The dilemma often surfaces: Koinly vs Cointracking – which platform triumphs in streamlining your digital assets and tax computations? Both platforms have carved out their own niches in the cryptocurrency universe, offering a suite of features that cater to both novice and adept investors alike.

The conundrum of choosing between Koinly’s comprehensive portfolio tracking and Cointracking’s robust multi-jurisdictional reporting features is one that many crypto enthusiasts find themselves entwined in. As we delve deeper into the nuances of these platforms, we’ll explore their unique strengths, potential drawbacks, and ultimately, assist you in deciphering which platform aligns seamlessly with your crypto management and tax reporting needs.

Buckle up, as we embark on a meticulous exploration through the capabilities and offerings of Koinly and Cointracking.

| Aspect | Koinly | Cointracker |

|---|---|---|

| 📊 Portfolio Tracking and Tax Calculation | Known for comprehensive portfolio tracking and tax calculation features. Automatically tracks crypto transactions across exchange accounts and wallet addresses, using a tax engine to calculate taxes with accuracy. Supports a wide range of exchanges and wallets. | Offers robust reporting features and supports multiple countries, making it suitable for businesses and individuals operating in multiple jurisdictions. Has a smaller number of exchanges and wallets integrated but covers popular options. |

| 👥 User Interface | Not specifically mentioned, but by contrast seems to be more user-friendly. | Might not be as user-friendly as Koinly, potentially making it a bit harder to navigate for new users. |

| 🔄 Integration | Supports over 300 exchanges and a wide range of wallets. | Offers support for 455 exchanges and 28 wallets. |

| 🌐 DeFi and NFT Support | Provides crypto tax services for all arms of the DeFi world and supports NFT transactions. | Helps users to track tax services for lending, staking, mining, and other DeFi activities, and also tracks NFT transactions. |

| 💰 Pricing | Offers a free plan along with paid plans. Some users might find its pricing to be on the higher side. | Also offers a free plan along with paid plans, and seems to offer better prices. |

Overview

Koinly and Cointracking are both very popular crypto tax calculators with similar pricing and features. However, depending on your needs (Koinly fits better if you are a day trader that does a lot of transactions, Cointracking is good for those who are on a tight budget, both support DeFi and NFTs etc.) either Koinly or Cointracking come out on top.

Let’s dig deeper into this comparison.

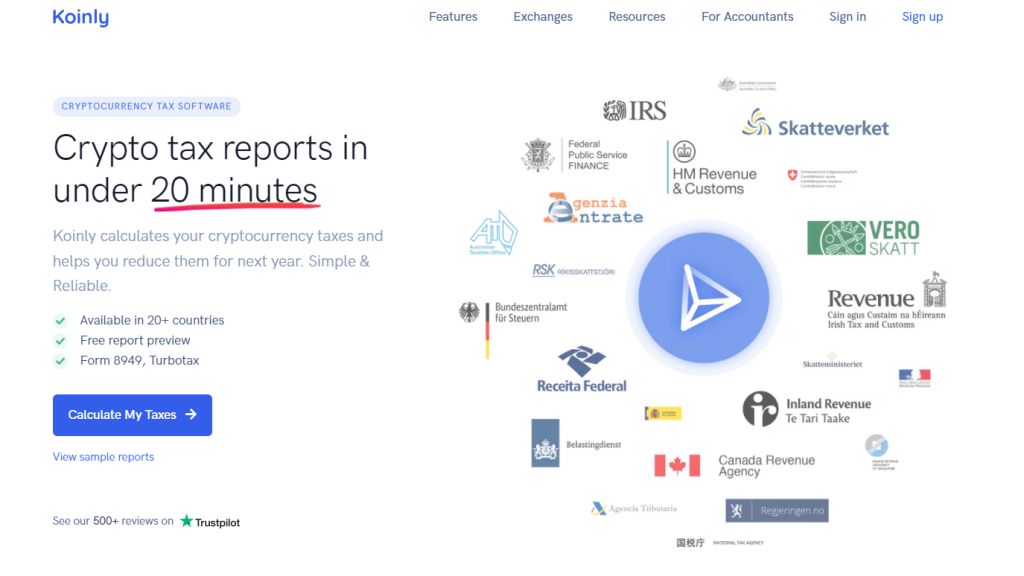

Koinly is a cryptocurrency tax calculator which allows investors to monitor their crypto activities and generate tax reports. It functions both as a portfolio tracker and a tax calculation tool. This two-in-one package has established it as one of the foremost in that department.

It is an online accounting platform that has made it easy to compile tax reports on crypto transactions, automatically importing transactions and market prices at the point of trading and matching transfers as well.

Cointracking is also a crypto tax software. It was created in 2017 and is one of the earliest cryptocurrency tax tracking software. It is designed to give up-to-date profit and loss reports of your account and tax reporting. It helps check your crypto holdings by currency in different crypto accounts.

These two tax tools are similar in many ways. However, there are also ways in which they are different. We will consider their various features in this article, highlighting their merits and demerits relative to each other and helping you choose between them

What you'll learn 👉

What are Crypto Tax Tools

Paying tax on investments is unavoidable. For many, though, paying taxes is not the issue. The issue is calculating how much tax you owe across your various investments and trades. The same happens in the crypto world. What is the solution? Crypto tax tools. What exactly are they?

Crypto Tax Tools are digital software designed to help business holders and individuals to calculate the tax owed on their various cryptocurrency investments. There are many such crypto tax tools, each with its own merits and demerits. Apart from Koinly and Cointracking, which this article will address, there are also Zenledger, Cointracker, etc.

Visit Koinly Now Visit Cointracking Now

KOINLY VS COINTRACKING SUPPORTED COUNTRIES

Koinly is supported in over 20 countries. Some of them are the United kingdom. Germany, Denmark, Finland, Norway, Netherlands, France, Spain, Italy, Austria, Lichtenstein, Ireland, Czech Republic, Estonia, Malta, etc.

On the other hand, Cointracking is supported in over 100 countries, including the big guns like the USA, UK, Germany, Netherlands, Canada, etc.

KOINLY VS COINTRACKING SUPPORTED EXCHANGES AND WALLETS

KOINLY SUPPORTED EXCHANGES AND WALLETS

Koinly supports over 300 exchanges which include Australian exchanges like Coinspot, Coinjar, Swyftx, independent reserve, as well as bigger exchanges like Coinbase, Crypto.com, Binance, FTX, Gemini, Kraken, Kucoin, andGate.io. Some supported wallets areBlockFi, Celsius, Exodus, Ledger, Nexo, Trezor, Trust wallet, Yoroi, etc

COINTRACKING SUPPORTED EXCHANGES AND WALLETS

Cointracking supports about 84 exchanges and wallets in total. Some of these exchanges are Crypto.com, Deribit, Binance, Gate.io, Hotbit, HitBTC, Gemini, FTX, Huobi, etc. Some of the supported wallets are Trust Wallet,MetaMask, Bitbox, Electrum, Exodus, etc.

KOINLY VS COINTRACKING – OTHER SUPPORTED SERVICES(MINING, STAKING, DEFI, LIQUIDITY PROVIDING, NFTS)

KOINLY: Koinly provides crypto tax services for all arms of the DeFi world. It supports both decentralized and centralized exchanges and allows you to track your total holdings across all the relics of the crypto world. With a simple API connection, you can see all the taxable income that comes from mining, staking, liquidity providing, NFTs, and other aspects of decentralized finance.

It also provides information regarding how exactly these DeFi items are taxed so that users know what to expect. It does that using its various help articles both on its website and blog.

COINTRACKING: Cointracking also helps users to track tax services for lending, staking, mining, and other DeFi activities. It also provides articles that state how those events are taxed. In addition, it tracks NFT transactions and compiles the tax requirements as applicable.

KOINLY VS COINTRACKING – PRICING

Koinly pricing plans come with unlimited wallets/exchanges, tax reports, portfolio tracking, margin trades, and DeFi. It also includes essentials like Form 8949, TurboTax, international tax reports, a comprehensive audit report, and a live chat.

- The NEWBIE plan ($49 per tax year) is for beginners and includes 100 transactions.

- The HODLER plan ($99 per tax year) includes 1000 transactions.

- TRADER plan ($179 per tax year) includes 3000 transactions and priority support.

- PRO plan ($279 per tax year) includes over 10,000 transactions and priority support.

As for Cointracking, there are five different pricing packages, namely:

- The FREE package: allows you to track up to 200 transactions with personal CSV exports and 2 trade backups

- The PRO plan: goes for 10.99 dollars and allows tracking up to 3,500 transactions.

- The EXPERT plan: allows you to track up to 20,000(for $16.99), 50,000(for $21.99), or 100,000(for $27.49) transactions.

- The UNLIMITED plan: unlimited number of transactions for $54.99

- The CORPORATE plan: a custom plan for companies who want to create multiple accounts.

In this regard, Cointracking is cheaper and offers more payment options.

Read also:

- Crypto Tax-Free Countries – Crypto Tax-Friendly Countries (Europe & Asia)

- Koinly vs Zenledger

- Koinly vs Coinledger

- Koinly vs Cointracker

- Cointracker Alternatives

CONCLUSION

Cryptocurrency tax software can help you manage your cryptocurrency investments successfully. It is also of importance that you keep your own records so that you can double-check your tax reports

Following the details in this article, it is observed that both software have a lot of similarities but also have unique features. However, Koinly is considered to be the best tax software among the two.

In terms of price, though, Cointracking is better. It has a generous free plan and cheap payment plans that seem to be for everyone. It also has a corporate solution for institutions to partake of.

That being said, though, you understand best what situation you are in. Therefore, it’ll be good to observe the facts we have presented in this article and decide for yourself which one will work for you.

Read also:

- CryptoTrader.Tax review

- ZenLedger Review

- Best Binance Tax Calculators

- TokenTax Review

- BearTax Review

- Is Accointing Crypto Tax Tool Any Good?

FREQUENTLY ASKED QUESTIONS

Are Airdrops, Forks, Staking, And Mining Taxed?

Mining

Crypto mining is a taxable event that depends largely on where you reside, how you mine, and how much you make from mining. Small-scale miners usually pay taxes only when they sell their mined coins. However, large-scale miners may have to pay double taxes – when they get the mined coins and when they sell them.

Forks

Whether or not a crypto fork will be taxed depends on the region you live in and the type of fork. If it is a soft fork where no new token is discussed to already existing token holders, it is not a taxable event. However, if it is a hard fork and gives you new coins, it is considered income and taxed.

Also, if you later sell the new coin gotten as a result of the fork, you have done another taxable event. Thus, forks usually give yield to double taxes for US citizens.

Staking

Staking generates rewards and is, therefore, a taxable event. Keep in mind, though, that you are not taxed for moving your coins to a staking pool as it is considered as moving your coins from one wallet to another( a non-taxable event).

Staking rewards, on the other hand, are taxed based on where you live and what staking mechanism you use. Generally, though, you will need to pay taxes when you dispose of your staking rewards by selling them

Some crypto enthusiasts are clamoring for a tax-free staking bill to be passed. However, that is yet to be realized.

Airdrops

Airdrops are considered to be easy money because, most times, they come free. However, they come with big responsibilities. You are taxed when you receive an airdrop because the IRS considers it as an income. You are also taxed when you swap, sell, spend or gift coins or tokens that are received from an airdrop. This is because the IRS considers it as Capital Gain