Coinbase Review – Is Coinbase Safe & Trustworthy To Use?

Coinbase is the world’s largest Bitcoinbroker around. It is available to users in over 30 countries, especially in the United States, the United Kingdom, and Brazil, which represent their largest customer base – and has more than 4 million customers around the world. It was founded in 2012 as part of Ycombinator, which means that Coinbaseis also one of the oldest crypto trading platforms around.

Customers can purchase and sell Bitcoinwith a connected bank account, SEPA transfer, Paypal account (selling only), Interac Online, and many more payment methods. This cryptocurrency exchange started out only as a broker (selling Bitcoinsdirectly to customers). However, in May 2016 Coinbasestarted operating GDAX (Global Digital Assets Exchange) – which is now called Coinbase Pro. This is a Bitcoin exchange, where Bitcoiners can trade Bitcoins with one another.

Coinbase currently allows its customers to purchase and sell, among many others, three of the most popular cryptocurrencies – Bitcoin, Litecoin, and Ethereum. Since the end of 2018 and during 2019, they added support for a lot of other coins, mostly Bitcoin Cash, ERC-20 tokens like BAT, 0x, ZILand etc. Also Coinbase has a native coin, USD Coin (USDC)

Did you know: Coinbase asked Vitalik Buterin to come in for a chat in 2013 and they nearly offered him a job on their team. However, this didn’t happen because early the following year, Vitalik went on to create Ethereum.

What you'll learn 👉

Is Coinbase a Scam?

Anyone reading this Coinbase review is probably asking this question and the straight answer is: Coinbase is definitely not a scam, but definitely has technical difficulties at times and poor customer support. They’re a bit clunky and still a work in progress but the most convenient way to buy and sell Bitcoinwe’ve found.

Is Coinbase Safe?

This is one of the most popular options used to buyBitcoin, Litecoin, Ethereum, and Bitcoin Cash so this is a common question.

The short answer is yes.

Coinbase is very safe. The company has invested heavily in ensuring its vaults to minimize its losses. Also is the fact that the company is integrated with the major banking industries that also protect their investments.

Having received funds to the tune of US $ 75 million and above over the years since its conception, the San Francisco-based cryptocurrency exchange goes, without doubt, one of the most secure virtual currency brokers in the world.

Is Coinbase legit? Coinbaseis a Bitcoin company based in San Francisco, which means that is required to comply with US laws and regulations, at both a federal and state level. Here are some of the regulatory bodies, laws, and regulations that Coinbase complies with:

- It complies with state money transmission laws and regulations.

- It complies with the USA Patriot Act.

- It complies with the Bank Secrecy Act.

- It is registered with FinCEN as a Money Services Business.

These laws and regulations force accountability onto Coinbase (also exists and Coinbase Pro). This is something that may be lacking from some of their offshore competitors in other countries with less strict regulations.

Aside from the United States, none of the other 31 countries, where Coinbase operates, require licenses to operate a cryptocurrency business.

It’s also worth noting that Coinbase (also exists and Coinbase Pro) is backed by trusted investors. These investors include Digital Currency Group, Blockchain Capital, Bank of Tokyo, and Alexis Ohanian (Reddit Co-Founder).

Coinbase is the world’s largest Bitcoin broker. It also offers a cryptocurrency exchange, digital wallet, and developer API.

In this article, we’ll review Coinbase and its brokerage, digital wallet, and exchange.

Read our updated guide on cryptocurrency trading bots.

Safe Keeping of Funds

This crypto exchange segregates customer funds from company operational funds. These customer funds are held in custodial bank accounts. This means they will not use your funds of yours to operate their business. They also claim, “Even if Coinbase (also exists and Coinbase Pro) were to become insolvent, the funds held in the custodial bank accounts could not be claimed by Coinbase or its creditors. The Funds held in those accounts would be returnable to Coinbase’s customers.”

98% of customers’ cryptocurrency funds are stored in secure offline cold storage. These cryptocurrencies are held on multiple hardware wallets and paper wallets (cold storage). The physical crypto wallet is then stored in vaults and safety deposit boxes around the world. These measures protect customers’ funds from being lost or stolen by hackers.

The remaining portion of cryptocurrency, that is stored online, is fully insured by a syndicate of Lloyd’s of London.

Coinbase Rapid Growth

Now that we answered the important “is Coinbase safe” question, it is time to move on and write a bit on the history of this cryptocurrency trading platform. Coinbase’s popularity surged in 2017 – to give you an idea of the popularity behind this exchange let’s take a look at visitor statistics for Coinbase in 2017.

Monthly visits have been skyrocketing with a 70% jump in traffic between the month of October and November 2017. This figure currently stands at 65 million monthly visits. You may be saying: “yeah but this is because of the current bull market” – well get this: no other bitcoin exchange has been growing so fast in recent times. Furthermore, 45% of visits to Coinbase are from the USA, with Brazil second at 9% of total traffic, and the UK at 4%. Finally, at the time of writing this (March 2017) Coinbase Pro’s daily volume represents 15% of the whole bitcoin market volume.

In 2021, Coinbase is estimated to be worth 20+ billion USD and it is getting ready for an IPO which could break many records in terms of valuation and capital inflow.

How Does Coinbase Work?

To start off this Coinbase (also exists and Coinbase Pro) review, let’s do a short guide on Coinbase’s inner workings. Coinbase operates more like a bank than a broker. This is so as the company was the first to receive the virtual currency operation license. This is also because major integration with the major Banks it is operating with has resulted in the adoption of most Banking laws. For this reason, Coinbase requires one to fill out extensive personal information and monitor the accounts to prevent money laundering. This should not water down your spirit as their services are secure and guaranteed which is hard to come by in virtual currency.

Thanks to Coinbase’s simple interface, it is very easy for first-time buyers to buy Bitcoins.

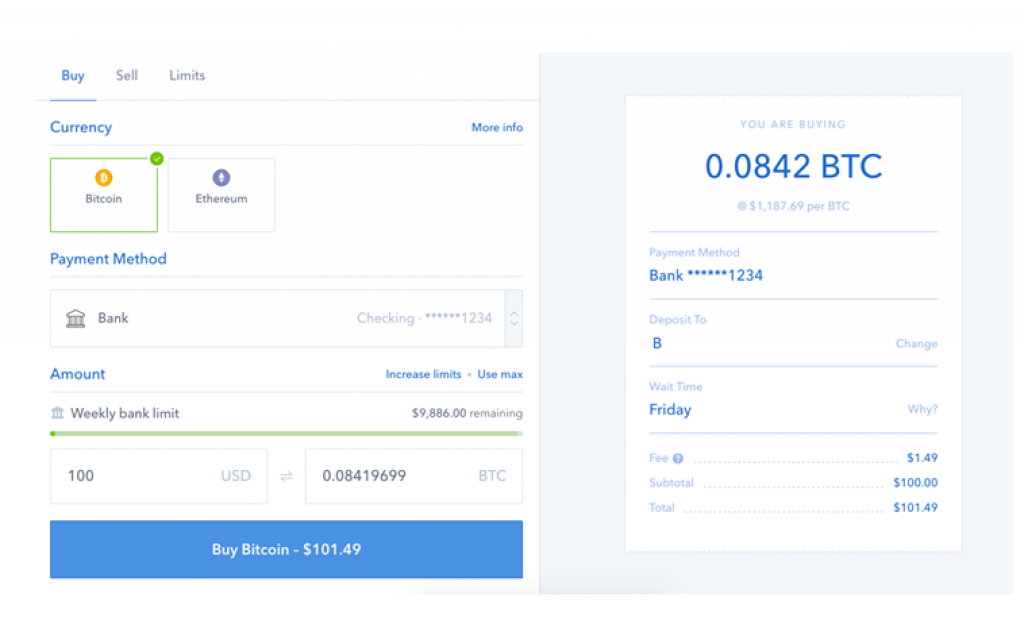

The most popular payment method for Coinbase customers is purchasing with a credit card or debit card. You can also use a bank transfer as a payment method.

At the bottom of this post, you can find a full guide that shows you how to purchase on Coinbase using a debit card.

What Type of Payment Methods Can You Use on Coinbase? What about Coinbase Fees?

Coinbase offers its services in 32 countries and the payment methods available depend on your country.

| Countries | Payment Method | Currency | Funds Available | Fees* |

| USA | Bank Transfer | USD | 5-7 days** | 1.49% |

| USA | Credit / Debit Card | EUR | instant | 3.99% |

| Canada | Credit / Debit Card | CAD | instant | 3.99% |

| Europe | SEPA Transfer | EUR | 1-3 days | 1.49% |

| Europe | Credit / Debit Card | EUR | instant | 3.99% |

| UK | Credit / Debit Card | GBP | instant | 3.99% |

| Singapore | Xfers Transfer | SGD | instant | 1.49% |

| Australia | Credit / Debit Card | AUD | instant | 3.99% |

*Actual deposit of currencies into your Coinbase account is free and Coinbase then charges a 1.49% fee per buy.

**US users may add a MasterCard or Visa card as a backup payment method. Coinbase “instant buy” will be enabled for up to $1,000 worth of Bitcoin per week if a backup credit card is available.

Two-factor authentication is used on every account for additional security that is covered by insurance. Our insurance policy covers any crypto assets kept on Coinbase servers.

Coinbase Compared

The most popular payment method on Coinbase is a credit card. The table below compares Coinbase to other popular credit card exchanges – CEX.io, BitPanda, and Coinmama.

| Exchange | Countries | Fees | Buy | |

| Coinbase | USA, Canada, Europe | 3.75% | Buy | |

| CEX.io | Global | 3.5% | Buy | |

| BitPanda | Europe | 5% | Buy | |

| Coinmama | Global | ~6% | Buy |

It’s important to note that fees are approximate. They may vary based on your country or purchase size.

Take a look at detailed comparisons of Coinbase to other exchanges:

Supported Countries

Coinbase serves customers in the United States, Singapore, and Canada.

Coinbase also offers its services in the following European countries: the United Kingdom, France, Greece, Norway, Poland, Sweden, Switzerland, Denmark, Finland, Monaco, Netherlands, Slovenia, Spain, Cyprus, Czech Republic, Liechtenstein, Malta, San Marino, Slovakia, Bulgaria, Croatia, Italy, Latvia, Portugal, Romania, Austria, Belgium, Hungary, and Ireland.

Is Your Privacy Kept When Using Coinbase?

Users have to provide full identity verification and a lot of personal information.

If you are buying with a card, you will be required to take a picture of your driver’s license or passport.

Coinbase Buying / Selling Limits and Liquidity

Once your Coinbase account is set up, you are able to purchase a small number of Bitcoinsuntil you raise your limit. Buy and sell limits can vary by payment method, user location, and verification status. For example, fully verified US customers may get these weekly limits fairly easily:

- $50 Buy through Credit/Debit Card

- $5,000 Buy through Bank Account

- $50,000 Sell

If these limits don’t meet your needs, you can apply for higher limits. It’s important to note that your limits for instant buys, such as debit card buys, may not be able to be increased.

European customers may at any time have a maximum of €30,000 in their account.

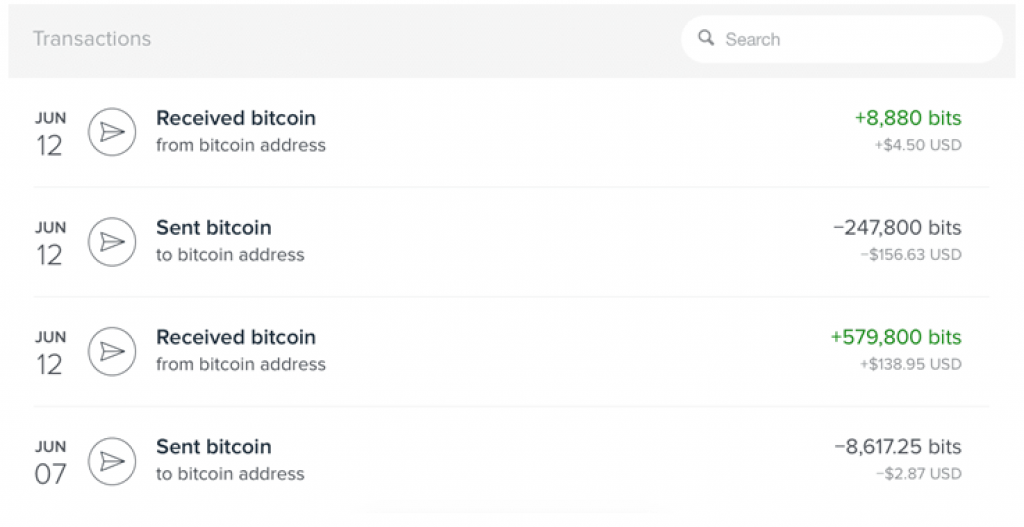

Coinbase Transactions

Coinbase transaction times depend on your country and the payment method you will use. For example, a Credit Card purchase will be instant whereas a wire transfer can take up to 5 days to be approved.

United States

Bank Transfer: When using bank transfer, US customers will receive their Bitcoins 5 business days after placing an order. If a credit card is added to the account as a backup payment method, then instant buy becomes possible.

The instant buy will allow fully verified users to purchase up to $1,000 worth of Bitcoin per week, while level 2 users are able to instantly purchase up to $100 worth of Bitcoin per week.

Credit/Debit Card: If you use a debit or credit card, delivery of Bitcoins is immediate once you complete your ID verification.

Europe

European customers who are paying with SEPA transfer will receive their Bitcoins within 1-3 days after placing their order.

Canada

Canadian EFT buys take 4 days to complete, while Interac Online buys are instant!

Customer Support

Coinbase offers customer support through a knowledge base and email.

Unfortunately, Coinbase provides miserable customer support services. Not much to comment on that, tickets go unanswered for weeks.

Coinbase “Community” can be used to ask questions and get support help, and you will probably receive responses from customer service within 24-72 hours.

Past Problems

There have been reports that Coinbase tracks how its users spend their Bitcoins. – Coinbase can and will track how its users spend their Bitcoins. They may also freeze or close your account if you deal with selling stuff on the darknet, gambling, adult services, and other shady business.

Coinbase Bitcoin Wallet Review

Your Coinbase wallet controls all private keys and can be accessed on the web or with the Coinbase App for Android and Coinbase App for iOS.

Coinbase acts more like a bank than a trueBitcoin wallet.

Coinbase should only be used to purchase or sell Bitcoin. However, it should not be used to store funds (unless you use the Multisignature Vault).

If you want to find a wallet that truly gives you full control over your Bitcoins, read our guide on Bitcoin wallets.

Coinbase Bitcoin Wallet Security

Three types of wallets may be created with Coinbase:

- Coinbase Bitcoin wallet

- Coinbase vault

- Multisig vault

Coinbase Wallet Review

With the Coinbase wallet, your Bitcoins are controlled by the company. You have to trust that they keep your coins secure, and you also have to keep your Coinbase login and account password safe.

Coinbase is a VC-backed company with over $100 million in funding. That’s why it’s likely they have a very strong security setup. However, the point of Bitcoin is that customers have the ability to control their own money, so it’s highly recommended to move your Bitcoins into a wallet you control after you buy.

It’s important to note that Coinbase (also exists and Coinbase Pro) has been known to track where their users send their cryptocurrency, and they can shut down your account and block access to your funds at any time.

Coinbase Vault Review

Coinbase recently introduced the Vault feature. This feature allows you to “share an account” with 2 or more users, which means that if a user adds two approvers to his vault, both must confirm that the withdrawal is valid before it processes.

Also, transactions have a 48-hour delay for added protection. This allows you to catch an unauthorized transaction in time.

However, the vault account is just an added security layer in case someone hacks your password, so using it doesn’t mean you personally control your Bitcoin wallet. It’s still hosted on Coinbase and it can be shut down by Coinbase at any time.

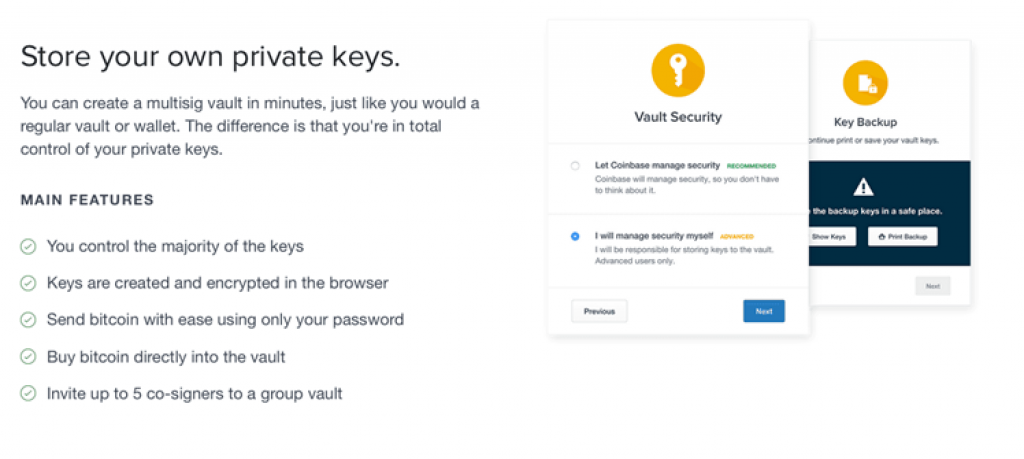

Multisig Vault

Coinbase understands that many users want complete control over their funds, so if you want total control of your wallet you can use a multisig vault.

Its multi-sig vault is a 2 of 3 wallets, where one key is held by the account holder, Coinbase has one key, and the third key is shared. You’ll need 2 out of 3 keys in order to conduct an action on the wallet. So even if Coinbase goes down, you should still be able to move funds from your wallet because you still have both the shared key and your own key.

The shared key is encrypted with your password, which means that funds cannot be held.

Privacy

Your name, email, phone number, and any other personal information are required. Coinbase knows your balance and addresses you at all times. The interesting thing is that they can connect this with your identity and IP address. That’s why you have to trust Coinbase’s nodes to verify transaction data.

Also, Coinbase must follow all KYC laws because it has buy/sell features. It’s important to note that there have been reports that Coinbase tracks how its customers spend their Bitcoin.

Each payment request uses a new address. This helps prevent other users from connectingBitcoin addressestogether.

It may also interest you that Coinbase (also exists and Coinbase Pro) received a score of 11 out of 100 from the Open Bitcoin Privacy Project’s Spring 2015 report.

Coinbase USD Wallets

These wallets allow you to store USD on your account. There are a couple of advantages to using these wallets:

- You can store USD in your account so that when you do want to buy Bitcoins later on you don’t need to wait for a bank transfer.

- It allows you to spend your Bitcoins online without exposing yourself to Bitcoin’s volatility.

Coinbase Debit Card

Coinbase used to work with Shift to issue their own credit card. They have since moved from that cooperation and have their own Coinbase Card that can be used to pay anything, anywhere using your cryptos stored on your Coinbase wallet.

Coinbase custody and staking

This is a newly launched service by Coinbase and you can read a detailed guide on it here. You can read more about top staking cryptocurrencies here.

Coinbase Purchasing Tutorial (Debit Card / Credit Card)

Coinbase allows you to purchase Bitcoins instantly using a debit card or a credit card. Check our step-by-step guide to help make the purchasing process easier for you.

Create an account on Coinbase, confirm your personal details, and log in. It’s important to note that you may be asked to upload a scan of your ID

- Go to account settings

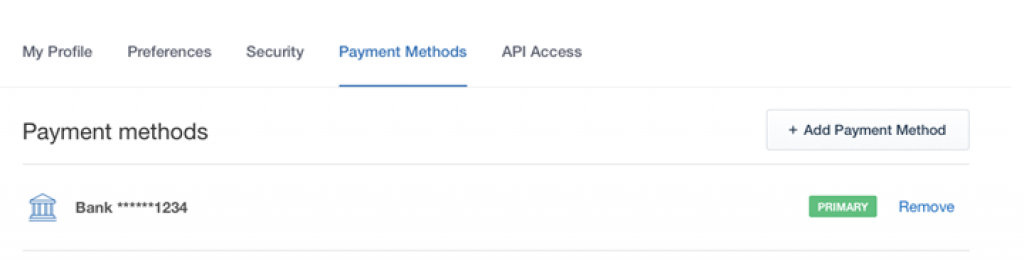

Go to the top right corner, click on your name and you should see a drop-down menu where you can click “Settings”. Then click “Payment Methods” on the menu at the top. There should be something that looks like this:

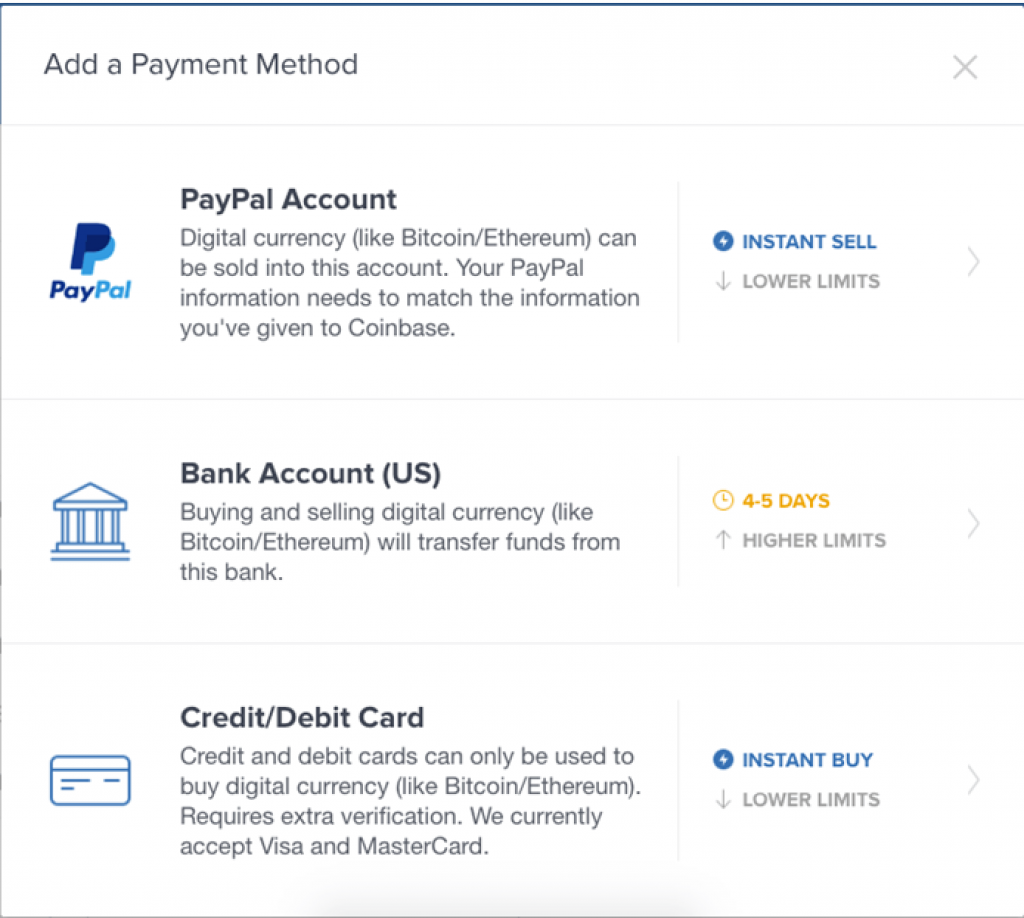

Navigate to the right corner and click on “Add Payment Method”.

- Click the “Credit/Debit Card” tab

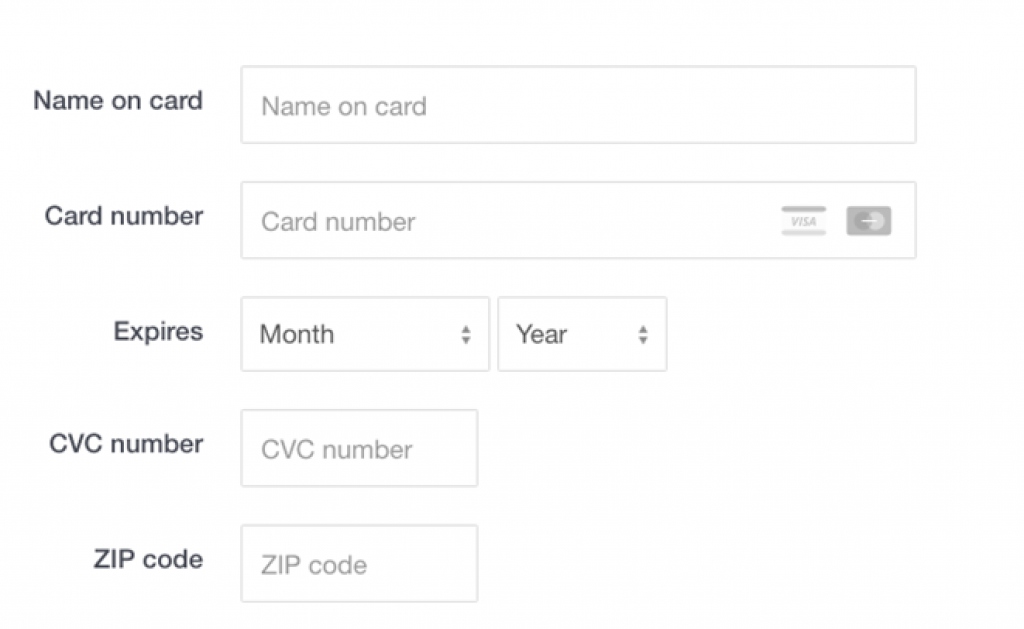

- Enter your Credit/Debit Card Information

It’s important to note that Coinbase currently only accepts MasterCard and Visa credit/debit cards.

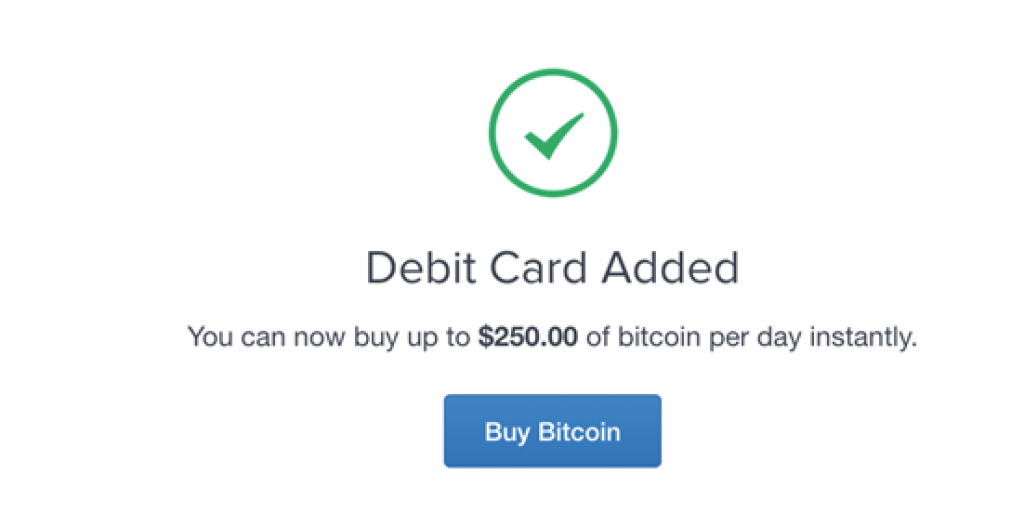

- Confirmation

You should see a confirmation like the one on the image below, and if you do, your credit/debit card has been successfully added!

- Purchase Bitcoins!

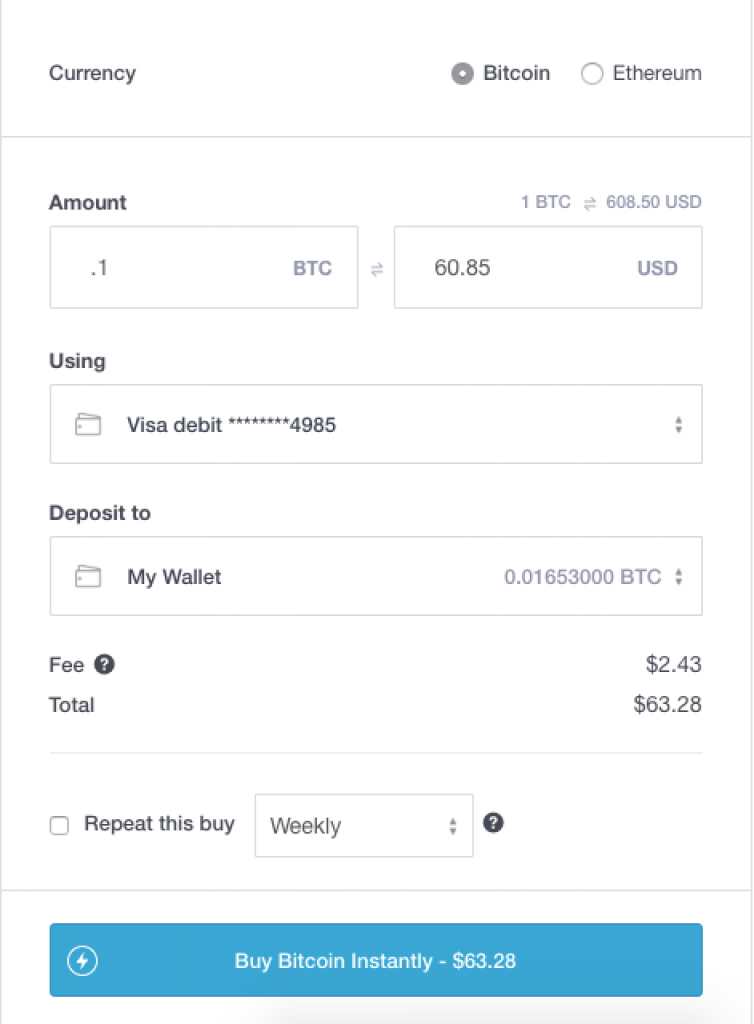

Go to the buy page and there should be a widget that looks like the image below:

Enter the amount you want to purchase. Then click “Buy Bitcoin Instantly” and your coins will then be delivered to your Coinbase wallet!

Note: This process may have changed slightly by the time you’re signing up to Coinbase because they continuously make small adjustments to their design and sign-up process.

Frequently Asked Questions (FAQ)

Make sure to check out our guides on other cryptocurrency exchanges:

- If, for some reason, you are not satisfied with Coinbase, here is a list of Coinbase alternatives.

- Is Binance safe and how to use it?

- Read how to buy coins on Kucoin in our complete review of the Kucoin exchange.

- Another popular exchange is Cex.io – learn more about it in our Cex.io review.

Make sure to also check comparisons we made between some of the most known exchanges:

- Coinbase vs Bitstamp

- Changelly vs Shapeshift

- Coinbase vs Coinmama

- Xapo vs Coinbase

- GDAX vs Gemini

- Changelly vs Coinbase

- Coinbase vs Bittrex

- Poloniex vs GDAX

- Poloniex vs Bittrex

- Coinbase vs Kraken

- GDAX vs Coinbase

- Gemini vs Coinbase

- Binance vs Kucoin

- Binance vs Bittrex

Warning!!!! Dozens of Wire Transfers missing from Coinbase!

Hundred of Thousands to Millions of Dollars in Wire Transfers missing from Coinbase Accounts and not returned to Customers.

Before wiring anything please see the Coinbase Reddit Forum!

Coinbase is charging a lot more then what list here. Right now you will loose 10% of purchase of Bitcoins through CB fees. They are charging close to 5% for both the purchase and sending. Not even close to the bs number of 1.49%. All CB transactions are held for 72 hours and are not instant as advertised. A Customer Service that do anything for you is NON- EXISTENT. I have had everything I own verified. My cell phone, email, my computer, my drivers license and bank accounts yet they hold the transaction for 72 hours and there is nothing you can do to change it. Coinbase is a complete joke and should be taken down by authorities for bold face lies.

Coinbase… beware… they were to deposit my money into my bank 28 days ago (as of Feb 17th). Still no deposit. Wire transfers missing, bank deposits missing. They have a great business model. Withdraw money from your bank and then don’t return it when asked it. This is not even discussing there insane fees… used beware

I support the comment above by @GEORGE. Cojbase is absolute scam and you should stay away from them. Secure and satisfactpory trading of bitcoins can only be done on liviacoins

Coinbase Support +1(855)750-0786 is really a great help.

Mafia. I invested 1700 Euro in February without any problem. Bitcoin suddenly dropped and I deposited 1700 Euro more a week later. After nearly 2 weeks of trying to call hopelessly I received an email from somebody called John asking for transaction details. The money was taken out of my bank account. I sent that and now almost a week later, no contact at all. I was sceptical about crypto but I feel I am dealing with the mafia here. Decide if all this is worth the potential stress for yourself.

I’ve had nothing but good experiences (thankfully) with Coinbase, although I’m not exactly a heavy buyer and seller of crypto. I will say though that back in 2013 I panic sold 5 figures worth of Bitcoin when the price dropped, and I DID get the money. So people who say if you sell a large amount on Coinbase they’ll just steal your money or whatever, that’s not true.

Coinbase is the worst bitcoin company. Please do you research and go with some other company. They have no real support and they don’t care about their customers.

I agree with Brian Robert Garret. Same feeling here.

I did not know this bad customer support even exists.

Coinbase is still a scam. You can put money in, but can’t take it out, because that requires getting verified, and there’s no way to get verified. The website simply doesn’t have that functionality.

I don’t think that is correct. I would advise getting in touch with their support to see resolve your issue.