Staking Ethereum with Lido Finance is a great way to earn rewards without limitations imposed by validators. It’s super straightforward and simple to get started – all you need is a private crypto wallet and ETH in it.

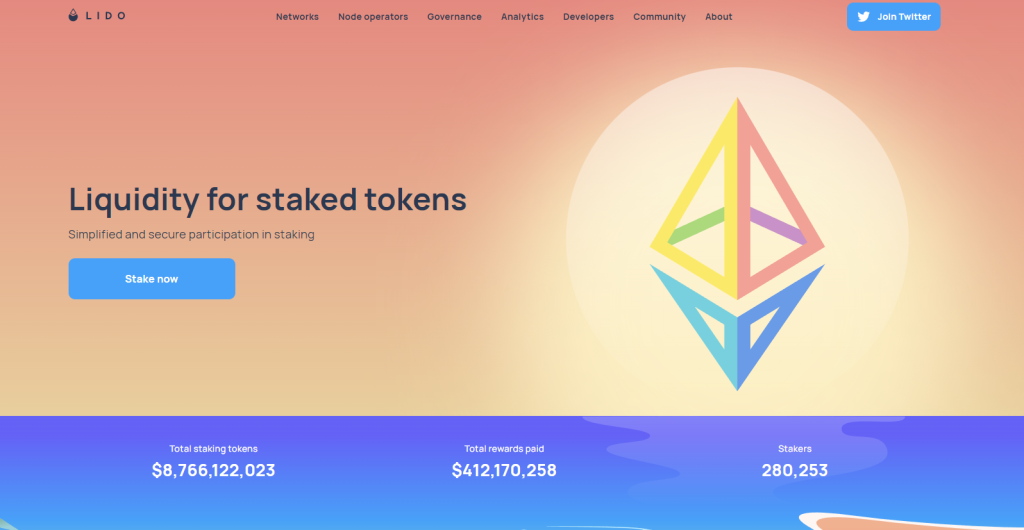

In the dynamic landscape of digital finance, Lido Finance emerges as a beacon for those seeking to maximize their cryptocurrency’s potential. Offering a unique blend of flexibility and profitability, Lido’s staking rewards have become a focal point for savvy investors looking to stake crypto and reap substantial returns.

This article delves into the intricacies of Lido Finance, exploring its staking rewards system, and illuminating how you can stake crypto to unlock new avenues of growth in your digital asset portfolio. Join us as we navigate the rewarding world of Lido staking, where every crypto holder can become a stakeholder.

| Key Points | Details |

|---|---|

| 🌐 What is Lido? | Lido is a liquid staking platform on the Ethereum blockchain. It allows users to stake any amount of Ethereum (ETH) without the need for complex infrastructure. |

| 🔄 How does Lido work? | Users stake their ETH and receive stETH tokens in return at a 1:1 ratio. The stETH tokens can be used in the same way as regular ETH. Staking rewards are received daily and there is no minimum deposit or lock-up periods for staking on Lido. |

| 🎯 Features of Lido | Lido offers liquid staking and is governed by a DAO. Users don’t need to lock assets or maintain a staking infrastructure. After depositing tokens, users receive liquid tokens in return. These tokens are staked by the DAO-controlled smart contracts using an elected staking provider. |

| 💰 Benefits of staking with Lido | Users can stake any amount of ETH and earn rewards every 24 hours. There’s no need to stake 32 ETH, and users can reduce the risk of losing staked cryptocurrency through software failures. Staked ETH (stETH) can be used in the DeFi space. |

| ⚠️ Risks of staking with Lido | Risks include potential delays or issues with the implementation of Ethereum 2.0, and vulnerabilities associated with using smart contracts. DeFi platforms like Lido are particularly vulnerable to security threats. |

| 📈 Is Lido staking lucrative? | Staking ETH with Lido can be a convenient way to stake on the Ethereum 2.0 network. It’s accessible to beginners and users get rewarded with Lido as well. Users can claim their cryptocurrency anytime without it being locked up for one year, as is the case with other staking protocols. |

| ❓ What is stETH? | stETH is the tokenized form of staked Ether issued by Lido. It combines the initial staking deposit and the daily staking rewards. stETH can be used in the same way as ETH and can be used on most DeFi apps. |

| 🏦 Lido DAO and the LDO token | The Lido DAO manages the Lido staking protocol. The LDO token is the Lido DAO governance token, enabling holders to vote on the DAO’s governance decisions. The amount of LDO they stake determines their voting power. |

What you'll learn 👉

🤔 What is Lido and How it Can Help You Earn More with ETH

Lido is a powerful Ethereum-based liquid staking solution that can help you to earn more with ETH. Supported by leading blockchain staking providers, it allows you to access DeFi applications like Curve, Sushi, Yearn and more without having to deal with complex infrastructure. You can stake any amount of ETH into Lido, unlocking the opportunity to earn rewards through stETH (staked ETH). This balance could then be used for further earning on other yield platforms and lenders.

What makes Lido Finance even better, is that it removes problems associated with staking Ethereum such as illiquidity, immovability and inaccessibility. Providing full control of your ETH while staking – meaning you can unstake within seconds when you’re finished – making it one of the safest ways to make the most out of your cryptocurrencies.

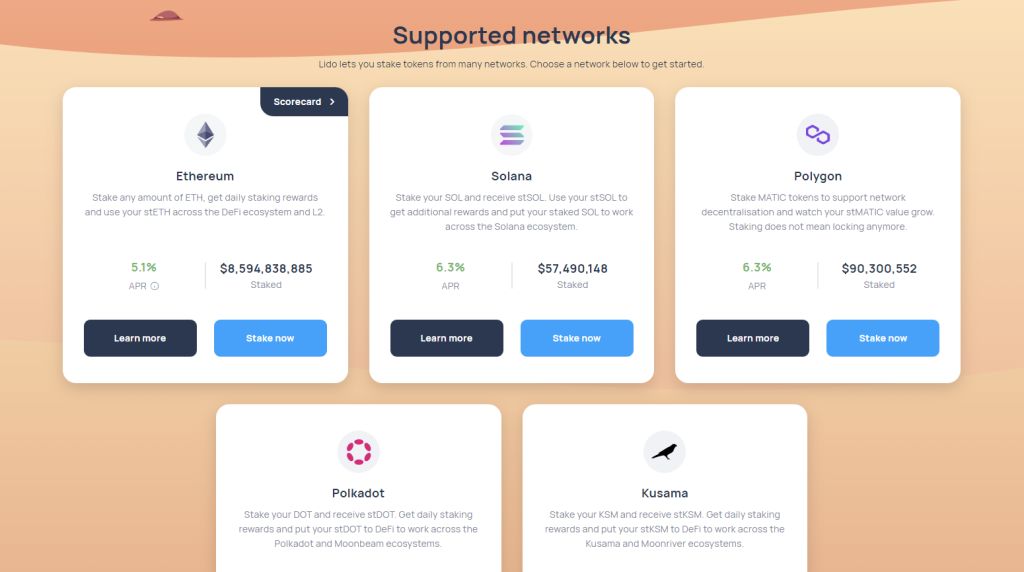

🌐 Supported Networks: A Comprehensive List of Lido’s Integrations

If you’re looking to stake on Lido, then the first thing you should check out is their comprehensive list of supported networks. They currently support Ethereum, Solana, Polygon, Polkadot, Kusama and many more! All you need to do is choose your network and start staking your tokens.

Lido also has a Scorecard feature that tracks your staking balances and activities in real-time. This gives you complete transparency over your staking rewards and activities. With such a wide range of integrations available from Lido, finding the perfect network for your needs is easy. So why not take advantage of these integrations today? Get started with Lido’s platform and stake those tokens in no time!

🛠️ The Inner Workings of Lido: A Detailed Explanation

The inner workings of Lido are an interesting thing to understand. But first things first: What does Lido do?

Lido is a decentralized protocol that allows users to stake Ether (ETH) and receive rewards for helping secure the Ethereum blockchain. Stakers receive stETH at a 1:1 ratio to the amount of ETH they stake, allowing them to use stETH instead of regular ETH. The staking rewards are sent directly to your account on a daily basis and there’s no deposit or lock-up period required when staking on Lido.

Moreover, staking with Lido doesn’t come with any downside risks as it only involves participating in the security of Ethereum without exposing yourself to any risk. The Annual Percentage Yield (APY) you’ll get when you stake your Ether will depend largely on the overall amount of ETH being staked in the network – As more people join in and more ETH is being staked, you can expect the APY rates to drop. It’s important to keep track of current APY rates, which is easy with the platform’s app.

Lastly, it should be said that Lido takes 10% of the yield you earn plus an additional 0.3% gas fee for transferring liquidity from Layer 1 to Layer 2, all part of their pooling process. All in all, if you’re looking for a safe way to invest your Ether then definitely consider giving Lido a try!

📝 Staking ETH with Lido and Metamask: A Step-by-Step Guide

Staking Ethereum (ETH) on the Lido protocol is a snap. Unlike other protocols, it allows users to instantly withdraw their tokens at any time with no penalty. Rewards are paid out every 24 hours based on the current Annual Percentage Yield (APY). Here’s a step-by-step guide to staking ETH with Lido and Metamask.

First, open up Metamask on your supported browser and ensure you’ve deposited some ETH into your wallet. Once that’s all set up, head over to lido.fi and click “Start Staking”. Enter the amount of ETH you want to stake, select “Stake Now”, confirm with MetaMask, and you’re in! You’ll start receiving rewards every 24 hours.

If you need to access or withdraw your staked ETH early, go back to lido.fi and click “Unstake”, enter the amount of ETH you want to unstake, then select Unstake Now; and finally confirm it with Metamask – it’s that easy! So why wait? Start taking advantage of higher yields today with Lido!

👉Step 1. Connect your wallet to the Lido app

If you want to stake on Lido, you first need to connect your wallet to the app. To do this, simply go to stake.lido.fi and hit the “Connect Wallet” button at the top right of the page or under the Stake Ether amount.

Once you’ve done this, you’ll be asked to read and accept terms and conditions, after which you can select which type of wallet you want to connect with Lido Protocol. You can choose from one of several supported wallets and must also make sure that it has an ETH balance before confirming your connection to the app. Once everything is set up properly, you will be able to proceed with staking on Lido!

👉Step 2. Select the amount of ETH to stake

Once you’ve connected your wallet to the Lido ETH Staking App, the next step is to select your desired amount of ETH to stake. The app will show you how much ETH is available for staking and the current APY rate. It will also display all details of your transaction and the amount of stETH tokens you’ll receive.

You’ll need to keep some ETH in your wallet to pay for transaction fees and make sure you read the disclaimer regarding the 10% reward fee which will be applied to rewards earned, not your deposited amount.

Now that you understand all that, it’s time to select how much ETH you want to stake! Go ahead and click “Submit” when you’re done making your selection – and watch those Ethereum rewards start rolling in!

👉Step 3. Confirm the transaction from your wallet

Confirm the transaction from your wallet: It’s time to confirm the transaction that you have set up in your wallet. This can usually be done by clicking on the “Confirm” button once you have reviewed all the transaction details. After doing so, you can now proceed with staking your ETH on Lido!

With Lido, you can rest assured knowing that you have complete control over your assets as you are free to unstake them at any time you choose. Furthermore, one great thing about using Lido for staking is that it can open up a whole new world of possibility regarding DeFi. For example, you could buy stETH on one of the many DEXs like 1Inch and then use Lido to unleash its full potential!

💰 Maximizing Your Earnings: How Much Can You Make with Lido Staking?

Maximizing your earnings is key when choosing how to stake on the Lido protocol. With Lido ETH staking you can make a decent return while also contributing to Ethereum’s 2.0 network. Plus, you don’t have to worry about having your ETH locked up for long periods of time like other staking protocols require.

So, just how much can you make with Lido staking? To maximize returns, the important elements are: understanding the reward system, having enough ETH in your wallet (at least 32 eth) and having patience. With these things in mind, you could potentially earn anywhere from 4-5% APY annually on your staked crypto – without sacrificing liquidity or flexibility.

Whether you’re a beginner or a seasoned pro at staking, understanding the rewards will help you decide which protocol is best for your needs and increase your chance of earning more over time. With Lido staking, you get rewarded with their associated tokens and enjoy quick liquidity and flexibility whenever needed – making this a great option for any investor!

Read also:

- eToro Staking Review

- Where To Stake Stablecoins [USDC, USDT]

- Best Places For Staking Dogecoin

- How To Pay Taxes On Staking

- Best Staking Cryptocurrencies

🏆 Benefits of Staking with Lido: Why It’s a Top Choice for Investors

Staking with Lido has become a top choice for investors looking to maximize their returns by taking advantage of the platform’s many benefits. With Lido, users can stake their ETH while still being able to trade, use, or unstake their tokens. Furthermore, it allows users to securely earn staking rewards no matter how big or small their deposits may be.

Lido also minimizes risks associated with losing staked funds through software failures or slashing due to its liquid staking feature and non-custodial structure — which means that users always have full control over their assets. Additionally, its stETH can be used as a building block in the DeFi space; for example, lending out collateral on ARCx or yield farming on Curve Finance.

All in all, Lido provides a trusted and improved alternative to exchange staking and self-staking for the Ethereum community — making it an ideal choice for investors who want more flexibility with their investments without compromising security and reliability.

🗳️ The Lido DAO: How It Empowers Investors with Decentralized Governance

The Lido DAO enables users to have more control over their investments through decentralised governance. With the Lido DAO, users gain access to a suite of tools and services that allow them to securely stake Ethereum without going through the technical complexities of self-staking.

These tools also enable deposits as small as 0.00001 ETH, meaning users don’t have to commit large amounts of ETH to benefit from staking rewards. This helps decentralize the Ethereum network further, by reducing the threshold entry for potential stakers.

In addition, the Lido DAO works to help promote Lido and educate its users on staking and other related topics. Through this process, investors are empowered with knowledge and understanding of how their investments will be governed and managed continuously.

Overall, the Lido DAO offers a streamlined solution that enables individuals with all levels of experience to safely and easily stake Ethereum while still enjoying returns on their investment. It’s an innovative approach that allows people to experience decentralized governance in action!

🤝LDO token

The LDO token is the native token of the Lido DAO and is responsible for decentralized ownership of the platform. It grants holders voting rights to influence key decisions that will shape the future of Lido. Furthermore, when staked, it determines a user’s voting power and also allows them to add/remove nodes from and manage fee parameters on the network.

LDO tokenomics works like this: 36.32% went to the DAO treasury, 20% to initial Lido developers, 22.18% to investors, 15% to founders & future employees and 6.5% to validators & signature holders.

What is stETH?

stETH is a tokenized representation of the Ether (ETH) that has been staked into Lido, a liquid staking solution on the Ethereum blockchain. You will receive a 1:1 ratio of stETH tokens in return whenever you stake ETH with Lido. These tokens represent your original staking deposit plus any daily rewards earned every day at 12pm UTC, due to a supply rebase.

Not only can you hold and manage these tokens as if they were regular ETH, but you can also use them for integrated platforms like Curve or SushiSwap, apply them as collateral for DeFi lending services, sell them off, or exchange them back into their original form – Ether (ETH). The total amount of Ether (ETH) deposited into Lido’s contract is represented by the supply of stETH tokens held by users; this figure can always be seen on Etherscan whenever needed.

❓ Frequently Asked Questions about Lido and Staking ETH

Yes, Lido is a great option for staking ETH. It provides users with a secure and reliable platform to stake their funds with full control over their assets. Additionally, its liquid staking feature helps minimize risks associated with slashing or software failure and allows users to benefit from staking rewards without having to commit large amounts of ETH.

Lido applies a 10% fee on a user’s staking rewards.

Lido pays out rewards to stakers based on their portion of the total amount of Ethereum staked in Lido. The reward rate is determined by the sum of all ETH staked, minus any fees associated with the platform and its services. Rewards are paid out in ETH on a daily basis at 12:00 UTC, and they can be tracked and monitored via Etherscan.

Yes, you can withdraw staked ETH from Lido at any time. All you need to do is go into your Lido Staking dashboard, click on the ‘Withdraw’ button and enter the amount of ETH you would like to withdraw. Once the withdrawal is processed, your staked ETH will be transferred back to your wallet address and you will no longer be able to earn rewards from it.

Yes, staking ETH on Lido is safe. The platform utilizes best-in-class security measures to protect user funds and data, including multi-signature wallets, regular audits and penetration testing. Additionally, the Lido team has also implemented a liquid staking feature that helps minimize risks associated with slashing or software failure while still allowing users to benefit from staking rewards without having to.

Lido pays out rewards to stakers based on their portion of the total amount of Ethereum staked in Lido. The reward rate is determined by the sum of all ETH staked, minus any fees associated with the platform and its services. Rewards are paid out in ETH on a daily basis at 12:00 UTC, and users can expect to receive a reward for each day that their ETH is staked.

There are some risks associated with staking through Lido, including the risk of slashing and software failure. Slashing occurs when a validator or delegator signs off on an invalid block, and as a result, their stake is reduced. Software failure can also lead to losses since it results in downtime that prevents users from earning rewards from their stake. In addition, there is always a risk of loss due to hacking or other malicious activities.

At the time of writing, Lido has over $1.5 billion in ETH staked on its platform. This is a testament to the popularity and success of the protocol, as it has become one of the leading DeFi protocols for staking ETH. Over 20,000 users have chosen to stake their ETH with Lido, and this number is rapidly growing as more people recognize the benefits of staking through the platform.

Liquid staking carries some risks associated with slashing and software failure. Slashing occurs when a validator or delegator signs off on an invalid block, resulting in their stake being reduced. Software failure can lead to downtime and prevent users from earning rewards from their stake.

Additionally, there is always a risk of loss due to hacking or other malicious activities. Liquid stakers should also be aware of the risk of impermanent loss, which occurs when the price of the token they are staking moves against them.

Yes, you can stake Lido tokens. All you need to do is deposit your Lido tokens into the wallet of your choice and start staking. Once you’ve done that, you can track and monitor your rewards in real-time using the Etherscan dashboard. Staked Lido tokens will accrue rewards based on their portion of the total amount of Ethereum staked in L ido, and rewards are paid out in ETH on a daily basis at 12:00 UTC.

Yes, Lido is a decentralized finance (DeFi) protocol that enables users to stake their Ethereum in order to earn rewards. The platform utilizes best-in-class security measures to protect user funds and data, as well as a liquid staking feature that helps minimize risks associated with slashing or software failure while still allowing users to benefit from staking rewards without having to lock up their tokens.