What you'll learn 👉

Top Crypto Exchanges in Europe: Most secure & user-friendly exchanges

Navigating the labyrinth of cryptocurrency trading can be a daunting task, especially when it comes to finding the best crypto exchange that suits your needs. Europe, being a hub of financial innovation, is home to a plethora of top-notch platforms that cater to both novice and experienced traders alike. This article aims to shed light on the top 10 European crypto exchanges that have made a significant impact in the realm of digital currency trading.

From the bustling crypto markets of London to the tech-savvy trading platforms in Berlin, European crypto exchanges have carved a niche for themselves in the global crypto landscape. These platforms not only offer a wide range of digital currencies for trading but also provide a secure and user-friendly environment that makes them the best crypto exchanges in the region.

Whether you’re seeking the best crypto exchange in Europe for high liquidity, low fees, or a diverse portfolio of cryptocurrencies, this comprehensive guide will help you navigate the Euro crypto exchange landscape with ease. We’ve sifted through the multitude of options to bring you a curated list of the best crypto exchanges that Europe has to offer. So, let’s dive in and explore the top 10 European crypto exchanges that are shaping the future of digital currency trading.

| Crypto Exchange Europe | Summary |

|---|---|

| 💼 Zeply | Zeply is a regulated crypto platform based in the EU. It offers a seamless and secure way for both individuals and businesses to interact with cryptocurrencies. The platform supports various cryptocurrencies and allows customers to buy, send, or convert crypto to fiat. It also offers free internal transfers and is preparing to launch crypto debit cards soon. |

| 🔒 Kraken | Kraken is one of the oldest and biggest Bitcoin exchanges known for having some of the lowest fees in the industry. It offers various ways to deposit funds and has a reputation for being easy to use, fast, secure, and reliable. |

| 📊 Kucoin | Kucoin is a top crypto exchange that offers digital money trading, exchange, and lending. It supports over 200 cryptocurrencies and offers low transaction costs. Kucoin also provides reduced transaction costs, promotions, and trading fee savings to skilled traders. |

| 💰 Binance | Binance, one of the largest crypto exchanges globally, is known for its high liquidity and low fees. It is technologically advanced and has its learning platform, which allows users to trade without worrying about technicalities. |

Btw. if you are looking for no KYC exchanges or crypto exchanges specialized for altcoin trading – click on the linked text to see separate guides on them.

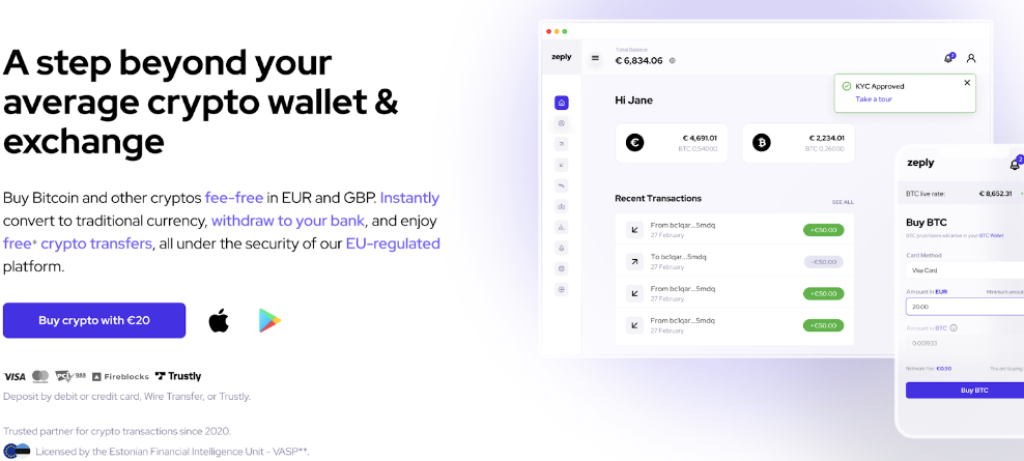

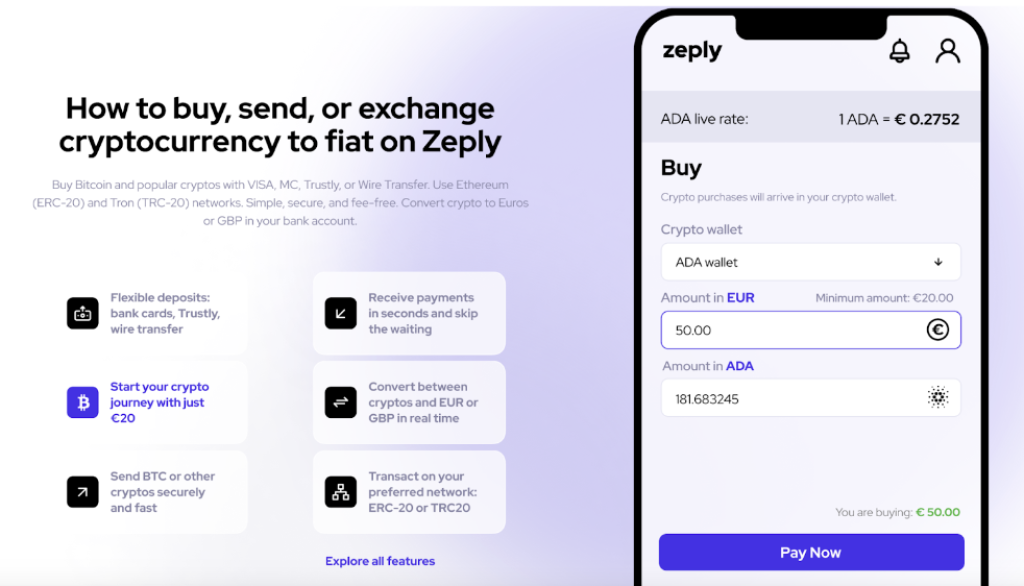

Zeply – Regulated and Secure

Zeply, a regulated crypto platform based in the EU, offers a seamless and secure way for both individuals and businesses to interact with cryptocurrencies. It’s an ideal choice for beginners looking to buy, send, or convert crypto to fiat and companies wanting to accept crypto payments and convert them to fiat instantly.

Zeply’s platform allows customers to buy Bitcoin and other cryptos such as XRP, ADA, ETH, USDT, USDC, DAI, LTC, SOL, and Doge fee-free in EUR and GBP. Blockchain networks in which customers can use Zeply transactions presented in ERC-20 and TRC-20. Users can instantly convert cryptos to traditional currency, withdraw to their bank, and enjoy free internal transfers, all under the security of an EU-regulated platform.

One of Zeply’s standout benefits is its onshore regulation and a physical office in Tallinn, Estonia, which adds an extra layer of trust for users. The platform’s integration with Trustly, a renowned cardless payment solution, makes transactions instant, more secure, and convenient.

Zeply’s services include commission-free crypto transactions, free internal transactions, facilitated crypto exchanging, the creation of multiple Bitcoin addresses, and round-the-clock customer support. The platform is also preparing to launch crypto debit cards soon.

Zeply offers a user-friendly and trustworthy experience that combines convenience, flexibility, and security. It’s an excellent choice for those who want a simple and secure way to buy, hold, send, and convert crypto to EUR or GBP and withdraw to bank accounts.

Kraken – regulated and low fees

Kraken exchange, one of the oldest and biggest Bitcoin exchanges, is known for having some of the lowest fees in the industry, and it’s been around since 2011. With over 6 million customers worldwide, Kraken is one of the biggest crypto exchanges in the world. Its reputation precedes itself, and you’ll find reviews praising Kraken for being easy to use, fast, secure, and reliable.

The exchange offers many different ways to deposit funds, such as:

- Visa and Mastercard debit/credit

- Digital wallet purchases (buy cryptos using Apple Pay or Google Pay Pay)

- ACH online banking

Fees vary for Kraken and Kraken Pro.

Using Kraken, quick purchases of most cryptos cost 1.5%, while stablecoins cost 0.9%. How you pay affects fees. 0.5% for bank account financing to 3.75% + 25 Euro cents using a debit card, credit card, or digital wallet.

Kraken Pro’s fees are less than Kraken’s. Your 30-day trading volume influences pricing. Taker costs are 0.26 %, and maker fees are 0.16 % if your 30-day trading volume is less or equal to $50 000. With more trading volume, your taker and maker fees will be cheaper.

KuCoin – lots of coins and features

KuCoin is a top crypto exchange. It offers digital money trading, exchange, and lending. Compared to other crypto exchanges, the site has cheap fees. The beginner-friendly interface attracts over a million people. The exchange gives crypto investors several benefits.

Users can trade a variety of cryptos on the exchange (over 200). Aside from that, KuCoin supports trading pairings such as BTC/ETH. This means that a trader can swap Bitcoin for Ethereum without first converting either currency to fiat money.

KuCoin gives the best exchange rates. Trading costs are low at 0.1% for each transaction. The platform provides reduced transaction costs, promotions, and trading fee savings to skilled traders.

KuCoin enables you to purchase crypto using major currencies. You can utilize fiat money by credit card or debit card, P2P trading, or KuCoin’s Fast Buy service. USD, CAD, AUD, and a variety of other currencies may be used to purchase crypto.

If you plan to use KuCoin only for trading crypto to crypto, you won’t have to go through KYC either.

Binance – high liquidity, low fees

One of the largest crypto exchanges globally, Binance, originally based in China but later moved its headquarters to the Cayman Islands, is one of the most technologically advanced exchanges that come complete with its learning platform, which allows users to trade without having to worry about technicalities.

Because of its sophisticated nature, some people believe that it is not suitable for newcomers. However, because of its many attractive features, such as low fees, fast transaction times, and high liquidity, Binance is still among the best choices for traders.

When trading on Binance, a flat 0.1% fee is applied to each trade. If you pay with BNB, you currently get a 50% discount on the trading fee, 25% during the second year, and so on, reducing it down to 0.05 %.

Binance offers a wide range (600+) of cryptos, including Bitcoin, Ethereum, Litecoin, Ripple, Dash, EOS, Stellar Lumens, Monero, Zcash, Tron, IOTA, and others.

In addition, Binance supports fiat currencies like USD, EUR, CNY, AUD, INR, RUB, and others. This makes it easy for users to buy cryptos with fiat money.

Uphold – a lot of non-crypto assets

Uphold is a crypto exchange that lets users purchase, sell, and trade supported crypto. This exchange lets users trade Bitcoin, precious metals, and equities. 130+ cryptos, 37 national currencies, 50 equities, and multiple precious metals are available.

Uphold lets users deposit national currencies (like USD) and buy Bitcoin and other assets. Users can exchange crypto-to-stock or precious metals for currency.

Uphold doesn’t charge any trading commissions or deposit fees. However, it does charge spreads for each trade on the platform. Depending on the assets being traded and market conditions, these spreads can be quite large.

Security is a key feature for any top crypto trading platform. Uphold uses advanced encryption and layered defenses to limit attacks. They keep an eye out for potential threats every day, responding quickly to them and carrying out regular audits and penetration tests to ensure everything is working properly.

Uphold gives consumers two-factor authentication (2FA), data server encryption, and KYC identity verification.

In terms of service fees, Uphold charges a spread. This is approximately 1% for BTC and ETH. When it comes to precious metals, this figure rises to 3%. Of course, network fees from the coins themselves exist.

eToro – copytrading, forex, commodities, ETF

eToro is one of the biggest social trading and multi-asset investment companies in the world. With over 20 million registered users across 140 countries, it boasts a wide range of clients, including major banks, hedge funds, family offices, and high-net-worth individuals.

The company launched in 2007 and now trades stocks, commodities, indices, ETFs, forex, and cryptos. Its mission statement is “To empower people to invest and manage their money.“

You can buy, trade, and exchange over 30 different cryptos, including decentralized finance (DeFi) tokens and stablecoins.

eToro stands apart from its competition due to its copytrading features, which allow new users to copy successful trading strategies from top-notched traders.

Aside from the $5 withdrawal fee, which is extremely low in comparison to other brokers, eToro imposes overnight/weekend fees for CFD positions. EToro also charges conversion fees for non-USD deposits, given the platform’s native currency is USD. Inactivity penalties will severely penalize residual account balances, charging $10 per month after 12 months of no trading activity.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

ByBit – derivatives trading

ByBit is the world’s fastest-growing crypto exchange and trading platform trusted by millions of users worldwide. ByBit offers leveraged trading up to 100x. They are mainly focused on providing access to leveraged trading for those looking to trade cryptos such as Bitcoin, Ethereum, Litecoin, Ripple, Monero, Dash, Zcash, Stellar Lumens, and many others. It offers margin trading and futures contracts.

The exchange was founded in 2018 and is headquartered in Singapore. ByBit is one of the most popular exchanges among those looking to trade with leverage. Its main focus lies in providing high liquidity for its clients.

Its charting platform and user experience remain easy to use and include all of the advanced features expected from a top-tier crypto exchange.

Users can set all kinds of orders when trading and access the trading engine, which boasts fast speeds and low latencies to ensure traders can get accurate prices when trading.

The smaller your trading fee rates are the higher your tier. The taker fee for derivatives is as low as 0.03 %, while the fee for spot trading is as low as 0.02 %.

Margex – high leverages

Margex is an innovative crypto derivatives trading platform offering high leverage (up to 100x). It was launched in 2020 and has already established itself as a reliable operator.

Margex is a crypto derivative trading platform, therefore, they don’t supply the underlying assets. Their noteworthy features include:

- Leverage 100x

- No KYC

- High safety

- Anti-manipulation software

- Trading pairs limited

The exchange imposes a trading fee for buy and sells positions based on a maker and taker basis, with costs of 0.19 % and 0.060 %, respectively.

Margex’s website lists the security safeguards it uses to protect customer data and payments. Multilayered security reduces hacking, theft, and fraud. Protections include:

- SSL encrypts user data.

- Email withdrawal confirmation

- All assets are in multi-sig cold wallets.

- Once-a-day withdrawals

- 2FA

- Asset notifications and real-time monitoring

Phemex – no fees with a premium account

Phemex was created in Singapore in 2019. Their stated objective is to become the most trustworthy Bitcoin derivatives trading platform in the world while being user-friendly.

Phemex supports a limited number of currencies, including Bitcoin, Ethereum, Ripple, and LINK, which may be exchanged against the USDT – Tether. Contracts are offered in USDT because there are no real Bitcoin transactions throughout the buying/selling procedure.

It provides long-term contracts. As has become industry standard, the leverage may be changed up to 100x. Setting a high amount of leverage might result in a rapid profit or a quick loss (double or nothing), which is why experienced traders avoid it.

It is going by the standard of the industry, with the maker-taker fees of -0.025% and 0.075%. But the most interesting part of the platform is their paid feautes – Phemex Premium. If you buy the Phemex Premium subscription,you can trade without paying any fees.

Phemex does not require any KYC verification. Phemex registration is fast and does not need any long verification procedures or government paperwork to establish your identification. It is ideal for traders who value their privacy.

Bitpanda – buy several crypto assets

One of the best places to purchase and sell Bitcoins is Bitpanda (previously known as Coinimal), a Bitcoin broker. Eric Demuth (co-CEO), Christian Trummer (CTO), and Paul Klanschek (CTO) launched the firm in late 2014 in Vienna, Austria. In the European Union, it is one of the most well-known crypto exchanges to use.

BitPanda is particularly well-liked among Bitcoin users in European countries. In addition, the platform is compatible with a number of the most popular payment choices in Europe, including SEPA, GIROPAY/EPS, SOFORT, NETELLER, and Skrill, as well as more traditional deposit methods, such as MasterCard and Visa.

BitPanda has over 3 million active users on its easy-to-navigate, beginner-friendly platform.

Maker and taker fees might be as low as 0.05%. The lesser your fees are, the more you trade. For the first 3 months of trading, new business accounts get promotional fees of 0% maker and 0.025 % taker fees.

By the law of the European Union, like other European crypto companies, Bitpanda is legally required to collect a certain amount of user information. This is known as the “Know Your Customer” (KYC) approach since it aids in the prevention of money laundering and terrorist financing.