Phemex Review – How Good Is Phemex Cryptocurrency Exchange?

This Phemex review will explain how this crypto exchange works, whether it is safe to use, what Phemex Premium is, whether you can earn money with Phemex Earn, and whether the company behind Phemex is legitimate.

Pheme, the Greek Goddess of Fame and Good Reputation, inspired the name of the Phemex cryptocurrency trading platform. It is one of the newer crypto derivative exchanges on the market. While everything around it looks and sounds appealing, Phemex still has things to prove, but what they accomplished until now is respectable.

The platform advertises itself as the fastest cryptocurrency exchange and has entered with confidence into the financial market.

What you'll learn 👉

What is Phemex?

Phemex was founded on Nov 25th 2019., in Singapore, and is owned by Phemex Financial Pte. Ltd. Their stated goal is to become the world’s most trustworthy cryptocurrency derivatives trading platform while maintaining the user-oriented approach. The company is of-shore, registered in the British Virgin Islands, like many other similar crypto companies. The reasons for this are mostly business related – looser regulatory standards and much lower tax rates. In short time, Phemex attracted over 50,000 new users and records more than $700 million of daily trading volume, which puts it among the top 10 derivative cryptocurrency exchanges on the Coinmarketcap rankings.

- Users need to go through the KYC process on Phemex to prove who they are. According to Phemex, users can finish the KYC process by registering or logging in to the Phemex website, clicking on the circle icon in the top right corner to go to their account, and clicking on Overview on the left side of the page, where all their profile information will be shown.

- Users can easily access the identity verification process by logging into their Phemex account and going to the Account Overview page. Users must click the ID & Face Verification button and then follow the instructions on the pop-up menu. Users will need to show a government-issued photo ID.

- The Financial Crimes Enforcement Network Department has signed up Phemex as a Money Service Business. But some people have said that their accounts have been locked. Concerns have also been raised about the KYC verification process, and some users have asked if Phemex makes users do KYC before they can withdraw funds.

- Phemex works with more than 250 coins, including Bitcoin, Ethereum, Ripple, ChainLink, Tezos, and Litecoin. Phemex offers leveraged trading with up to 100x leverage. With a Phemex demo account, users can practice trading cryptocurrencies without risking their own money.

- Phemex charges 0.10% for spot trading, 0.075% for takers, and -0.025% for makers. Phemex has different membership levels, and premium members can trade without paying any fees. Phemex lets users deposit and withdraw cryptocurrency for free, but there are fees for withdrawing some coins.

- Through Phemex Earn, users can earn interest on some of the cryptocurrencies they have in their accounts. The interest rates can change at any time, and each coin has a minimum and a maximum amount that can be invested. For the best rates, users may also have to lock up their coins for a certain amount of time. Phemex gives up to 8.8% APY in interest and works with about a dozen popular coins, such as USDC, USDT, BTC, and ETH.

- When it comes to deposit methods, Phemex works with third-party partners to handle credit and debit card transactions. Each partner has its own fees.

- Phemex is available in the US, but users in some states are not allowed to use it because of laws.

- Phemex lets you trade with multiple advanced orders, and it also has a Phemex Launchpool where tokens with higher than usual APYs for staking are added from time to time. Each token campaign will be a different length, have different rewards, and have different ways to bet.

- Phemex Premium has extra benefits like no trading fees, faster withdrawals, and higher trading limits. The cost of a premium membership varies by membership level.

Phemex team

- Jack Tao, CEO

- Yang Du, Trading System Architect

- Cecilia Wang, Head of Marketing

- Federico Variola, Security and Strategy Consultant

This is a respectable team, consisting of former Morgan Stanley executives with proven track records in the financial world. Phemex currently has a team of 40 employees and is recruiting new staff as we speak. They have already won the public sympathies by donating 10,000 face masks during the Coronavirus outbreak.

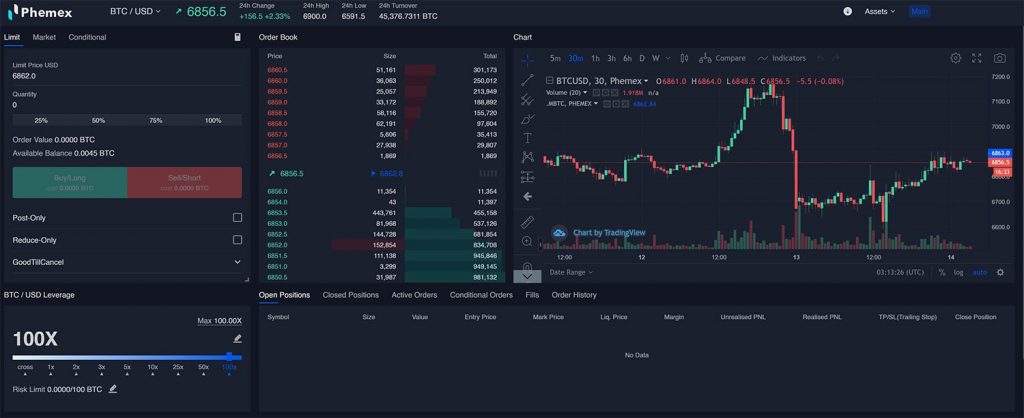

Phemex user interface

The homepage, phemex.com, is a challenge for your eyes, thanks to the bright white background. Other than that, it is clear-cut and intuitive.

Implementing their user-oriented approach, they decided to go with the modular design for the charts and trading tools. Most crypto traders will feel comfortable with the familiar Tradingview charting interface used by so many platforms, Phemex included.

You can choose from 5 different languages with a plan to add more world languages as their userbase grows.

All the standard trading tools are available, and the number of indicators per chart is unlimited. Users can adjust the platform to their desired preferences, and also there is a demo-trading option, for an easy inside view of all the Phemex options without adding any funds. However, some parts aren’t fully customizable, for instance, time frames on the trading view chart.

Overall, Phemex comes with a nice interface solution, similar to most of the crypto trading platforms. Experienced Trader with questionable internet speed will surely appreciate the ping monitor, displayed at the bottom left corner of the UI.

Phemex trading platform background is comprised of two core components: the CrossEngine and TradingEngine, in which it matches client orders based on price and time priority. Their CrossEngine is designed to handle 300,000 TPS, with the response time less than 1 millisecond.

Phemex, like FTX, has developed its own Android and iOS app, to enhance the user experience, and offer a full platform functionality on mobile platforms, too.

Phemex – supported currencies

Phemex offers a small list of supported currencies: Bitcoin, Ethereum, Ripple, and LINK that can be traded against the USDT – Tether. As there are no actual transfers of Bitcoin in the buying/selling process, contracts are quoted in USDT. Phemex offers three types of trading orders similar to many other crypto margin platforms:

- market orders – executed and filled at the best market price

- limit orders – guaranteed execution if the price reached the set value. You can choose the method of execution: GoodTillCancelled (GTC), ImmediateOrCancel (IOC), or FillOrKill (FOK)

- conditional orders – similar to the limit orders, except for setting a trigger price. This method is the most popular amongst experienced traders.

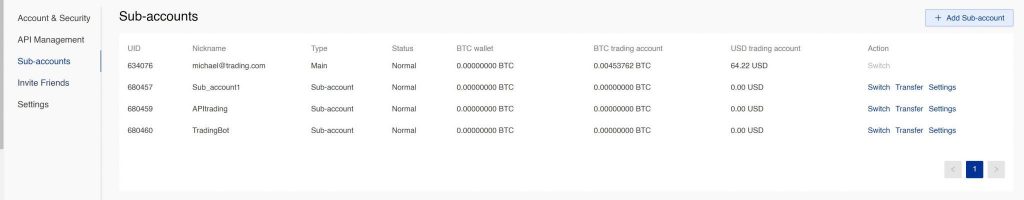

Phemex Sub-accounts

The platform offers a unique system of creating the sub-accounts within the existing account, for the option of holding both short and long positions. Each sub-account can have separated balance and a level of permission, for isolating different trading strategies. You can also use them with trading bots and transferring balances between one sub-account to another. The sub-account feature is in high demand among quantitative trading teams and is promised to provide L3 market data in the future.

100x Leveraged trading

100x leverage anyone?

Phemex currently offers 7 leveraged contract trading pairs that can be traded on a margin :

- BTC / USD

- ETH / USD

- XRP / USD

- LINK / USD

- XTZ / USD

- LTC / USD

- GOLD / USD

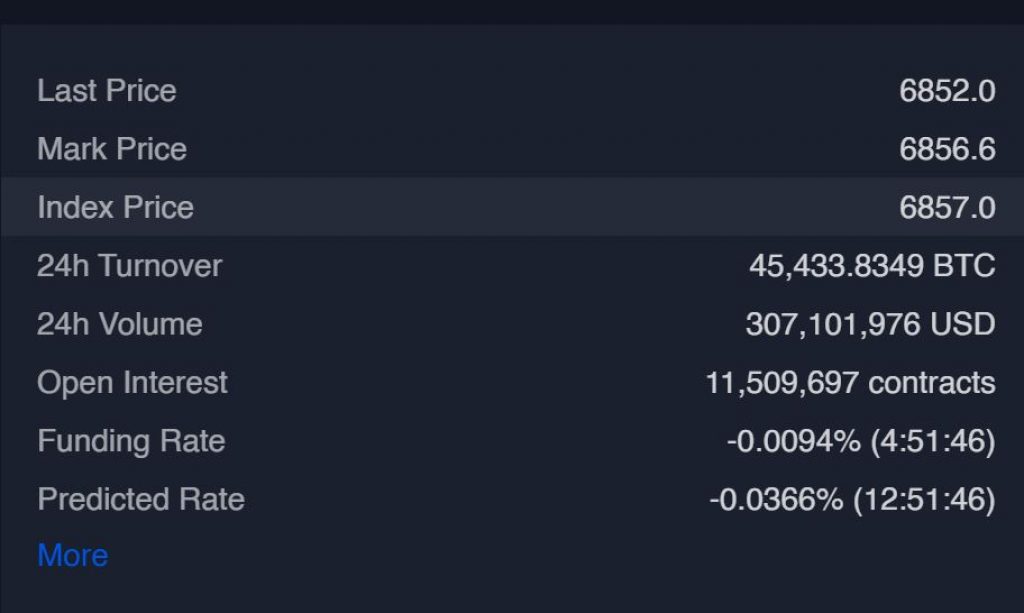

Phemex also offers perpetual contracts, the same as BitMEX and Bybit. The leverage can be adjusted up to 100x, as it has become an industry standard. Setting that high level of leverage can get you quick profit, or a quick loss, (double or nothing) and experienced traders tend to avoid it.

Aside from this, Phemex also has a funding rate that is dependent on the leveraged position.

Depending on whether it’s a “negative funding” or “positive funding” rate, the funding rate is paid directly to the people who have long or short positions.

If the funding rate is negative, shorts will have to pay longs a portion of their position.

If the funding rate is negative, shorts will have to pay longs a portion of their position.

Phemex fees

Phemex is going by the standard of the industry, with the maker-taker fees 0.025% and 0.075%, identical to Bybit and BitMEX.

You can check this table to see how Phemex trading fees compare to its competitors:

| Crypto Exchange | Leverage | Cryptocurrencies | Fees | Link |

|---|---|---|---|---|

| Prime XBT | 1000x | 5 | 0.05% | Trade Now |

| BitMEX | 100x | 8 | 0.075% – 0.25% | Trade Now |

| Binance Futures | 10x | 17 | 0.012% – 0.06% | Trade Now |

| Deribit | 100x | 2 | 0.025% – 0.075% | Trade Now |

| Bithoven | 20x | 13 | 0.2% | Trade Now |

| Kraken | 5x | 8 | 0.01 – 0.02% ++ | Trade Now |

| Gate.io | 10x | 43 | 0.075% | Trade Now |

| Bitfinex | 5x | 25 | 0.1% – 0.2% | Trade Now |

| PrimeBit | 200x | 4 | 0.02%-0.05% | Trade Now |

| ByBit | 100x | 8 | -0.025%-0.075% | Trade Now |

| Phemex | 100x | 4 | 0.025% – 0.075% | Trade Now |

| Poloniex | 2.5x | 22 | 0.09% | Trade Now |

Deposit and withdrawal payment methods

Phemex used to only supports BTC deposits and withdrawals. They started to accept fiat deposits with credit cards or debit card, while PayPal or any other fiat deposit method is not available.

However, in case you want to buy with fiat currency, you will need to do KYC.

This is to be expected from an unregulated derivatives platform. That does grant anonymity and non-KYC account, but is very limiting, considering their competition platforms like BTSE, that offers 7 different digital assets and 10 fiat currencies to deposit. So, to start trading on Phemex, you need to own or buy Bitcoin. For trading USDT settled contracts, you need to exchange BTC to a USDT trading account at a current rate.

The withdrawing process is easy, you need to enter your wallet address and choose the amount of Bitcoin to withdraw. The 2FA process is implemented, but there is no option to set your white-list of trustworthy IP addresses. That’s a downside, because most of the competition platforms, like Coinbase Pro or BitMex, offer that option. Also, the speed of the withdrawal can be a drag sometimes, and usually takes several hours. The withdrawal process takes place three times a day, 8 am, 4 pm, and 12 am UTC. The cut-off time for withdrawals is 30 minutes before the next interval.

Phemex Deposit & Withdrawal Fees

Tthere are no fees for depositing funds. The withdrawal fee is set at a low 0.0005 BTC, with the minimum withdrawal amount of 0.002 BTC. There are no deposit and withdrawal fee when moving funds from one subaccount to the other. Of course, that might change in the future, as the platform continues to grow in users and daily volume tradings. (https://phemex.com/fees-conditions)

How To Trade With Phemex With Zero Fees

To buy and sell cryptocurrency with Phemex, follow these simple steps:

- Login to your Phemex.com account

- Navigate to the top menu and hover over ‘Products’

- Use the drop down menu to select ‘Spot Trading’

- Choose the crypto asset (e.g. Bitcoin, Ethereum)

- Enter the amount to buy or sell back to USDT

- Review the order to ensure the details are correct

- Click on the green ‘Buy’ or red ‘Sell’ button to place the trade

This crypto exchange also provides a trading contract for GOLD/USD and with more assets such as S&P 500 stocks, stock indexes, interest rates, FOREX, commodities, energy and metals that will be released on the platform shortly according to the Phemex website.

Phemex Earn – fixed and flexible savings accounts on BTC and USDT

There are three ways to earn interest and generate passive income on Bitcoin and Tether stored on Phemex that are not being used. The third way includes other coins that yield higher APYs via the Phemex Launchpool.

The Phemex Launchpool is an exclusive service where certain tokens with higher than usual APYs for staking are included periodically. Each token campaign will have a different length, rewards, and ways to stake.

The first is a product called Flexible Savings.

This lets people earn interest on their cryptos without having to commit to anything for a long time. The best thing is that you can put money in and take it out at any time, and you still get a good rate of return while the money is in your account. A user only needs to move money from their Phemex spot wallet to their Flexible Savings account. As soon as the money comes in, the user will get the daily interest that goes with it. You can take out your initial deposit and any interest at any time.

The second way is to use Phemex’s Fixed Saving product, which lets users earn more interest on BTC and USDT they put away for a certain period of time. Users must sign up for this option for a set amount of time before they can cash out their earnings. Flexible Saving has a higher and more stable rate of return. Right now, you can’t take money out of your Fixed Savings account early.

Verification: Is KYC required at Phemex?

Phemex does not require KYC verification checks. Registration process on Phemex is instantaneous and does not require lengthy verification hassles or any official documents to prove your identity. It is perfect for privacy-conscious traders.

Is Phemex safe to use?

The team behind the platform has proven itself in the business world already and has over 40+ years of combined experience in delivering high-frequency technology. As they often emphasize, they are led by eight former Morgan Stanley executives, and that gives this platform a high level of trustworthiness.

The platform uses an HD Cold Wallet System to secure the funds. All the funds are periodically sent to one, multi-signature cold wallet via offline signature. Phemex doesn’t have own hosting service but uses Amazon Web Service (AWS) Cloud, the industry leader when it comes to cloud-based security and safety. Trading zones are separated from the internal network with the layer of firewalls. The platform is also secured with SSL technology and uses PCI scanning.

The platform’s recovery system gives the users 99.99% availability, and that can be a game-changer if the Phemex withstands the test of time. Don’t forget, the platform is the new player on the market, and major challenges are yet to come, including eventual hacking attempts or major bull runs that weigh down even the big guns like Coinbase or Kraken.

Phemex customer support

Their Help Center is surprisingly well managed, with a plethora of helpful articles, FAQ sections, how-tos, and recent blog posts. You can find most of the answers regarding the platform here. The support team is available via email, live chat, and the Telegram community. The CEO is also available on Telegram and Twitter, but it’s mostly a nice marketing trick, nothing more. The platform doesn’t have a direct telephone line, but I am sure that will change in the future.

List of prohibited countries

- USA

- Quebec (Canada)

- Cuba

- Sevastopol

- Singapore

- North Korea

- Iran

- Sudan

- Syria

Is Phemex available in Canada?

Phemex is an offshore crypto trading platform that offers services to users across the world. Although Canada is not on the list of restricted countries, Phemex advises users to check if their jurisdiction’s laws allow them to use their services, as regulations may differ from one country to another.

In terms of legality, Phemex is registered in the British Virgin Islands, where regulations and tax rates are much lower. While this does not make Phemex illegal in Canada, it also means that it is not regulated by Canadian authorities. Hence Canadian residents should assess the risks associated with using an offshore trading platform before opening an account with Phemex.

Is Phemex legal in the US? Can you use Phemex in the US?

No, Phemex is not registered in the USA and Americans are prohibited from trading on this platform.

You can test your luck with VPNs.

Just to be clear about VPNs. All traffic leaves a footprint, there are 100 variables passing through the browser and your signature is unique.

VPNs on the other hand leave no footprint which is the biggest footprint of all.

Netflix doesn’t care cause they’ll lose a customer, leverage brokers don’t care cause they’ll lose a customer, but they can both easily see when a VPN is being used.

All I’m saying is don’t let your balance get too high, cause if they want they can just ban you and take your case for ToS violation.

VPNs are very overhyped, any network manager can see a VPN connection from a mile away.

|

|

Conclusion

Phemex builds its position on the market by focusing on its main strengths: user-oriented approach, surprisingly quick transaction time, and sub-account option. The small choice of the trading options does make this platform quick, but at the same time uninteresting to some traders. So far, Phemex is still just a new interesting platform, nothing more, nothing less.

But they are quick to list new low-cap coins before they enter the real spotlight and you can scoop them up before a familiar “to the moon” moment. This alone is a reason enough to have an account on Phemex. Their potential is unquestionable, but some more time will have to pass to see the results.

Phemex Alternatives

In case you are not swayed into registering on Phemex, you might be interesting in learning more about its direct competitors like

The main thing that I do not like about Phemex is the withdrawal times. Withdrawals are only processed at 2400 0800 and 1600 (UTC) that is very limiting for a 24 hour market.

i am in the usa. according to this article usa users are not allowed to open accounts and buy /sell cryptos

Please update article. USA residents have been allowed to trade on this platform. I’ve been trading on it since May 1, 2021.

I do not recommend and cannot tell you to use and trust this exchange. It looks quite attractive, but listen to my story.

I demand a response to this review, and if the situation changes, the review will be the opposite. When I created my account, I made a deposit, and later the exchange started kicking me out of my account, I wrote it off as some technical problems. Just in case, I decided to go through identity verification and started withdrawing funds, but my withdrawal did not want to be processed at all, it looked like it was checked manually. In less than 10 minutes, my login, deposit/withdrawal, and their passive income system were blocked, even though I hadn’t even touched it. After that, I immediately contacted the support service, where I was again asked to provide documents, and they asked me to record a whole video with documents dated today and to voice the text “Unblock my account, my mail…”. The support team accepted all this and said they were looking into it and conducting an investigation. At the moment, every time I contact the support service, I get a response that there is no deadline, and I am left with only breakfast and no specifics. The amount left on my account is significant enough to just forget about this story, so I will continue to press on, including by spreading the word among my community. At the moment, I have all the necessary evidence to substantiate my words, I leave my ticket #506958 and #506976