Cryptocurrency has been making great progress over the past few years. Digital currencies are more and more in demand lately, so several key innovations have been integrated to further improve this system, including crypto exchanges, storage solutions to safekeep assets, and integration protocols placed on different kinds of industries. Also, more and more businesses are accepting cryptocurrency as a form of payment.

All this points to another issue – cryptocurrency taxation. Not only is cryptocurrency taxation complicated and confusing, but it’s also in its early stages and is still evolving. Calculating your crypto taxes can be very stressful because it takes a lot of time to calculate the number of coins you have, the number of trades you’ve done, and the number of exchanges you used.

It would be great to have some simple way to explain your revenue in a given year when filing tax returns, right? And that’s where BearTax steps in.

What you'll learn 👉

BearTax Overview

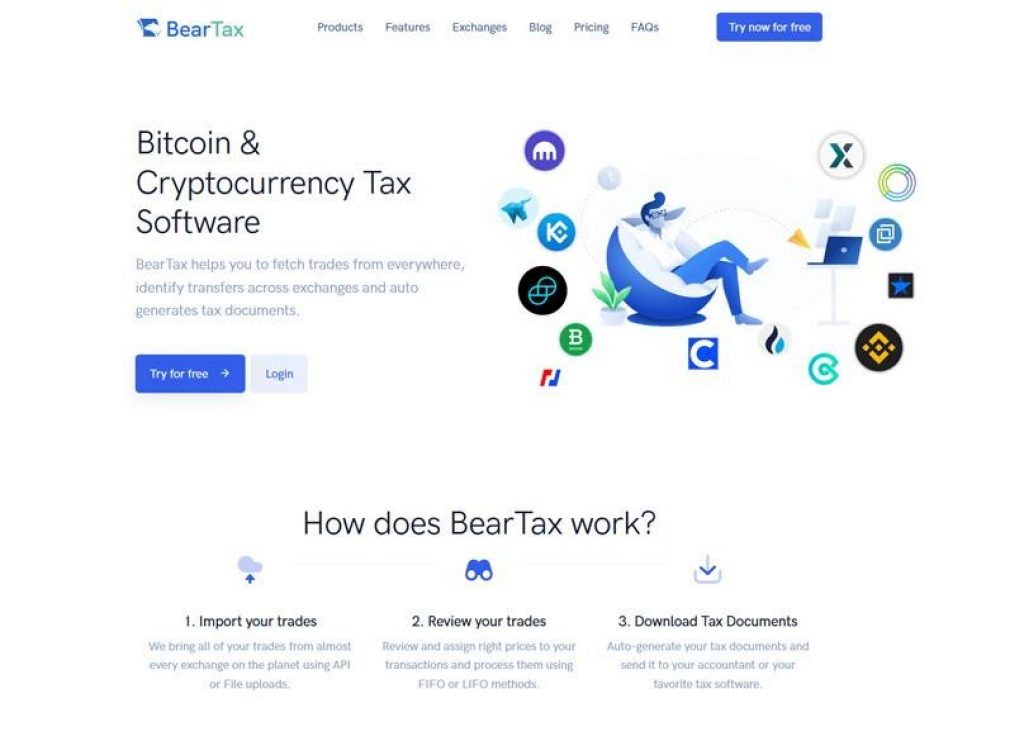

BearTax is an easy-to-use cryptocurrency tax software that aims to be the leading tax filing service for crypto users. BearTax is catered towards both individuals and CPAs to calculate capital gain and file crypto taxes on capital gains. The platform import transactions, calculate gains, and file taxes in a few quick and easy steps.

Their smart matching algorithm matches your withdrawals and deposits across their supported exchanges and is easily reviewable in the interface, which helps you avoid hitting any negative balances, which could have a negative effect on the accuracy of your tax report.

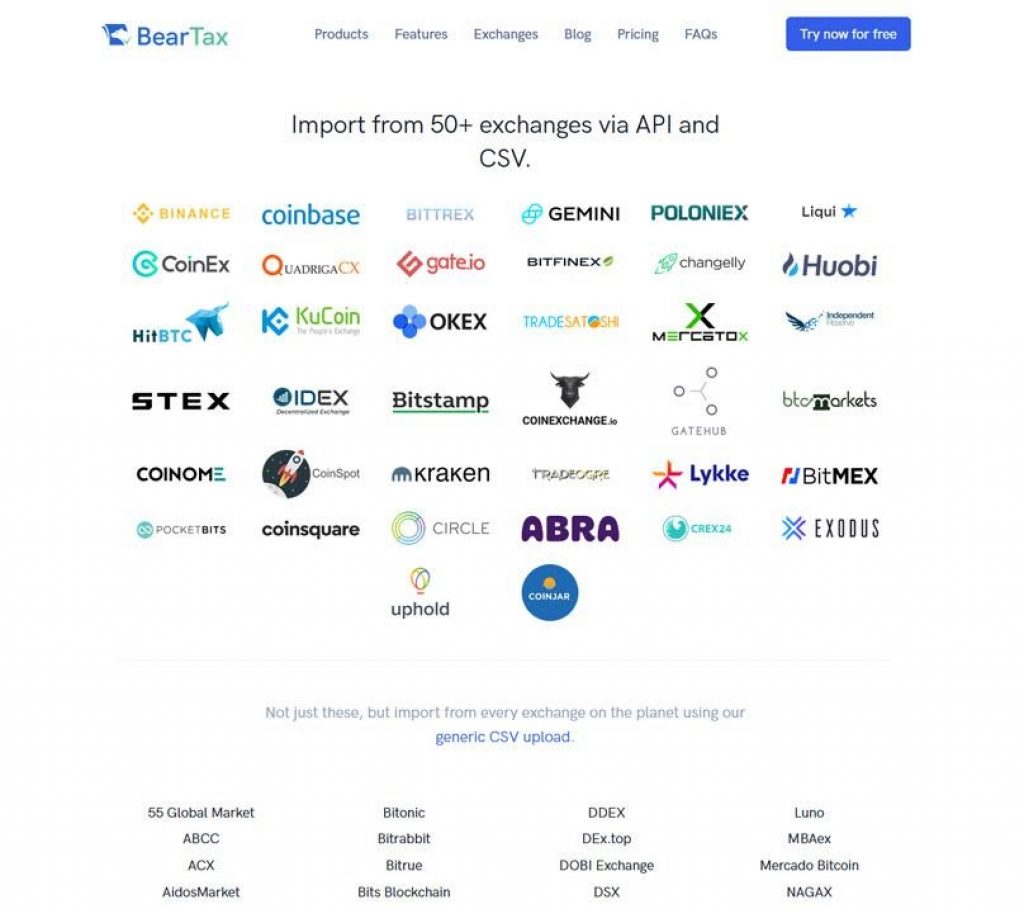

BearTax helps their users to fill in their annual tax returns through an innovative API-based algorithm that links up with your chosen crypto exchanges. The platform imports your transaction data using integrations with over 25 major exchanges, including Coinbase, Coinbase Pro, Poloniex, Gemini, Binance, Bittrex, Kraken, BTCMarkets, Independent Reserve, and many others.

BearTax Homepage

BearTax works like other crypto accounting software, which means that you need to import transaction history from your crypto exchange account, then upload your transaction history to BearTax. After that, the platform performs calculations to produce your capital gains and losses, and then generates tax forms in PDF format, which you can give to your accounting professionals or submit with your taxes if you do them yourself.

How to Use BearTax?

Utilizing the BearTax software to calculate your cryptocurrency taxes is super-easy. BearTax’s interface consists of a simple 3-step wizard. Here’s a quick guide on how you can use this really innovative solution:

Step 1: Create and Setup Your Account

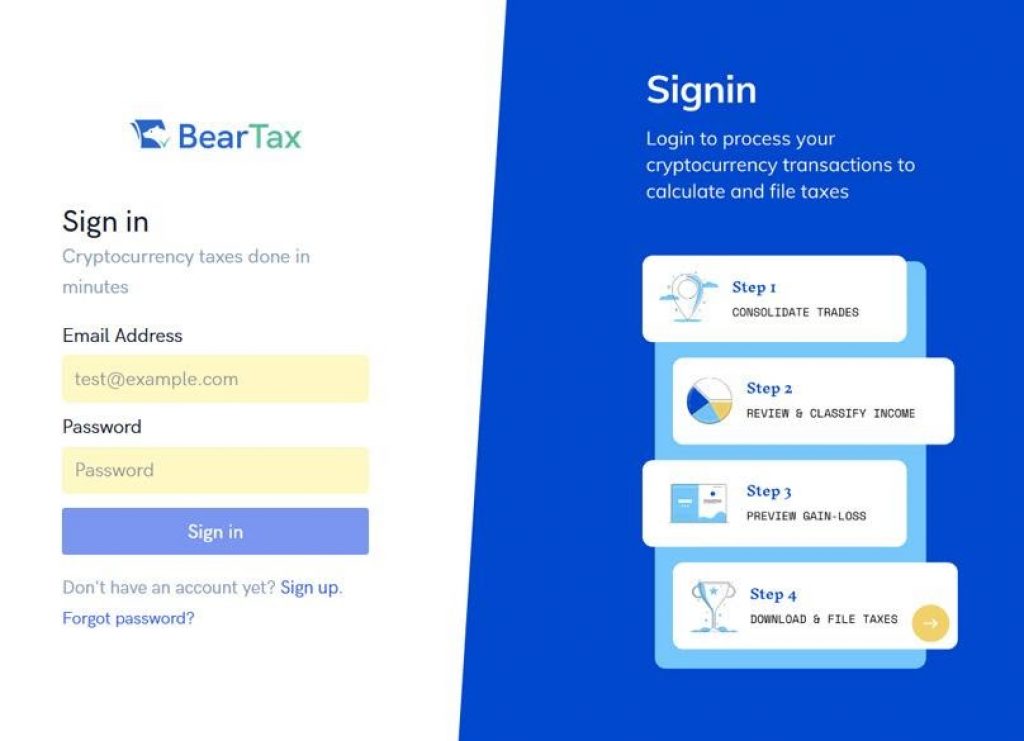

Go to the BearTax homepage and create an account. You will see that creating an account is really simple. This will require you to provide some personal information, such as your full name, the country where you’re based at, and your email address. After submitting those information, you will now be asked to choose a username and password.

BearTax Signup Page

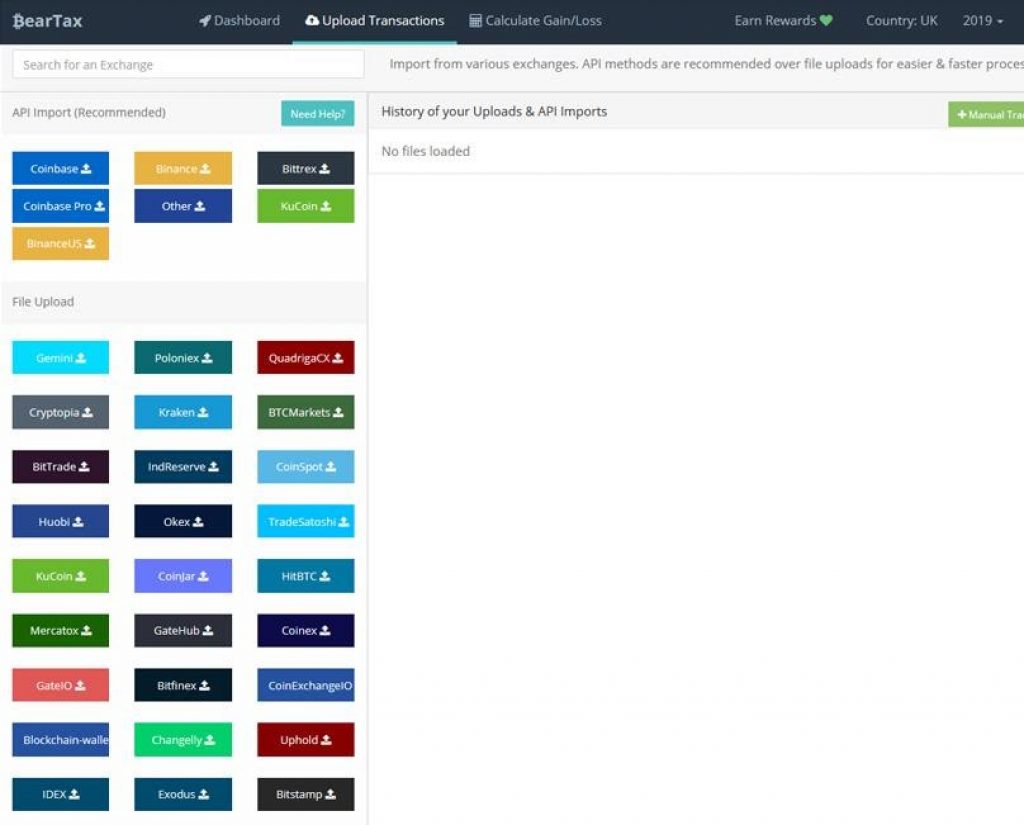

Step 2: Setup Your Crypto Exchange

Once you create your BearTax account, you can now set up the crypto exchange on which you plan to calculate your transactions, which is a fairly straightforward process. However, note that the specifics can vary from exchange-to-exchange. If you use Coinbase, Binance, Bittrex, GDAX or Poloniex, you can link your accounts automatically through those exchanges’ APIs, which can typically be found within your exchange account settings. After you find it, you’ll have to copy the long string of characters and then paste them into BearTax.

On the other hand, if you use one of the other supported crypto exchanges, you’ll have to generate a CSV file and then upload the file into BearTax manually. You can get this by downloading it from your crypto exchange.

Connect your crypto exchanges via API or CSV upload

Step 3: Wait for Your Gains and Losses to be Calculated

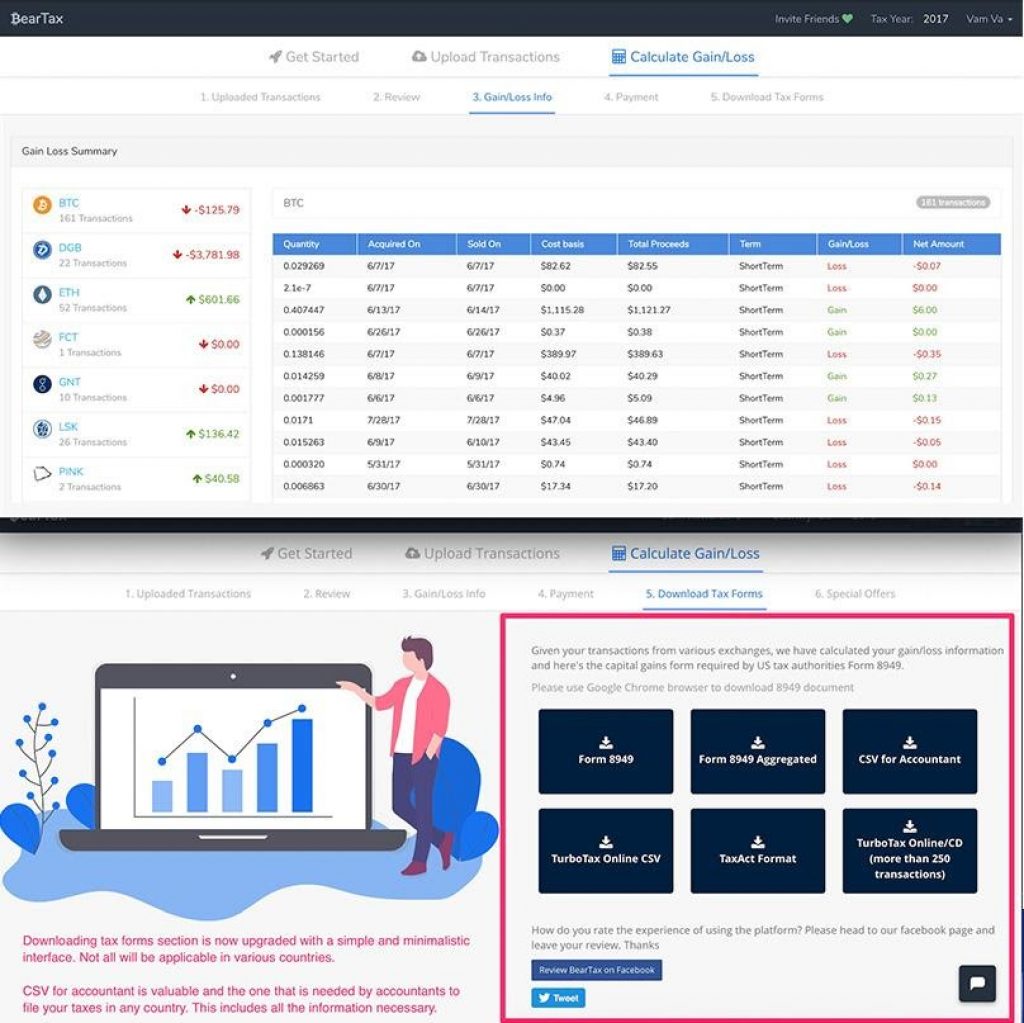

The last part of the wizard contains five tabs:

- Uploaded Transactions – This tab displays all the info that you’ve uploaded through the APIs or with CSV files.

- Review – This tab lets you edit those values manually.

- Gain/Loss Info – This tab shows you a line-by-line analysis of each of your trades.

- Payment – This tab lets you pick out a subscription.

- Download Tax Forms – This tab lets you print out IRS form 8949 and other tax forms.

Automatically calculate profit and loss on every transaction

BearTax Pricing

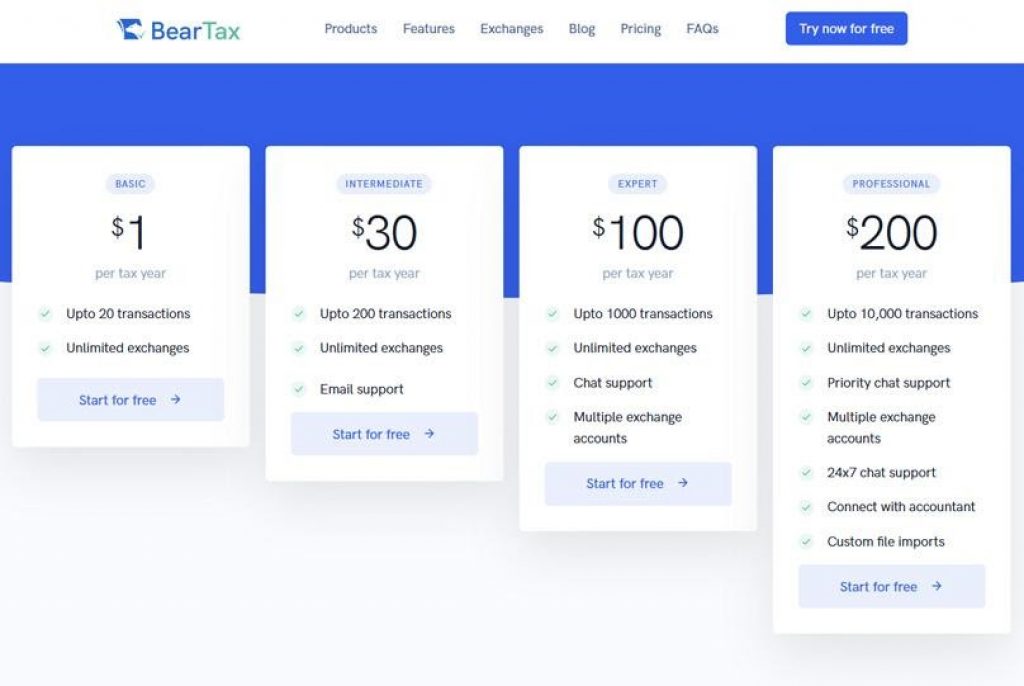

BearTax is a paid-for service and offers four subscription plans: Basic, Intermediate, Expert and Professional. All plans offered on BearTax include live chat support, unlimited exchange integrations, a gain loss summary, downloadable tax forms, itemized data, and full tax year availability. It’s important to note that these plans are very competitive and you’ll be hard pressed to find a platform that offers a better plan for the cost. Also note that you are not required to pay upfront. Pricing depends on the number of crypto transactions to be calculated. For instance, users who did only 10 trades throughout the financial year will only need the basic plan.

BearTax Pricing Structure

Basic Plan: $1 Per Tax Year

This plan costs $1 and is suitable for casual crypto traders that have only placed a handful of trades. Its main limitation is that it can only process up to 20 transactions – which can be done across an unlimited number of exchanges.

This plan comes with:

- BearTax email support

- Connection to unlimited crypto exchanges

- Capability to view data in an itemized manner

- A summary of your gains and losses

- Downloadable tax forms

- A full tax year availability

Intermediate Plan: $30 Per Tax Year

This plan costs $30 and can handle up to 200 transactions per tax year. This plan is perfect for a semi-casual crypto trader.

This plan comes with:

- 24 x 7 BearTax email support

- Connection to unlimited crypto exchanges

- Capability to view data in an itemized manner

- A summary of your gains and losses

- Downloadable tax forms

- A full tax year availability

Expert Plan: $100 Per Tax Year

If you’re an avid trader, then you should consider this plan. The expert plan permits up to 1,000 transactions per year, offers support via live chat in real-time, and allows you to merge multiple accounts at the same crypto exchange. However, this pleasure will cost you $100 per tax year.

This plan comes with:

- 24 x 7 BearTax live chat support

- Connection to unlimited crypto exchanges

- Capability to view data in an itemized manner

- A summary of your gains and losses

- Downloadable tax forms

- A full tax year availability

Professional Plan: $200 Per Tax Year

The most expensive plan is perfect those for who do a heavy amount of trading. Professional plan costs $200 per tax year and has the capacity to track up to 10,000 transactions per year. It also allows users to connect their files with your chosen accountant, as well as import custom files. It’s also important to note that you’ll get priority chat support on a 24/7 basis.

This plan comes with:

- UNLIMITED BearTax support

- Connection to unlimited crypto exchanges

- Capability to view data in an itemized manner

- A summary of your gains and losses

- Downloadable tax forms

- A full tax year availability

BearTax Core Features

BearTax offers more than just a way to calculate your crypto gains and losses. Here are a few features you can expect to encounter when using this really impressive software.

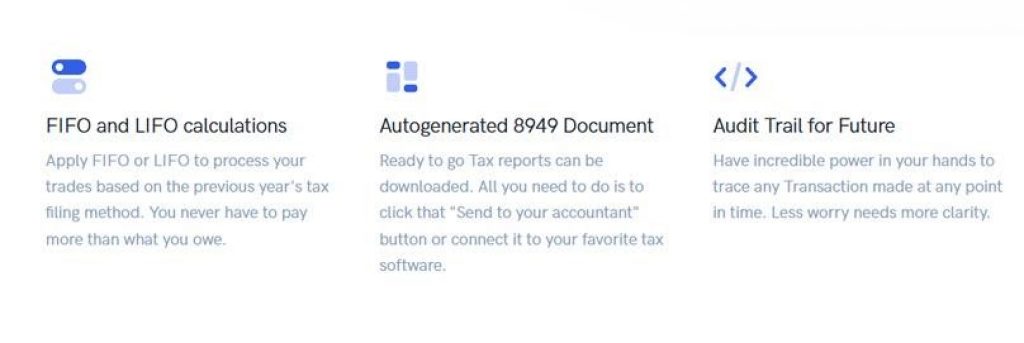

Audits

Using BearTax gives you a solution that provides end-to-end tracking and allows you to provide a full breakdown of any information that your respective tax agency requires. In the event you are audited, you can simply log in to your BearTax account and you’ll have all the information about gains and losses you need in seconds.

Intuitive Interface

BearTax has a walkthrough which guides you through the process of connecting your crypto accounts and uploading your financial data. BearTax also works with a wide range of crypto exchanges, so you don’t have to worry about whether or not your favorite exchange is supported.

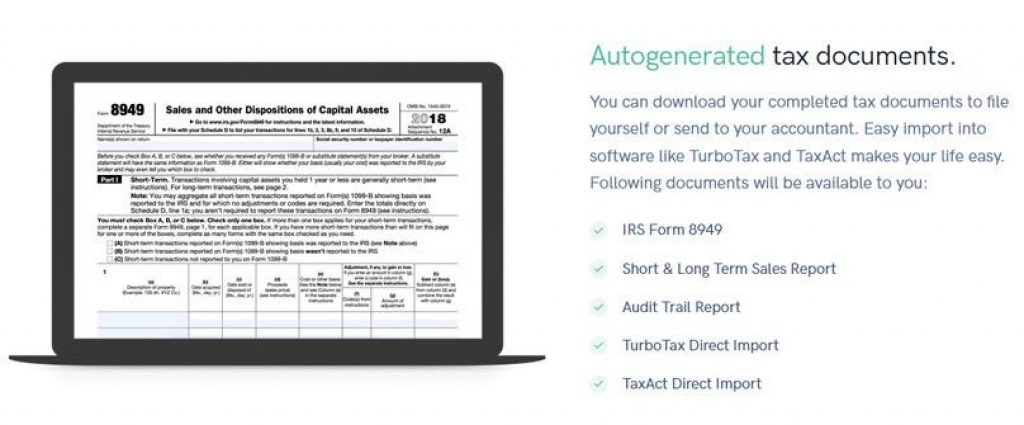

Export to Account Software

BearTax also allows you to export your crypto tax obligations to external software programs, including two of the top tax preparation platforms – TurboTax and TaxAct.

Accuracy

BearTax tracks your deposits, withdrawals, purchases, sales, and trades throughout the year and claims its platform is more accurate than any other system currently on the market.

Purchase and Sale Price

The BearTax platform looks at a number of key variables when it undergoes the process of calculating your profits and losses, including the amount that you paid for the coin at the time of the purchase, as well as the amount received when you sold it.

It’s also important to note that the TaxBear calculation also looks at whether the transaction is a short-term trade (assets held one year or less) or a long-term trade (assets held more than one year).

Form 8949

There are so many Tax forms that are available for the Crypto holders, and Form 8949 is one of them. Form 8949 is a new form for reporting capital gains introduced in the 2011 tax year. It is used by individuals, partnerships, corporations, trusts, and estates to report capital gains and losses from investment.

BearTax allows you to download your Form 8949 with all of the required information, which effectively removes hours of manual work. BearTax also allows its users to automatically forward the form onto their accountant to process it.

Autogenerated tax documents

FIFO and LIFO Calculations

FIFO and LIFO are two methods of accounting and reporting the value of inventory. It’s extremely important that you keep these calculations consistent because failure to do so can lead to sanctions from your respective tax authority. BearTax system allows its customers to choose whether they want to choose FIFO or LIFO, and then implement this on all future calculations.

Apply FIFO or LIFO to process your trades based on the previous year’s tax filing method

Supported Countries

BearTax currently supports tax returns being reported in the following jurisdictions:

- Australia

- the USA

- Canada

- India

Users can choose their country while signing up and all tax rules will be auto-assigned to their account. The people behind the platform plan to expand to Japan and other South-Asian countries.

BearTax Team

BearTax was founded in 2018 by Vamshi Vangapally and Pradyumna Doddala. BearTax was actually created because Vamshi Vangapally needed to find a solution on how to file his taxes, since he had made some cryptocurrency transactions.

The most impressive thing about the platform is that its massive growth didn’t involve any marketing at all because the founders chose to focus on promoting its brand organically rather than spend a lot of money on fancy marketing tactics. The team behind BearTax chose to put their users first, so today BearTax has a group of happy and loyal customers all around the world who provided feedback to the site by pointing out bugs and defects and recommending improvements. In this way they have helped to make the platform what it is today.

Vamshi Vangapally (Co-founder) – Vangapally is the cryptocurrency enthusiast who graduated from Bangalore’s International Institute of Information Technology with a master’s degree in Technology. Additionally, Vamshi was also a UX consultant for various Fortune 500 companies throughout his career, including Genuine Parts Company, Noblesoft Solutions, CVS Health and others.

Pradyumna Doddala (Co-founder) – Doddala has a Master’s degree in CS (he is a graduate of the University of Missouri-Kansas City). Before co-founding BearTax, Doddala founded Kronch, a mobile development company. He also developed software for the University of Missouri-Kansas City and Genuine Parts Company.

The company is registered under the name BearTax Inc and their address is in Alpharetta, Georgia.

Supported Exchanges

BearTax currently supports mre than 50 major exchange platforms. Supported exchanges include:

- Binance

- Bitfinex

- Bitstamp

- Bittrex

- BTC Markets

- Changelly

- Coinbase

- Coinbase Pro

- CoinEx

- CoinExchange.io

- CoinJar

- Gate.io

- GateHub

- Gemini

- HitBTC

- Huobi

- IDEX

- Independent Reserve

- Kraken

- KuCoin

- Mercatox

- OKEx

- CoinSpot

- Poloniex

- TradeSatoshi

- Uphold

The BearTax platform connects to these crypto exchanges and imports the information right into their solution. Alternatively, if your exchange isn’t listed, then you can also give BearTax a CSV file that allows you to add in your trades manually. Once you do, the platform will then perform the required calculations.

Customer Support

BearTax’s users claim that they have an excellent experience with customer support. BearTax offers its “Mr. Ted” chat assistant which offers immediate help. The platform also offers access to its FAQ page where users can find answers to common questions.

If you need more information, you can visit:

- Website – bear.tax

- Facebook – View on Facebook

- LinkedIn – View on LinkedIn

- Twitter – View on Twitter

- Contact Email – support@bear.tax

Conclusion

Doing taxes isn’t fun, but luckily there is a solution like BearTax to make this a much less painful experience. BearTax is easy to use and intuitive and the platform focuses on customer experience and service and it shows.

BearTax also offers plenty of plan options, so whether you’re new to crypto or a professional trader, you’ll find something that works for your needs. BearTax is priced as little as $1, although high-frequency traders can pay $200 for a professional plan to calculate capital gains and losses from an unlimited number of transactions.

Bear Tax Alternatives

BearTax has a whole range of competitors, most of which we already covered in our reviews:

- CryptoTrader.Tax review

- TaxBit review & guide

- TokenTax review

- Cointracking.info review

- ZenLedger.io review

- Koinly review

- Cointracker review

- Best Binance Tax Calculators