Diving into the world of cryptocurrency trading can be as exhilarating as it is complex. One of the key strategies that traders often employ is short selling. This technique, which involves betting against the market, can be particularly effective when used on platforms like Bybit. If you’ve ever wondered how to short on Bybit, or specifically how to short Bitcoin or other crypto on this platform, then you’re in the right place.

In this article, we’ll unravel the intricacies of Bybit short selling, providing you with a comprehensive guide to confidently navigate this trading strategy. Whether you’re a seasoned trader or a newcomer to the crypto scene, understanding how to effectively short crypto on Bybit can be a game-changer for your trading portfolio. So, let’s dive in and explore the world of short selling on Bybit.

| 📝 Features | Details |

|---|---|

| 💰 Contract Options | Bybit offers three contract options: Inverse perpetuals, USDT perpetuals, and Inverse futures. |

| 🔀 Margin Trading Types | Bybit provides two types of margin trading: Isolated Margin Trading and Cross Margin Trading. |

| 📈 Leverage | Bybit offers up to 100x leverage for Bitcoin and 50x leverage for other cryptocurrencies. |

| 📝 Order Types | Bybit supports three types of orders: Market orders, Limit orders, and Conditional orders. |

| 📊 Long and Short Positions | Bybit allows users to go long (buying a coin and selling at a higher price) and short (borrowing an asset, selling it, and then buying it back at a lower price). |

| 🔒 Mutual Insurance | Bybit offers a mutual insurance fund to hedge positions and cover losses in the event of extreme market movement. |

| 🔎 Maintenance Margin | This is the minimum balance required to maintain a trade position. When the isolated margin (or total margin in case of cross trading) goes lower than the maintenance margin, liquidation occurs. |

| 📉 Liquidation Price Calculation | Bybit calculates the liquidation price using a specific formula. |

| 🔐 KYC Requirements | Bybit has implemented KYC verification which allows users to increase their withdrawal limits to a maximum of 100 BTC. |

| 💸 Fees | Bybit has different fee categories for spot trading and derivatives trading. |

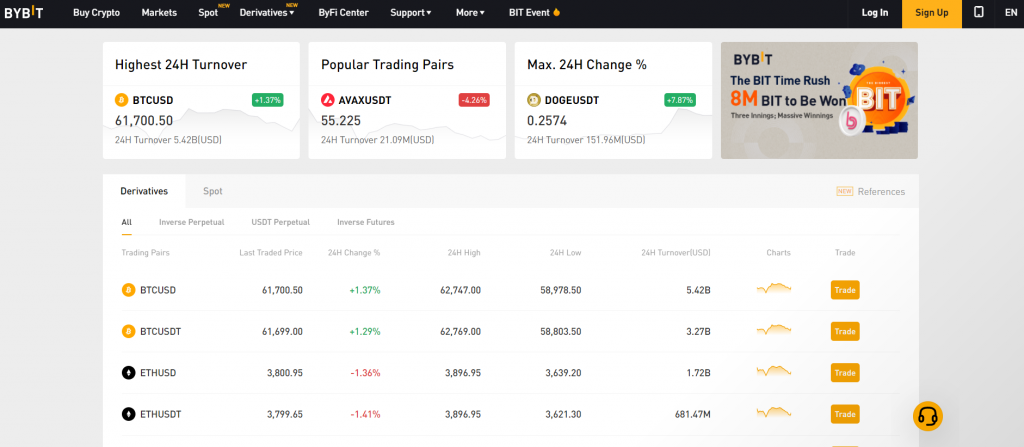

Bybit is a unique crypto exchange that focuses mainly on derivatives trading. More than two million people are registered with the platform, which was launched in March 2018.

Being a spot and derivatives exchange, it comes with a wide range of advanced trading tools, which can be complicated for beginners.

This article takes you through the various features of the Bybit exchange and breaks the trading process into easy-to-understand segments.

What you'll learn 👉

WHAT IS BYBIT MARGIN TRADING

Generally, margin trading is a trading method where traders gain access to capital provided by a third party to trade financial assets. The access to greater funds enables traders to amplify their market positions, thereby increasing their potential gains, or conversely, their potential losses. The same principle is followed in Bybit margin trading.

HOW DOES BYBIT MARGIN TRADING WORK?

In order to start margin trading, you should first create an account with the Bybit exchange and send funds to your Bybit wallet. After that, you can go to the margin trading tab and choose your trade parameters, namely the trade direction(long or short), margin amount, and leverage.

CONTRACT OPTIONS

There are three contract options on the Bybit exchange:

- Inverse perpetual: This type of contract offers margined trading quoted in USD but settled in the base asset. You need to own the base asset to partake in this type of trading. Bybit currently offers BTC-USD, ETH-USD, EOS-USD, and XRP-USD in inverse perpetual contract trading.

- USDT perpetual: This contract offers margin trading quoted in a base asset and settled in USDT. It is a linear contract and more direct compared to inverse perpetuals. You don’t need to hold the base asset; you just need to have USDT.

- Inverse Futures: Inverse futures contracts(also known as Coin-margined futures) are similar to inverse perpetuals in that profit and loss are settled in the base asset. The critical difference is that inverse futures have an expiration or settlement date while inverse perpetuals do not.

BYBIT ISOLATED MARGIN TRADING

In this trading method, the exchange locks only your selected funds as collateral for the margined position you entered. Thus, in the event of extreme market reactions that lead to liquidations, only the specific amount you put in for the trade is affected; your remaining balance stays intact.

BYBIT CROSS MARGIN TRADING

Here, you put down your entire trade balance as collateral for the margined position you entered. In the event of extreme volatility that leads to liquidations, your total balance is affected. This trading method is more risky than the isolated margin trading, but it also gives more room for price changes in your selected asset pair.

LEVERAGE ON BYBIT

With Bybit, you can get up to 100x leverage on their exchange. There is a 100x leverage for Bitcoin and a 50x leverage for other cryptocurrencies. However, the leverage selection is fixed on 100x in cross margined trading.

Read also:

- BitMex vs ByBit 2021 – Comprehensive Exchange Comparison

- PrimeXBT vs ByBit: Fees, Leverage, Security & Volume

- Bybit vs FTX: Fees, Leverage, Security & Features Compared

- Phemex vs Bybit: Fees, Features, Payment Methods & Security Compared

- How to short Ethereum? Short ETH on Binance & Co.

- How To Short Bitcoin? 3 Ways To Do It

ORDER TYPES ON BYBIT

There are three types of orders on the Bybit interface:

Market orders

These orders are also known as market-taking orders. They are executed instantly and do not rest on the order book. This type of order is suitable for fast-moving markets.

Limit orders

These orders are also known as market-making orders. They are not executed instantly; instead, they rest on the order book and add liquidity to it. They are suitable for situations when urgency is not the case.

Conditional orders

These are more advanced orders in which you set specific conditions for your orders, and they are only executed when those conditions are met. Apart from market and limit orders, conditional orders also come with certain features like:

Close on trigger

This ensures that your stop-loss order will be executed when the price gets to the order point, no matter what happens

Post-only order

With this feature, your limit orders will be canceled if it is not executed immediately at the order price. It ensures that traders get a rebate on order prices(as is customary for limit orders)

Reduce-only order

This order type ensures that you do not unintentionally place a sell order. Thus, if you have set stop-loss and take-profit orders on a particular trade and the stop-loss hits before the take-profit; the system will cancel the order automatically to ensure that you do not sell your position unintentionally when the price goes back to your take-profit point.

HOW TO GO LONG ON BYBIT

Going long on Bybit means that you borrow funds from Bybit exchange to buy a coin and sell at a higher price. The buyer returns the borrowed funds to the exchange after selling the coins and keeping the profit.

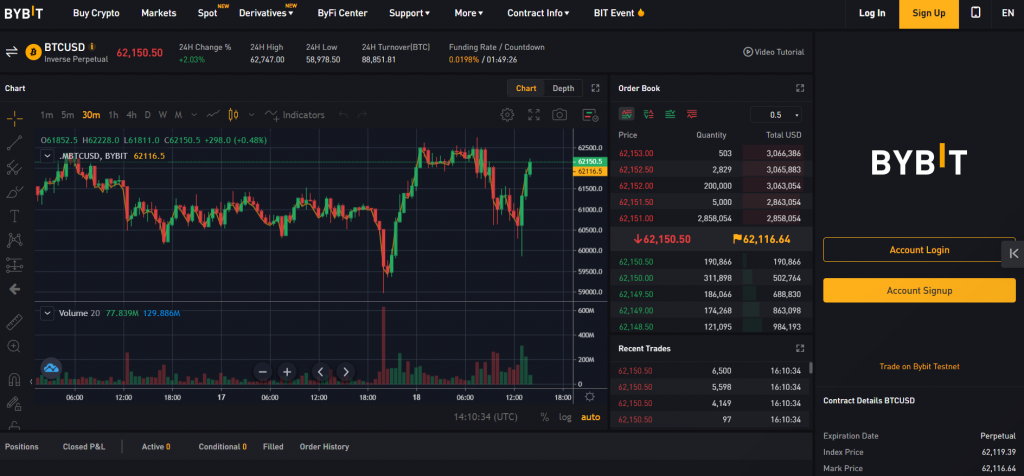

To enter a long position, click on ‘Derivatives’ on the exchange page, choose the type of contract you want to trade, and click ‘Long/buy’ on the left side of the screen.

HOW TO GO SHORT ON BYBIT

Going short on Bybit means that you borrow an asset from the Bybit exchange, sell it off, and then use the money to buy back the asset at a lower price. You then pocket the profit.

To enter a short position, click on ‘Derivatives’ on the exchange page, choose the type of contract you want to trade, and click ‘Short/sell’ on the right side of the screen.

- What makes an excellent short strategy? It depends on how risk-averse you are. Here are some common ones:

- Trends catching strategy.

- Breakouts swing strategy.

- Breakdown swing strategy.

- Fading trading strategy.

MUTUAL INSURANCE

This is an arrangement that works just like the usual insurance concept. You pay money regularly to a mutual insurance fund, and it hedges your position to cover losses in the event of extreme market movement. The residual margin of liquidated positions is also added to the insurance fund.

MAINTENANCE MARGIN

This is the minimum balance required to maintain a trade position. When the isolated margin(or total margin in case of cross trading) goes lower than the maintenance margin, liquidation occurs. It is 0.5% of the contract value for BTC and 1% for ETH, EOS, and XRP.

HOW DOES BYBIT CALCULATE LIQUIDATION PRICE

Bybit liquidation price is calculated with the following formula:

L.P= (A × L)÷ {L + 1(M × L)}

Where:

- A = Average entry price

- L = Leverage

- M = Maintenance margin rate.

HOW DOES A CONDITIONAL ORDER WORK ON BYBIT

As mentioned above, conditional orders are placed upon set conditions. Upon meeting these conditions, the order is placed. You can find more explanations if you scroll up.

WHAT IS TRIGGER PRICE IN BYBIT

The trigger price is part of the stop-loss mechanism. In Bybit, you enter two figures when you set a stop loss: the trigger price and the limit price. An automatic sell order is placed by the system when the price reaches the trigger price. The order is then executed at the limit price.

For example, let’s say you buy 2 BTC at $47000 and put a stop-loss order to cut your losses. Your trigger price is $45,500, and your stop-limit price is $45000. At $45500, the system will automatically place your stop-loss order. The order will be executed when the price gets to $45000.

HOW DO I PLACE A LIMIT ORDER ON BYBIT

On the order page, you’ll see an options tab showing the three types of orders. Select the limit order option, and another window will come up. You can then enter the various parameters of your trade like the leverage, the order size, and the limit price. When you have selected that, click on the ‘Buy/long’ option(or ‘Sell/short’), and you’re good to go!

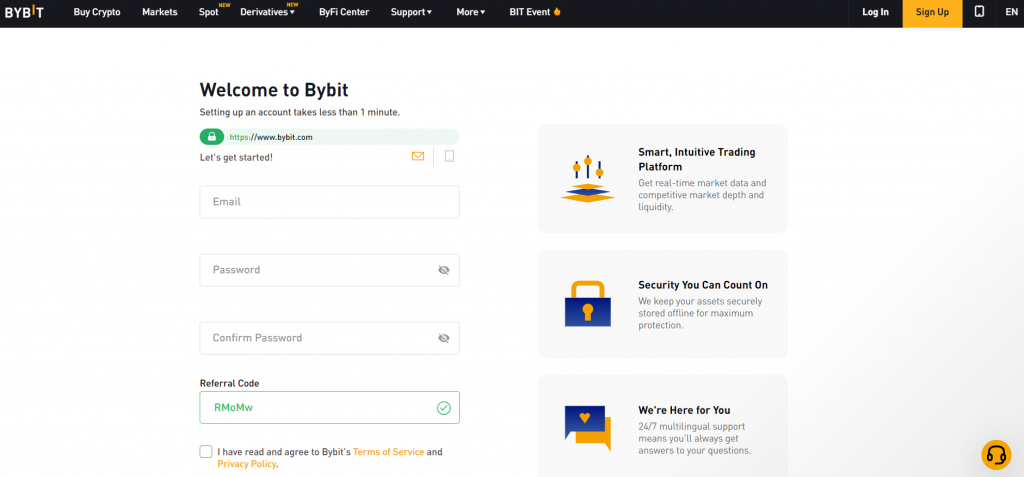

DOES BYBIT REQUIRE KYC(KNOW YOUR CUSTOMER)

When Bybit started, it didn’t impose KYC verification on its users. This was likely because it only dealt in derivatives and didn’t see the need to verify its users. However, it implemented KYC registration when it introduced its spot trading and hot wallet option on July 15, 2021.

There are two levels to Bybit’s KYC registration. The first level, KYC 1 level verification, requires users to submit their identity documents and perform facial verification. When this level is completed, the withdrawal limit of the user is raised from 2 BTC to 50 BTC.

The second level, KYC 2 verification, required users to submit documents that verify their place of address. When completed, the withdrawal limit is increased from 50 BTC to 100 BTC.

There is only one level of KYC verification for businesses. They are required to submit their business registration documents, after which the withdrawal limits are increased to 100 BTC.

HOW TO START USING BYBIT

- Create an account. This is a straightforward process. Go to www.bybit.com and click on ‘sign up’. Create a password and an email address. After that, you’ll be asked to verify your email by clicking on a link sent to your provided email address. Once that is done, you have created an account with Bybit. Occasionally, Bybit offers incentives for new users.

- Deposit funds: To deposit funds, open your account page on Bybit.

- You’ll see an ‘Assets’ tab, click on it, and it will bring out a list of supported cryptocurrencies(for now, they are 20).

- Choose the cryptocurrency you want to deposit.

- You’ll be directed to another page that shows your deposit address.

- Make sure to select the chain you want to deposit on, as each chain has a different address.

- Enter the address and chain in the required column of the wallet/exchange from which you want to send the coin.

- Sit back and expect your deposits.

- Place an order. Follow this step-by-step guide:

- Choose an order type. As earlier mentioned, there are three order types. Decide which you would like to place and fill out the parameters. You’ll need to enter the leverage, the order size, limit price, and position your order will take(either long or short).

- Stop Loss and Take Profit. As you well know, these are very important concepts in crypto trading. If they are not set, you may encounter more significant losses or miss out on huge profits. Therefore, a window pops up that enables you to set your ‘Take Profit’ and ‘Stop Loss’ prices.

Before pressing ‘confirm’ on the pop-up window, review the entered information very well and make sure, among other things, that your ‘Stop Loss’ price comes before the liquidation price. Press confirm, and your order will be placed by the system according to the conditions you set.

- View your open positions. After your order has been placed, you can view its progress in the information tab at the bottom of the screen. You may see some unfamiliar words. Let me explain what they mean:

- ‘Qty’- This stands for the worth of your contract at the time of opening. It is your initial margin multiplied by your leverage.

- ‘Margin’: shows the funds drawn from your account to fill your position

- ‘P&L’: your unrealized profit and loss, which changes in real-time.

- Close your position. When you are satisfied with the profit you’ve made(or when you can’t stomach further losses), you can close your position by clicking the buttons at the bottom right corner of the screen.

Withdraw funds: Before submitting a withdrawal request, ensure that you have added the withdrawal address to your Bybit account. Once you’ve done that, follow the steps below:

- Select the blockchain mainnet(e.g., ERC20, OMNI, TRC20)

- Enter the address of the receiving wallet under ‘Wallet address.’

- Enter the withdrawal amount.

- Click ‘submit’

BYBIT FEES

Bybit fees are categorized, under ‘maker fees’ and ‘taker fees’. Makers(limit orders) make liquidity for the order book because they sit on the order book until their orders are executed. In contrast, Takers(market orders) take liquidity away from the order book because their orders are filled right away.

With that in mind, these are Bybit’s fee categories:

- Spot trading:

- Makers: 0%

- Takers:0.1%

- Derivatives trading:

- Makers: 0.025%

- Takers: 0.075%

RISKS WITH BYBIT MARGIN TRADING

Many traders focus so much on the increased rewards that accompany margin trading that they fail to acknowledge that ‘with great rewards comes greater risks’.

Cross trading on Bybit is the most risky because the leverage slider is automatically fixed on 100x. This means that the potential of losing your money has increased by a hundredfold. Also, the risk doesn’t only affect the amount you put down for the trade. Like a cancer, it spreads gradually to your remaining balance and only rests after engulfing everything. Is that something you’re prepared to deal with? Find out before delving into the trade.

CONCLUSION

Bybit margin trading is one of the best there is right now. Its user interface provides a lot of advanced tools that are delightful to professional traders. Even though it may be complex for beginners, there are explanatory articles provided by the support team that break down difficult concepts.

On the other hand, there is a need for caution as one can easily get carried away with the potential profits and ignore the potential losses.

In conclusion, examine the various features of the bybit exchange as detailed in this article, determine your risk appetite, and plan out what margin-trading strategy would suit your style.

FREQUENTLY ASKED QUESTIONS

CAN YOU SHORT ON BYBIT?

Yes, you can. Bybit is a mainly derivatives exchange that provides excellent trading tools for margin and futures trading. In order to short on Bybit, follow these steps:

- Create an account on Bybit and deposit funds accordingly.

- Select your contract type. There are three contract types to choose from:

- Inverse Perpetuals

- USDT Perpetuals

- Inverse futures(or Coin-margined futures).

- Select the pair you want to trade.

- Select your order type. There are three order types you can select from:

- Limit orders

- Market orders

- Conditional orders

- Input the required variables, like order size, price, and leverage.

- Click on ‘Sell/short’ and enter your ‘Take Profit’ and ‘Stop Loss’ values.

- Confirm and click ‘Submit’.

Is trading on Bybit illegal?

Bybit is run by Bybit Fintech Ltd, a derivatives company based in Singapore. It is duly registered and is not an illegal platform. However, it has not been registered in the United States of America. Therefore, it is currently illegal for residents of the US to trade on Bybit.

How do you add a position on Bybit?

- Go to ‘derivatives’ from the home page and choose from the three contracts presented.

- Select the order type and fill the presented boxes accordingly

- Select the position you would like to enter(Short/sell or Long/buy).