When it comes to staking on Ethereum, two popular choices are Rocket Pool and Lido. While both have their advantages, it can be difficult to choose between them. In this article, we’ll take a closer look at each option from an individual perspective.

What you'll learn 👉

Liquid Staker Comparison

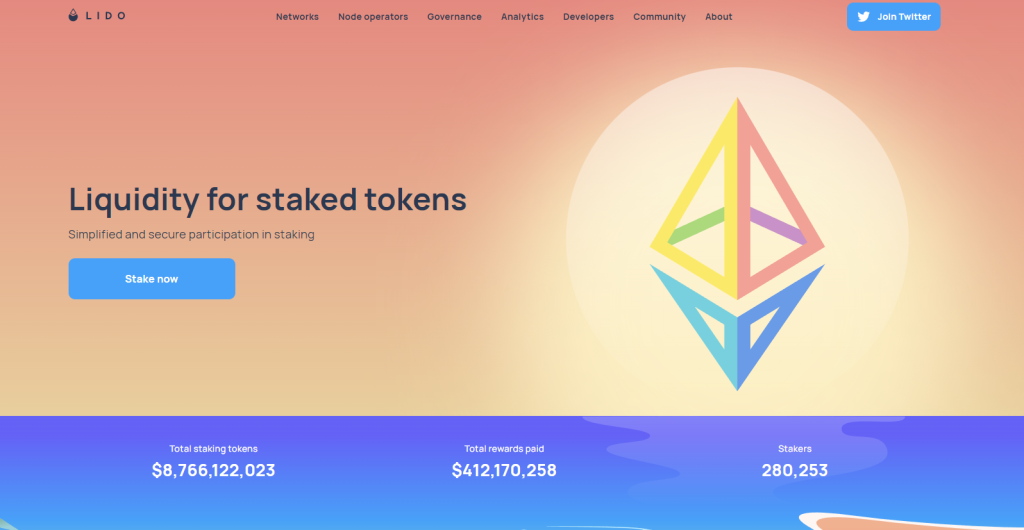

Lido

With Lido, you can stake any amount of ETH and receive stETH, a rebasing token, or wstETH, which accrues value. One of the benefits of stETH is that it is quite liquid and can be used as collateral for various providers. There is no counterparty risk as Lido is non-custodial.

However, there is a 10% commission fee, with 5% going to the protocol and 5% to the node operators. Additionally, there is some smart contract risk, and Lido has no direct control over their Node Operators, which means there is some minor counterparty risk. Node operators for Lido are also chosen from a small, permissioned set.

This is a full guide on how to stake crypto on Lido finance.

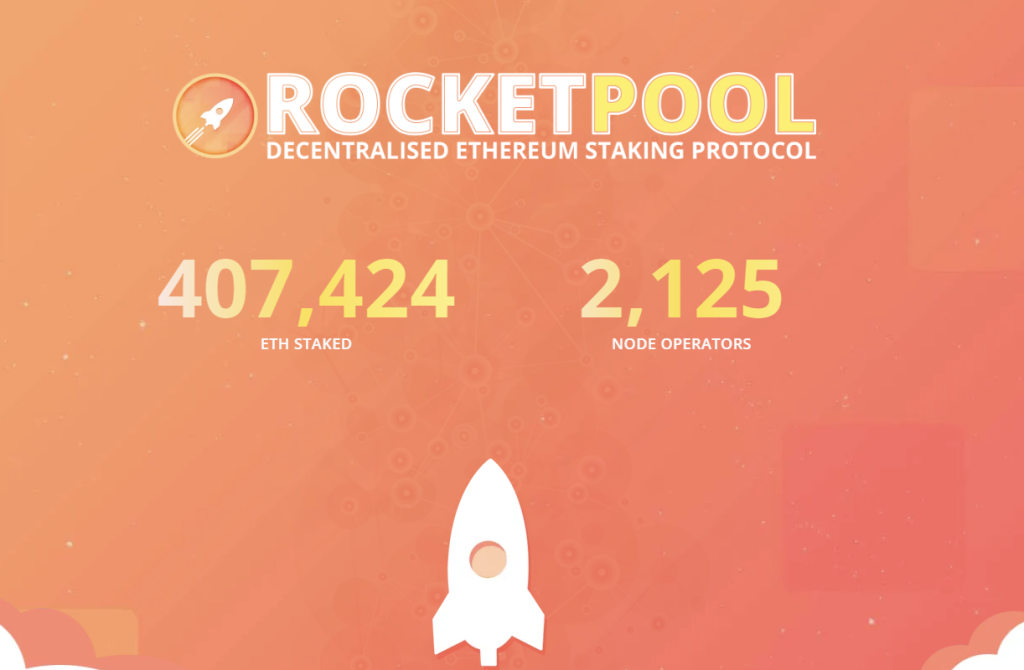

Rocket Pool

Rocket Pool also allows you to stake any amount of ETH and receive rETH, a token that accrues value. There is a good and helpful community of people associated with Rocket Pool. While rETH has less liquidity than stETH, it tends to stay closer to its “ideal” mint/burn rate.

The commission fee for Rocket Pool is 15%, with all of it going to the node operators. There is some smart contract risk associated with Rocket Pool. However, there is less counterparty risk. While Rocket Pool has no direct control over their node operators, there are arbitrage opportunities that exist to prevent significant depeg, providing some indirect control through market incentives.

Node Operator Comparison

Lido

With Lido, it is unlikely that you can be a node operator or validator for them. Node operators are chosen from a small, permission set, and they are paid in stETH, including the 5% commission mentioned above.

Rocket Pool

Rocket Pool has permissionless node operation, which means anyone can become a Node Operator by staking 16 ETH and 1.6 ETH worth of RPL. Node operators are paid in ETH, including the 15% commission mentioned above. Additionally, RPL gains RPL rewards, adding an extra benefit.

Conclusion

Both Rocket Pool and Lido have their advantages and disadvantages, so it ultimately depends on what an individual is looking for. If you want to stake any amount of ETH, Rocket Pool might be a better option. If you value liquidity more, Lido might be a better choice.

Additionally, if you are interested in becoming a node operator, Rocket Pool offers more opportunities. Regardless of which option you choose, it’s essential to keep in mind the associated risks and do your due diligence before staking.

Read also: