BTCpop is a crypto-backed loan platform that allows the user to get a credit extension in Bitcoin. As a notoriety based bank, your credit and budgetary history don’t factor into your qualification. There are not many reviews or opinions readily available for this company making it hard to contrast it with other crypto loan specialists. We’ve taken a look at the BTCpop platform to help you understand how it works and how it compares with the competition.

What you'll learn 👉

Summary

BTCpop is one of a small number of companies that are offering credit advances in Bitcoin. Like other crypto loan suppliers, it doesn’t take into account your credit score or salary when applying for a loan; rather they take into account your reputation on the platform, with different lenders offering different rates.

Some portion of your notoriety depends on your history of reimbursement through the stage, thus you probably won’t get the best arrangement from the outset. In any case, it could be a decent choice if you’re keen on taking out different advances or plan on engaging in Bitcoin lending.

What is BTCpop?

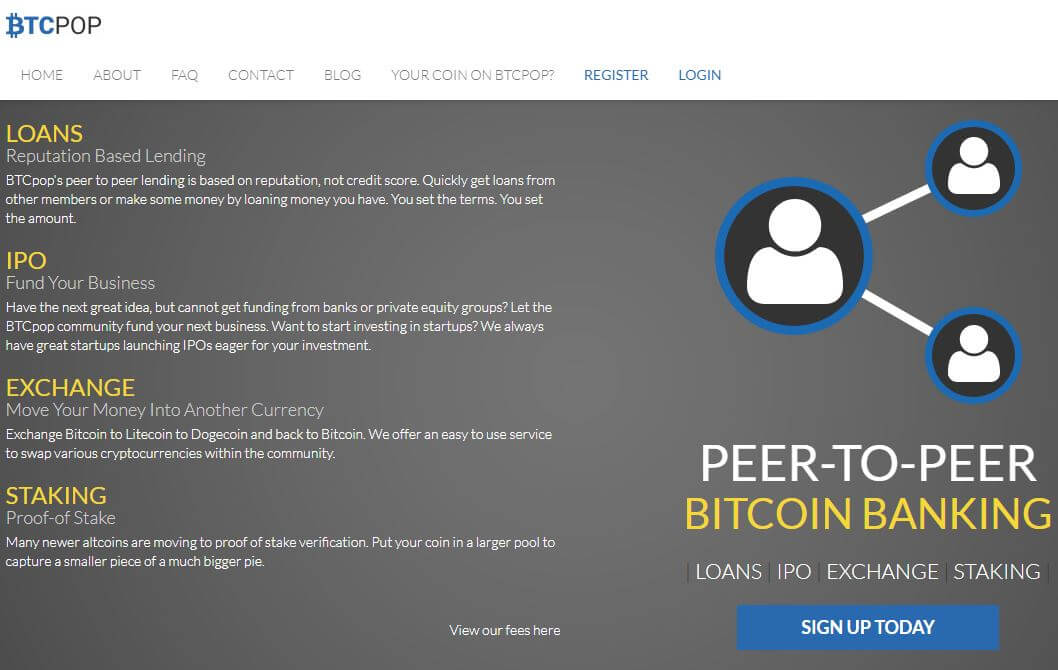

BTCpop is a peer to peer lending platform that offers loans in the form of Bitcoin. The company is based in the Marshall Islands. The platform is unique in the way that the rates and fees for loans are set by the individual lender.

BTCpop charges an expense that relies upon the sort of credit you apply for:

- No-insurance advances — 4% of the credit sum

- Credits with unconfirmed guarantee — 3% of the advance sum

- Credits with confirmed guarantee — 2% of the advance sum

There is a further 1% charge for posting your credit application and a 2% expense for any late installments.

Read also:

Advantages

This kind of P2P setup comes with a multitude of advantages, just a few of these are:

- ✅ Instant funding – Receive funds into your wallet as soon as you are approved.

- ✅ No Credit Checks – Your loan is based on your reputation on BTCpop rather than your credit history or income.

- ✅ Offers other crypto services – Also offers services such as IPOs, bitcoin exchanges, and staking.

Disadvantages

Consider these potential disadvantages before taking out a BTCpop advance:

❌ Must build a reputation to get good rates – It takes some time to get good rates if you are new to the platform as you first need to build trust within the service.

❌ Not regulated – As BTCpop is situated in the Marshall Islands and your lender can be from anywhere, there isn’t much regulation in place, meaning you aren’t protected if something goes wrong.

❌ The company is not transparent – BTCpop doesn’t have much information about itself on its website, rates and terms are not available to see until you get a proposal from an individual lender.

The sector of cryptocurrency lending and borrowing is blooming and today’s subject of our review is BTCPop – one of the many bitcoin lending platforms on the market right now. Blockfi is definitely number one in the USA, while it does have serious competitors in Nebeus, CoinLoan, YouHodler, SpectroCoin Loans, NEXO and Celsius Network elsewhere.

Frequently Asked Questions

What is the Public Opinion of BTCpop?

The general opinion in regards to BTCpop is fairly mixed. It gets an 8.8 out of 10 rating from Trustpilot with over 200 reviews. These reviews seem promising however various Bitcoin discussion groups and web journals claim that BTCpop is a scam.

A few members have praised the website for its community like structure, however, few give information regarding their own experiences. Some users have complained about being locked out of their accounts and some mention that the company are breaking a few UK budgetary guidelines.

Am I qualified?

With BTCpop, qualification depends on your reputation on the platform: Your FICO assessment, salary, and different factors about your income don’t make a difference. Rather, BTCpop allocates you a notoriety score that permits you to apply for a certain amount of credit.

How Can I Get Better Rates?

To get better rates you need to build a good reputation on the platform, you have a few different options to build a positive reputation on BTCpop:

Take out and reimburse a credit line. BTCpop suggests applying for a smaller loan using altcoin or portions of Bitcoin as insurance. After successfully paying back your credit line you will have a better reputation with the company which in turn makes it possible to access loans with better rates

Move your notoriety from another stage, if you have had any cryptocurrency based loans in the past, you can get a better reputation with BTCpop by providing information about these loans.

Take an interest in the network. The Bitcoin loaning network is still fairly new. Furthermore, the more you take part in BTCpop, the more trust you will build within the platform.

I Received a Credit Extension, Now What?

Reimburse your credit as indicated by the terms. In case you’re experiencing difficulty with reimbursements, converse with the individual that you are lending from, ignoring them will only make things worse. While defaulting on a Bitcoin advance probably won’t hurt your FICO assessment or influence your capacity to get a traditional loan from the bank, it’ll harm your notoriety in the crypto network.

Conclusion

BTCpop is a revolutionary Bitcoin lending platform. It’s a trust-based network — and a little one at that. While not perfect for getting an advance immediately, it could be an asset for those keen on acquiring and putting resources into Bitcoin later on. It’s also a great option for people who are interested in being lenders, allowing them to make money by lending Bitcoin to others.