If you’ve been on the hunt for the best staking NFT opportunities, your search ends here.

Our guide explains the most promising NFT staking projects, helping you identify the best NFTs for passive income. From the ins and outs of staking NFTs to the best NFT staking platforms, we’ve got you covered. So, if you’re eager to elevate your crypto game, look no further, your ultimate guide to NFT staking starts now.

NFT staking opens up new ways in which you can use the NFTs you possess, apart from just collecting, buying, or selling them. If you are interested in informing yourself further about this topic, take a few minutes to go over this review, and hopefully, by the end of it, you will be ready to stake your NFTs and make a steady passive income for yourself.

| 🔍 Topic | Summary |

|---|---|

| 🤑 Passive Income with NFTs | The article discusses how NFT staking offers a new avenue for earning passive income in the crypto world. |

| 🛠️ How NFT Staking Works | NFTs are staked by locking them in smart contracts or blockchain protocols. The income generated depends on the number of NFTs staked, the duration, and the annual percentage yield. |

| 🎮 Platforms for NFT Staking | Various platforms like MOBOX, Zookeeper, and Whenstaking.com are highlighted, each offering unique features and rewards for staking NFTs. |

| 🔄 NFT Utility & Monetization | Staking NFTs provides new opportunities for investors to monetize their assets and potentially increase demand for the staked NFTs. |

| 🔐 Security & Risk | NFT staking is considered to be highly rewarding with little to no investment risk, making it a safe option for investors. |

| 🎖️ Best NFTs to Stake | The article lists several NFTs that are ideal for staking, including those from play-to-earn games and various blockchain projects. |

| 📊 FAQs | Addresses common questions like the safety of NFT staking, its potential for passive income, and the technical requirements for staking. |

What you'll learn 👉

NFT Staking: How does it work?

As you probably already know, NFTs are basically tokenized assets. This means that you can transfer them to platforms that will keep them safe and govern them in your place. To stake your NFTs, you are required to lock them away either in a smart contract or on the blockchain protocol. In many ways, staking your NFTs is considered to be highly rewarding with little to no investment risk and, all in all, very safe in general.

Initially, NFT staking was niche and experimental. Now in 2026, it’s evolved into a mature segment of the crypto economy, fully integrated with DeFi, GameFi, and metaverse platforms. When you choose to lock your NFTs on a platform of your choice, you receive income depending on the number of NFTs you staked, the duration you stake them for, and finally on the annual percentage yield.

Because of the distinctiveness of NFTs, investors usually favor holding rather than selling. Due to this, staking NFTs gives way to new opportunities for investors to monetize their assets and bring more users to join in and potentially increase the demand for the staked NFTs.

In 2026, NFT staking often involves liquidity pool (LP) staking, yield farming, or using NFT-collateralized derivatives. The exact process varies by platform, but in most cases, you’ll need a wallet holding the NFTs, connect it to the staking protocol, and commit them for a set period to earn rewards.

NFT staking tends to overlap with DeFi. Platforms like NFTfi and BendDAO enable you to stake NFTs as collateral in liquidity pools, collecting yield without sacrificing ownership. This enables you to stake your NFTs, borrow stablecoins, and use them on other DeFi trades — all without needing to cash out of your holdings.

Top NFT Staking Platforms in 2026

NFT staking has come a long way since the early days. Back then, it was a bit of a niche experiment. Now in 2026, it’s a major part of the NFT world, with platforms offering real rewards, deeper DeFi integrations, and even in-game perks. If you’re looking for where the action is, here are some of the top spots to stake your NFTs this year.

Blur Blend & Lending

Blur isn’t just a marketplace anymore, it’s turned into a full NFT finance hub. With its Blend protocol, you can use blue-chip NFTs like BAYC, Azuki, and DeGods as collateral to borrow ETH or stablecoins.

While your NFTs are locked up, you can still earn yield from lending pools, so you’re putting your assets to work without giving them up. Thanks to low fees and a ton of liquidity, Blur has become a go-to for NFT-collateral staking.

Magic Eden NFT Rewards

Magic Eden has built one of the biggest NFT marketplaces across multiple blockchains, and now they’ve added a Rewards Program for collectors.

By staking your NFTs, you can earn points, get access to exclusive drops, and even save on marketplace fees. Those points can be redeemed or traded, and the best part? This works across Solana, Polygon, Ethereum, and even Bitcoin Ordinals.

Parallel Alpha Staking

If you’re into trading card games, Parallel Alpha is one of the most rewarding NFT staking options out there. Assets like Prime Keys and Catalyst Drives can be staked for in-game benefits, governance token rewards, and early access to special cards. It’s a nice mix of earning yield while also getting a real gameplay advantage.

Yuga Labs Ecosystem Staking

The team behind Bored Ape Yacht Club has gone big with staking. Now, you can stake Otherside land, HV-MTL robots, and Kodas to earn $APE tokens.

These tokens can be used for upgrades in the Yuga metaverse, voting on governance proposals, or future projects they roll out. Whether you’re in it for the rewards or to level up in their virtual world, there’s plenty of incentive to lock in your NFTs.

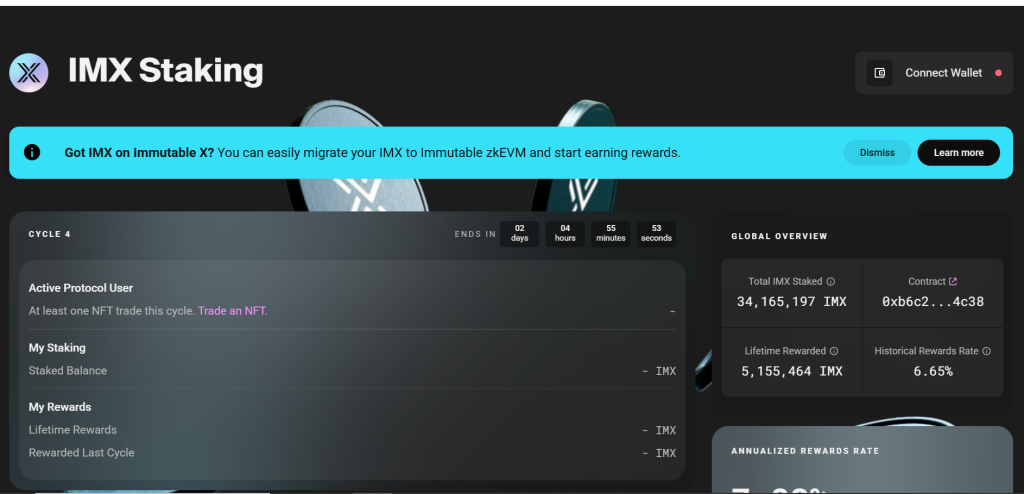

Immutable zkEVM Staking

Immutable’s zkEVM is making NFT staking a lot more affordable. You can stake in-game NFTs to earn $IMX tokens and game-specific rewards, all with super low gas fees compared to Ethereum mainnet. If you’re playing Immutable-powered games, it’s a no-brainer to put your assets to work here.

NOTE: If you already hold NFTs from any of these platforms, staking them in 2026 isn’t just about passive income, it can also make your NFTs more useful, valuable, and fun to own.

Other Notable NFT Staking Projects

NFTs being non-fungible means that staking them on most DeFi platforms is not possible. Because of that, there have been a number of projects that devoted their time to creating protocols where you can stake NFTs. At the current time, for the most part, opportunities for NFT staking lay in play-to-earn games. With that being said, here is a list of NFT staking platforms that you can choose from.

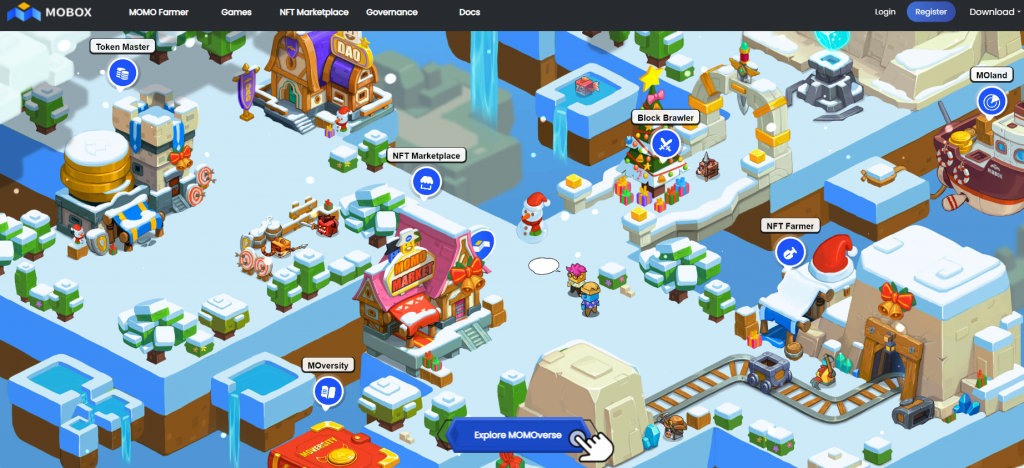

👉 MOBOX (MBOX)

First, we will talk about MOBOX. It is a play-to-earn game with its own metaverse named MOMOverse. Here on this platform, there are NFTs called MOMOs. These NFTs give you ample options; you can earn or purchase them from the marketplace, as well as mint them, and most importantly, stake them for a passive income.

Every MOMO differs in quality and has its hashing power generated randomly. When you stake MOMO, you are able to acquire the governance token called MBOX. So, depending on how many MOMOs you have, the more MBOX you can acquire on a daily basis. When you acquire a MOMO, as soon as it is minted, it is automatically staked and starts earning MBOX for you. This feature saves you quite a bit of time.

As we mentioned, MOMOs vary in hash power. This is because every MOMO has a different rarity. The higher the rarity, the more hash power the MOMO has and ultimately acquires you more MBOX in the long run. Rarities of MOMOs are as follows: common, uncommon, unique, rare, epic, and lastly, there is a market for legendary MOMOs. If you managed to get your hands on a rare, epic, or legendary MOMO, you are in luck because these ones can be upgraded to increase their hash power to make farming much faster.

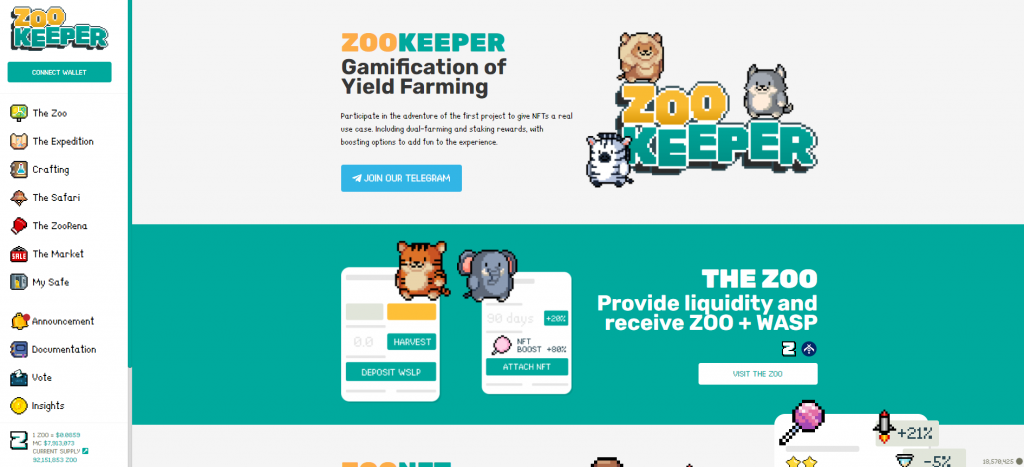

👉 Zookeeper (ZOO)

Next, we will mention Zookeeper. It is one of the latest projects that are based on a Wanchain Dapp. Zookeeper offers a unique dual farming method designed for the rising popularity of NFTs. It integrates with another Wanchain Dapp called WanSwap, thereby increasing its own liquidity. Nevertheless, it also has its own token called $ZOO that is being given as a reward for farming to all of the WanSwap Liquidity Providers that decide to stake their WanSwap Liquidity Provider tokens, also known as WSLP for short.

The dual farming feature on Zookeeper that came from the partnership with WanSwap allows users to farm $ZOO tokens as well as $WASP tokens together. A zookeeper gives an option of boosting yield farming rewards to its users via the lock period function that is available on every pool. As you can probably guess, you will earn more rewards depending on how long the lock period you have chosen is.

Another great feature to help your NFTs earn more passive income through staking is with ZooBoosters. You can purchase, earn or even win through various ways on the Zookeeper Dapp. These boosters are a great way if you want to shorten the lock duration of your NFTs while also increasing the rewards you are getting.

👉 Whenstaking.com

Whenstaking is an NFT staking platform that is based on the Onessus blockchain. It gives its users a possibility to stake many different NFTs as well as a native token called VOID to support the platform’s NFTs. It is important to mention that the WhenStaking only supports NFTs that are from the games on the Onessus blockchain.

The procedure of staking NFTs on the Whenstaking platform is as follows: depending on several factors, an APR for an NFT will be determined. These are a rarity, average price, and the collection of NFTs. When it comes to the rarity of NFTs, the higher the rarity of the NFT, the higher the average price of said NFT; and with that, the collection as a whole is more valuable and in a result, will have a higher annual percentage rate as well as higher staking capacities.

Keep in mind that Whenstaking, there is a Base Cap feature which is the minimum value that the NFT must possess for you to be able to stake it on the platform. This minimum value is based on the VOID tokens, and at the current time, it is 40.000 VOID tokens.

The platform connects to the WAX Cloud Wallet without any problems. These in-game NFTs can be staked to earn a profit or used in the games on the platform. What’s more, determined by the lock-up period, WhenStaking provides up to 80% APY for the holders.

👉 NFT PowerStation on the Binance Fan Token Platform

Being one of the best-ranked cryptocurrency exchanges in the world, Binance is the first one that started offering an NFT charging service. The Binance Fan Token Platform offers a possibility for token holders to stake the NFTs supported by their favorite team in order to earn additional Binance Fan Tokens.

You might wonder what Binance Fan Tokens are. These tokens are basically utility tokens that are affiliated with, for example, a brand, club, or a team, and they provide fans with special privileges. One of the examples of this might be a priority in buying tickets or getting better seats at the game, but also decision-making and voting on important decisions for the club.

Binance Fan Tokens are, for the most part, affiliated with sports clubs, celebrities, or anything with a sizable following. Take, for example, FC Barcelona. It is one of the several clubs that have their own token, and the value of these tokens is not the same as cryptocurrencies such as Bitcoin, but the value depends on the aforementioned benefits the fans can receive upon owning the token. If the benefits are good and worthwhile, the price of the token will be higher.

Finally, by staking the NFTs of your favorite team, you can boost the team’s fandom and acquire additional Binance Fan Tokens; remember, the longer they are staked, the higher the rewards will be.

👉 Earn in DEC and SPS on Splinterlands

There are several ways to earn DEC and SPS on Splinterlands. As a player, the current best option to earn SPS is through the Airdrop source. This Airdrop gives SPS to its players on a daily basis, depending on how many points they have. Players acquire these points with staking. Anything you have a stake in brings you a certain amount of points, and with more points come bigger rewards.

On the other hand, DEC tokens are earned through winning. Basically, to get them, you need to win several matches. The higher you get on a competitive level, the more DEC tokens you will earn. Now with your freshly earned DEC, it is time to put them to good use. Doing nothing with your DEC is a waste, rather you should use them to boost your SPS earnings through the Airdrop system we mentioned.

👉 Earn in AETHER on R-Planet

R-Planet is a play-to-earn game where you can stake NFTs to earn the platform native token called Aether. Aether is used in creating the 4 basic elements that are in the game: Water, Fire, Wind, and Earth. These elements are necessary for further progression and creating new items. You will have to combine the elements and try out various combinations in an effort to create new materials.

Keep in mind that there is also an Inventor Prize. Combining elements and creating new materials gives you a higher chance to win this prize. The reward for the Inventor Prize is being collected from every player, as they mix the elements, a fraction of the cost is taken for the prize pool. Another thing that adds to the prize pool is the initial sales of the elements.

As you acquire and stake more and more NFTs, you have an option to put your NFTs up for sale, and other players can buy them from you, paying you in Aether tokens which are used everywhere on the platform.

You can also combine and create new NFTs, which you can either sell or stake again to make more profit.

👉 Earn in PYR on VulcanVerse

Lastly, we will mention VulcanVerse. The native token that is running the economy on the VulcanVerse is PYR. It gives a possibility to all the players on VulcanVerse to earn a passive income through staking in many different in-game assets. There are several different ways to earn PYR through staking, but there are 3 of them that are used the most.

First and foremost, there is Land leveling. To acquire a plot of land, you will have to buy it from the marketplace or participate in Dapps on the Vulcan Forged ecosystem. This plot of land represents an NFT that you can build on and upgrade up to level 7. To level up your land, you need to pass through 2 stages. The first stage is where you need to SOWN your land, once sown, the land will never have to be sown again. Then, you need to wait for 20 days before you can level up your land. To upgrade it, there is a necessary amount of PYR you need to stake in the land, and if you remove it, the land will lose its level.

Secondly, there are programs for staking PYR that help provides liquidity. They might not always be accessible.

Thirdly, the last of the 3 most common ways of staking PYR is Seed Harvesting. You can harvest seeds in order to get Special Items from the Vulcan’s Vault.

For every way you opt to use in order to stake and earn PYR, based on how well you did, you will receive rewards in the form of PYR tokens from the staking pool.

NFT Staking Trends in 2026

NFT staking isn’t what it used to be, and that’s a good thing. Over the past couple of years, the space has matured, and the way people stake NFTs has shifted in some big ways.

From Idle Staking to Utility-Based Staking

A few years ago, staking was often just “lock your NFT and earn tokens.” The problem? Many of those tokens didn’t hold value for long.

It has transformed in 2026 to utility-based staking, specifically in gaming and metaverse projects. Staking now typically unlocks in-game rewards, exclusive content, governance power, or metaverse upgrades, which is a lot more exciting than simply farming tokens.

Goodbye Inflation, Hello Real Utility

Previously, a lot of the staking rewards were derived from inflationary token models, i.e., more supply and, eventually, falling prices.

In 2026, there are more platforms that are tying rewards to real utility, i.e., marketplace fee discounts, early access to NFT drops, or maybe revenue sharing from platform activity. This keeps rewards valuable and sustainable over time.

Ethereum Layer 2 Makes Staking Cheaper

Gas fees used to be a deal breaker for many NFT stakers. That’s changing fast thanks to Ethereum Layer 2 solutions like zkSync, Arbitrum, and Immutable zkEVM. These networks make staking transactions faster and much cheaper, which is opening the door for more casual collectors to join in without worrying about $20+ in gas every time they interact.

FAQs

Read also:

- Binance NFT Marketplace Review

- Best NFT Projects To Invest

- How To Find a Good NFT Project To Buy EARLY

- Best Metaverse Projects To Invest In

- Best NFT Wallets

- Best Play-To-Earn Crypto Games

- Best NFT Marketplaces on Solana

- How Does Crypto.com NFT Buying Works?

- What Are NFT Loans? Where Can You Get an NFT-backed Loan

- Best NFTs on Terra Luna Blockchain – Terra NFTs List

- Best NFT Marketplaces on Terra Luna Blockchain