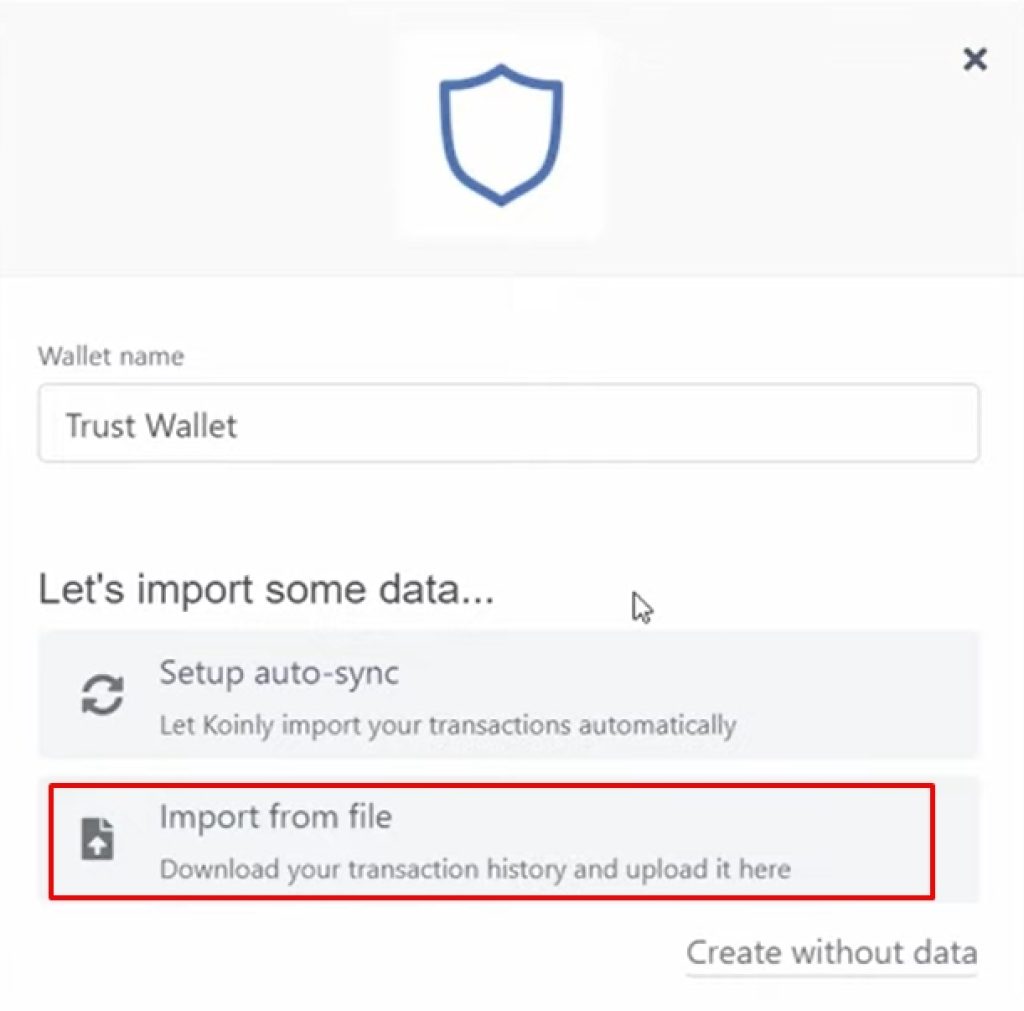

Importing CSV files into a tax tool is a very easy process which we show below on the example of Koinly tax tool. You just do these steps in the text below:

- First, to add your Trust wallet to your tax tool account, press the “Add wallet” button

- Then, in the dropdown menu, select “Trust” as your chosen wallet

- After that, click on “Import a file“, and then press the “Continue” button

- Chose your downloaded CSV file from your computer, and type “Trust” for the wallet name

- To import all your data, select the “Import All” option, and after that, click on the “Save” button

After doing all these steps, your data will import into a tax tool.

Integrate with a tax calculator via the Trust wallet API

You can access your investments’ performance and gain/loss history from your Trust Wallet wallet by connecting your account with the platform via the methods described below.

Exporting data from Trust Wallet is done automatically by using its built-in API. It doesn’t require any manual effort.

Connect the crypto tax tool of your choice to your Trust Wallet account with the read-only API.

Let the crypto tax calculator import your data and automatically generate your gains, losses, and income tax reports.

FAQs

Since the Trust wallet does not include an in-built option to download CSV files, to get your Trust wallet transaction history, you must use some public explorer such as Etherscan or BscScan or manually create a file with all your deposit and withdrawals.

Customers and the IRS do not get tax reporting information through Trust Wallet. However, it’s conceivable that something may change soon. Brokers that assist crypto transactions must provide 1099-B forms to customers and the IRS under the 2021 American infrastructure bill.

No, Trust Wallet does not provide CSV Exports. So, to get your Trust wallet transaction history, you must use some public explorer such as Etherscan or BscScan or manually create a file with all your deposit and withdrawals.

No, Trust Wallet does not provide an end-of-year statement, but it can provide you with this if it integrates with crypto tax software.

Trust wallet API is a software code that lets Trust Wallet connect with software such as tax tools.

Since Trust Wallet does not provide a mechanism to export transaction data via CSV file, the API integration approach is the most effective way to keep tabs on your financial activity. Your Trust wallet transaction history may be quickly imported via an API interface, which will instantly sync your Trust wallet transaction history with the tax tool.

Customers and the IRS do not get tax reporting information through Trust Wallet. However, it’s conceivable that something may change soon. Brokers that assist crypto transactions must provide 1099-B forms to customers and the IRS under the 2021 American infrastructure bill.