In the dynamic world of cryptocurrency trading, Binance Grid Trading has emerged as a powerful tool for traders. This automated trading strategy, often employed by a Binance trading bot, allows users to capitalize on market fluctuations within a specific price range.

In this Binance Grid Trading review, we delve into the mechanics of this trading strategy, exploring its potential for profitability. We address the question, “Is Grid Trading profitable?“, providing insights into the factors that can influence the success of this trading strategy.

We also take a closer look at the Binance Spot Grid Trading system, examining its features, benefits, and fee structure. This includes a detailed analysis of the Binance Spot Grid Trading fees, helping you understand the cost implications of using this trading strategy.

Join us as we navigate the intricacies of this innovative trading strategy, equipping you with the knowledge you need to make informed trading decisions.

| Topic | Summary |

|---|---|

| 🤖 What is Binance Grid Trading? | Binance supports automated grid trading with three different grid trading bots: spot grid, futures grid, and TWAP. Spot and futures grid are similar, but the futures grid strategy allows for leverage up to 20x. TWAP aims to achieve an average execution price close to the time-weighted average price of a user-specified period. |

| 🛠️ How to Set-up Your Grid Trading Strategy | Log into your account, go to the USD-M features trading interface, and click on Grid Trading. There are various parameters to edit and select. Once you have the desired options chosen, select “create”. |

| 🔄 Grid Trading Mechanism | Grid trading mechanism is simple to use, from setting up the bot to using it on trading pairs. |

| ⚙️ Grid Trading Parameters | There are several parameters to set up including symbol, isolated margin mode, balance profit, lower and higher amount, mode, grids, leverage/grids, primary margin, entire investment, quantity, activate type, and others. |

| 📊 How to Check Active Grid and History | There are options to check the active grid and history of your grid trading. |

| 💰 Binance Grid Trading Fee | Binance.US charges a flat 0.1% spot trading fee which is lower than many other US exchanges. |

| 🤖 8 Reasons to Use a Grid Bot | Grid trading is a reliable strategy, easy to use, adaptable, offers enhanced risk management, allows for automated trading, works well in a sideways market, is versatile, and uses the grid strategy. |

| 🔄 Other Platforms Offering a GRID Bot | Other platforms offering grid bots include 3Commas, KuCoin, and Bitsgap. |

What you'll learn 👉

What Is Binance Grid Trading?

Binance added support for automated grid trading as one of the ways to keep people on its platform and earn more trading fees. Currently, Binance has 3 different grid trading bots built-in the platform. Those are:

- spot grid

- futures grid

- TWAP

Spot grid and futures grid are the same, except the futures grid strategy enables you to use leverage up to 20x.

TWAP (Time-Weighted Average Price) is an algorithmic trade execution strategy that aims to achieve an average execution price close to the time-weighted average price of the user-specified period. A TWAP strategy is often used to minimize a large order’s impact on the market by dispersing the large order into smaller quantities and executing them at regular intervals over time.

Binance often rearranges its interface, and grid trading has seen its tab moved around quite a lot. Right now, on the app, you can find it under strategy trading.

Far more superior grid trading bots can be found on Pionex and Kucoin. They allow you run more than 10 same grid pairs concurrently, you can change the trading range and increase the investment without pausing or terminating the bot. None of this is available on Binance grid trading.

Check the Pionex review here or click here to visit their page.

Check the Kucoin bot review here or click here to visit their page.

Other then this built-in bot options, there are third-party bots that work with Binance which we covered in this article.

How to Set-up Your Grid Trading Strategy

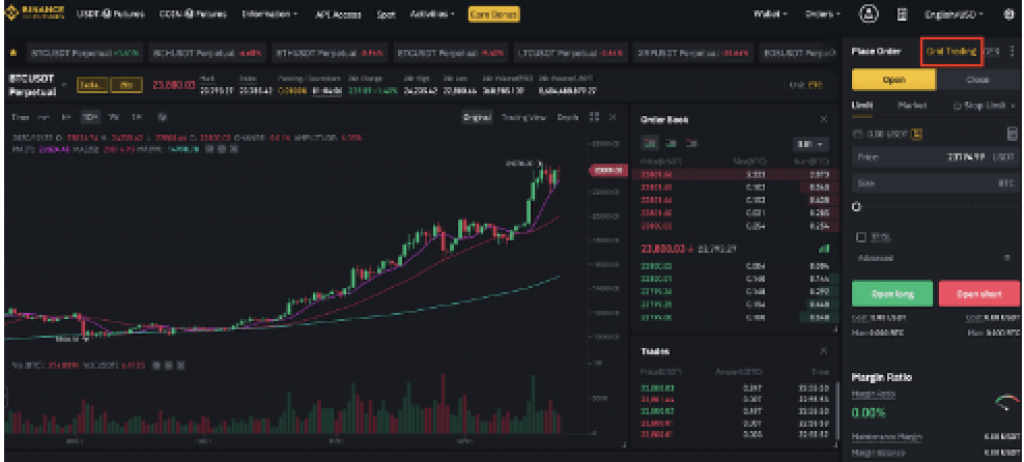

1. First, log in to your account, then go to USD-M features trading interface and then click on Grid Trading.

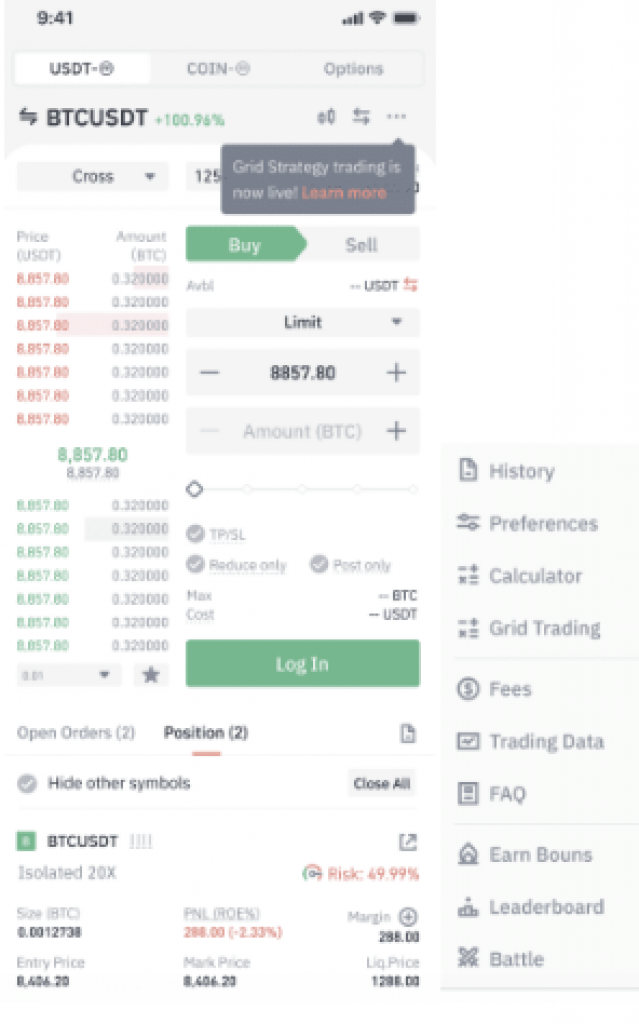

So if you are working on Binance App, click the Futures tab and then Grid Trading.

There is a range of different parameters you need to edit and select, so take your time when creating your bot. Once you have the desired options chosen, select “create” and you will be good to go!

Grid Trading Mechanism

It is simple to use the Grid Trading mechanism, from setting up the bot to using it on trading pairs. Simply follow the steps to set up your bot and its that simple. Binance is a well known exchange that is respected by the wider crypto community, this helps to ensure their quality and ease of use.

Grid Trading Parameters

- Pick a symbol

- Isolated margin mode

- Balance profit

- Lower and higher amount

- Mode: Arithmetic/Geometric (cannot alter after the grid order is set)

- Grids (i.e., number of perimeter order)

- Leverage/Grids (fees reduced)

- Primary margin (cannot be altered when the grid order is set)

- Entire investment (cannot alter when the grid order is set)

- Quantity (i.e. grid amount)

- Present margin balance (i.e., Margin balance of USD-M Futures account)

- Activate type:Final price (optional, can be used before the grid is activated)

- Activated-price (Optional, can be used before the grid is activated)

- Stop-higher-boundary/stop-inferior-boundary i.e. stop losing peak price/stop losing bottom price(Elective, can be chosen before the grid is setoff)

- Terminate all orders on stop (Elective, ticked by default, can be chosen before the grid is activated)

- Shut all placements to stop (Optional, can be selected before the grid is activated)

How to Check Active Grid

Time: Formation time of the grid.

Symbol: During grid trading, users can click on the leverage/profit showed next to the symbol to adjust the grid leverage

Initial Margin: Margin at the time of grid formation.

Total Profit: Collected profit=Grid profit + Unrealized P&L

Notes:

If all the close placements on stops are entitled to open placements under the grid, all the placements will be closed at market price after finishing the grid. The P&L of closing positions is not included in the grid profit.

The funding fees accrued during strategy work are not added to grid profit.

Realized profit: Profits and losses which are realized from grid trading

Unrealized P&L: Based on the last price and return on equity percentage, the unrealized profit and loss of open orders are calculated.

Duration: Span starting from the grid formation when the time of operation surpasses one day the time of operation is shown as 1d2h9m; and when the time of operation surpasses one year. The time of operation is shown as 1y1d2h9m, updated every minute.

Grid Status: New: When the grid is formed but not activated

Working: Subsequently, the grid is activated

Read also:

- Binance NFT Marketplace Review – Create & Trade NFTs on Binance

- Binance Staking Review – How to Stake Coins on Binance?

- Binance Earn Review – How Do Binance Fixed & Flexible Savings Work?

- How to Trade Binance Options | Binance Option Review

- Binance Tax Calculators – 3 Steps to Calculate Binance Taxes

- Best Wallets for Binance Coin (BNB) – Beginner’s Guide

- Binance Crypto Debit Card Review – When Do We Get It?

- Binance Alternatives & Competitors

- Binance Options vs Futures: What are the differences and similarities?

How to Check History

Duration:

To check grid transaction history, press the [History] tab and view the details of the grid and finished orders.

History types of grid bots:

- Abolished: Situation terminating the grid

- Expired

Binance Grid Trading Fee

Binance.US demands a flat 0.1% spot trading fee which is lower than any other US exchange. such as eToro which is at 0.75%, Coinbase at about 0.5%. If we were to take an overview of all reputable US exchanges, we will find that Binance.US demands the lowest fees among them. (Bittrex, Poloniex, etc.).

8 Reasons to Use a Grid Bot

1. Reliable Crypto Trading Strategy:

Grid Trading has been a commonly used strategy for a long time, and it is a well-developed, well-tested, well-established, and profitable approach. There are several examples of successful traders who have been using it for a long time at different marketplaces. Because of its extreme volatility, the crypto business, in particular, has shown to be one of the most reliable for grid trading methods.

2. Usability:

The strategy is very simple to use and to understand for the user because it does not carry any complicated calculations or difficult measurements. It is easy for those that don’t have experience and expertise in the crypto trading business to start with Binance.

3. Adaptability:

Grid Trading applies the most basic trading concept (buy low, sell high, earn the difference); consequently, it can be applied on any market. It is great for crypto, due to the new technology being such an emotional market, it can be utilized to take on its big swings.

You can actively determine the number and duration of the strategy by selecting the price range and the number of grids.

Grids can be established for the short term, for getting micro profits utilizing minor changes in the thousands of trades every hour, or the long term by selecting a wide range and leaving it to run for months to get profit from every major trend shift.

4. Enhanced Risk Management:

The independence to choose your grid strategy is great as it lets you create the level of risk and the level of reward that you are comfortable with. To produce a consistent ordinary profit with a little bit of risk, you can use a grid bot on less dramatic currencies, such as a BTC/USD pair, and for higher rewards, you can use a riskier strategy (e.g., with a low market cap coin that has high variations)

5. Automated Trading:

Grid trading is especially good for automation because of its clear logic and the fact that all the actions are pre-planned, letting the bot completely remove the emotional side of trading which is extremely difficult for humans to do when trading manually. Using Grid Trading with a Bot is a significantly hassle-free, and well-organized experience compared to trying to follow a strategy with manual trades.

For traders looking to take their starting steps towards automation, it is one of the greatest methods since it can set off practically any market in any condition. It can be done 24/7, and it can be set at almost any time frame.

6. Best Strategies for a Sideways Market:

The majority of the trading strategies are based on taking advantage of the market’s current trend. However, more often than not that the market has no clear trend. Thus, traders using this type of strategy have to wait it out and stay flat most of the time.

In a sideways market, you are able to profit with a grid bot through trading different ranges, it isn’t as easy as taking advantage of a bull or bear market, but it will help you earn a steady profit.

7. Versatility:

The grid strategy uses the most fundamental idea of trading, “buy low, sell high” so it can be extrapolated to fit in almost any market. By selecting the limit of the price and the number of grids, you can actively trade with confidence, with your trades being void of emotion.

Grids can be established for the short term, making a large number of trades to grab the micro profits from all small variations of a day or for the long term by selecting a huge range allowing it to run for over a month to earn profits from every huge trend change.

8. The Grid Strategy:

The grid strategy is a technique where a certain number of buying and sell orders are placed at preset intervals below or above the set price. Instead of preventing loss, it targets profits.

Which other platforms are offering a GRID Bot?

A. Binance is one of the best platforms for beginners. But except it, most of the other platforms offered Grid Bot such as,

- 3Commas

3commas is a great alternative to Binance when it comes to bot trading. 3commas’ entire service is bot trading so it could be argued they are more knowledgeable in this field. Although, Binance being one of the most respected crypto platforms, it is fair to say they are both great choices for those looking to bot trade.

- KuCoin:

KU Coin is a well-known exchange. In 2017 it offered grid trading bots which are especially good for illiquid pairs.

Grid trading bots are also available from Bitsgap. They are well-known for their demo.

There are many other platforms out there, though be sure to do your research and so you know for sure that they are legitimate.