Accointing? Yes, you read that right. Now, we all pay taxes, well, that’s common. However, the process can be full of hassles and complexities, especially when it comes to disruptive assets like digital currencies. With everything changing fast due to technology, many options are cropping up in the name of portfolio management tools.

Accointing is one such solution and is among the most comfortable platforms you can use to track and report your crypto taxes on bitcoin and other digital currencies. As you shall see, it brings you an array of user-friendly and easy tools necessary in managing your crypto tax excellently.

What you'll learn 👉

So, grab the drink of your choice, sit, and let’s do this, shall we?

What is Accointing

It’s a crypto portfolio management and tax platform that allows you to import, track and manage all your cryptocurrency transactions. It also generates tax reports for tax season according to your jurisdiction.

Accointing comparison to the existing market

When it comes to portfolio management tools, the most basic features include:

- Real-time market data

- Easy portfolio performance review

- The support offered

- General app design

- Easy data importation

All these features may or may not be available on some tax management solutions. However, we can only speak about Accointing as a one in all solution. What does it have to offer?

Portfolio management tool

As a portfolio management tool, Accointing allows you to review your crypto investments quickly. One of its notable features is the Overview Tab that gives you the performance of your crypto assets within a specific period.

Simply put, you can analyze your open positions and determine your next trading strategy once you look at the day’s change in percentage. Accointing also gives you an asset allocation chart to choose the crypto asset you want to buy next.

You can create the highest profitable trading strategy by just monitoring your portfolio’s daily value and composition. Accointing also gives you a Full Data Set for incisive monitoring of every transaction you make.

Holding Period Assistant Dashboard

A novice investor or tax contributor lacks the experience to execute tax strategies. Accointing gives you a chance to experiment as it guides you on tax strategies through its Holding Period Assistant Dashboard.

Among these strategies is the tax-loss harvesting strategy, which entails incurring losses on your crypto assets aiming at reducing your capital gains, and the tax liability. It may sound confusing, but you can familiarize with the tax-loss harvesting strategy with the holding period dashboard.

Crypto tax review features

You can calculate your crypto tax automatically using the tax review feature. Once you perform all the steps and the review process, click “generate” to get as many tax reports as you wish. You will get the same reporting features from most of the crypto tax tools available. This includes the tax documents, guided report creation, and so on.

However, nothing beats Accointing, especially if you want to calculate your crypto income because it has various cost basis methods. The flexibility becomes necessary and helpful as you get a better taxpaying experience.

If you are using this platform for the first time, you must be proactive because your best tax strategy emanates from your classification method. Once you import your data, you can edit and mark it as an airdrop, gift, hard fork, or payment.

This type of inclusivity is not found in most platforms, which makes Accointing unique.

Importing your data via the wallet and exchanges auto-sync

To generate your tax report, you record and analyze your trades and crypto transactions. Seemingly, it’s a long process, but with Accointing’s premium data software, you can do it within a few minutes. It allows you to upload your operations in CSV or API formats manually.

More importantly, Accointing allows you to link your exchanges with your wallets. Simply put, you can automatically import your trades and taxable transactions with just a click of the button. Isn’t this cool?

You can use API connections for your big exchanges. CSV works for mall exchanges. It would also be useful if you can complete transacvt5ions with CSV and compare the data retrieved through API. Note that the CSV files your wallets according to the Accointing Template for manual reconstruction.

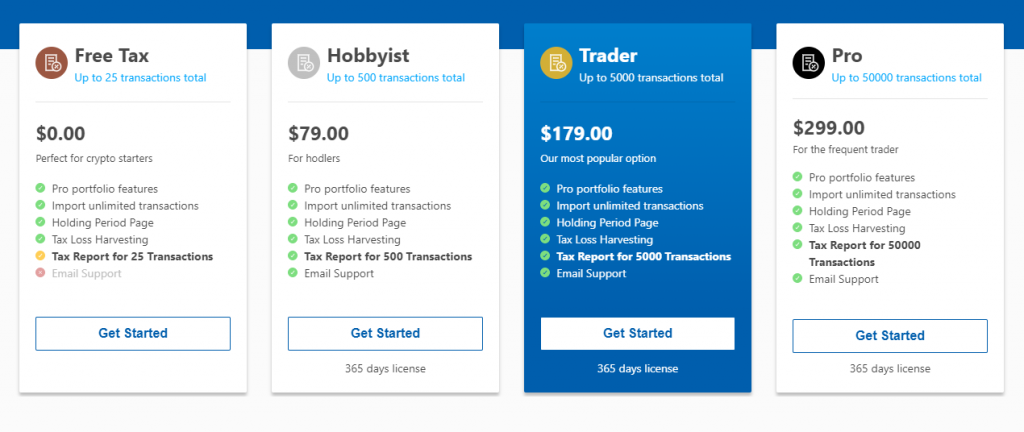

Accointing prices

Price is arguably everything in every transaction. With Accointing, you get the most affordable prices within the crypto market. It offers up to 25 free transaction reports, including all tracking features (crypto tracker and portfolio tracker). Other features include:

- Professional tax reports

- Annual license

- Country specific tax report

- Advanced holding period page

- Tracking unlimited transactions

- Previous reports from past years

- Full classifications

This makes Accointing the perfect starting point for all crypto novices. What’s more, Accointing may change the pricing model soon to enable annual payments to incorporate only the relevant taxable transactions in the tax year instead of all transactions over the total history.

Let us look at Accounting transactions in your portfolio

Accounting transactions

This involves unknown currencies, identifying internals, classifying transfers and missing funds

Unknown currencies

The best thing here is that Accointing offers you all the necessary guidelines to assist you in the classification process.

Quick tips include:

- Identify and ascertain the various currencies on the correct ticker

- Ensure that the project is legit and still existing

- If not, you can send a request through your setting page

If Accointing does not support your currency, you can identify it on the unknown currency tab

Identify your internals

The best thing here is that Accointing offers you all the necessary guidelines to assist you in the classification process.

Quick tips include:

- Ensure that the deposit and withdrawal amounts are similar

- Double-check the amount

- Ascertain that the withdrawal and deposit token (sticker) is the same

Accointing enables you to organize all your transactions showcasing movements, including fees, amongst your different exchanges and wallets.

Classify transfers

The best thing here is that Accointing offers you all the necessary guidelines to assist you in the classification process.

Quick tips include:

- Use filters to make faster classifications

- Do not take time in the classifications, but you can make your best guess if you do not recall

Depending on your country’s jurisdiction, different trades will have different tax implications. Ensure that you classify your trades and transactions accordingly to optimize your crypto tax report. The best thing here is that Accointing offers you all the necessary guidelines to assist you in the classification process.

Missing funds

Quick tips include:

- Review the exchange with the biggest amount of missing funds first

- Should the amount be too big, ensure you remember where those funds can be found

- Once you reconcile, review the implications of Accounting’s resolution to your missing funds

The missing funds page allows you to add data manually to the full data set. You can also click on ‘Fix me,’, and Accointing will generate the transactions for you to match the difference.

Full Data Set

Quick tips include:

- Always use your filters to go through your data faster

- Have as fixed purpose as you make classifications for bulk transfers from wallets and exchanges

- Use the search bar for any specific queries

The full data set gives you a complete overview of your transactions, trades, and fees.

How to get started

- Choose a transaction that you want to have a clear picture of pertaining to the history of your transaction

- You can manually add transactions with the “New” button

- Select one or more transactions if you want to duplicate or delete them from your history

- Classify your transactions accordingly

Getting the Right License

- Ensure you have imported all your transactions, including wallets, exchanges, services, or other tax tools.

- Feel free to upgrade at any time, only that you will pay the difference

- Once all the transactions have been imported, you will see the total transactions count on the reports page.

- Accointing will assist you with a 365 days license, which enables you to print as many tax reports as you want during that period.

Accointing summarized

To make it easy for you to understand this platform, look at the simple summary below:

- Accointing has the fastest import prices in the market in comparison with other tools

- It has a guided process available for every exchange

- It has a personalized dashboard with insightful and straightforward graphics that gives you the real value of your data

- Its Full Data Set Function aligns with your transactions and classifications in a single exportable file

- Accounting gives you real-time market data

- It comes with features that help you create personalized strategies

- Holding Period Assistance gives you guided tax strategies

- Tax reports are comprehensive and easy to follow

- It supports tax reports for Europe and the USA

- It’s the easiest, affordable, and user-friendly crypto tracking platform

- You can use it on Android or iOS

Conclusion

As a crypto portfolio management and tax platform, Accointing blends efficiency and innovation. It is a simple platform that even novice and experienced crypto traders can use and optimize their strategies with a few clicks.

It makes the process of tracking your crypto taxes and prices easy, as well as fast tax report generation. In other words, you can use Accointing even if it is your first-time paying taxes from your crypto trades.

Accointing Alternatives

Accointing has a whole range of competitors, most of which we already covered in our reviews:

- CryptoTrader.Tax review

- Bear Tax review

- TaxBit review & guide

- TokenTax review

- Cointracking.info review

- ZenLedger.io review

- Koinly review

- Cointracker review

- Best Binance Tax Calculators